The Principle of Flexibility: Understanding the Self-Assessment Late Filing Penalty Waiver

The Context of Exceptional Circumstances and HMRC’s Response

In recognition of the unique and exceptional challenges posed by the pandemic, HM Revenue & Customs (HMRC) demonstrated operational flexibility to assist millions of UK taxpayers struggling to meet their statutory obligations. Specifically, the HMRC Chief Executive, Jim Harra, announced a crucial concession for Self-Assessment customers. This decision acknowledged that many people were facing extraordinary pressures that made compliance with the traditional timeline extremely difficult.

The core feature of this relief was the waiving of the initial late filing penalty. HMRC stipulated that no late filing penalty would be imposed on customers who submitted their online tax return after the statutory deadline, provided that the return was filed by the deferred date of 28 February 2021. This last-minute adjustment was a significant development, estimated to benefit more than three million people who had yet to file their returns during the crisis. The intent behind this extension was clear: to grant taxpayers the necessary “breathing space” required to complete and submit their documentation without the immediate concern of administrative sanctions.

The Unwavering Payment Deadline and Interest Implications

While the filing deadline was extended, it is paramount for sole traders and small business owners to understand a critical distinction in UK taxation: the concession applied only to the administrative filing requirement, not the financial payment obligation. The deadline for settling the Self-Assessment tax bill remained firmly set at 31 January.

HMRC continued to encourage all customers to file and pay as early as possible, ideally by the original 31 January date. This unwavering commitment to the payment deadline underscores a core principle of HMRC policy: administrative penalties for filing can be mitigated under exceptional circumstances, but the underlying tax liabilities are considered due on the statutory date. This ensures immediate revenue collection remains prioritized over the enforcement of administrative sanctions.

The immediate consequence of failing to pay by the statutory date was the automatic imposition of interest charges. Interest on any outstanding tax liabilities began accruing automatically from 1 February 2021. This late payment interest is rarely waived, irrespective of the difficulties experienced by the taxpayer. Therefore, even if a taxpayer benefited from the filing extension to 28 February, they were still liable for at least 28 days of interest if payment was not made by 31 January. This recurring mechanism highlights the necessity for meticulous financial planning to protect against unnecessary future costs.

Prefer watching instead?

Here’s a video summary for you

How Can Customers Pay Tax? Comprehensive Methods for Settling Your Tax Bill

Core Payment Responsibility and Compliance

All UK taxpayers must discharge their responsibility to pay their tax bill by the statutory payment deadline of 31 January, even if their return is submitted earlier or later due to an extension. Timely payment is the primary defense against the immediate imposition of interest charges.

When remitting payment, strict compliance requires the use of the taxpayer’s unique identifier. Taxpayers must ensure they use the correct payment reference number, which is typically their 10-digit Unique Taxpayer Reference (UTR). This reference number is essential for ensuring that funds are correctly allocated to the taxpayer’s Personal Tax Account and avoiding complications or potential late payment notifications from HMRC.

Detailed Breakdown of Payment Methods and Timelines

Taxpayers have a variety of secure methods available for remitting their tax liabilities, including online payment, bank transfer, and payment by post. However, the choice of payment method directly affects the time taken for the payment to clear and be formally registered by HMRC. This clearance time is a critical factor, especially when taxpayers are approaching the 31 January Self-Assessment deadline.

The Fastest and Most Recommended Payment Options

For taxpayers making payments close to the deadline, digital solutions offering same or next-day clearance are strongly recommended to mitigate the risk of triggering interest charges from 1 February.

- Faster Payments (Online or Telephone Banking): This method is highly reliable, with funds typically reaching HMRC on the same or next day. Crucially, this rapid processing time applies even on weekends and bank holidays, making it the preferred solution near the 31 January deadline.

- Debit Card or Corporate Credit Card Online: Payments made using a debit card or a corporate credit card online are processed quickly and generally reach HMRC on the same or next day. It is important to note, however, that HMRC does not accept personal credit cards for the settlement of tax liabilities.

- The HMRC App: The free HMRC app allows taxpayers to approve payments through their bank’s app or online banking, facilitating same-day or next-day clearance.

- CHAPS (Clearing House Automated Payment System): CHAPS payments reach HMRC on the same working day, provided the transfer is made within the paying bank’s cut-off processing times. This method is typically used for high-value or highly urgent payments.

Slower Payment Options Requiring Planning

Taxpayers must exercise caution when using payment methods that require a longer lead time, as payment must reach HMRC on or before 31 January to avoid interest.

- Bacs (Bankers’ Automated Clearing Services): Bacs transfers are standard bank transfers but generally require 3 working days to clear and reach HMRC.

- Cheque by Post: If paying by cheque, taxpayers must send it through the post to the specified HMRC Direct address. Taxpayers must allow 3 working days for the cheque to reach HMRC and be processed.

The disparity in processing times creates a significant latent compliance risk for taxpayers who wait until the final few days. A small business owner using Bacs on January 29th, for instance, risks the payment clearing on 1 February or later, instantly triggering the retrospective interest charges. For this reason, chartered accountants always advise clients to rely on Faster Payments or digital card options when payment is imminent.

Table 1: HMRC Self-Assessment Tax Payment Methods and Clearance Times

| Payment Method | Processing Time (Working Days) | Recommended Usage | Risk Level Near 31 Jan |

|---|---|---|---|

| Faster Payments (Online Banking) | Same or Next Day | Recommended for deadline payments | Low |

| Debit / Corporate Credit Card Online | Same or Next Day | Highly reliable digital option | Low |

| CHAPS | Same Working Day | High-value, urgent payments | Low |

| Bacs | 3 Working Days | Standard bank transfer, requires planning | High |

| Cheque (Post) | 3 Working Days (after receipt) | Avoid if payment is urgent | High |

What Happens to Taxpayers Who Cannot Afford to Pay Their Tax Bill on Time? (Navigating Time to Pay)

The Time to Pay (TTP) Mechanism

For UK taxpayers, including sole traders and small business owners, facing genuine, temporary financial difficulty and unable to settle their full Self-Assessment tax bill by the 31 January deadline, HMRC provides the Time to Pay arrangement. This mechanism acts as a vital lifeline, allowing the taxpayer to spread their outstanding tax debt over a manageable period, typically up to 12 months.

Although TTP arrangements provide crucial flexibility and prevent the immediate escalation of debt collection measures, two key facts must be understood: firstly, the taxpayer must still have filed their return; and secondly, interest will continue to be charged on the outstanding tax debt for the entire duration of the payment plan, starting from 1 February.

Essential Prerequisites for TTP

The availability of a TTP arrangement is contingent upon the taxpayer first fulfilling their primary statutory duty: filing. A critical precondition for setting up any TTP arrangement is that the customer must have successfully filed their 2019 to 2020 tax return (or the return for the relevant tax year) before attempting to establish the payment plan. HMRC views TTP as a solution to the payment problem, and compliance with the filing requirement is non-negotiable before payment terms can be negotiated.

Where And How Can Customers Discuss Time to Pay?

HMRC offers two distinct routes for establishing a TTP arrangement, depending on the complexity and size of the tax debt.

The Online Service for Automated Arrangements

For most Self-Assessment cases, HMRC provides a straightforward, automated online application service. This route is available only if the taxpayer meets specific, strict eligibility criteria:

- The total tax liability owed must be £30,000 or less.

- The taxpayer must plan to pay the debt off within 12 months.

- The taxpayer’s tax returns must be fully up to date.

- The application must be initiated within 60 days following the 31 January payment deadline.

This automated process is efficient for many small business owners whose tax debt falls within these standard parameters.

Negotiation via the Phone Helpline

Customers who do not meet the criteria for the automated online service must contact HMRC directly by phone. The designated helpline for discussing TTP is 0300 200 3822. Direct negotiation is mandatory if:

- The outstanding tax bill is over £30,000.

- The taxpayer requires a payment plan lasting longer than the standard 12 months.

- The taxpayer has other existing tax debt or payment plans already in place with HMRC.

The distinction between the automated threshold and the required human negotiation defines the point where standard compliance moves into complex financial restructuring. For debts exceeding £30,000 or requiring terms longer than 12 months, scenarios often faced by larger small business owners or those in acute financial distress professional intervention is highly recommended. HMRC requires a detailed demonstration of the taxpayer’s ability to service the debt and maintain ongoing compliance. Experienced chartered accountants can act as crucial intermediaries, presenting a robust financial case that increases the likelihood of securing the required terms, sometimes extending the repayment period beyond the typical 12-month limit in specific turnaround or insolvency scenarios.

Can Customers Reduce Their Payments on Account? Managing Estimated Tax

Defining Payments on Account (POA)

The Self-Assessment system operates on a “pay as you go” basis, primarily through Payments on Account (POA). POA are advance payments made by taxpayers towards their estimated tax liability for the current tax year. This system is designed to distribute the tax burden across the year, rather than requiring a single, large payment.

A typical year’s liability is divided into two equal instalments of POA, each representing half of the previous year’s total tax liability. These payments are due by midnight on two crucial dates: 31 January and 31 July.

Grounds for Requesting a Reduction

Taxpayers who anticipate a reduction in their taxable income for the current year are entitled to apply to HMRC to reduce their POA. This option was particularly relevant during the period in question due to widespread loss of earnings during COVID-19, which significantly impacted on the profitability of many sole traders and small business owners.

Reducing POA prevents the taxpayer from overpaying tax throughout the year, thereby providing essential relief and safeguarding crucial cash flow. By accurately forecasting a lower tax bill, the taxpayer can maintain better financial liquidity until the final balancing payment is due.

The Procedure and Risks of Reducing POA

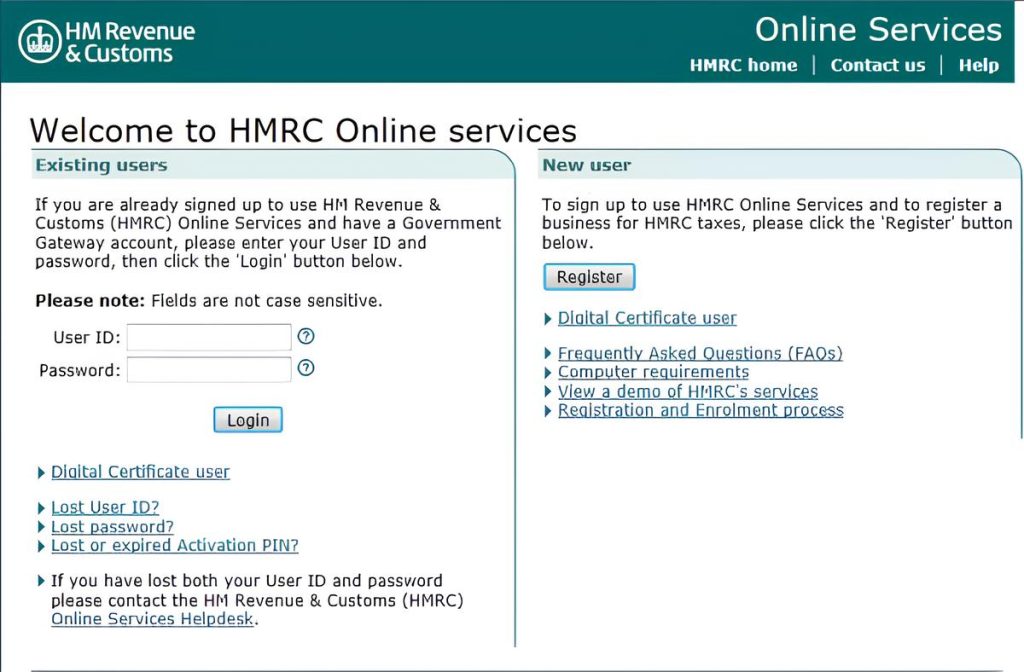

Taxpayers can request a reduction in their Payments on Account either through the HMRC online services or by traditional post.

Procedure for Reduction

The most efficient approach is to utilize the online system via the Government Gateway:

- Sign into the HMRC online services account.

- Navigate to the Self-Assessment section.

- Select the option to ‘Reduce payments on account’.

- Provide a justified, revised estimate of the expected current year’s income and resulting tax liability.

Alternatively, customers can complete and submit Form SA303 by post to their respective tax office.

The Risk of Underestimation

While reducing POA provides cash flow relief, it is not a decision to be taken lightly. The freedom to reduce the payments is strictly conditional upon the taxpayer making a reasonably accurate estimate of their future income.

If a taxpayer reduces their POA too much and their final tax bill ultimately proves to be higher than the revised estimate, HMRC will charge interest on the difference between the reduced amount paid and the amount that should have been paid. This interest is calculated retrospectively from the original due dates of the POA instalments (31 January and 31 July). In severe cases of excessive reduction without genuine justification, HMRC reserves the right to impose financial penalties.

This exposure to retrospective interest charges highlights the absolute necessity of accurate financial forecasting. Relying on the professional expertise of chartered accountants to calculate the projected tax liability before requesting a reduction ensures that the taxpayer minimizes the risk of incurring unexpected future costs from HMRC.

How Can Customers Claim a Contributory Benefit? The Importance of Class 2 National Insurance

The Crucial Link Between NICs and Contributory Benefits

For self-employed individuals and sole traders, the payment of National Insurance contributions (NICs) is intrinsically linked to eligibility for certain forms of state support. These are known as contributory benefits, which include fundamental components of the UK social safety net such as the State Pension, Maternity Allowance, and New Style Employment and Support Allowance (ESA).

The specific contributions relevant here are the Class 2 National Insurance contributions (NICs). These are typically calculated and paid alongside Income Tax and Class 4 NICs through the Self-Assessment system. Maintaining a continuous, up-to-date National Insurance record by ensuring these Class 2 NICs are paid on time is vital for establishing entitlement to these benefits.

The Danger of Late Payment or TTP Arrangements

The administrative timing of payments creates a unique vulnerability for self-employed individuals who need to claim a contributory benefit soon after the 31 January deadline. Self-Assessment customers in this situation must ensure their annual Class 2 National Insurance contributions are paid by 31 January 2021 to guarantee that their claims are unaffected.

The risk arises when a taxpayer cannot pay their full Self-Assessment liabilities (tax debt) by the deadline and opts to enter a Time to Pay arrangement. Because the Class 2 NICs are typically included within the overall balancing payment due on 31 January, deferring that payment through a TTP plan even if the taxpayer makes regular instalments can defer the date on which those Class 2 NICs are officially credited to the National Insurance record.

Safeguarding Your National Insurance Record

A delay in the credit of Class 2 National Insurance can be critically detrimental for time-sensitive applications, such as for Maternity Allowance. If the benefit claim is submitted before the delayed NICs are officially recorded as paid, the claim may fail or be reduced, even though the taxpayer is actively working toward clearing their tax debt with HMRC.

This critical compliance intersection requires proactive management. The explicit instruction for taxpayers is to prioritize settling the portion of their tax liability specifically covering the Class 2 NICs by 31 January, even if the remaining Income Tax portion is subject to a TTP plan. This strategy ensures that the essential National Insurance record is protected, guaranteeing immediate access to contributory benefits should the need arise. Although HMRC typically takes steps to identify and contact customers affected by this issue, relying on this retrospective process carries unnecessary risk for critical welfare provisions.

How Can Customers Contact HMRC? Effective Communication and Identity Verification

Available Contact Channels and Access

HMRC maintains a robust array of communication channels designed to support UK taxpayers with their queries relating to Self-Assessment and UK taxation. These channels include the dedicated Self-Assessment phone helpline, digital support via webchat, and interactive platforms such as Twitter (by directing posts to @HMRCcustomers). Furthermore, customers can efficiently access personalized information, track payments, and manage various aspects of their tax affairs through their Personal Tax Account or the free HMRC app.

Helplines and Webchat Availability

Standard operating hours for the main Self-Assessment phone helpline are generally weekdays, typically running from 8 am to 6 pm, with webchat services sometimes offering slightly longer availability. However, during critical peak filing periods, such as the final days leading up to the 31 January deadline, HMRC significantly extends its services to handle increased demand.

During the critical period leading up to the 2021 filing deadline, for instance, HMRC extended opening hours for both phone helplines and webchat services across the final weekend of 30th and 31st January. The specific weekend timings reflected this extended commitment:

- Phone Helpline Opening Times: Saturday, 30th January: 8 am to 6 pm; Sunday, 31st January: 9 am to 6 pm.

- Webchat Service Opening Times: Saturday, 30th January: 8 am to 8 pm; Sunday, 31st January: 8 am to 8 pm.

These temporary extensions illustrate HMRC’s commitment to providing maximum accessibility to taxpayers during high-pressure compliance windows.

Protecting Your Identity: Verification Requirements

To safeguard sensitive personal financial data against identity fraud and ensure the integrity of the system, HMRC enforces strict identity verification protocols before granting access to its online services or the Personal Tax Account.

Taxpayers must be ready to verify their identity using multiple, independent sources of information. This requirement for at least two sources of information ensures robust security and reflects the sensitive nature of the information held within the system.

The types of documents and data points generally required for verification include:

- A UK passport (used as photographic identification).

- Recent financial documentation, such as a P60/payslip.

- Existing relationships with HMRC, verified through details regarding Tax credits.

- Financial data validated by a Credit Reference Agency Data.

- Other accepted sources for digital verification may include a UK photocard driving license or a current account with a UK bank or building society.

The extensive nature of these security requirements demonstrates the high level of Trustworthiness and control necessary for managing personal financial information within the UK taxation framework. Preparation is key; taxpayers must have these documents readily available to prevent being locked out of their accounts during crucial filing or payment deadlines.

Table 2: Required Identity Verification Documents for HMRC Online Services Access

| Category | Source Example | Minimum Required | Purpose |

|---|---|---|---|

| Primary Identification | UK Passport (or Driving Licence) | At least two sources required | Proving personal identity |

| Employment / Earnings | P60 / Payslip | At least two sources required | Validating employment history |

| Financial History | Credit Reference Agency Data | At least two sources required | Verifying financial footprint |

| Existing HMRC Relationship | Tax Credits Correspondence | At least two sources required | Confirming prior tax interactions |

Need More Help? Partnering with Lanop Chartered Accountants and Tax Advisors

The Value of Expert Advisory Services in Complex Compliance

The administrative flexibility demonstrated by HMRC during periods of crisis, while welcomed, introduces layers of complexity, particularly when navigating the fine print regarding interest charges from 1 February, the rigid prerequisites for Time to Pay arrangements, and the delicate link between delayed payments and Class 2 National Insurance credit for contributory benefits.

For small business owners and sole traders, the compliance landscape requires more than simply meeting deadlines; it demands strategic planning, precise forecasting, and expert negotiation. Accurately assessing the justification for reducing Payments on Account, mitigating the risk of retrospective HMRC interest charges, and ensuring robust representations during potential HMRC Tax Investigations requires the specialized knowledge of highly experienced chartered accountants.

Lanop’s Commitment to Excellence and Technological Expertise

Lanop Chartered Accountants and Tax Advisors are dedicated to providing comprehensive financial solutions and expert guidance across all facets of UK taxation and compliance. As experienced chartered accountants and trusted business advisors, the firm focuses on building long-term relationships founded on reliability and high standards of professionalism.

The firm maintains extensive knowledge in modern cloud accounting platforms, including XERO Accounting, providing clients with seamless technical guidance and support for their day-to-day financial operations.

FAQs – HMRC Self-Assessment Deadline Extension

1. What was the purpose of HMRC’s late-filing penalty waiver?

The HMRC late-filing penalty waiver was introduced to support UK taxpayers affected by the pandemic. It allowed individuals extra time to submit their Self-Assessment tax return without facing the usual £100 penalty, if they filed online by 28 February 2021. The measure acknowledged the financial and logistical pressures faced by self-employed professionals and small businesses, giving them breathing space to stay compliant while managing their cash flow more effectively.

2. Did the HMRC extension also apply to tax payments?

No, the HMRC deadline extension applied only to the filing of Self-Assessment returns, not to tax payments. The actual payment deadline remained 31 January 2021, and any unpaid tax began accruing interest from 1 February. Even if the return was submitted by the extended date, interest on outstanding amounts still applied. Taxpayers were therefore encouraged to pay their Self-Assessment tax bill on time to avoid unnecessary costs.

3. How can taxpayers avoid penalties and interest in the future?

The best way to avoid penalties is to plan ahead. Keep accurate digital records using XERO Accounting or similar tools, set aside funds for your Self-Assessment tax bill, and submit early. Partnering with professionals such as Lanop Chartered Accountants and Tax Advisors can make a big difference. Their team helps you calculate liabilities correctly, manage cash flow, and ensure compliance with HMRC requirements before deadlines, protecting you from late-payment interest or filing penalties.

4. What options are available if I can’t pay my tax bill on time?

If you cannot pay your Self-Assessment tax bill, HMRC may allow you to set up a Time to Pay arrangement. This lets you spread your balance over several months, usually up to 12. Interest still applies, but it prevents harsher debt recovery actions. For larger bills or complex cases, it’s best to seek help from Lanop Accountants, who can liaise directly with HMRC and negotiate manageable terms that protect your business finances.

5. Does reducing my Payments on Account affect future tax years?

Yes, it can. Reducing Payments on Account can help if your income drops significantly, but underestimating your earnings could lead to HMRC interest charges later. Before requesting a reduction, review your figures carefully or consult experts such as Lanop Chartered Accountants, who can forecast your income and advise on the safest adjustment. Getting this right avoids future underpayment penalties while keeping your cash flow balanced during uncertain periods.

6. Why is working with a tax advisor like Lanop beneficial for Self-Assessment?

Handling Self-Assessment tax returns can be time-consuming and stressful, especially with frequent updates from HMRC. Working with Lanop Business and Tax Advisors gives you professional support from experts who understand UK tax law, digital accounting software, and submission requirements. They help ensure your returns are accurate, filed on time, and compliant. Beyond filing, Lanop provides strategic advice to reduce tax liabilities, manage cash flow, and strengthen your financial planning year-round.