Introduction

For many self-employed individuals we work with, Value Added Tax (VAT) is more than just another compliance burden; it’s a major psychological hurdle. It often signifies the problematic transition from simply “being self-employed” to running a serious, structured, and regulated operation. The truth is that the VAT threshold is the single most common compliance failure point for growing businesses in the UK.

The critical nature of this topic stems from the fact that, unlike Income Tax, where you benefit from personal allowances and stepped rates, the VAT rules are entirely binary. You are either registered and compliant, or you are not. Crossing the financial line without proper awareness can lead to devastating economic consequences. We have personally seen profitable years wiped out because a sole trader failed to recognise their liability began six months ago, not on the day they finally checked their figures. Add a simple monthly check, and if you want, your VAT position remains clean from day one, our VAT return service can handle the setup and ongoing compliance.

The core confusion typically revolves around how to calculate taxable turnover correctly (it is far more comprehensive than just the money hitting your bank account) and, crucially, when the 12-month clock starts ticking. In this guide, we will walk you through the practical, end-to-end mechanics of the system, not just reciting the textbook rules, but explaining how these regulations genuinely play out in the unpredictable real world for freelancers, consultants, and small business owners.

What Is the VAT Threshold in the UK?

VAT Threshold Defined

Technically, the VAT threshold,or VAT registration threshold, is the statutory taxable turnover limit set by the government that triggers compulsory entry into the UK VAT system. This applies equally to any “taxable person,” encompassing sole traders, partnerships, and limited companies without distinction.

From an advisory perspective, think of this figure as a non-negotiable legal boundary. The moment your taxable sales hit this limit within the relevant timeframe, your business is legally obligated to become an unpaid tax collector for HMRC. You must then charge VAT on your sales, ringfence it, and keep reporting accurately through properly managed VAT returns.

VAT Threshold 2024 vs 2025

As we stand today, the current VAT threshold is £90,000. This increase, which took effect on April 1, 2024, followed a long period where the limit had been frozen at £85,000.

When we look ahead to the VAT threshold 2025, the government has clearly indicated that this £90,000 limit will not be increased. This non-movement is a deliberate, powerful policy known as “fiscal drag.” As your business simply increases its prices to keep pace with basic inflation, you are effectively being pulled closer to the VAT threshold UK 2025 without having sold more services or worked more hours. It’s an effective, quiet method of expanding the tax net, and it demands constant vigilance from small business owners.

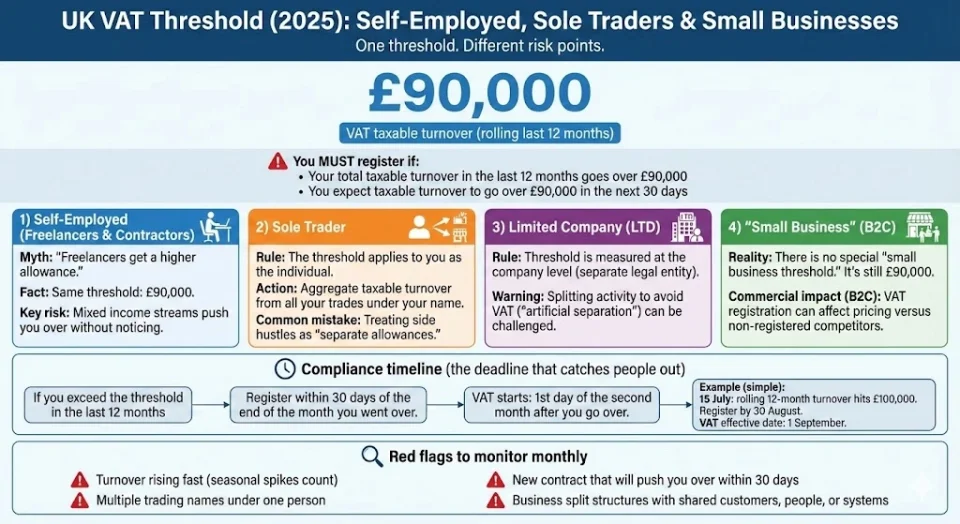

VAT Threshold for Self-Employed, Sole Traders & Small Businesses

VAT Threshold for Self-Employed Individuals

There is a persistent and dangerous rumour that freelancers operate under a different, more generous allowance than limited companies. Let me be clear: this is incorrect. The VAT threshold for self-employed professionals is the exact same £90,000. Whether you operate as a contract software developer, a locum healthcare provider, or a design consultant, your total turnover must be measured against this single, hard limit. If your turnover is rising or you have mixed income streams; a self-employed accountant can help you track the threshold properly and avoid accidental late registration.

Sole Trader VAT Threshold

This area is where we see the highest number of compliance missteps. The sole trader for VAT threshold is applied to you as the unique individual taxpayer, not to the number of distinct trades you operate. If you run a part-time landscaping service and an online store selling rare books, you do not benefit from two separate allowances. You are legally required to aggregate the total taxable turnover from both trading activities.

LTD Company VAT Threshold

In contrast, the LTD company VAT threshold is anchored to the specific legal entity. This is an important distinction. If you operate via a limited company structure, the turnover legally belongs to the company, making its liability distinct. This structure is often used strategically by entrepreneurs to legally separate business liabilities from their personal finances. However, let us be clear: structuring a company purely as an artifice to avoid VAT, what HMRC calls artificial separation, is a highly aggressive tactic that is monitored and challenged closely.

Small Business VAT Threshold

You will frequently hear the term small business VAT threshold, but in tax law, it is simply the standard £90,000 limit. For a small business primarily dealing with the public (B2C), staying below this ceiling provides a significant competitive advantage, effectively allowing you to be 20% cheaper than your VAT-registered competitors (whose customers cannot reclaim the tax).

Lanop Client Case Study: Aggregation Error

‘David’ maintained a successful gardening service and a completely separate winter gritting business. He was treating them as legally distinct entities, each earning approximately £50,000. We immediately identified that his combined personal turnover stood at £100,000, placing him decisively over the VAT turnover threshold. We swiftly consolidated his accounts and managed the compliance issue before a review could be triggered.

“I honestly thought they were separate. Lanop saved me from a massive future bill by spotting that my two side-hustles counted as one.”— David P., Gardener, Surrey.

How the VAT Threshold Is Calculated

Rolling 12-Month Turnover Explained

This is arguably the most common, and therefore most dangerous, trap in the UK tax system. The UK VAT turnover threshold is absolutely not determined by the standard tax year (April to April) or the calendar year. It is based entirely on a rolling 12-month basis. This is precisely why consistent monitoring matters, because it drives the correct effective date and the first VAT return timeline.

Crucially, you must review your cumulative turnover for the past 12 months at the close of every single month. If your sales, for example, from the 1st of June last year to the 31st of May this year, exceed £90,001, you have fundamentally breached the threshold. The fact that your tax year turnover is lower is entirely irrelevant to the VAT liability.

What Counts Toward VAT Taxable Turnover

To ensure full compliance, you must understand precisely what income must be included in this calculation. For the VAT threshold UK 2024, taxable turnover is comprised of:

- Standard-rated supplies (goods/services charged at 20%).

- Reduced-rated supplies (items charged at 5%).

- Zero-rated supplies (0% items such as books, most food, and children’s clothes).

The critical point here is that zero-rated items must count toward the VAT registration threshold UK, even though no actual tax is charged on them. Failing to include zero-rated sales is a frequent mistake we see.

What Does NOT Count Toward the VAT Threshold

Certain categories of income can be correctly excluded from the rolling turnover calculation:

- Exempt income (specific financial services, insurance provision, certain education, and health services).

- Outside-scope of income (turnover which does not fall within the UK VAT system’s jurisdiction).

- Capital sales (such as the one-off sale of an old office printer or a used work vehicle).

Lanop Client Case Study: Zero-Rated Confusion

We provided advice to ‘Tiny Threads’, a children’s clothing retailer. The owner, Lisa, mistakenly believed she was exempt from registration because her products were entirely zero-rated. We clarified that because her turnover decisively exceeded the VAT threshold for sole traders, she was still legally required to register and submit full returns, even if her net VAT bill to HMRC was consistently zero.

VAT Registration Threshold UK

Compulsory VAT Registration Rules

There are two distinct “tests” you must actively monitor concerning the VAT registered threshold in the UK:

- The Backwards Look: Have your sales gone over £90,000 in theimmediatelypreceding 12 months? If this test is met, you must notify HMRC and register within 30 days of the end of that specific month.

- The Forward Look: Do you realistically expect to go over the £90,000 threshold in the next30 daysalone? If this test is met, you must register immediately (i.e., before the expected threshold breach actually occurs).

Once either test is triggered, the practical priority is getting registered correctly and preparing for your first VAT filing without invoice errors.

Effective Date of VAT Registration

The effective date is of enormous importance for compliance. If you breach the VAT registration threshold on a rolling 12-month basis ending in July, you must notify HMRC by 30th August, and you will be registered from 1st September. However, the breach is measured at the end of the month, not on a specific day mid-month like the 15th. However, if you trigger the more immediate “forward look,” you are registered from the precise date that the expectation of the breach arose. Mistakes in determining this specific date are a prevalent source of later disputes with HMRC.

How to Register for VAT

Registration is typically done online via the Government Gateway. You will require your UTR, NI number, and bank account details. While the form appears straightforward, our experience shows that incorrectly selecting the appropriate business activity code or entering non-matching bank details can easily stall the entire process for weeks.

Lanop Client Case Study: The Big Contract

We provided timely advice to ‘BuildCo’, a construction firm that was on the verge of signing a single contract worth £100,000. Triggering the “forward look” test, we registered immediately before the contract work commenced, thus ensuring their very first invoice for that project was fully VAT-compliant from day one.

“Lanop’s proactive advice meant we were VAT ready before the big contract even started, avoiding a messy invoice later.” —Gary W., Builder, Essex.

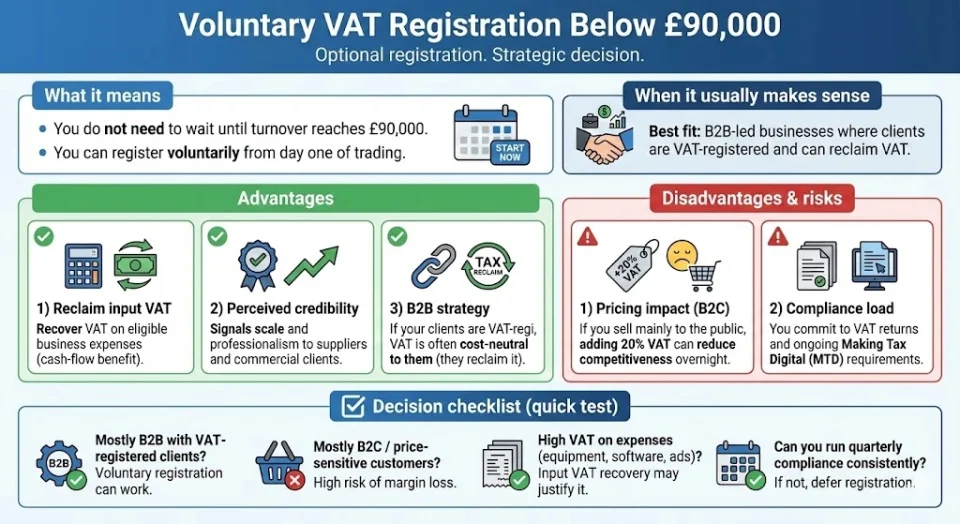

Voluntary VAT Registration Below the Threshold

What Voluntary VAT Registration Means

It is not a requirement to wait until your business turnover hits the £90,000 threshold. You have the option to register for VAT threshold purposes voluntarily right from day one of trading.

Advantages of Voluntary VAT Registration

- Reclaiming input VAT: A direct benefit, getting cash back on your legitimate business expenses.

- Perceived Credibility: Being VAT-registered often lends an air of greater size and seriousness, especially for new companies.

- B2B Strategy: If your entire client base consists of VAT-registered businesses, they can seamlessly claim the VAT back, meaning charging them VAT is effectively cost-neutral to them.

This is covered in more detail in our article on the advantages of voluntary VAT registration.

Disadvantages & Risks

- Pricing impact: If you predominantly sell services to the public (B2C), the required addition of 20% VAT will make your services or goods instantly more expensive overnight.

- Administrative Burden: You are immediately committing your business to mandatory quarterly returns and the ongoing compliance requirements of Making Tax Digital (MTD).

Lanop Client Case Study: The Start-Up Boost

We advised ‘DesignHub’, a new agency with a turnover of just £40,000, to register voluntarily. The reasoning was clear: they were incurring significant setup expenditure on high-value computers, software licenses, and office fit-out. This proactive step allowed them to reclaim thousands of pounds of input VAT immediately.

VAT Deregistration Threshold

Should your business experience a decline in activity, you are permitted to leave the VAT system. The VAT deregistration threshold is currently set at £88,000. Note carefully that this limit is intentionally set lower than the registration limit to prevent businesses from tactically flipping in and out of the system. You must convincingly satisfy HMRC that your turnover will realistically remain below this level for the entire following 12 months.

Lanop Client Case Study: Downsizing

We assisted ‘John’, an architect who was semi-retiring, whose turnover had naturally dropped to around £60,000. We meticulously managed the deregistration process, ensuring he was not unnecessarily burdened with charging VAT on his significantly reduced workload.

What Happens If You Exceed the VAT Threshold

Late VAT Registration

What is HMRC’s definition of “late”? Any notification received after the 30-day statutory grace period has elapsed. If you realise you crossed the VAT threshold in the UK six months ago, you are immediately and strictly liable for the entire amount of VAT you should have legally charged. In almost all circumstances, you will be required to fund this uncollected back tax directly from your business profits or personal funds.

VAT Penalties and Interest

HMRC imposes statutory “Failure to Notify” penalties. These are calculated as a percentage of the unpaid VAT, and the severity depends entirely on whether you voluntarily disclosed the error, or HMRC identified the non-compliance first. Interest will be relentlessly charged on top of the principal amount of the unpaid tax. For a clear breakdown of how fines are applied, see our UK VAT penalties guide.

Temporary or One-Off Threshold Breaches

If you exceed the VAT threshold 2025 UK due to a genuine freak event, such as the one-off, non-recurring sale of a valuable piece of business machinery, and you confidently expect your turnover to drop back down immediately, you are permitted to apply for an exception. This requires a formal, detailed written request to HMRC outlining the specific circumstances.

Lanop Client Case Study: The Rescue

‘Mario’, a self-employed plumber, engaged us 18 months after he had passed the threshold. He was facing significant back-tax liabilities. We performed a careful calculation of the exact arrears and successfully negotiated a manageable Time-to-Pay arrangement with HMRC, thereby preventing a severe bankruptcy scenario.

Multiple Businesses, Income Streams & Anti-Avoidance Rules

Multiple Self-Employed Activities

As we stressed earlier, the VAT threshold for self-employed covers the totality of your sole trader income streams. HMRC uses your National Insurance number to establish a clear link between all your activities, leaving little room for separation.

Business Splitting Rules

“Disaggregation” is the term used when a business is artificially fragmented (for instance, separating the bar operation from the kitchen in a single pub) solely to avoid the business VAT threshold. HMRC targets this tactic with extreme aggression. If your split entities share common elements such as a bank account, staff resources, or core equipment, HMRC will almost certainly view and treat them as a single business.

Lanop Client Case Study: The Pub Split

A couple, ‘Pete and Jen’, sought to legitimately split their pub and B&B business. We advised them on the strict, demonstrable operational separation required, including separate bank accounts, distinct insurance policies, and independent purchasing processes, to ensure the arrangement would not be viewed as artificial avoidance by HMRC.

VAT Threshold and Digital / Overseas Sales

Digital Services Sold to UK Customers

For digital services explicitly sold to UK consumers, the standard VAT threshold rules apply without exception. There are no special exemptions in this area.

Digital Services Sold to EU or Overseas Customers

This area is considerably more complex and requires expert interpretation. Sales made to non-UK customers are often correctly classified as “outside the scope” of UK VAT, which means they do not count toward your UK VAT registration threshold. However, the crucial caveat is that these sales might simultaneously trigger immediate VAT registration liabilities within the customer’s own country.

Overseas Sellers & Non-Established Businesses

If you are a non-UK business, but you are selling goods that are physically stored within the UK, the applicable VAT threshold is, in fact, zero. You are legally required to register immediately upon making your very first taxable supply in the UK.

Lanop Client Case Study: The E-Book Author

We provided comprehensive guidance to ‘Sarah’, an author selling e-books primarily to private customers in France and Germany. We successfully registered her for the EU’s OSS (One Stop Shop) system to manage her EU VAT obligations, while confirming that her specific UK turnover remained below the VAT threshold for small businesses domestically.

VAT Schemes and Strategic Choices

VAT Flat Rate Scheme

The Flat Rate Scheme (FRS) is designed to simplify VAT reporting for smaller businesses. Under FRS, you pay a fixed percentage of your gross turnover to HMRC and retain the difference between that and the VAT you collected. It is less financially generous now than it once was, but for certain low-cost service businesses, it can still provide a marginal benefit.

Other VAT Accounting Schemes

- Cash Accounting: This vital scheme means you only pay the VAT to HMRC once your customer has actually paid you. This is essential for managing cash flow when you have clients who are notoriously slow payers.

- Annual Accounting: Allows the business to submit a single annual return, though you are still required to pay quarterly or monthly instalments.

Practical Challenges Near the VAT Threshold

Pricing Strategy When Close to the Threshold

The “VAT cliff edge” is not an abstract concept; it represents a genuine financial hazard. If your business is turning over £90,000, you are often financially worse off than a business earning £89,000, particularly if you cannot successfully pass the 20% VAT cost on to your customers. You will need to immediately increase your base prices by 20% to maintain your current net profit level. If you are close to the line, planning the switch early makes pricing, invoicing, and your next VAT return far easier to manage.

Cash Flow Management

The moment you become VAT-registered, a core principle must be understood: the extra 20% that appears in your bank account is not profit; it belongs directly to the Crown.

The “VAT Growth Trap”

We frequently observe businesses that intentionally suppress their own growth to remain under the VAT turnover threshold. This commercial braking is often referred to as “bunching.” From our experience, the best long-term advice is usually to push through this immediate pain barrier and aim for growth well beyond £120k+, which naturally makes the administrative burden of registration financially worthwhile.

Record-Keeping & Monitoring the VAT Threshold

Records You Should Maintain

For compliance, you need digital accounting records that are fully compatible with the Making Tax Digital (MTD) regime. If you want the compliance cycle explained clearly, here is how quarterly MTD VAT reporting works in practice. Under Making Tax Digital (MTD) rules, a basic spreadsheet is no longer sufficient on its own; you must use either compliant software like Xero or QuickBooks, or use “bridging software” to link your spreadsheets digitally to HMRC. Strong bookkeeping. This is what makes the rolling 12-month calculation reliable, mainly when your invoices include zero-rated or mixed supplies.

How Often You Should Review Turnover

We caution all clients: do not wait for your annual accountant’s review to be informed of your status. By the time that happens at the end of the year, it is almost certainly too late. You must be personally reviewing your rolling 12-month total at the close of every calendar month.

Lanop Client Case Study: The Monthly Health Check

We institutionalised a monthly “health check” process for a high-growth startup, ‘TechFlow’. This involved a detailed review of their rolling 12-month turnover, which allowed us to accurately predict their VAT registration threshold breach date for a full three months in advance.

“The monthly checks meant the VAT registration didn’t come as a surprise. We were ready.” — Sam D., TechFlow CEO, London.

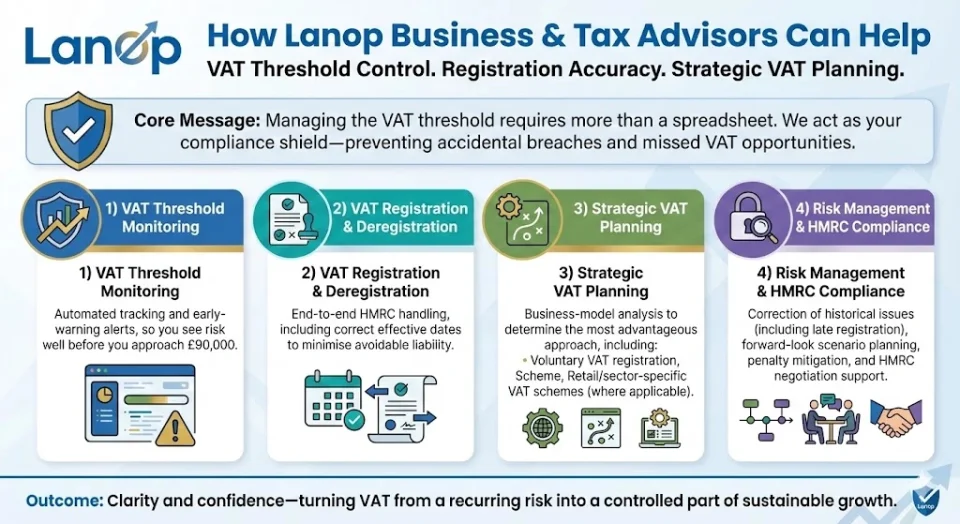

How Lanop Business & Tax Advisors Can Help

Navigating the intrinsic complexities of the VAT threshold demands far more than just a simple spreadsheet; it requires seasoned commercial and professional judgment. At Lanop Business & Tax Advisors, we serve as your essential compliance shield, ensuring that you never inadvertently breach a statutory threshold or miss a crucial strategic tax opportunity.

We provide comprehensive support for self-employed clients and growing small businesses through:

- VAT Threshold Monitoring: We implement robust, automated tracking systems designed to give you a clear, early warning well before you are close to the £90,000 limit.

- VAT Registration and Deregistration: We professionally handle the entire HMRC liaison process, ensuring the legally correct effective dates are applied, which is key to minimising potential liability.

- Strategic VAT Planning: We perform a complete analysis of your business model to determine if voluntary registration, the Flat Rate Scheme, or specific retail schemes will provide the maximum strategic advantage to your tax position.

- Risk Management and HMRC Compliance: From expertly correcting historical late registrations to managing complex “forward look” scenarios, we actively mitigate penalties and negotiate effectively with HMRC on your behalf.

Our primary goal is to provide you with absolute clarity and confidence, ultimately transforming VAT from a common source of fear and burden into a securely managed, inevitable aspect of your business’s sustainable growth.

Conclusion

A thorough understanding of the VAT threshold is a non-negotiable, fundamental requirement for being self-employed and operating a business in the UK. Whether you are cautiously approaching the £90,000 mark or are simply establishing your new business, the strict regulations governing the VAT turnover threshold are clear and, generally, highly unforgiving of “honest mistakes.”

Proactive, meticulous monitoring is truly your best and most effective defence. By knowing precisely what income counts toward the VAT registration threshold in the UK, and by consistently calculating your rolling 12-month turnover monthly, you ensure that you remain in complete control of your business’s compliance destiny.

If you harbour any uncertainty about your current trading position, or if you have the uneasy feeling that you may have already inadvertently crossed the VAT threshold, our firm’s advice is to seek professional guidance immediately. In our experience, tackling the issue head-on and promptly disclosing the position to HMRC is invariably the most cost-effective solution in the long run.

Frequently Asked Questions

What is the current UK VAT registration threshold for self-employed individuals?

The VAT registration threshold is currently £90,000. This mandatory limit is based on your total taxable turnover over any rolling 12-month period.

Do I need to register for VAT as a sole trader if my turnover is below the threshold?

No, registration is not legally compulsory if your business is operating below the VAT turnover threshold. However, we often advise voluntary registration if it creates a clear commercial advantage for your specific business model.

How do I check if my rolling 12-month turnover exceeds the VAT threshold?

At the close of every month, you must calculate and total your taxable sales for the preceding 11 months plus the current month. If this cumulative total exceeds £90,000, you have breached the VAT threshold.

What happens if I exceed the VAT threshold and register for VAT late?

You become strictly liable for the VAT you should have charged from the date you were legally required to register. Furthermore, HMRC will almost certainly charge “failure to notify” penalties on the uncollected tax.

Does the VAT threshold apply to my total business turnover or just profit?

The threshold applies strictly to your gross taxable turnover (total sales revenue). Your business profit margins have no bearing whatsoever on the VAT threshold calculation.

How does the VAT threshold work if I have multiple self-employed businesses or income streams?

All taxable turnover generated from all your sole trader activities is legally aggregated. If you operate two separate businesses under your name, their combined revenue counts toward the single £90,000 VAT threshold for the self-employed.

When is voluntary VAT registration below the threshold beneficial for self-employed people?

It is usually beneficial if you sell services or goods exclusively to other VAT-registered businesses (B2B), who can reclaim the VAT, or if you have high initial startup costs and need to reclaim the VAT paid on essential equipment.

What VAT threshold rules apply if I sell digital services to EU or overseas customers?

Sales made to overseas customers are subject to complex “place of supply” rules. While these may not directly count toward your UK VAT registration threshold, they can instantly trigger VAT liabilities in the customer’s own country (e.g., using the OSS for the EU).

How does using the VAT Flat Rate Scheme affect the VAT registration threshold?

The Flat Rate Scheme is solely a simplified method of calculating and paying VAT after you are registered. It fundamentally does not alter the £90,000 VAT registration threshold required to enter the system.

What records should I keep proving I monitored the VAT threshold correctly?

Maintain a complete digital record of all sales invoices and, critically, a monthly log or report of your rolling 12-month turnover total. This is the evidence that proves to HMRC you were actively monitoring your position against the UK VAT turnover threshold.

How quickly must I register for VAT after crossing the UK threshold, and from what date is VAT due?

You must submit your registration application within 30 days of the end of the month in which you exceeded the threshold. VAT then becomes due from the first day of the second month after you exceed the limit.

What penalties and interest can HMRC charge for breaching the VAT registration threshold?

Penalties are calculated as a percentage of the overdue VAT, depending on the length of the delay and whether the disclosure was voluntary. Interest will also be charged on the outstanding balance.

Can I deregister for VAT if my turnover falls below the UK VAT threshold?

Yes, if your taxable turnover convincingly falls below the VAT deregistration threshold of £88,000, and you do not expect it to exceed the registration threshold in the following year, you are permitted to apply to deregister.

Are VAT threshold rules different for online sellers, freelancers, and consultants in the UK?

No, the £90,000 VAT threshold applies universally and without variation to all UK-established businesses, regardless of the specific sector or trading activity.

How should I manage pricing and cash flow when my turnover is close to the VAT registration threshold?

We advise an immediate review of your entire pricing structure. Determine if your market can genuinely absorb a 20% price increase. Critically, set aside immediate cash reserves to ensure you can cover the first VAT bill, as there will be a significant time lag between collecting the tax and remitting it to HMRC.