Hassle-Free Self-Assessment Tax Returns That Deliver Accuracy, Speed, and Peace of Mind

Filing a tax return shouldn’t disrupt your life or your business. At Lanop Business & Tax Advisors, our experts handle your Self-Assessment with precision, speed, and complete HMRC compliance. Whether you’re self employed, a company director, or managing diverse income streams, we make the process seamless and stress-free. Expect fixed fees, rapid turnaround, and zero guesswork, just straightforward self employment accounting done right and on time.

Three Powerful Ways Lanop Gets Your Tax Return Right the First Time

- Let Lanop handle the pressure of your tax return, so you can stay focused on growing your business and living your life. Our tailored approach to self employment accounting gives you confidence, clarity, and control.

Expert Support That Speaks Your Language

- Our seasoned tax professionals offer personalized advice based on your unique financial situation. No jargon, just clarity and confidence. If you are asking, "Do I need to complete a tax return?" our experts will provide a clear answer.

Complete Control From Start to Submission

- We manage your entire tax return journey. From gathering documents and identifying reliefs to submitting directly to HMRC, our end-to-end self employed accounting services ensure every detail is correct and every opportunity is maximised.

Deadline Mastery That Keeps You Covered

- Never miss a deadline again. We keep you informed, handle submissions early, and provide full support even if you're running late. Don't worry about the self assessment tax return deadlines, we manage them for you.

Explore Our Full Suite of Expert Accounting Services

At Lanop, our self employed accounting services are built to empower individuals, startups, and growing businesses. Discover how our expert-led solutions help you stay compliant, tax-efficient, and stress-free.

Expertly managed tax return filings for self employed professionals, landlords, freelancers, and directors. We ensure full HMRC compliance, maximise tax reliefs, and eliminate errors or delays.

Comprehensive CT600 filing and compliance for limited companies. We identify tax-saving opportunities while keeping your business aligned with HMRC deadlines and reporting requirements.

Accurate monthly bookkeeping, VAT calculations, and digital submissions. Our services support MTD compliance and keep your records in perfect order for smooth tax seasons.

Seamless weekly or monthly payroll management, including RTI submissions and auto-enrolment. We ensure your team is paid correctly and your payroll remains fully HMRC compliant.

We prepare and submit your statutory accounts with precision. From balance sheets to Companies House filings, everything is handled by qualified professionals you can trust.

Get expert help with incorporation, company structure, and financial setup. Our guidance gives your startup a solid foundation with clear direction from day one.

Proactive tax planning tailored to your situation. Our team helps you legally reduce your tax burden and protect your income with future-focused strategies.

Who We Help

Our Self-Assessment Tax Return Services are designed for:

- Self-Employed Individuals & Sole Traders

- Freelancers & Contractors

- Landlords with Rental Income

- Directors & Shareholders

- High Earners (over £100,000)

- Investors with Dividends or Capital Gains

- Anyone with Untaxed Income or Side Hustles

- Crypto Traders, Etsy Sellers, and Content Creators

If you’ve received income not taxed at source, you likely need to file. If you are unsure of the threshold for self-assessment, ask us.

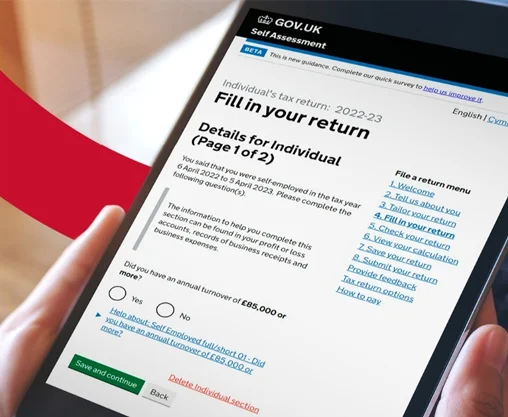

What is a Self-Assessment Tax Return?

A Self-Assessment Tax Return is how individuals report their income to HMRC when it’s not automatically taxed. If you’re self-employed, receive rental income, dividends, or foreign earnings, you must declare this via a SA100 tax return form. Understanding who needs to do a tax return is the first step, and we can clarify the requirements for you.

The process involves calculating your total income, allowable expenses, tax owed, and submitting it by the 31st January deadline. Failure to comply results in penalties, interest, and even HMRC investigations. But for most people, the challenge lies in understanding what qualifies, what can be deducted, and how to avoid errors. This is why many look for a self assessment tax return accountant.

At Lanop, we break the complexity down into manageable steps. We’ll advise what documents you need, help you claim eligible expenses, and file self assessment tax return directly with HMRC, giving you total peace of mind.

Whether it’s your first time filing or you’re tired of the yearly stress, our fully managed Self-Employed Accounting Services are designed to take the pressure off your shoulders. With Lanop, your self employment accounting is in safe, experienced hands.

Common Challenges Self-Employed Personals Face

- I don’t know what expenses I can claim

- I missed the deadline or filed late before

- I don’t have time to deal with HMRC forms

- I’ve just gone self-employed and need help

- I’m not sure if I even need to complete a tax return

- I’m afraid of making mistakes and getting fined

- I have multiple income sources (e.g., freelance + rental)

The Risks of Filing Incorrectly or Late

If you file your tax return late or with mistakes, it can cause more trouble than you might expect. HMRC will fine you £100 right away if you miss the deadline. Then, after three months, the fines start adding up every day. You’ll also owe interest on any tax you haven’t paid yet. If you keep making errors, HMRC might even open an investigation, which is stressful and takes time.

It’s easy to make honest mistakes. Maybe you forgot to include some income or claimed something that isn’t allowed. Even small errors like these can lead to checks that mess with your money and peace of mind.

That’s why having a good self employed accountant on your side makes all the difference. At Lanop, we check every number carefully to make sure your return is right and follows all the rules. If you’re late or need to fix something from before, we’ll talk to HMRC for you and sort it out.

Don’t risk fines or headaches because of confusion or busy days. Let Lanop’s self employed accounting services take care of it so you can relax and focus on what matters.

Penalty Triggers You Can Avoid With Lanop

- Submitted incomplete records

- Missed out on allowable deductions

- Missed the 31 January filing deadline

- Claimed ineligible expenses or reliefs

- Incorrect calculation of taxable income

- Filed without registering for self-assessment

How We Make Filing Easier Than Ever

At Lanop, we know filing your tax return can feel overwhelming, so we’ve designed a service that’s simple and stress-free, no matter your situation.

It all starts with a free chat. We’ll talk about your income, expenses, and deadlines so we fully understand your needs. This way, we can give you a clear fixed price from the start, with no hidden costs.

Next, we’ll send you a list of the documents we need. You can upload them securely using our portal or just email them, whatever works best for you. We want to make it easy and convenient, so you don’t have to worry about complicated steps.

Then, our team will get to work preparing your SA100 tax return. We check everything carefully to make sure it follows all the HMRC rules. When it’s ready, we’ll file it directly with HMRC for you. After that, you’ll get a confirmation and a copy of your return to keep.

But we don’t just stop there. We also offer handy tax-saving tips, remind you about important deadlines, and give you direct access to a tax expert whenever you need advice. Whether you need help once or want ongoing support, Lanop’s self employed accounting services take the hassle out of tax time and give you peace of mind.

FAQ

ask us anything

Do I need to file a self-assessment tax return?

If you earn money that isn’t taxed straight away, maybe from running your own business, renting out a place, or investments, then yes, you’ll need to file a self-assessment tax return. It’s how HMRC knows what you owe. Lots of people use our self employed accounting services to avoid the confusion and get it right the first time.

What is the self-assessment tax return filing deadline?

The deadline to get your online self-assessment tax return in is January 31st every year for the previous tax year. And if it’s your first time, you need to register by October 5th, or HMRC will charge you fines. Missing this deadline can get expensive, so having an accountant for self employed on your side is a real help.

Can I claim expenses like phone, mileage, or home office?

Yes, you can claim expenses like phone bills, driving costs for work, or even a home office space if you use it regularly. These claims help lower the amount of tax you pay. Our self employed accounting services make sure you don’t miss out on any legitimate deductions you qualify for.

What happens if I miss the deadline?

Missing the deadline isn’t ideal, HMRC starts charging fines quickly, and you could owe interest on what you owe. But don’t panic. We can help get your return filed fast and talk to HMRC to keep any penalties as low as possible. That’s the benefit of working with an experienced tax accountant for self employed.

Can I file a self-assessment without an accountant?

You can, for sure. But many people find it tricky and stressful, especially when it comes to claiming the right expenses or avoiding mistakes. Hiring a self employed accountant means you get it right the first time and can focus on running your business instead.

Is your service 100% online?

Yes, everything can be done online. You upload your documents through our secure portal, and we’re available for calls or video chats whenever you need advice. Our online accountant for self employed service means you get expert help wherever you are.

Our Identity

Integrity, honesty, and dedication are the core values at Lanop Business & Tax Advisors. Since launching our first Putney office in 2010, we’ve grown into a fully digital, UK‑based accounting and tax advisory firm that blends expert compliance with forward‑looking guidance and business strategy.

Our team of specialized chartered tax advisors and accountants delivers a full spectrum of services including tax planning, bookkeeping, VAT, payroll, and virtual finance director support all designed to help you manage your business more efficiently and confidently.

We believe accounting is more than numbers it’s about empowering your journey through modern finance. That means applying strategic insight, breaking down complex financial processes, and acting as your trusted partner not just submitting filings.

Put simply, Lanop Business & Tax Advisors is more than an accounting firm we are your strategic ally, dedicated to guiding your financial success with integrity, precision,

EXCELLENTTrustindex verifies that the original source of the review is Google. We're a small company in business for 23 years. We've been with Lanop for over a year now. From the outset they listened carefully to our somewhat complex bookkeeping needs (we sell products and services with different tax codes); they've provided a tailored solution that they execute with precision and in a timely manner. We hired them to provide combined bookkeeping, payroll and accountancy service, and they're a dream to work with on all aspects. They are careful and conscientious, and never last minute. Excellent measured responses when I ring up with questions - always so friendly, too. The price is very reasonable, not least given the high standard of service and the peace of mind we have. Top drawer.Posted onTrustindex verifies that the original source of the review is Google. I'm in the early stages of a startup and got in touch with Lanop, who looked to be very knowledgeable in my niche. I booked a 30-minute consultation with Muhammad, who was great and understood all the challenges i'd be facing and what direction i need to go. I was very impressed with his advice, and i came away with confidence and reassurance that this is someone i need to be working with as i scale up.Posted onTrustindex verifies that the original source of the review is Google. The Free 30 mins call was exactly what I needed to understand my situation better and the team was really helpful in providing advise and recommending next step. I look forward to working with them long termPosted onTrustindex verifies that the original source of the review is Google. It has been an absolute pleasure working with Lanop. Excellent!Posted onTrustindex verifies that the original source of the review is Google. I reached out to Zaib with some business and visa compliance related questions. Zaib was extremely kind and efficient in sharing his knowledge to my specific circumnstance and beyond helpful with helping us understand how to set up our business and ensure we were being tax efficient. Thanks, Zaib and team.Posted onTrustindex verifies that the original source of the review is Google. I was so lost in the woods with taxes and accounts, and on top of that, I had a limited company I was eager to get off my hands. Lanop was fabulous from start to finish and got everything taken care of. I went from being a bundle of nerves about anything financial to feeling totally at ease. I never thought I'd see the day! Everything occurred in a timely manner and I was always updated on everything that was going on, which was lovely. I was also quoted really fairly for everything as well! Above all else, Lanop gave me incredible peace of mind. If you work with them, you'll certainly be in good hands.Posted onTrustindex verifies that the original source of the review is Google. Had a great meeting with Mohammad. Cleared up all questions we had surrounding “Gift with Reservation of Benefits”. Very calm and clear communicator. Thank you.Posted onTrustindex verifies that the original source of the review is Google. Very happy to recommend Lanop accountants at 389 Upper Richmond Road. They were very communicative, helpful and efficient.Posted onTrustindex verifies that the original source of the review is Google. I am a new owner to a company and they have really helped in supporting me in the startup of my businessPosted onTrustindex verifies that the original source of the review is Google. Excellent service, timely delivery, and response are a few words that describe Lanop tax advisors at best. I had seamless communication with Florentina, and Sohaib. They both accommodated me well and it was a hassle free experience overall. Quick resolution too! Highly recommend their services.

Here's some other accountancy services we offer...

Get in touch

Monday to Friday 9am – 6pm