The Critical Window for Maximising FHLTax Relief.

For decades, the Furnished Holiday Lettings (FHL) governance has stood as one of the most precious tools for duty-effective property investment in the UK. Unlike standard Buy-to-Let models, FHLs are treated as a trading business for duty purposes, giving property possessors access to a range of fiscal benefits. Chief among these is the capability to claim comprehensive FHL capital allowances, which reduce taxable gains by allowing deductions for qualifying capital expenditures on crucial means such as cabinetwork, institutions, and outfit. As an enduring counsel in specialist property taxation, Lanop recognises that understanding and maximising capital allowances on FHL is pivotal for investors aiming to enhance long-term returns. Still, time is running out.

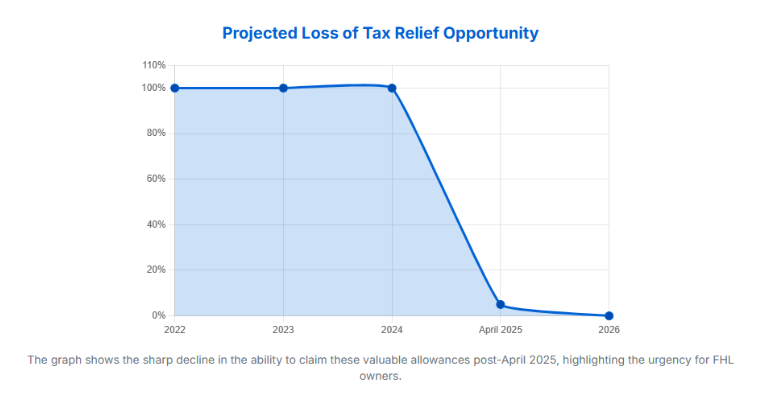

The UK government has blazoned the invalidation of the FHL governance effective 6 April 2025 for Income and Capital Earnings duty, and 1 April 2025 for Corporation Tax. This marks the 2024/2025 duty time as the last occasion for investors to claim and completely use allowances similar to the Annual Investment Allowance (AIA) or Full Expensing. After this date, new UK vacation let capital allowances will no longer be available, making visionary planning essential. Every investor should act now to ensure all eligible furnished vacation let capital allowance claims are secured, maximising FHL duty savings before this critical change takes effect. For those seeking to guard returns and reduce arrears, expert guidance in Tax Planning is necessary.

The Foundation: Why Furnished Holiday Lets (FHLs) Qualify for Special Tax Treatment

The annuity to claim sophisticated duty reliefs, including FHL capital allowances, is directly tied to a property’s qualification as a Furnished Holiday Let (FHL). This bracket distinguishes an FHL business from standard rental exertion, which HMRC considers an unresistant investment rather than a trading adventure.

Defining Eligibility: The Statutory FHL Qualification Criteria

To profit from preferential governance, a property must satisfy specific statutory criteria. However, the property loses FHL status, meaning its income is treated as regular domestic rental income, and precious reliefs like capital allowances on FHL are lost if it fails any of these tests.

Key HMRC criteria include

- Position and Furnishing: The property must be in the UK or EEA and adequately furnished for normal use by guests.

- Marketable Intent The property must be let with the genuine intention of making a profit.

- Vacuity Test Available to the public for at least 210 days annually.

- Letting Test Let commercially for a minimum of 105 days.

- Pattern of Occupation Test: Long-term lettings (over 31 successive days) must not exceed 155 days per time.

HMRC treats all UK FHLs as one business and all EEA FHLs as another, meaning gains and losses cannot be cross offset between the two regions.

The Core Benefit of FHLs as a Trading Business

The trading bracket is what opens the door to important reliefs. Because FHLs are treated as trading businesses, investors can

- Claim Plant and Machinery(P&M) capital allowances for cabinetwork, institutions, and outfit.

- Access to CGT reliefs like Business Asset Rollover Relief and Business Asset Disposal Relief (BADR).

- Count gains as applicable earnings for pension benefits.

This distinction positions FHL power as one of the many property gamblers offering both FHL duty savings and palpable trading advantages.

A literal Perspective Understanding the invalidation of the FHL Regime

The government’s plan to abolish the FHL governance in April 2025 marks the end of a period for duty-effective vacation let investments. Introduced in 1984, the policy aimed to encourage tourism and stimulate original husbandry. The forthcoming changes are designed to produce equality between short-term lets and long-term settlements, removing benefits such as full finance cost deductions and FHL capital allowances

With HMRC awaiting fresh duty earnings rising from£ 35 million in 2025/26 to£ 245 million by 2028/29, scrutiny of final-time claims will consolidate. Thus, every capital allowances FHL illustration must be directly supported with detailed computations and professional records to repel HMRC review. For investors aiming to cover their position and unmet cash inflow, visionary Financial Planning is now more important than ever.

Table 1: FHL Statutory Qualification Criteria

| Condition | Requirement | Notes |

|---|---|---|

| Location | UK or EEA | Loss restrictions apply between UK and EEA businesses. |

| Furnished | Sufficient furniture for normal occupation | Visitors must be entitled to use the furniture. |

| Availability Test | Available for letting for at least 210 days in the year | Excludes private use days. |

| Actual Letting Test | Actually, let for at least 105 days in the year | Must be commercially let with intent to profit. |

| Long-Term Letting Restriction | Lettings exceeding 31 continuous days cannot be more than 155 days during the year | Prevents the property being used for long-term residency. |

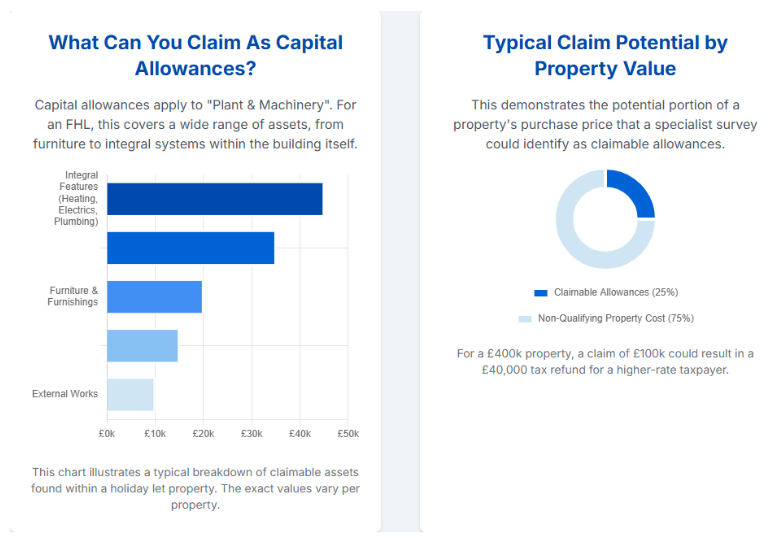

Deconstructing Capital Allowances on FHL Eligible Expenditure Understanding what qualifies as an eligible expenditure is the foundation for successfully claiming FHL capital allowances. These allowances serve as a vital form of duty relief, allowing property possessors to abate the cost of qualifying factories and ministry(P&M) from their taxable gains. For Furnished Holiday Let (FHL) investors, this relief can result in substantial FHL investment duty relief, frequently resulting in significant FHL duty savings multiple times.

Capital Allowances Explained: The description of Plant and Machinery(P&M)

For FHL purposes, factory and ministry include a broad range of tangible means used within the property to generate income. These means can encompass portable furnishings, as well as fixed systems that are part of the property’s functional structure. This wide compass is crucial for maximising claims before the April 2025 deadline.

FHL Furniture and Equipment Allowances (Loose particulars)

Loose particulars are portable furnishings and outfits that make the property suitable for guests. These particulars are easy to validate and claim since they correspond to buy checks. Eligible loose particulars include settees, chairpersons, wardrobes, beds, curtains, and coverlets, alongside appliances such as fridges, freezers, washing machines, broilers, kettles, and boxes. Under current FHL capital allowance rules, numerous of these means qualify for 100% relief at the time of purchase under the Annual Investment Allowance (AIA), giving investors immediate Holiday let capital allowances and cash inflow advantages.

Unleashing Bedded Capital: Integral Features and Institutions

Integral features and institutions frequently represent the largest untapped source of capital allowances for FHL possessors, occasionally equating to 20 – 30 of the property’s purchase or make cost. These ‘embedded means are overlooked in standard accounts but can deliver knockouts of thousands of pounds in FHL duty savings when duly linked.

- Integral Features include

- Heating and water systems

- Electrical and lighting systems

- Air- exertion or ventilation systems

- Lifts, escalators, and other mechanical

This means falling under the Special Rate Pool, with a Writing Down Allowance (WDA) of 6 per time. Institutions, like fitted kitchens, bathrooms, security systems, and fire alarms, also qualify as factories and ministries. Including both institutions and integral features in your claim dramatically enhances overall relief and can indeed recover levies from previous times through proper reassessment. For being possessors, conducting a Capital Allowance Survey before the April 2025 cut-off is pivotal to uncovering this retained value. To ensure compliance and accurate reporting, all claims should be duly proved within your Self-Assessment Tax Return, a crucial step in guarding your annuity and maximising permissible deductions.

Restrictions on Claims

While the compass of FHL capital allowances is broad, some expenditures fall outside the eligible orders. These include

- Land, structures, and structural rudiments (although the Structures and structures Allowance may apply to certain construction costs, it does not extend to FHL trading conditioning).

- Differences to the property that are not directly needed for installing a qualifying factory and ministry (P&M).

- Routine conservation and repairs, which are treated as FHL permissible charges and subtracted from profit income rather than capital allowances.

Calculating and Claiming FHL Capital Allowances Effectively

As the April 2025 deadline approaches, FHL possessors must borrow a precise, strategic approach when calculating and claiming FHL capital allowances. Proper timing and categorisation of expenditures can significantly enhance FHL duty savings and ensure compliance with HMRC norms.

Core Mechanics Annual Investment Allowance (AIA) Priority

The Annual Investment Allowance (AIA) remains the most precious relief available for maximising capital allowances on FHL. It enables a full 100 deduction of qualifying P&M expenditures (up to £1 million annually) at the time they are incurred. FHL possessors planning significant investments in FHL cabinetwork and outfit allowances or non-integrated institutions should prioritise using the AIA within the 2024/2025 duty time, as this accelerated relief will no longer be available after April 2025.

Writing Down Allowances (WDA) The Medium for Ongoing Relief

When expenditures exceed the AIA threshold or apply to means that do not qualify, remaining balances are added to the Writing Down Allowance (WDA) pools for gradational relief.

- Main Pool Covers most portable means, like cabinetwork, fittings, and appliances, written down at 18 per time.

- Special Rate Pool Includes integral features like electrical, heating, and water systems, relieved at 6 per time.

Learning how to calculate capital allowances on FHL means applying the AIA first, also allocating the remaining asset values equally between these pools for continued deductions.

Commercial Maximization Full Expensing (FE) and AIA

For commercial investors, Full Expensing (FE) presents a fresh opportunity. Introduced in April 2023, FE permits companies to abate 100 of qualifying factory and ministry expenditure immediately, banning leased or intimately used means. Still, as the FHL governance for companies ends on 1 April 2025, commercial possessors must act instantly to finalise claims within the account period that spans this date. Delayed action could result in the complete loss of these reliefs, especially where capital investments remain unclaimed.

Navigating Account Styles: Accruals Base vs. FHL Capital Allowances Cash Base

The choice between the supplements base and the FHL capital allowances cash base directly affects eligibility for claiming reliefs.

- Supplements Base Under GAAP, this traditional system is needed to claim AIA, WDA, and bedded institution allowances, making it suitable for larger or further complex FHL investments.

- FHL Capital Allowances Cash Base Available to lower FHL businesses with income under £150,000, this system allows the full deduction of certain capital costs (like cabinetwork and appliances) as charges in the time of payment, replicating a 100% AIA effect.

Bedding means integral features; they must transition to the supplements base before April 2025 if an FHL proprietor wishes to claim high value. This process can be intricate and frequently requires expert account support to handle transitional adaptations duly. For detailed guidance on optimising FHL claims, particularly those linked to property investments and duty planning within the UK chasing request, visit our Real Estate section.

Table 2: Summary of Capital Allowances Rates and Key Claim Methods (2024/2025 Tax Year)

| Allowance Type | Rate/Amount | Qualifying Expenditure | Key Implication for FHLs |

|---|---|---|---|

| Annual Investment Allowance (AIA) | 100% deduction (up to £1M) | Most P&M (excluding cars) | Immediate, single-year write-off. Critical for urgent pre-2025 claims. |

| Full Expensing (FE) | 100% deduction | New main rate P&M (Companies only) | Highly beneficial for corporate-owned FHLs prior to 1 April 2025. |

| Writing Down Allowance (WDA) – Main Pool | 18% per annum (reducing balance) | General P&M and loose Furnished holiday furniture and equipment allowances. | Applies when AIA/FE limits are reached. |

| Writing Down Allowance (WDA) – Special Rate Pool | 6% per annum (reducing balance) | Integral Features (e.g., electrical systems, heating, fitted kitchens). | Essential for high-value embedded fixtures claims. |

Advanced Tax Planning Strategies for FHL Owners

As the FHL capital allowances 2025 deadline approaches, strategic foresight becomes pivotal for landlords seeking to save their tax benefits. This section outlines crucial Holiday let duty tips and planning ways to help property owners secure every relief before the governance’s check.

FHL Capital Allowances for Landlords: The significance of Acquisition Due to industriousness

When acquiring an FHL property, numerous possessors inaptly assume that capital allowances automatically transfer upon accession. These allowances, particularly those related to bedded institutions, must be laboriously linked and claimed. This involves tracing original capital expenditure through major power or construction records, ensuring that the bedded factory and ministry(P&M) value within the purchase price is duly recognised. Without this due industriousness, landlords risk losing access to precious FHL capital allowances for landlords, which could otherwise induce significant FHL duty savings.

Claiming on Bought parcels via Section 198 choices

For alternate-hand FHL investments, the capability to claim relief on institutions depends on the prosecution of a Section 198(S198) election under the Capital Allowances Act 2001. This election formalises the agreed value of institutions between the dealer and buyer, allowing the purchaser to inherit the allowance annuity fairly. Still, the “S198 Sunset Trap” poses a major threat. Following the invalidation of the FHL governance, HMRC guidance suggests that institutions acquired for use in residences post-2025 may become ineligible for relief under Section 35. Thus, any FHL possessors who bought within the last two years must claim FHL capital allowances now and ensure the S198 election is completed before the April 2025 deadline. Failure to act in time could permanently exclude access to knockouts of thousands of pounds in FHL investment duty relief.

Using the Tax Year Time- Sensitive Planning

Effective FHL duty planning depends on precise timing. All qualifying capital expenditure should be completed and claimed within 2024/25 duty time to work the Annual Investment Allowance (AIA) and other accelerated reliefs. Also, when disposing of an FHL property, possessors must precisely consider balancing events. Transitional measures allow continued letting beyond April 2025 without driving immediate balancing adaptations, offering flexibility in managing disposals and duty arrears. Still, expert guidance is essential to optimise these deals and ensure compliance with HMRC transitional rules. For professional support in enforcing these complex strategies and maximising your claim effectiveness, visit our AI Companies section to explore how advanced robotisation and premonitory technologies can help in managing and recycling FHL capital allowance claims effectively.

The 2025 Deadline and Transitional Strategy

The end of the FHL governance marks a vital shift for property investors, making the FHL capital allowances 2025 deadline the most critical moment for action. To save precious duty reliefs, FHL possessors must finalise their claims and ensure compliance before the governance of invalidation takes full effect.

The proximity of the Deadline

To retain eligibility for capital allowances for FHL, all qualifying expenditure must be incurred before the close of the 2024/25 duty time, 5 April 2025 for individuals and 31 March 2025 for companies. The property must also be functional as an active Furnished Holiday Let before these dates. However,” the affiliated costs will not qualify for FHL capital allowances relief, if a property was bought or repaired but not yet “live,” also, HMRC has introduced anti-forestalling rules (effective 6 March 2024) to help prevent manipulation of contracts designed to secure pre-abolition duty advantages. This means that any claim made under the FHL capital allowances HMRC frame must be completely marketable and backed by solid attestation.

Continuing Claims WDA on Unrelieved Pools Post-April 2025

Despite the invalidation, transitional protection exists for pre-established claims. Under the FHL capital allowances changes, any unrelieved balance remaining in the capital allowance pools as of April 2025 will continue to profit from Writing Down Allowances (WDA) at the standard 18 or 6 rates until completely exhausted. This provision highlights the significance of submitting comprehensive claims now. Indeed, if total expenditure exceeds the Annual Investment Allowance (AIA) threshold, creating a valid pool ensures long-term access to relief. Still, no new particulars or expenditure incurred after April 2025 can be added to these pools.

The Future of Relief of Domestic particulars Relief (RDIR)

Following the governance’s invalidation, FHL parcels will transition to standard domestic letting rules. The current system of full capital allowances will be replaced by relief of Domestic particulars Relief (RDIR), which allows deductions only for the relief of furnishings and outfit like FHL cabinetwork and outfit allowances on a like-for-like basis. While this system maintains limited deductibility, it offers significantly lower immediate relief than the AIA and other accelerated mechanisms under the current governance. For expert digital and logical backing in structuring, reviewing, and automating these time-critical cessions, visit our AI Companies section to explore how technology-driven results can enhance compliance delicacy and maximize your final FHL capital allowance claims before the 2025 cut-off.

Table 3: FHL Tax Treatment: Before and After Abolition (April 2025)

| Tax Aspect | Status Before 6 April 2025 (FHL) | Status After 6 April 2025 (Standard Rental) |

|---|---|---|

| Capital Allowances (New Spend) | Available in P&M, fixtures, and integral features. | Abolished for new expenditure. |

| Existing CA Pools | WDA continues unrelieved balances. | WDA continues unrelieved balances (Transitional Rule). |

| Furniture/Equipment Relief | Capital Allowances claimed (AIA/WDA). | Replacement of Domestic Items Relief (RDIR). |

| Mortgage Interest | Fully deductible expenses against income. | Restricted to 20% basic rate tax credit. |

| Capital Gains Tax (CGT) | Access to Business Asset Disposal Relief (BADR), Rollover Relief. | Standard CGT rates apply (18%/24%), reliefs withdrawn. |

| Pension Contributions | Profits count as relevant earnings (relevant UK earnings). | Profits do not count as relevant earnings. |

Realizing FHL Tax Savings: A Client Case Study

To demonstrate how timely, expert action can unleash significant FHL duty savings. Let’s look at how one customer successfully maximised their FHL capital allowances before the approaching 2025 deadline.

Case Study Mr. a’s Coastal Portfolio Acquisition and Refurbishment

Client Profile and Background

A, a high-rate taxpayer, bought a luxury littoral property in Cornwall for £750,000 in July 2023, intending to run it as a decoration-furnished Furnished Holiday Let. He invested a further £150,000 in refurbishment, including new installations and FHL cabinetwork and outfit allowances. Still, his 2023/24 duty return only covered fluently identifiable loose particulars, missing deeper openings for FHL capital allowances.

The Challenge and Missed occasion

While using the supplements counting base, Mr A had not completely employed the Annual Investment Allowance (AIA) or explored the bedded value of factory and ministry(P&M) within the property’s structure. Without calculating capital allowances on FHL properly, a sizable portion of the implicit furnished vacation let capital allowance relief is overlooked.

Lanop’s Advanced Review (Q4 2024)

Lanop conducted a detailed Capital Allowance Survey, examining literal construction documents, checks, and architectural plans. The analysis uncovered

- Original Bedded Institutions Hidden Qualifying P&M, including electrical and heating systems.

- Refurbishment: Integral Features fresh qualifying particulars, such as upgraded wiring and advanced space and water heating systems.

This forensic review uncovered £145,000 in unclaimed P&M, around 16 of the property’s total investment cost.

The Maximisation Strategy (2024/25)

To optimise duty relief before the 2025 arrestment

- AIA Utilisation £100,000 of qualifying P&M was allocated to the AIA, giving an immediate 100 deduction.

- WDA Pool Establishment The remaining £45,000 in integral features was added to a Writing Down Allowance (WDA) pool, allowing continued deductions post-abolition.

Result and Conclusion

Through visionary planning, Mr A secured over £100,000 in immediate deductions and shielded long-term relief for the remaining balance. Acting before April 2025 assured he maximised his FHL investment duty relief, avoided endless loss of unclaimed value, and significantly reduced his taxable gains. To explore how visionary fiscal structuring can safeguard your means and ensure intergenerational benefits, visit our Heritage Tax Planning section for integrated strategies aligned with your FHL property duty deductions UK pretensions.

How Lanop Helps Regarding FHL Capital Allowances and Tax Optimisation

The specialised complexity of FHL capital allowance claims, combined with the strict 2025 deadline and implicit HMRC scrutiny, requires specialist knowledge. Lanop’s platoon brings expansive experience in specialist property duty and commercial strategy, ensuring every customer’s position is optimised for compliance and maximum return.

“Lanop helped us make sense of the tax rules around our holiday. They showed us what we could claim and how to do it properly, which saved us far more than we expected. Their guidance made the whole process clear and gave us confidence that everything was done right.”

UK Small Business Owner

Precision in Pre-2025 Claim Submission

Lanop ensures all Claim FHL capital allowances are submitted directly and within the needed time limit. This includes vindicating that each FHL operates under the correct supplements counting base, using HMRC-biddable forms like SA105 (individualities) or CT600 (companies). Our detailed analysis guarantees that all FHL capital allowances for HMRC sessions are completely biddable, defensible, and strategically structured.

Specialist Capital Allowance Checks

The loftiest implicit FHL duty savings frequently come from relating bedded integral features missed by general accountants. Lanop’s platoon conducts professional Capital Allowance Checks, uncovering 20–30 retired qualifying factory and ministry (P&M) within property accession, refurbishment, and construction costs. This process maximises FHL property duty deductions UK before the 2025 deadline.

Transitional Planning and Checkups

Lanop provides visionary guidance to ensure flawless compliance during the FHL capital allowances changes period, including

- WDA Pool Management: Establishing and maintaining unrelieved pools as of April 2025 to save long-term relief.

- Commercial Optimisation icing limited companies use Full Expensing and AIA before the 1 April 2025 cut-off.

- Post-Abolition Compliance Supporting guests in transitioning to the relief of Domestic particulars Relief (RDIR) for post-2025 expenditure.

Holistic Duty Advice

Lanop’s support extends beyond capital allowances. We give full-diapason advisory on affiliated counteraccusations, like the pullout of Capital Earnings duty (CGT) reliefs like BADR, and the mortgage interest deduction cap. Our integrated approach ensures guests maintain duty-effective vacation let investments, combining moxie across Landlord Services, Limited Companies, and Tax Planning for complete fiscal alignment.

FAQs

How to claim FHL capital allowances?

To claim FHL capital allowances, your FHL business must use the supplements counting system and submit claims via SA105 (individualities) or CT600 (companies). Identify qualifying Plant and Machinery (P&M) costs, apply the Annual Investment Allowance (AIA) for 100 deductions, and allocate remaining values into Main (18) or Special Rate (6) pools. Commissioning a specialist Capital Allowance Survey helps uncover retired institutions, ensuring compliance and maximising available relief under the FHL capital allowances HMRC frame before April 2025.

Who qualifies for FHL capital allowances in the UK?

Eligibility for capital allowances on FHL applies to individuals, partnerships, or companies meeting all statutory FHL tests available for letting 210 days, actually letting 105 days, and not exceeding 155 long-term letting days. Qualifying FHL capital allowances 2025 expenditure must be incurred before April 2025. Claims must relate to functional Furnished Holiday Let parcels that meet these criteria, ensuring compliance with HMRC norms and allowing possessors to pierce precious FHL duty savings through licit deductions and Holiday let capital allowances strategies.

How do I calculate FHL capital allowances?

To calculate capital allowances on FHL, identify all qualifying Plant and Machinery (P&M) charges, including integral institutions and loose particulars. Abate up to £1 million using the AIA, with remaining costs allocated to the Main Pool (18) or Special Rate Pool (6) for Writing Down Allowances. Expert assessment ensures delicacy and helps uncover missed means. Computations should include bedded features to optimise furnished vacation let duty relief and ensure compliance with the FHL capital allowances HMRC frame before the 2025 invalidation deadline for FHL capital allowances claims.

Do I need to keep records to claim FHL capital allowances?

Yes, accurate record-keeping is vital to claim FHL capital allowances. Maintain checks, bills, evidence of payments, and detailed Plant and Machinery reports. HMRC requires precise attestation to corroborate eligibility under the FHL capital allowances of HMRC governance. For parcels with bedded institutions, professional checks support bidding and defensible claims. Keeping comprehensive records ensures transparent FHL capital allowances, cash-based or addendum-grounded reporting, and protects your right to claim maximum FHL property duty deductions UK before the April 2025 deadline.

Can a limited company claim FHL capital allowances?

Yes, limited companies can claim FHL capital allowances until 1 April 2025. Commercial realities profit from Full Expensing, offering a 100% deduction on qualifying Plant and Machinery means for the first time. It is pivotal to claim before the deadline to secure FHL capital allowances 2025 benefits. Strategic planning ensures effective use of the AIA while optimising long-term relief. Professional advice helps limited companies completely use FHL capital allowances changes to enhance duty-effective vacation let investments and secure maximum commercial duty savings.

How can I maximise my duty savings with FHL capital allowances?

To maximise FHL duty savings, act now. Commission a specialist Capital Allowance Survey to uncover unclaimed institutions and bedded Plant and Machinery within your property. Use the AIA for 100 relief on FHL cabinetwork and outfit allowances before April 2025, and pool unrelieved balances for ongoing WDA protection. Timely planning safeguards unborn deductions under FHL capital allowances changes. Acting snappily ensures your FHL investment duty relief is locked in, precluding endless loss of precious Holiday let capital allowances once the governance ends.

Conclusion: Staying in Control So You Don’t Pay Too Much Tax UK

Most people only realize they’ve been paying too much tax when the issue has already hit, maybe a tax code error quietly reduced their take-home pay, or a pension lump sum was cut down by emergency tax. By then, frustration sets in. But avoiding these problems isn’t complicated. It simply comes down to being proactive. Check your tax code regularly instead of assuming HMRC got it right. Review your Council Tax each year to see if you qualify for discounts like the Single Person Discount or disability reductions. And if you take money from your pension, don’t wait months for HMRC to sort it out, use forms like P55 or P53 straight away to recover anything you’ve paid too much tax on pension withdrawals.

Another point people often miss is the strict four-year limit for Overpayment Relief. If you don’t claim in time, even clear evidence of paying too much tax, HMRC will not bring your money back. That’s why relying on automated systems like the P800 isn’t enough. You need to stay on top of your own records. When you make these checks a routine, you stop unnecessary losses before they happen. Instead of constantly asking yourself, “am I paying too much tax UK workers always worry about, you’ll know the answer. You’ll be confident that your money is protected and that you’re paying only what’s fair, no more.