Expert Accounting Support Built for UK Freelancers

Freelancing gives you the freedom to choose your work, but handling your finances can quickly become a full-time job. From unpredictable income and managing expenses to meeting tax deadlines, it’s easy to feel overwhelmed. At Lanop, our trusted freelancer accountants provide personalised accounting for freelancers across the UK. We help you stay on top of your finances, save on tax, and run your business with clarity, so you can focus on doing what you do best.

Why UK Freelancers Trust Lanop with Their Finances

- We understand that your freelance world doesn’t run on office hours, and neither should your accountant. At Lanop, we’ve worked with creatives, consultants, and independent pros who know the chaos of late invoices, shifting deadlines, and confusing tax rules. We don’t offer generalised services for all, instead we listen first, then tailor our services to how you actually work. Whether you’re just getting your footing or ready to scale, we’re here to simplify the numbers and help you move forward with clarity.

Hands-On

Tax Guidance

- From self-assessment to VAT returns, we take care of the essentials, so all the work and processes are done well before deadlines.

Bookkeeping That Works for You

- Using real-time platforms like Xero and QuickBooks, we offer intuitive, cloud-based bookkeeping for freelancers that fits exactly around your lifestyle and needs.

Continuous Consistent Support

- If you want to register as a limited company, we’ll guide you through the process, when to do it, what to watch for, and how to make it work in your favour.

Comprehensive Accounting Services for UK Freelancers

At Lanop, we don’t believe in generic solutions. Our tailored services are built around how freelancers really work. Whether you’re just starting or ready to scale, our trusted accountants for freelancers make your finances easier to manage, and easier to grow.

We register you with HMRC, calculate your freelance income tax, and file everything accurately and on time. Our expert freelance tax accountants keep you compliant and stress-free during tax season.

Know what you can claim and how to track it properly. We help you log every allowable expense, so you only pay what’s fair, no more, no less.

We’ll set you up with Xero, QuickBooks, or another preferred tool, helping you manage your freelancer accounting digitally, with full training and integration support.

If you are thinking about going limited, let us handle registration, legal setup, and ensure full compliance while helping you understand the tax advantages of incorporation as a freelancer.

We’ll help you decide when to register, handle your quarterly VAT submissions, and keep you updated on relevant rules and deadlines.

We help you build a personalised budget that works with your freelance income. From chasing late payments to forecasting, we keep your cash flow steady.

If you are dealing on a global scale with the clients, we’ll help manage currency, payment platforms, contracts, and tax implications, making international freelance work smooth and compliant.

As your agent, we deal directly with tax authorities on your behalf, giving you peace of mind and professional support. We make sure your business follows all the rules and stays compliant with HMRC regulations.

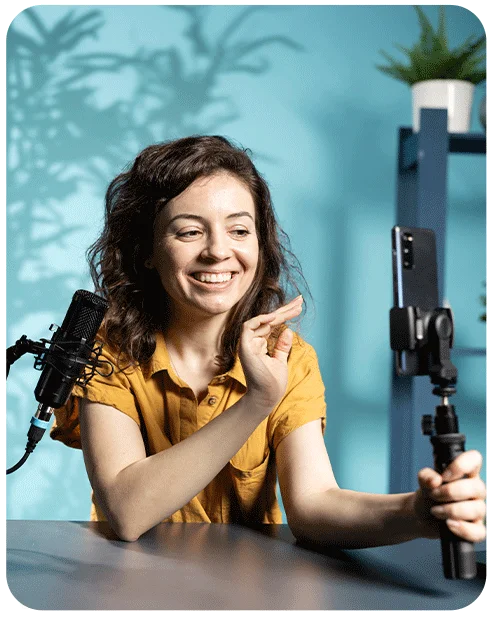

Who We Help

We specialize in accounting services designed for today’s digital creators and freelancers. Here are just some of the professionals we support:

- YouTubers & TikTokers

- Instagram Influencers & Lifestyle Bloggers

- Twitch Streamers, Gamers, and Vloggers

- Podcasters, Writers, and Freelance Journalists

- Musicians, Actors & Voiceover Artists

- Creative Freelancers, PR Consultants & Media Pros

Smart Tax Solutions Built for Freelancers

Tax season shouldn’t feel like an emergency, but for many freelancers, it does. Between chasing invoices, meeting deadlines, and logging expenses, it’s easy to fall behind on what HMRC expects. That’s exactly where Lanop steps in.

Our experienced accountants for freelancers simplify everything. We help you understand your obligations, track your income, and meet every deadline with confidence. No jargon or confusion, just clear, practical support built around your freelance setup.

We make the self-assessment process straightforward. From declaring all income to identifying allowable expenses, we ensure your tax return is accurate, compliant, and submitted on time. Our expert freelance tax accountants also help you claim the reliefs and deductions you're entitled to, so you’re never paying more than you should.

One of our clients came to us after receiving a penalty for not declaring payments from international clients. We not only resolved the issue and corrected past filings but also built a system that prevented it from happening again.

At Lanop, we don’t just file your return, we make sure you understand it. Whether you're just starting out or managing a roster of long-term clients, we tailor our support to fit your goals. That’s what turns tax stress into peace of mind.

Why Influencers Need Specialist Accountants

We specialize in accounting services designed for today’s digital creators and freelancers. Here are just some of the professionals we support:

- Chartered Accountants & Tax Advisors with cross-border expertise

- Deep understanding of the influencer economy & content monetisation

- Offices in both the UK and Dubai

- Friendly, no-jargon advice with fixed, transparent pricing

- Proven success with six- and seven-figure creators

Focused Accounting Support for UK Freelance Professionals

As a freelancer, your time is your currency, and your tools should support that. That’s why Lanop builds accounting solutions around how you actually work. Our clients log expenses from train platforms, issue invoices while waiting for client feedback, and monitor payments between gigs. You need systems that are quick, mobile, and intuitive, and that’s exactly what we provide.

We set up cloud-based software like Xero and QuickBooks to integrate with your workflow. That means fewer spreadsheets, fewer manual errors, and more clarity. You'll be able to track your income across multiple clients and currencies, flag overdue payments, and see exactly how your business is performing, all from your phone or laptop.

Beyond the tools, our seasoned accountants for freelancers help you navigate financial curveballs like late client payments, cross-border contracts, or unexpected expenses. We’ll help you with the management and planning of cash flow during the dry season. Even if you are confused about whether your overseas clients fall under the category of VAT rules in the UK, you do not need to worry. We’ll explain everything to you and be with you at every step to support your business with our unmatchable expertise.

You deserve accounting that works at your speed, not the other way around. Lanop Business and Tax Advisors is here to give you real-time visibility and the confidence to make smart business choices, no matter how unpredictable your freelance schedule may be.

How It Works

- Income & platform review, UK and global

- Free consultation to understand your goals

- Accounting setup, cloud-based, fully digital

- Ongoing support, tax planning, filings, WhatsApp access

- International advisory, for relocation, expansion, and UAE structuring

From Freelance Hustle to a Structured Business

Freelancing isn’t just a side gig anymore, it’s your full-time career. You manage clients, deadlines, invoices, and everything in between. But as your income grows, so do the decisions. That’s where Lanop’s expert freelance accounting services come in.

We help ambitious freelancers move beyond survival mode into real, scalable business planning. If you’re consistently earning, landing bigger contracts, or managing multiple clients, it might be time to rethink your setup. We’ll help you decide whether it is a best option for you to stay as a sole trader in the Uk or as a limited company with perks such as tax efficiency and stronger brand presence.

At Lanop, we guide you through every stage, from assessing your current structure to handling limited company formation, registration, payroll, and ongoing corporation tax compliance. For many freelancers, this shift brings access to more tax planning tools, better pension contributions, and even more credibility with clients.

But we don’t stop there. Our expert accountants for freelancers help you navigate VAT thresholds, smooth out irregular income, plan for downtime, and track performance across all your income streams. One creative consultant came to us doing solo gigs, and within two years, they were running a small agency. We were there every step of the way, ensuring their finances stayed as solid as their client work.

As HMRC tightens rules for the self-employed, having a structured financial system isn’t just smart, it’s essential. With Lanop, your freelance hustle evolves into a resilient, scalable business, backed by smart numbers and proactive strategies.

FAQ

Accountants for freelancing

Do you really need an accountant if you’re freelancing?

Honestly, it depends on how much you want to deal with tax stuff yourself. When you start making money from different places like brand deals, YouTube, or freelance gigs, it can get confusing. An accountant who knows freelancing can save you a lot of time and stop you stressing over deadlines and paperwork.

Can you claim things like your phone or Netflix as expenses?

You can claim stuff that’s actually for your work. For example, your phone bill, laptop, or any software you use. Netflix won’t count unless you’re reviewing shows for work! It’s tricky figuring out what’s legit, but a good accountant helps you get it right without wasting time.

What happens when you get paid from clients around the world?

Getting paid internationally is common now, but it can make taxes complicated. Different countries have different rules, and it’s easy to get mixed up or pay tax twice. Having someone who understands how this works takes the pressure off and keeps things legal and smooth.

Should you wait until you earn more to hire an accountant?

Starting with an accountant early on actually makes life easier. They help you set up your business the right way and keep things organized so you don’t mess up later. It’s better than trying to figure it all out on your own when taxes come knocking.

How much will an accountant cost you?

Most accounting services have clear prices. They usually charge a set fee each month based on what you need. Whether you’re earning a little or a lot, you can find a plan that fits your budget and won’t surprise you with hidden charges.

Our Identity

Integrity, honesty, and dedication are the core values at Lanop Business & Tax Advisors. Since launching our first Putney office in 2010, we’ve grown into a fully digital, UK‑based accounting and tax advisory firm that blends expert compliance with forward‑looking guidance and business strategy.

Our team of specialized chartered tax advisors and accountants delivers a full spectrum of services including tax planning, bookkeeping, VAT, payroll, and virtual finance director support all designed to help you manage your business more efficiently and confidently.

We believe accounting is more than numbers it’s about empowering your journey through modern finance. That means applying strategic insight, breaking down complex financial processes, and acting as your trusted partner not just submitting filings.

Put simply, Lanop Business & Tax Advisors is more than an accounting firm we are your strategic ally, dedicated to guiding your financial success with integrity, precision,

EXCELLENTTrustindex verifies that the original source of the review is Google. We're a small company in business for 23 years. We've been with Lanop for over a year now. From the outset they listened carefully to our somewhat complex bookkeeping needs (we sell products and services with different tax codes); they've provided a tailored solution that they execute with precision and in a timely manner. We hired them to provide combined bookkeeping, payroll and accountancy service, and they're a dream to work with on all aspects. They are careful and conscientious, and never last minute. Excellent measured responses when I ring up with questions - always so friendly, too. The price is very reasonable, not least given the high standard of service and the peace of mind we have. Top drawer.Posted onTrustindex verifies that the original source of the review is Google. I'm in the early stages of a startup and got in touch with Lanop, who looked to be very knowledgeable in my niche. I booked a 30-minute consultation with Muhammad, who was great and understood all the challenges i'd be facing and what direction i need to go. I was very impressed with his advice, and i came away with confidence and reassurance that this is someone i need to be working with as i scale up.Posted onTrustindex verifies that the original source of the review is Google. The Free 30 mins call was exactly what I needed to understand my situation better and the team was really helpful in providing advise and recommending next step. I look forward to working with them long termPosted onTrustindex verifies that the original source of the review is Google. It has been an absolute pleasure working with Lanop. Excellent!Posted onTrustindex verifies that the original source of the review is Google. I reached out to Zaib with some business and visa compliance related questions. Zaib was extremely kind and efficient in sharing his knowledge to my specific circumnstance and beyond helpful with helping us understand how to set up our business and ensure we were being tax efficient. Thanks, Zaib and team.Posted onTrustindex verifies that the original source of the review is Google. I was so lost in the woods with taxes and accounts, and on top of that, I had a limited company I was eager to get off my hands. Lanop was fabulous from start to finish and got everything taken care of. I went from being a bundle of nerves about anything financial to feeling totally at ease. I never thought I'd see the day! Everything occurred in a timely manner and I was always updated on everything that was going on, which was lovely. I was also quoted really fairly for everything as well! Above all else, Lanop gave me incredible peace of mind. If you work with them, you'll certainly be in good hands.Posted onTrustindex verifies that the original source of the review is Google. Had a great meeting with Mohammad. Cleared up all questions we had surrounding “Gift with Reservation of Benefits”. Very calm and clear communicator. Thank you.Posted onTrustindex verifies that the original source of the review is Google. Very happy to recommend Lanop accountants at 389 Upper Richmond Road. They were very communicative, helpful and efficient.Posted onTrustindex verifies that the original source of the review is Google. I am a new owner to a company and they have really helped in supporting me in the startup of my businessPosted onTrustindex verifies that the original source of the review is Google. Excellent service, timely delivery, and response are a few words that describe Lanop tax advisors at best. I had seamless communication with Florentina, and Sohaib. They both accommodated me well and it was a hassle free experience overall. Quick resolution too! Highly recommend their services.

Here's some other accountancy services we offer...

Get in touch

Monday to Friday 9am – 6pm