Why the VAT Registration Threshold Confuses So Many UK Businesses

Most UK business owners don’t worry about VAT because they want to dodge it. They fear it because it often shows up without warning. One month, everything feels under control, and the next, VAT suddenly becomes part of the conversation. The VAT registration threshold isn’t just a technical rule; it’s the moment when prices, cash flow, and paperwork can start to feel very different, very quickly.

It’s common for businesses to treat the threshold like a line they shouldn’t cross. Some slow things down on purpose, turn work away, or hesitate to grow because they’re worried about adding VAT and upsetting customers, especially when selling to the public, where VAT can’t be reclaimed. That caution makes sense, but over time it can quietly limit progress and leave money on the table, particularly when VAT on business costs could have been reclaimed.

What trips people up most is how the threshold is measured. VAT doesn’t reset at the end of the tax year or follow neat accounting periods. It’s checked on a rolling 12-month basis, which means a business can drift over the line without realising it. In 2025, with prices higher across the board, that drift happens faster than many expect. Understanding how the threshold works isn’t about tax theory anymore; it’s about staying in control and avoiding problems before they start.

What Is the VAT Registration Threshold in the UK?

Most people hear the term VAT registration threshold long before they really understand what it means. In practice, it’s simply the point where HMRC expects a business to stop operating “quietly” and start dealing with VAT properly. Up to that point, VAT registration is optional. After it, there’s no choice left.

What makes this threshold important isn’t the number itself, but what follows once you cross it. VAT suddenly becomes part of everyday business life: invoices change, prices may need rethinking. You have to keep cleaner records, submit VAT returns, and stay on top of deadlines. At the same time, you can finally reclaim VAT on certain costs, which can be helpful but only if it’s managed properly.

The threshold exists because VAT isn’t light admin. For tiny businesses, the paperwork alone can be overwhelming. HMRC knows that. So, the limit acts as a buffer, giving businesses time to grow before they’re expected to deal with VAT rules, software, and ongoing reporting.

Case Study: A Growing Freelancer Who Nearly Crossed the VAT Threshold Without Realising

A London-based self-employed digital marketer has been living and working well for some years now, grossing £6k a month. Wo of the marketer’s long-term clients upped their monthly retainers late in 2024. leading to a higher turnover than usual. Since income increased slowly and no month stood out as unusual, the freelancer did not realise that the rolling 12-month total had exceeded the VAT registration threshold.

After seeking advice, the firm scrutinised the freelancer’s monthly turnover, rather than working from yearly figures. And that immediately pointed out where the breach point was and what the proper registration deadline was. Lanop took control of the VAT registration side of things, guided on the wording of invoices throughout the transition period, and ensured that VAT was correctly applied from the go-live date. This enabled the freelancer to escape late registration fees and allowed them to negotiate prices with clients prior to a new billing cycle.

UK VAT registration threshold 2025 (latest figures)

As of 2025, the VAT registration threshold in the UK 2025 is £90,000 in taxable turnover. That figure has been in place since it was increased in 2024 and hasn’t changed since. Once your turnover goes beyond that level, VAT registration is required whether you are ready for it or not.

One thing that often surprises business owners is how high the UK threshold is compared to other countries. It’s designed that way, mainly to keep smaller firms from being buried in tax admin too early. Still, the rules are clear. If your turnover edges past £90,000, even gradually, VAT becomes part of the picture. Waiting too long to deal with it is usually what causes trouble, not the registration itself.

| Period | VAT Registration Threshold | VAT Deregistration Threshold |

|---|---|---|

| 2017 – 2024 | £85,000 | £83,000 |

| 2024 – 2025 | £90,000 | £88,000 |

| 2025 – 2026 (Projected) | £90,000 | £88,000 |

Is the VAT registration threshold based on profit or turnover?

One of the biggest misconceptions new business owners make is that VAT is calculated on profits. Just to clarify, the VAT registration threshold is turnover based, not profit. Taxable supplies are those supplies of goods and services on which VAT is not zero-rated. It is the commercial number in the worldwide stats, and you haven’t even factored in costs, overheads or taxes.

For instance, a company that has not yet made a profit may need to register for VAT if its overheads or start-up costs are high, yet if its gross taxable turnover exceeds £90,000 within a rolling 12-month period, then it will still need to register. This comparison is essential as a business with a very low margin can consider the registration duty and possibly absorb some of the VAT cost quite significantly. As a result of this, tracking your gross income against the UK #VAT threshold for small businesses is an essential compliance requirement, one which can’t be left until year-end accounts are prepared.

How HMRC Actually Tests the VAT Registration Threshold

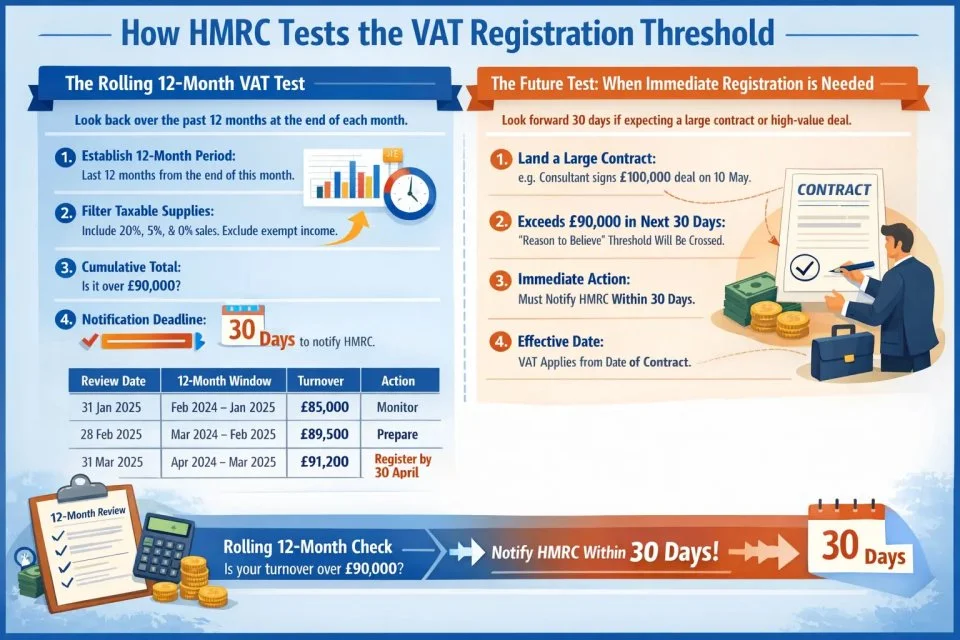

The rolling 12-month VAT registration turnover test

The VAT registration turnover test is retrospective and continuous. It does not reset at the end of the calendar year, the tax year (5 April), or the business’s own financial year-end. Instead, it looks back at the previous 12 months from the end of every single month. At the completion of any month, the business owner needs to sum up the taxable turnover for the 12 months that ended in that month. The threshold has been surpassed if the sum of those particular 12 months is higher than £90,000.

Monthly VAT registration threshold check (step-by-step)

Any business that is approaching the threshold will need to do a VAT registration threshold monthly check, which is a legal requirement. The following are the proper procedures, the way we, as professionals, believe this type of audit should be conducted:

Establish the 12-month period: On the last day of this month, sum up total sales starting from the first day of this same month a year ago.

Filter Taxable Supplies: Sum up all 20%, 5% and 0% out of sales. Exclude “exempt” income, like residential rent or insurance.

Cumulative Total Statistics: Add up all of these numbers. If the amount is £90,000.01 or more, you’ve exceeded the VAT registration threshold.

Notification Deadline: You have 30 days from the end of that month to notify HMRC. For example, if you exceed the limit on 15 July, your notification must be submitted by 30 August.

| Review Date | 12-Month Window | Turnover Calculation | Action |

|---|---|---|---|

| 31 Jan 2025 | Feb 2024 – Jan 2025 | £85,000 | Monitor |

| 28 Feb 2025 | Mar 2024 – Feb 2025 | £89,500 | Prepare |

| 31 Mar 2025 | Apr 2024 – Mar 2025 | £91,200 | Register by 30 April |

The future test: when you must register immediately

While the rolling test looks backwards, the “future test” looks forward. Under HMRC VAT registration threshold rules, a business must register if it expects its taxable turnover to exceed £90,000 in the next 30 days alone. This typically occurs when a business lands on a large contract or a one-off high-value project. For instance, if an unregistered consultant signs a contract for £100,000 on 10 May, they have “reason to believe” their turnover will exceed the threshold in the next 30 days.

In this scenario, the 30-day clock for notification begins immediately from the date of that realisation, not from the end of the month. The effective date of registration is the date of the realisation, meaning all invoices issued under that contract must account for VAT from day one.

Case Study: Late VAT Registration Resolved Before HMRC Intervention

A construction subcontractor providing his services through a limited company, approached the VAT registration threshold after winning several large contracts in rapid succession. Because he was too busy on site and customers had been slow to pay, the director didn’t realise that VAT registration was overdue for months. Lanop established the original breach date, quantified the potential VAT risk and made an unprompted disclosure to HMRC prior to any verification or compliance checks being issued.

By presenting clear records and a complete explanation, Lanop helped minimise penalties and interest. The business was also moved onto a cash accounting approach to prevent future cash flow pressure. What initially felt like a grave mistake was resolved without long-term damage to the company.

What Counts Toward the VAT Registration Threshold (And What Doesn’t)

What counts as taxable turnover

To accurately calculate the VAT registration threshold, one must understand what constitutes “taxable turnover.” It includes the gross value of:

- Standard-rated goods and services (currently 20%).

- Reduced-rated goods and services (currently 5%).

- Zero-rated goods and services (0%), such as most food, books, and children’s clothing.

- Goods hired or loaned to customers.

- Business goods used for personal reasons or given as gifts.

- Services received from abroad that are subject to the “reverse charge” mechanism.

- Building work over £100,000 is done for the business’s own use.

Crucially, zero-rated items are still taxable supplies, even though the rate of tax is 0%. They must be included in the threshold calculation. This is a common pitfall for retailers of essential goods who assume that because they don’t charge “tax,” they don’t need to register.

What does NOT count toward the VAT threshold?

Income that is “exempt” or “outside the scope” of VAT does not contribute to the £90,000 limit. Correctly identifying these can prevent unnecessary registration. Examples include:

- Insurance and financial services.

- Education and training provided by eligible bodies.

- Residential rent and the sale of certain land/buildings (though an “option to tax” can change this).

- Grant funding is not a payment for a specific supply.

- Sales of goods that take place entirely outside the UK and do not involve UK imports/exports.

- Statutory fees and some charitable donations are non-reciprocal.

When Do You Have to Register for VAT in the UK?

Once the threshold is breached via the retrospective rolling test, the business has exactly 30 days from the end of that month to notify HMRC. If the breach occurred at the end of May, the notification must be made by 30 June.

The effective date of registration is the first day of the second month following the breach. Using the May breach example:

- Threshold breached: 31 May.

- Notification deadline: 30 June.

- Effective date of registration: 1 July.

From the effective date, the business must charge VAT on all taxable sales and can begin reclaiming VAT on business-related expenses.

What Happens If You Cross the VAT Threshold Suddenly?

Most VAT breaches aren’t planned. They usually happen after one strong month or a large contract. In many cases, HMRC still looks at your position at the end of the month, so a single invoice doesn’t automatically trigger immediate action.

That said, if you already know a deal will push you over the threshold within the next 30 days, you’re expected to register at that point. When in doubt, it’s safer to check early rather than wait and fix it later.

VAT Registration Processing Time: What to Expect

VAT registration isn’t instant. It often takes a few weeks, sometimes longer. During that time, you may need to treat prices as VAT-inclusive until your VAT number arrives.

The important thing is to apply on time. Waiting for approval is normal. Delaying registration is what usually causes problems.

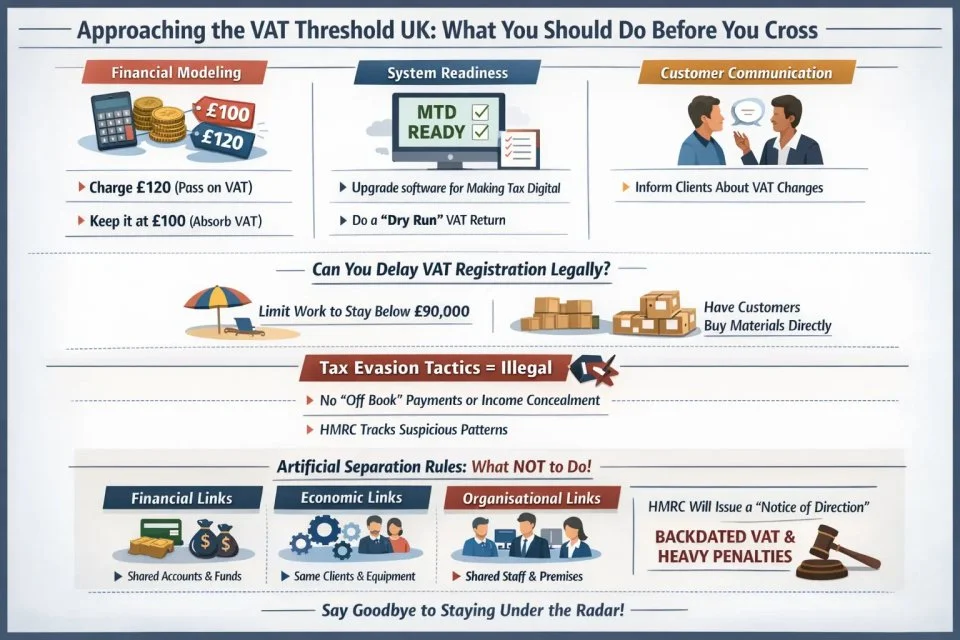

Approaching the VAT Threshold UK: What You Should Do Before You Cross

For businesses nearing the £ 90,000-mark, proactive management is essential. The Approaching VAT threshold UK advice usually focuses on three areas: financial modeling, system readiness, and customer communication. Owners should model the impact of a 20% price increase on their profit margins. If a business currently sells a service for £100, it must decide whether to charge £120 (passing the cost to the customer) or keep it at £100 (absorbing the £16.67 VAT cost itself).

Additionally, software systems must be upgraded to comply with Making Tax Digital (MTD), which requires digital record-keeping and direct filing to HMRC. It is often wise to perform a “dry run” of a VAT return using your existing bookkeeping data to see how the numbers would look if you were already registered.

Can you delay VAT registration legally?

There are only certain legal ways to avoid registering. One option here is to cut back the amount of work you take on each year so that your turnover doesn’t go over £90,000. This is typical for sole traders who might be able to take a holiday or stop accepting new orders when they reach the £88,000 threshold. Another is pushing customers to buy materials directly from suppliers and not through the business, removing those costs from the business’s turnover figures.

But any tactics that involve concealing income, “off book” payments, or artificially shifting the timing of invoices to keep amounts below the threshold are tax evasion and are punished harshly. HMRC’s innovative data-matching software frequently identifies firms that manage to remain just below the threshold for years.

Artificial separation rules (what NOT to do)

A common myth is that a business owner can split one large business into two smaller entities to stay below the threshold through a practice known as “disaggregation” or “artificial separation”. HMRC has robust anti-avoidance powers to combat this. They look for three types of links:

- Financial Links: Sharing the same bank account, one entity being financially dependent on the other, or having a common economic interest in the profits.

- Economic Links: Having the same business objectives, sharing equipment, or serving the same pool of customers.

- Organisational Links: Using the same employees, sharing premises, or having common management.

If HMRC determines that a separation is artificial, they can issue a “Notice of Direction,” treating the businesses as a single entity and backdating the VAT liability to the date the combined turnover first hit the threshold. This often results in a massive, unexpected tax bill and heavy penalties.

Exception From VAT Registration

What is the exception from VAT registration?

If a business breaches the VAT registration threshold only temporarily, it may apply for an “exception from registration.” This is applicable when a one-off event, such as a large, non-recurring contract or a high-value asset sale, pushes the turnover above £90,000, but the business can prove that its turnover will fall below the deregistration threshold of £88,000 in the subsequent 12 months.

This is not an automatic waiver. The business must still notify HMRC of the breach but simultaneously submit a request for an exception using forms VAT1 and VAT5EXC. If granted, the company remains unregistered but must continue to monitor its turnover monthly.

Evidence HMRC expects

HMRC requires more than a mere statement of intent to reduce workload. The burden of proof lies with the business owner to demonstrate that the spike was an anomaly. Acceptable evidence includes:

- Copies of one-off contracts with specified start and end dates.

- Detailed sales forecasts for the next 12 months showing the expected decline.

- Correspondence showing that a specific project has concluded and will not be renewed.

- Historical turnover data show a consistent pattern well below the threshold.

A successful case study involved a consultant whose project overran, pushing her turnover above the limit. By providing email correspondence and proving that her other income was low, she secured an exception and avoided a loss on her contract.

Voluntary VAT Registration Below the Threshold: Is It Worth It?

When voluntary VAT registration makes sense

Many businesses choose voluntary VAT registration below the threshold as a strategic move. In fact, roughly 41% of VAT-registered businesses in the UK have a turnover below the mandatory limit. This choice is often driven by:

- B2B Credibility: Large corporate clients often prefer dealing with VAT-registered suppliers as it signals a certain level of business maturity and scale.

- Input Tax Recovery: If a business has significant start-up costs, such as machinery, stock, or professional fees, being registered allows them to reclaim the VAT on these expenses, improving cash flow.

- Avoiding the “Cliff-Edge”: Registering early allows a business to integrate VAT into its pricing and accounting systems gradually, rather than being forced into a sudden transition during a period of rapid growth.

- Backdating reclaims: You can often reclaim VAT on goods bought up to four years before registration and services bought up to six months before, provided you still have the goods.

When voluntary VAT registration is a bad idea

Conversely, voluntary registration can be detrimental if:

- B2C Sensitivity: If a business sells primarily to private individuals or unregistered charities, the 20% VAT charge represents a direct price increase for customers, which can reduce sales volume.

- Administrative Burden: Compliance with MTD requires digital software and quarterly filings, which may be an unnecessary overhead for a very small micro-business with minimal expenses.

- Net Payment Position: If the business has very few VATable expenses, it will collect tax from customers and remit it to HMRC, without receiving any significant benefit from reclaiming VAT.

VAT Registration Threshold by Business Type

Sole trader VAT registration threshold

For a sole trader, the sole trader’s VAT registration threshold is £90,000 across all their business activities. It is a common misconception that if a person has two different trades, each gets its own £90,000 allowance. This is incorrect. The individual is the taxable entity, and their total personal business turnover is what counts.

VAT registration threshold for self-employed

The VAT registration threshold for self-employed rules is identical to that of sole traders. Whether operating as a freelancer, a sub-contractor, or a consultant, the rolling 12-month test applies. It is vital for self-employed individuals to maintain accurate monthly records, especially if they operate near the threshold, to avoid a retrospective tax bill. Upcoming changes to Making Tax Digital for Income Tax (MTD for ITSA) in 2026 will further increase the digital record-keeping requirements for this group.

VAT registration threshold for a contractor

A VAT-registered contractor often faces unique challenges, particularly when working through a Personal Service Company (PSC). For these contractors, the VAT threshold of £90,000 applies to the company’s gross billings. Because many contractors have very low overheads, the decision to register is often purely based on whether their client (typically another business) is VAT-registered and can absorb the cost. Contractors should also consider whether the Flat Rate Scheme offers a simpler or more profitable alternative.

E-commerce VAT registration threshold UK

The E-commerce VAT registration threshold in the UK can be complex due to cross-border rules. While UK-based sellers follow the standard £90,000 rule for UK sales, businesses based outside the UK (Non-Established Taxable Persons, or NETPs) have a VAT registration threshold of zero. This means international sellers must register for UK VAT from their very first sale to a UK customer. Additionally, if an e-commerce business uses a UK fulfilment centre (like Amazon FBA), they are typically required to register immediately, regardless of turnover.

How VAT Affects Your Prices (And How to Handle It Without Panic)

Absorb VAT vs charge VAT to customers.

The most pressing concern upon registration is the pricing strategy. A business has three main paths:

- Add VAT to Current Prices: The price to the customer increases by 20% (e.g., £100 becomes £120). This preserves the business’s profit margin but may deter price-sensitive buyers.

- Absorb the VAT: The price remains the same (£100), but the business pays the VAT out of its existing revenue. This reduces the gross margin significantly as the business effectively receives only £83.33 for the same work.

- The Hybrid Approach: Increase prices by a smaller amount (e.g., 10%) and absorb the remainder of the VAT cost. This “shares” the burden with the customer and is often a good compromise for growing brands.

VAT pricing strategies for B2B vs B2C

The strategy depends entirely on the customer base:

- B2B (Business-to-Business): Most business customers are VAT-registered and can reclaim the tax. Therefore, adding 20% to the price is usually acceptable and has a neutral impact on the customer’s bottom line.

- B2C (Business-to-Consumer): Since individual consumers cannot reclaim VAT, a 20% hike is a genuine cost increase. In these markets, businesses often look to “absorb” the tax or move toward zero-rated products if possible.

| Market Focus | Pricing Action | Result |

|---|---|---|

| Primarily B2B | Add VAT on top | Profit margins maintained |

| Primarily B2C | Absorb VAT | Profit margins drop by 1/6th |

| Mixed Market | Tiered pricing | Complex to manage but optimizes profit |

VAT Schemes Near the Threshold: Which One Fits You Best?

VAT flat rate scheme threshold

The VAT flat rate scheme threshold for entry is an expected taxable turnover of £150,000 or less (excluding VAT). Under this scheme, a business pays a fixed percentage of its gross (VAT-inclusive) turnover to HMRC, rather than calculating the exact difference between input and output tax.18 The specific percentage depends on the industry (e.g., 14.5% for IT consultants, 12.5% for catering). While it simplifies record-keeping, “limited cost traders” must use a high rate of 16.5%, which often negates the scheme’s benefits.

VAT registration threshold cash accounting scheme

The VAT registration threshold cash accounting scheme is available for businesses with a taxable turnover of £1.35 million or less. This scheme is particularly beneficial for small businesses struggling with cash flow. Instead of paying VAT to HMRC based on the date an invoice is issued, you only pay when the customer has actually paid the invoice. This ensures you are never out of pocket for VAT on unpaid debts.

Compare VAT schemes near the threshold.

Choosing the right scheme can significantly impact profitability and administrative ease.

| Scheme Name | Join Limit | Exit Limit | Best For |

|---|---|---|---|

| Standard Scheme | N/A | N/A | High-expense businesses |

| Flat Rate Scheme | £150k | £230k | Service-based micro-firms |

| Cash Accounting | £1.35m | £1.6m | Slow-paying B2B sectors |

| Annual Accounting | £1.35m | £1.6m | Reducing filing frequency |

What If You Register Late?

Late VAT registration penalties explained.

Failing to notify HMRC within the 30-day window results in Late VAT registration penalties. These are calculated as a percentage of the “net tax” owed from the date the business should have been registered to the date HMRC was actually notified.

- Up to 9 months late: 5% of the tax due.

- 9 to 18 months late: 10% of the tax due.

- Over 18 months late: 15% of the tax due.

These are in addition to any late payment penalties that might apply once the backdated return is eventually filed.

Risk of delaying VAT registration

The financial risk of delaying VAT registration extends far beyond the percentage-based penalty. When a business registers late, HMRC will backdate the registration to the original date of liability. The company is then responsible for paying 20% VAT on every sale made since that date, even if they never charged the customer VAT. In most cases, it is impossible to go back to customers and ask for that tax retroactively, meaning the business must pay the entire amount out of its own pocket, which can lead to insolvency.

How to reduce penalties if you registered late

To mitigate the damage, businesses should disclose the error voluntarily before HMRC discovers it. An “unprompted” disclosure typically attracts lower penalties than if HMRC finds the error during an audit. HMRC has the discretion to reduce or waive penalties if there is a “reasonable excuse,” such as a severe illness, but ignorance of the law is not a defence. Providing accurate digital records immediately and cooperating fully with the registration unit can help secure a more favourable outcome.

VAT Deregistration Threshold UK 2025

When can you deregister from VAT?

A business can apply for voluntary deregistration if its taxable turnover is expected to fall below the VAT deregistration threshold UK 2025 of £88,000 in the UK in the next 12 months. The deregistration limit is purposely set £2,000 lower than the registration threshold to prevent businesses from constantly hopping in and out of the system due to minor fluctuations. You must prove to HMRC that your income is unlikely to rebound.

What happens after VAT deregistration

Once deregistered, the business must stop charging VAT immediately and cannot reclaim VAT on purchases. A final VAT return must be submitted, and you may need to pay VAT on any assets or stock still held by the business if the total VAT value of those items exceeds £1,000. This “exit tax” is often overlooked and can be a surprise for businesses closing down or scaling back.

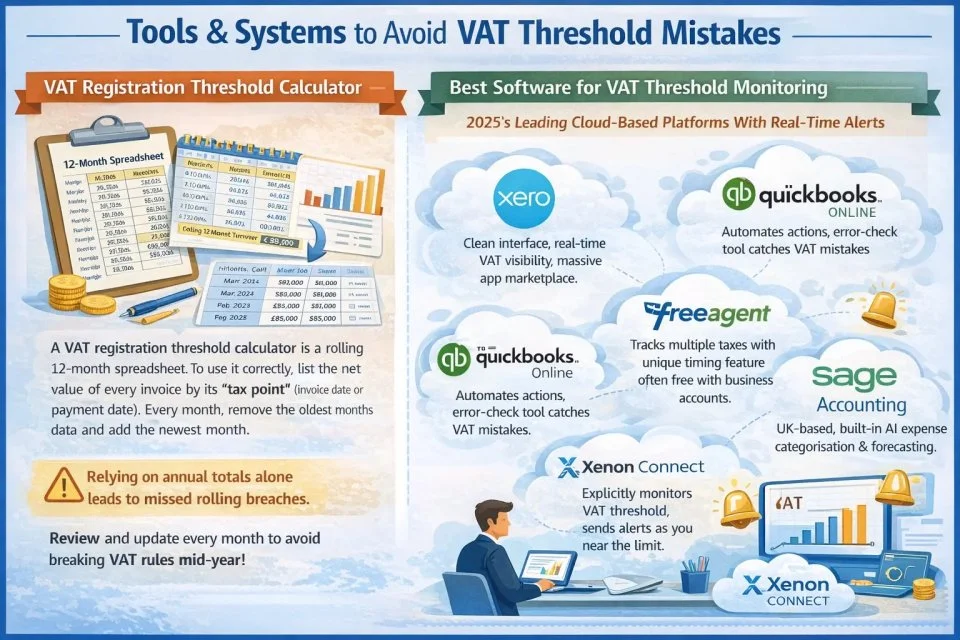

Tools & Systems to Avoid VAT Threshold Mistakes

VAT registration threshold calculator

A VAT registration threshold calculator is a rolling 12-month spreadsheet. To use it correctly, you must list the net value of every invoice by its “tax point” (usually the date of the invoice or the date payment was received). Every month, you must remove the oldest month’s data and add the newest. Relying on simple annual totals is the most common cause of non-compliance, as it misses “mid-year” breaches.

Best software for VAT threshold monitoring

In 2025, the best software for VAT threshold management includes cloud-based platforms that provide real-time alerts.

- Xero: Offers a clean interface and a massive app marketplace. It provides real-time visibility into VAT liabilities and integrates directly with HMRC for MTD filing.

- QuickBooks Online: Known for strong automation and an “error-check” tool that flags potential mistakes before submission.

- FreeAgent: Ideal for freelancers and contractors. It features a unique “Tax Timeline” that tracks various tax obligations simultaneously and is often free with certain business bank accounts.

- Sage Accounting: A reliable UK-based choice with built-in AI (Copilot) to help with expense categorisation and forecasting.

- Xenon Connect: An add-on tool that monitors the VAT registration threshold explicitly and alerts the user when they are approaching the limit.

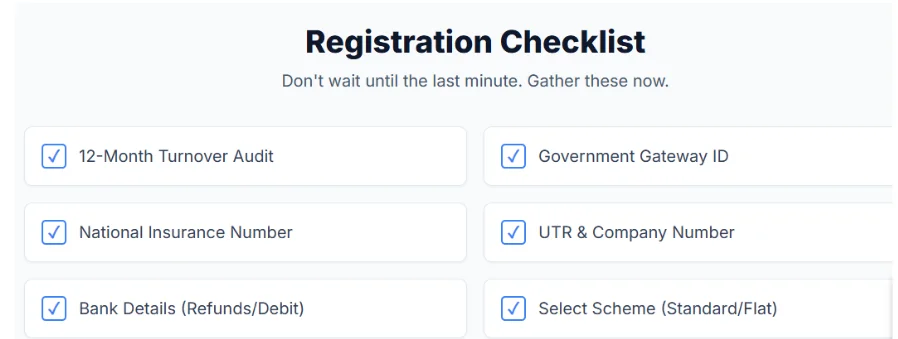

VAT Registration Checklist

Documents needed for VAT registration

To complete the process, the following documents needed for VAT registration should be gathered:

- Identity Proof: A valid passport or UK driving license.

- National Insurance Number: Required for sole traders and partners.

- Business Identifiers: Your Unique Taxpayer Reference (UTR) and, if a limited company, your Company Registration Number.

- Bank Details: For receiving VAT refunds and setting up direct debits for payments.

- Financial Data: A summary of your taxable turnover for the last 12 months and a realistic estimate for the next 12 months.

VAT registration cost in the UK 2025

There is no official fee charged by HMRC for the act of registering; the VAT registration cost in the UK 2025 is effectively £0 in terms of government fees. However, businesses should budget for the ongoing expenses of MTD-compliant software (£15–£40/month) and potential professional fees if an accountant manages the application on their behalf.

Step-by-step VAT registration checklist

- Audit Turnover: Run a 12-month rolling report to confirm a breach (> £90,000).

- Verify Gateway Access: Ensure you have a Government Gateway ID and password.

- Prepare Evidence: Gather identity documents and business registration details.

- Submit VAT1: Complete the online application, selecting your trade classification.

- Choose a Scheme: Select Standard, Flat Rate, or Cash Accounting.

- Review MTD Readiness: Confirm your software connects to the HMRC API.

- Finalise Registration: Receive your VAT Certificate and add the 9-digit number to your invoices.

Case Study: Small Retail Business Preparing for VAT Before It Became Mandatory

A family-run home décor business selling mainly to UK consumers experienced steady growth after launching an online store. By early 2025, turnover was approaching £85,000, and the owners were unsure whether to slow sales or prepare for VAT. Their primary concern was losing customers if prices suddenly increased.

Lanop worked with the business several months before registration became mandatory. Together, they modelled different pricing scenarios, assessed supplier VAT recovery, and reviewed whether a hybrid pricing approach would soften the impact for customers. Lanop also helped migrate the bookkeeping system to be entirely Making Tax Digital compliant ahead of time. When the business eventually crossed the threshold, VAT registration felt planned rather than forced, and customer demand remained stable.

How Lanop Helps You Stay Compliant

Navigating the VAT registration threshold requires constant vigilance and technical expertise. Lanop Business & Tax Advisors provides comprehensive support to ensure that UK businesses meet their obligations without overpaying. The firm assists by performing monthly turnover reviews against the VAT registration turnover test, managing the entire online registration process, and advising on the most tax-efficient schemes, such as the Flat Rate or Cash Accounting schemes. By integrating digital tools like Xero and QuickBooks, Lanop ensures that all records are MTD-compliant, reducing the risk of errors and shielding the business from the risk of delaying VAT registration.

Client Testimonial

“We had heard plenty of VAT advice before, but it was always vague. Lanop was the first firm that actually explained how the rolling threshold worked using our real numbers. They didn’t just register us; they helped us understand the impact on pricing and cash flow, so nothing came as a surprise.”

UK Small Business Owner

Conclusion:

For most UK businesses, VAT isn’t a problem because of the tax itself; it becomes a problem when it arrives unexpectedly. The VAT registration threshold is one of those rules that quietly sits in the background until turnover grows, prices rise, or a strong few months push you closer to the line. By the time many business owners realise what’s happened, they’re already playing catch-up. The reality is that VAT doesn’t have to disrupt your business if you understand how the threshold works and keep an eye on it early. Knowing how the rolling 12-month test applies, what counts as taxable turnover, and when registration becomes mandatory gives you control. It also puts you in a position to make calmer decisions about pricing, cash flow, and whether VAT registration might even work in your favour.

Whether you’re approaching the threshold, have already crossed it, or are unsure where you stand, the key is not to ignore it and hope for the best. A little planning goes a long way with VAT. With the proper tracking, advice, and timing, registering for VAT becomes a manageable step forward, not a setback to growth.

Frequently Asked Questions

What is the current VAT registration threshold in the UK, and how is it calculated on my turnover?

The current VAT registration threshold in the UK is £90,000. It’s calculated using your taxable turnover over any rolling 12-month period, not a tax year. That means HMRC looks back at your last 12 months of sales at the end of every month. If the total of those months goes over £90,000, VAT registration becomes mandatory.

When must I register for VAT in the UK after my turnover goes over the VAT registration threshold?

You must register for VAT within 30 days of the end of the month in which your turnover first exceeds the threshold. Your VAT registration usually becomes effective from the first day of the following month. Many businesses miss this because they notice the breach late, not because they intended to delay.

Does the UK VAT registration threshold apply to my total business turnover or only to taxable sales?

The threshold applies only to taxable turnover, not total income. This includes standard-rated and zero-rated sales but excludes exempt income. This distinction matters a lot for businesses with mixed income, such as property, education, or healthcare services.

How do I check if my rolling 12-month turnover has exceeded the VAT registration threshold in the UK?

The safest way is to do a monthly check. At the end of each month, add up your taxable sales from that month and the previous 11 months. If the total exceeds £90,000 at any point, you’ve crossed the threshold. Accounting software helps, but even a simple spreadsheet can work if updated consistently.

What are the HMRC penalties and interest for late VAT registration after crossing the UK threshold?

If you register late, HMRC can charge you backdated VAT, meaning you owe VAT from the date you should have registered, even if you didn’t charge customers. On top of that, penalties and interest may apply. The longer the delay, the higher the risk. That said, penalties can sometimes be reduced if you act quickly and explain what went wrong.

What is the VAT registration threshold for self-employed sole traders in the UK?

There is no separate threshold for sole traders. The VAT registration threshold for self-employed individuals is the same £90,000 limit. Sole traders are often caught out because personal and business finances are closely linked, making turnover harder to track casually.

Can I voluntarily register for VAT if my turnover is below the UK VAT registration threshold?

Yes, voluntary VAT registration below the threshold is allowed. Some businesses choose this to reclaim VAT on costs, improve credibility, or prepare for growth. However, it’s not always beneficial, especially for consumer-facing companies where higher prices can be an issue.

What happens if I briefly go over the VAT registration threshold and then my turnover drops again?

In some cases, you may be able to apply for an exception from VAT registration if you can show that the breach was temporary and turnover will fall below the limit. HMRC will usually expect forecasts, contracts, or other evidence before agreeing.

How does the VAT registration threshold work for online sellers and e-commerce businesses?

For online sellers, the UK ecommerce VAT registration threshold works the same way as any other business. All taxable UK sales count toward the threshold, regardless of whether they’re made through a website, marketplace, or social media. High-volume, low-margin sales can push turnover up faster than expected.

How does using the Flat Rate Scheme or Cash Accounting Scheme affect the VAT registration threshold rules?

These schemes do not change the threshold itself. You still must register once the turnover exceeds £90,000. The schemes only affect how VAT is calculated and paid after registration, which is why choosing the right one near the threshold can make cash flow easier to manage.

What records and evidence do I need to keep proving I monitored the VAT registration threshold correctly for HMRC?

You should keep clear sales records, invoices, bank statements, and monthly turnover summaries. If HMRC ever questions your timing, being able to show that you actively monitor your turnover can make a big difference, especially when penalties are being reviewed.

How long does VAT registration take with HMRC once I cross the UK VAT threshold?

VAT registration processing time varies, but it typically takes a few weeks. During busy periods or if HMRC asks for extra information, it can take longer. Even if approval is delayed, you may still need to charge VAT from your effective registration date.

What is the VAT deregistration threshold in the UK, and when can I cancel my VAT registration?

The VAT deregistration threshold in the UK for 2025 is £88,000. If you expect your taxable turnover to stay below this level, you can apply to deregister. HMRC will usually want evidence that the drop is ongoing, not just temporary.

How can an accountant help me plan around the VAT registration threshold to manage pricing, cash flow, and HMRC risk?

An accountant can help you monitor turnover properly, choose the right VAT scheme, plan pricing changes, and deal with HMRC if things go wrong. More importantly, they can help you make decisions before the threshold becomes a problem, rather than fixing issues after the fact.