Introduction

In aviation finance, few things trigger a headache faster than the VAT treatment of a flight with no passengers. Determining the correct VAT position for an aircraft ferry flight isn’t as simple as checking whether the plane crossed a border. It requires a forensic look at who you are billing, where they sit, and, crucially, whether the aircraft itself qualifies for relief, then locking that position into an audit-proof process through robust VAT return and compliance support.

For operators, management companies, and owners, getting this wrong leads to two painful outcomes: you either pay 20% VAT you didn’t owe (killing your margin), or you zero-rate a flight without the proper paper trail (inviting HMRC to issue a penalty assessment years later). If your team also wants clarity on how quickly VAT liabilities and interest can escalate once HMRC reclassifies a transaction, read our UK VAT penalties guide.

This guide cuts through theoretical noise. We are going to look at the exact decision logic you need to determine whether a ferry flight is 0% (zero-rated), 20% (standard-rated), or entirely outside the scope of UK VAT.

What does this guide include?

This isn’t a general overview; it’s a manual for your finance and ops teams. We will break down the decision logic for classifying ferry flights, translate the dense text of HMRC Notices 744B and 741A into plain English and provide you with a defensible evidence pack aligned with what holds up in practice when you run it through VAT compliance reviews and filings. We’re moving beyond “what the rules say” to “what you must hold on to file” to survive an audit.

Who this is for

- Commercial Operators (AOC holders) with mixed fleets (managed/charter).

- Aircraft Management Companies charge owners for positioning costs.

- Charter Brokers acting as intermediaries in ferry flight transactions.

- Finance Directors who need to sign off on VAT returns without crossing their fingers.

What an Aircraft Ferry Flight Is (And Why VAT Gets Misapplied)

Definition:

Operational teams use these terms loosely, but for VAT, the definitions need to be tighter. A “ferry flight” usually refers to moving an aircraft for maintenance, delivery, or returning it to base. “Positioning” implies moving the aircraft to pick up a revenue charter. An “empty leg” is a commercial product sold to offset the cost of that movement.

For UK VAT ferry flights, the label doesn’t matter as much as the contractual reality. Why is the flight happening? Is it a distinct service you are selling? Is it a cost you are absorbing to fulfil a passenger charter? Or is it a movement of the aircraft as a piece of hardware?

“Label vs supply”, what you are supplying for VAT

VAT law ignores your flight schedule and looks at the “economic reality” of the supply. A ferry flight is typically one of three things:

- A Transport Service: You are moving the aircraft from London to Nice for a fee.

- A Hire of Means of Transport: You are giving the customer possession of the aircraft so they can move it themselves.

- An Ancillary Cost: The flight is just a logistical step to deliver a passenger charter (often absorbed into the main charter fee).

If you invoice a ferry flight as a standalone item, HMRC treats it as a distinct supply. This is where the risk of applying the wrong VAT rate originates. If you bill it separately, it must stand on its own two feet for VAT purposes.

Typical situations where the VAT rate gets picked incorrectly

We see the same errors repeatedly:

- The “International” Trap: Assuming a flight is 0% just because it leaves UK airspace (ignoring that the customer is a UK business, and the aircraft isn’t “qualifying”).

- The “Maintenance” Trap: Assuming a flight to a maintenance facility is 0% (it’s often 20% if the operator isn’t an airline).

- The Reverse Charge Error: Brokers applying the Reverse Charge to a UK customer because the flight went to France.

Case Study: The “Empty Leg” Trap

A UK operator incorrectly zero-rated an empty leg flight from London to Nice for a UK business client, assuming all international flights were VAT-free. Lanop identified that because the operator did not meet the “qualifying aircraft” status, and the aircraft was empty, the movement was a standard-rated service (as the Place of Supply remained in the UK). We corrected the invoice to 20% VAT before an audit, preventing a major compliance failure and costly HMRC penalties.

"We assumed 'international' always meant zero VAT. Lanop showed us exactly why that assumption would have cost us £4,000 in penalties."

James Sterling, Finance Director.

The 60-Second VAT Outcome Map (0% vs 20% vs Outside Scope)

Step 1: Identify the supply type (transport vs hire with crew vs agency)

Are you paid to move the plane? Or are you hiring the plane out (asset)? Most ferry flights are services.

Step 2: Check qualifying aircraft / qualifying customer conditions (where relevant)

Does the aircraft meet the qualifying aircraft vat rules? Remember: for VAT zero-rating under Notice 744B, the aircraft is “qualifying” if it is used by a “qualifying airline” (an airline operating for reward chiefly on international routes).

Step 3: Apply place of supply (UK VAT charged vs outside scope)

Where does your customer belong? If you need a refresher on the UK/EU position post-Brexit (and how evidence expectations have tightened), see Lanop’s post-Brexit VAT changes guide.

- B2B General Rule: The supply is where the customer is established.

- Transport Exception: Passenger transport is taxed where it happens, but ferry flights (freight/movement) often fall back to the General B2B rule or specific “transport of goods” rules.

Step 4: Validate the evidence threshold (what you must hold before using 0% / outside scope)

Do not issue the invoice until you have proof. No VAT number on file? No AOC copy? Then you can’t defensibly zero-rate it, and your safest default is to align the invoice with your VAT returns sign-off process before it goes out.

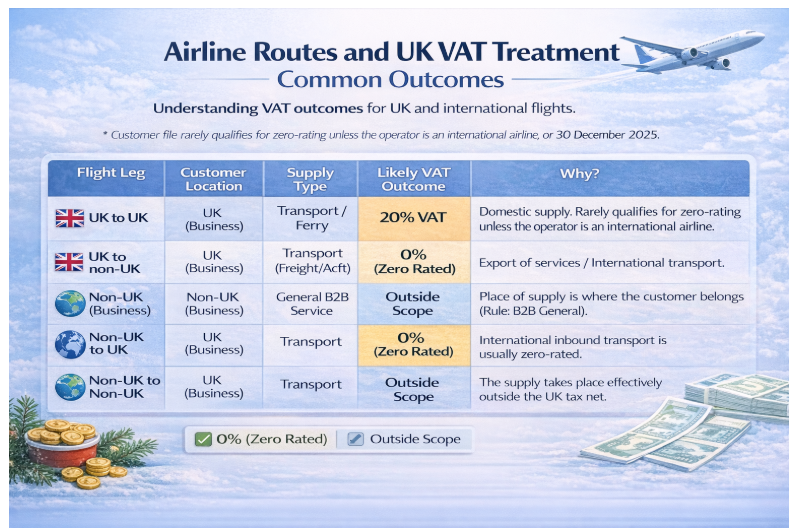

Summary table: common outcomes for UK-to-UK, UK-to-non-UK, and non-UK-to-UK legs

| Flight Leg | Customer Location | Supply Type | Likely VAT Outcome | Why? |

|---|---|---|---|---|

| UK to UK | UK (Business) | Transport / Ferry | 20% VAT | Domestic supply. Rarely qualifies for zero-rating unless the operator is an international airline. |

| UK to non-UK | UK (Business) | Transport (Freight/ACFT) | 0% (Zero Rated) | International transport of an aircraft. |

| UK to non-UK | Non-UK (Business) | General B2B Service | Outside Scope | The place of supply is the customer's location (Rule: B2B General). |

| Non-UK to UK | UK (Business) | Transport | 0% (Zero Rated) | International inbound transport is usually zero-rated. |

| Non-UK to Non-UK | UK (Business) | Transport | Outside Scope | The supply takes place effectively outside the UK tax net. |

Zero-Rating (0%): When Ferry Flights Qualify and When They Don’t

What “zero-rated aircraft VAT” means in practice (and what it does not mean)

Zero-rated aircraft vat doesn’t mean “VAT free.” It means the rate is 0%. You must still include the net value in Box 6 of your VAT return. Crucially, it gives you the right to reclaim your input VAT (fuel, handling, crew costs).

The qualifying aircraft VAT rules (plain-English explanation)

Under the VAT Act 1994, Schedule 8, Group 8, zero-rating applies to the supply, repair, and maintenance of “qualifying aircraft.”

A qualifying aircraft is not just a heavy jet. It is an aircraft used by an airline operating chiefly on international routes.

If you are a private owner, move your own jet? Not qualifying. If you are a charter operator with 90% of your domestic flights? Not qualifying.

The “chiefly international” airline test (what it is, what it isn’t)

HMRC defines “chiefly” as the international route of turnover or mileage exceeding the domestic route. They look at the operator, not the specific plane. If you are British Airways, every plane is qualified. If you are a small charter firm, you must prove your “airline” status and your route mix.

Do positioning/ferry legs count toward the chief international test? (how to think about it)

Generally, no. HMRC looks at “revenue sectors” held out for public transport. A ferry flight is an operational necessity, not usually a “public transport” flight. However, they support the international network. The safest bet? Don’t rely on ferry flights to push your percentage over the line.

UK-to-UK ferry flights: when people assume 0% and why it usually fails

If you fly from Luton to Glasgow for maintenance, that is a domestic flight. Unless the aircraft is “qualifying” (i.e., the operator is a qualifying airline), this flight is standard rated (20%). Don’t assume zero VAT applies just because the plane could fly to New York tomorrow.

UK-to-non-UK ferry flights: when 0% is based on transport vs based on qualifying aircraft

A ferry flight leaving the UK (e.g., Luton to Paris) is often zero-rated for a different reason: it’s an export of services or international transport. Here, the zero rating comes from geography (crossing a border), not the aircraft’s status.

Case Study: The Maintenance Misconception

A management company ferried a jet domestically for maintenance and failed to charge VAT, believing the “maintenance” category provided a blanket exemption. Lanop intervened, clarifying that domestic ferry flights for private, non-airline owners do not qualify for zero-rating under Group 8 rules. By immediately adjusting the billing to 20% VAT, we ensured the management company remained fully compliant with UK transport laws.

Standard Rating (20%) – When Ferry Flights Are Taxable in the UK

If the aircraft does not qualify, is a UK ferry flight always 20% VAT? (decision logic)

If the customer is in the UK and the flight stays in the UK, the answer is almost always yes. This covers standard-rated aviation VAT scenarios, such as moving a plane between UK bases or delivering an aircraft to a UK buyer.

UK-to-UK ferry flights: why 20% is the default outcome in many cases

Without the “International” trigger or the “Qualifying Airline” shield, a ferry flight is just a truck delivery in the sky. It’s a taxable transport service.

UK departures, UK use, UK customer factors that push you into 20%

Watch out for “holding out.” If you are not holding the flight out for public transport (e.g., it’s a private ferry for an owner), you lose the passenger transport zero-rating. If the flight is domestic, you lose the export zero-rating. You are left with 20%.

“No evidence = no zero rate” rule (commercial reality and audit posture)

HMRC’s default position is Standard Rate. If you can’t provide evidence for 0% (see the pack below), they will assess at 20%. In an audit, if the paperwork is missing, the fact that the flight really went to Dubai doesn’t matter, and it will still flow through your VAT return corrections and resubmission process when you’re forced to fix it.

Outside the Scope – When UK VAT Is Not Charged Because Place of Supply Is Not the UK

Place of supply aviation (B2B rule applied to ferry/positioning services)

This is your most common friend. The place of supply of aviation rules for B2B services is where the customer belongs.

If you are a UK operator ferrying a plane for a German business, the supply is in Germany. It is Outside the Scope of UK VAT.

When is a ferry flight outside the scope of UK VAT due to the place of supply rules?

Any time your business customer is established outside the UK. It doesn’t matter if you fly from London to Manchester; if the customer is a US corporation and the service is for their business, the supply is likely in the US (Outside Scope). Note: Exceptions exist for “use and enjoyment” in aircraft hire, but pure ferry services usually follow the general rule.

UK-to-non-UK legs: outside scope vs zero-rated transport (how to separate)

- Customer is a UK Business: Flight goes to France = Zero Rated (Export/Transport).

- Customer is a French Business: Flight goes to France = Outside Scope (Place of Supply is France).

What proof is required for B2B in place of supply when the customer is non-UK?

You need a valid VAT evidence checklist for UK items: A VAT number (if EU/Taxable country) or a Certificate of Incorporation (if non-EU). A generic email address is not proof of business establishment. If your business is not yet VAT registered (or you’re approaching thresholds), align your processes with Lanop’sVAT threshold and registration support.

Reverse charge notes (what you state, and what the customer must do)

You must write: “Place of Supply: [Customer Country]. Services subject to Reverse Charge in the country of receipt.” This tells HMRC why you didn’t charge VAT.

Case Study: The International Broker

A UK operator was unsure how to bill a ferry flight conducted for a Swiss-based broker. Lanop performed a place of supply analysis, confirming the transaction was “Outside the Scope” of UK VAT because the customer was established abroad.

We drafted the specific reverse-charge wording for the invoice, ensuring the operator’s Box 6 reporting was accurate and defensible for future tax inspections. (Standard practice is to capitalise “Box” when referring to specific VAT return fields.

“Lanop gave us the exact wording we needed for our Swiss clients. It made our audit trail bulletproof.”

Marc Rossi, Charter Broker.

Agency and Intermediary Scenarios (Brokers, Managers, and “Who Is Supplying What?)

If I act as an agent, is my agency fee 0%, 20%, or outside scope?

If you arrange the flight, your fee is a B2B supply. Customer in the UK = 20%. Customer abroad = Outside Scope.

Principal vs agent: practical indicators and documentation

Are you invoicing the full flight cost? You are likely a principal (buying and reselling the flight). You take full VAT risk. If you only invoice a commission, you are an Agent.

Multi-party chain risks (operator, broker, owner, end-customer) and rate consistency

A common mess: Operator charges Broker (Outside Scope). Broker charges UK Owner (20%). If the Broker forgets to charge the 20%, the chain breaks, and the Broker is left holding the liability.

Invoicing, Wording, and Record Keeping Controls (Make It Audit-Proof)

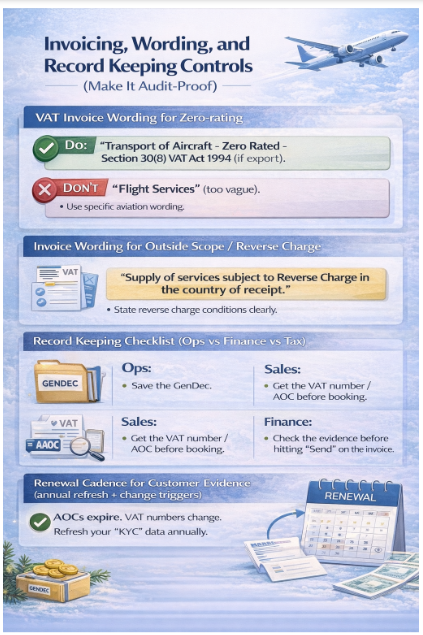

AT invoice wording for zero-rating (what to include, what to avoid)

- Do: “Transport of Aircraft – Zero Rated – Section 30(8) VAT Act 1994” (if export).

- Don’t: “Flight Services” (too vague).

- Use: VAT on flight training that is specific.

Invoice wording for outside scope / reverse charge (what to state)

- “Supply of services subject to Reverse Charge in the country of receipt.”

Record keeping checklist (who owns what: Ops vs Finance vs Tax)

- Ops: Save the GenDec.

- Sales: Get the VAT number/AOC before booking.

- Finance: Check the evidence before hitting “Send” on the invoice, and ensure the paperwork is consistent with your VAT returns workflow and audit trail.

If your records are not consistently clean (and you’re relying on ad hoc inbox searches), fix the foundation first with structured bookkeeping and record support so VAT positions don’t collapse under basic evidence pressure.

Renewal cadence for customer evidence (annual refresh + change triggers)

AOCs expire. VAT numbers change. Refresh your “KYC” (Know Your Customer) data annually.

How Lanop Can Help

We don’t just file returns; we audit your logic before HMRC does. Aircraft ferry flight VAT compliance requires a specialist eye, and it should plug directly into your VAT return review and filing function, not sit as a one-off technical memo.

VAT position review for ferry/positioning flights (0% / 20% / outside scope)

We scan your invoices over the last 12 months to identify UK VATcorrection disclosu rerisks.

Qualifying aircraft assessment and “chiefly international” evidence strategy

We build the “Airline Status” defence pack so you can safely use the VAT on flight training (if applicable) or qualifying aircraft exemptions.

Place of supply analysis and reverse charge support for non-UK customers

We map your client base to ensure every charter or ferry invoice has the correct tax code.

Contract and invoice wording review (classification protection + evidence linkage)

We rewrite your invoice templates to include the mandatory UK VAT legislative references.

Evidence pack build-out (templates, checklist, retention policy, owner responsibilities)

We provide your team with checklists to ensure aircraft repositioning is documented accurately and consistently with the outputs required for VAT returns and HMRC submissions.

HMRC enquiry support (audit defence file + response strategy)

If the letter arrives, we handle defence onzero-rated vs outside scope disputes. If you need a wider understanding of how HMRC approaches scrutiny (and what you must and must not do in responses), see Lanop’s guide on HMRC compliance checks, rights and obligations.

Ongoing compliance controls (monthly checks, staff guidance, sign-off workflow)

We act as your VAT safety net, catching VAT on positioning flight errors before they become penalties.

Conclusion

There is no single VAT rate for a ferry flight. The rate is the result of a formula: Nature of Supply + Customer Location + Evidence Held.

If you change one variable (e.g., the customer is a private individual vs a business), the rate changes. “If you can’t prove it, don’t claim it” (risk posture), treat a zero-rated invoice like a loaded gun. It’s powerful for your cash flow, but dangerous if you mishandle it. If you don’t have the evidence pack on your desk, do not issue the invoice at 0%.

Is your evidence packed and audit-ready? Would you like Lanop Business and Tax Advisors to stress-test your last quarter’s ferry flight invoices and build a custom compliance checklist for your team?

FAQs

Are aircraft ferry flights 0% VAT, 20% VAT, or outside scope in the UK?

It varies, depending on who is footing the bill and where the plane is headed. Generally, a UK-to-UK flight for a UK business is 20%. If the flight crosses a border, it’s often 0%. If the customer is a business based outside the UK, the flight is usually entirely “Outside the Scope”.

When is an aircraft ferry flight zero-rated (0%) under qualifying aircraft rules?

This only happens if the customer is an airline that operates for reward chiefly (interpreted by HMRC as more than 50% of its total operations by distance or turnover) on international routes. If you are ferrying a plane for a private owner or a purely domestic charter company, this specific 0% rule won’t apply.

What is a qualifying aircraft for UK VAT zero-rating?

HMRC defines “qualifying” based on use, not size. It must be used by an international airline to reward or be a state-owned plane (HMRC Notice 744B does not apply a strict 8,000kg weight limit to the definition of a Qualifying Airline, though weight is a factor in other customs reliefs). Private business jets used for corporate travel or personal trips do not qualify as aircraft.

What evidence proves the customer is an airline operating chiefly on international routes?

You need a paper trail. This includes a copy of their current Air Operator Certificate (AOC) and a signed declaration. This document must state that they operate for reward and that their international work outweighs their domestic flights.

Do positioning/ferry legs count toward the chief international test?

No. HMRC only cares about “revenue sectors”; flights where the airline gets paid to move people or cargo. Ferry flights and empty positioning legs are considered operational overhead and don’t help the airline meet that 50% international threshold.

If the aircraft is not qualified, is a UK ferry flight always 20% VAT?

Not necessarily. You can still hit 0% if the flight is international (crossing the UK border). Also, if your customer is a business based outside the UK, the “Place of Supply” rules often remove the transaction from the UK VAT system.

Is a ferry flight a transport service or a hire of an aircraft with crew for VAT purposes?

Usually, it’s a “transport service” because you (the operator) stay in control. It only becomes a “hire” if the customer takes complete control of the crew and destination, as in a wet lease. This matters because “hire” rules can sometimes trigger 20% VAT.

Is a UK-to-UK ferry flight ever zero-rated, or is it typically 20%?

Domestic flights are usually 20%. The only exception is if the plane is “qualifying” (used by an international airline). In that case, the airline’s status protects the flight, making even a short hop like Manchester to London 0%.

Is a UK-to-non-UK ferry flight with zero-rated transport or place-of-supply outside the UK?

It depends on the bill to address. If the customer is a UK business, it’s a 0% “zero-rated” export. If the customer is a business in the USA or Europe, it’s “Outside the Scope” because the tax is technically handled in their country.

When is a ferry flight outside the scope of UK VAT due to the place of supply rules?

This happens when your customer is a business established outside the UK. Under B2B rules, the “Place of Supply” is where the customer is located. Since the supply takes place legally abroad, it falls outside the UK VAT net.

What documents does HMRC expect to support 0% VAT on ferry flights?

Keep a full evidence pack: the contract, the invoice with the correct legal wording, and proof of the flight (e.g., a journey log or GenDec). If using the airline’s exemption, you must also have their signed declaration and AOC.

If the customer won't provide evidence, should I charge 20% VAT?

Yes. If they won’t give you their AOC or business proof, you have no protection. It is much safer to charge the 20% upfront than to have HMRC demand it from your own pocket during a later audit.

If I act as an agent, is my agency fee 0%, 20%, or outside scope?

Your fee is based on the customer’s location. If you’re an agent for a UK company, your commission is subject to 20% VAT. If you’re working for a foreign business, your fee is generally “Outside the Scope,” regardless of where the plane flies.

What records should I retain to defend 0% / 20% VAT treatment on ferry flights?

Preserve all of it, contracts, logs, VAT numbers and declarations, for a minimum of six years. HMRC investigations can look at historical international deals, so multiple audit trails for each flight will show exactly why you didn’t charge 20%.