Introduction: Why Appealing a Self-Assessment Penalty Matters

If you have received an unexpected letter from HMRC about a fine, you are not alone. According to HMRC’s 2023 compliance statistics, over 1.2 million taxpayers received penalties many due to minor filing delays. Having helped numerous individuals navigate this, we know it’s rarely due to negligence. But here’s the thing: not every fine is final. If you believe the penalty was not fair, or there was a good reason you missed something, you have the right to appeal against a self-assessment penalty. And you are not alone thousands of people appeal each year. You just need to know the rules, the process, and what HMRC is looking for when they review your case. That is exactly what this guide will walk you through. From understanding how to appeal against a self-assessment penalty to identifying whether your situation qualifies, you will learn everything step by step. Whether it’s an appeal against a self-assessment penalty fine, interest on late payments, or both, don’t panic. You might be able to set things right. We’ll break it down in plain language. No jargon. No guessing games. Just practical help so you can take control of your situation, avoid further charges, and get back on top of your finances calmly and confidently.

When and Why HMRC Issues a Self-Assessment Penalty

No one enjoys opening a letter from HMRC, especially when it says you owe a fine. In most cases, penalties arise not from bad intentions but from simple oversights or unexpected circumstances. You may have missed the deadline by a day or two or forgot a payment while juggling a dozen other things. As noted in HMRC’s penalty guidelines, their system is automated and does not initially account for context unless an appeal is submitted, which means even a small slip-up can result in a penalty. A self-assessment penalty is usually triggered when something important has not been done on time, like filing your tax return or paying what’s owed. It doesn’t matter whether you are self-employed, earning rental income, or just submitting a return because you’re required to follow the same rules as everyone else. But the good news? You can push back. If you believe the penalty is not fair, you have the right to appeal against self-assessment penalty. The key is to understand why HMRC issued it and what qualifies as a reasonable excuse. Once you know what went wrong and gather your facts, you can challenge it and in many cases, get it reduced or cancelled.

Common Reasons You Might Get Penalized

There are plenty of situations that can lead to an HMRC fine, some more common than others. We’ve worked with dozens of self-employed clients from consultants to delivery drivers who didn’t even realize their side income required a return. That honest confusion, if clearly explained, can form a valid basis for appeal.

Here are the main reasons HMRC issues penalties:

- Filing your return late

- Paying your tax bill after the deadline

- Entering incorrect details on the form

- Forgetting to tell HMRC about changes (like starting your own business)

Any of these can lead to a charge, sometimes more than one. But even if you made a mistake, it does not mean you have to accept the fine without question. If you think your situation deserves a second look, you can submit an HMRC appeal against a self-assessment penalty. That means telling your side of the story clearly and showing why it happened. If your explanation fits HMRC’s rules for a “reasonable excuse,” there is a real chance they will agree to wipe it out.

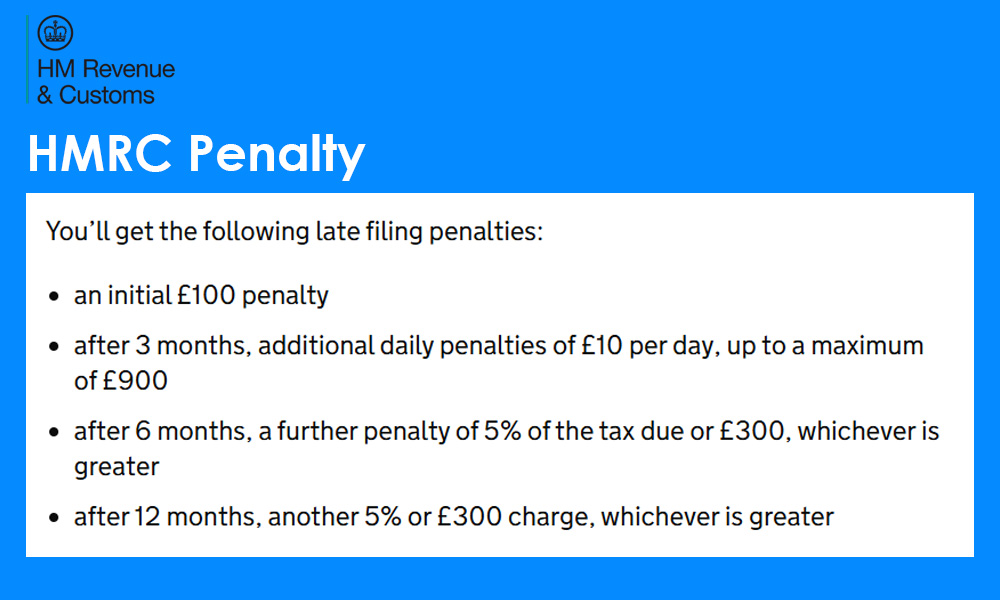

HMRC Penalty Amounts and Deadlines to Know

Penalties from HMRC don’t just arrive once and disappear, they escalate quickly over time. That is why understanding how they build up is so important if you want to fix things before they get worse. These thresholds are detailed in HMRC’s official Self-Assessment Penalty Policy, which was last updated in 2024. It starts with a flat £100 fine if you miss the 31 January deadline for filing your return. That applies even if you don’t owe any tax at all. If your return stays late for three months or more, the charges increase, and you can be fined £10 per day, up to a maximum of £900. Six months later, you will face another 5% of what you owe (or £300, whichever is higher). If you still haven’t filed after a year, HMRC imposes further penalties. Then there’s interest. If you have not paid your tax bill, HMRC will charge daily interest until it is cleared. That is in addition to the original fines. If you are already facing penalties and the circumstances were beyond your full control, you may still be able to submit an appeal of self-assessment penalty by providing a clear explanation of what happened. Submitting a proper request through the HMRC penalty appeal process can make all the difference.

Can You Appeal a Self-Assessment Penalty?

As per HMRC guidelines, you must appeal within 30 days of receiving the penalty notice. This timeframe is strict and it’s where most people unintentionally lose their chance. Many people wrongly assume that once a penalty is issued, it’s final. That is not true. HMRC allows people to appeal against self-assessment penalty decisions but only if there is a good enough reason behind the delay or mistake. The system is strict, but not heartless. HMRC knows things can happen. Life can throw curveballs — illnesses, family emergencies, even technical issues, and in such cases, there’s room to explain. The important thing is to act quickly, be honest, and clearly lay out the facts. If your situation qualifies as an HMRC reasonable excuse, your appeal has a fair chance of success. But it is not just about ticking boxes; it is about telling your story in a way that makes sense to them.

Who Can Appeal and What Counts as a Valid Reason

If you have received a fine for late filing, late payment, or submitting incorrect tax details, you have the right to appeal. It doesn’t matter whether you are self-employed, a company director, or just someone with side income, if you file under the self-assessment system, you are entitled to challenge a penalty.

The key is whether your reason fits what HMRC considers valid. So, what kind of reasons do they usually accept?

Here are a few that often work:

- You were seriously ill or in hospital

- A close family member passed away around the time of the deadline

- You experienced a serious emergency like a flood, fire, or burglary

- There were technical issues with HMRC’s online system

- You were genuinely delayed in receiving vital documents

The Low Incomes Tax Reform Group (LITRG) advises maintaining records such as medical certificates or technical error screenshots when filing a penalty appeal especially for vulnerable groups. HMRC does not expect perfection, but they do want sincerity and evidence. Submitting an HMRC appeal against a self-assessment penalty with proper paperwork attached gives you the best chance.

Who Cannot Appeal and Mistakes to Avoid

There are also situations where an appeal is unlikely to succeed. It’s important to be honest with yourself about why you missed the deadline or payment.

Here are examples of excuses that almost never get accepted:

- “I forgot.”

- “I was too busy with work or family.”

- “My accountant didn’t remind me.”

- “I wasn’t sure of the deadline.”

- “I thought HMRC would send me a notice first.”

HMRC generally does not consider these as valid excuses. They expect people to stay informed, even when using a tax advisor. Submitting an appeal with one of these reasons will be a waste of time and energy. If you are not sure whether your case qualifies, take a step back. Look at the facts. If there is something truly outside your control, then you may have grounds for a proper HMRC penalty appeal process. However, if it was simply an oversight, it may be more practical to pay the fine and focus on avoiding such mistakes in the future.

Prefer watching instead?

Here’s a video summary for you

Steps to Appeal a Self-Assessment Penalty: Full Process

When that penalty letter from HMRC lands in your inbox or hits your doormat, it is easy to panic. But before you let the stress take over, take a breath because you might have more control than you think. A lot of people don’t realize just how straightforward it can be to appeal against self-assessment penalty charges, especially if there is a genuine reason thing went off track. Think of this process as setting the record straight. You’re not arguing with the tax office; you are simply explaining what happened, showing your side of the story, and giving HMRC the chance to reconsider. It’s more common than you might expect, and plenty of successful appeals happen every year.

Here’s what you need to do, one step at a time.

Step 1 – Review Your HMRC Penalty Notice

First, read the letter carefully. It’ll tell you why you’ve been fined late filing, missed payment, or errors in your return. Take your time to look over the dates, the amount owed, and whether interest has been added. If you know that you submitted your return or made the payment, check your HMRC account for confirmation. Sometimes, a return does not go through properly, or a payment takes longer to show up. That alone might give you grounds to appeal self-assessment penalty fines, especially if the issue was on their end. You typically have 30 days (about 4 and a half weeks) from the date of the letter to raise your objection. Failing to do so can greatly reduce your chances of a successful HMRC penalty appeal.

Step 2 – Prepare Your Evidence and Reasonable Excuse

Now it is time to back up your case. HMRC won’t cancel a fine just because it’s unfair; they’ll need to see what happened. A valid excuse, backed by documents, puts you in a strong position.

Let’s say you were in the hospital. All personal documents, including hospital discharge letters or bereavement notices, must be handled securely. We recommend scanning and redacting sensitive data before uploading through HMRC’s secure portal. Lost a loved one around the deadline? A death certificate helps confirm that. Or their online system failed while you were submitting a screenshot to prove your efforts. What you are doing here is giving them a reason to believe your mistake was not careless, but unavoidable. That is what they mean when they refer to a reasonable excuse under HMRC guidelines. If you were trying to do the right thing but ran into a serious roadblock, say so and prove it. Many people filing a HMRC appeal against self-assessment penalty forget to include these extra details. Do not make that mistake. Being thorough could be the difference between getting the fine waived or having it stick.

Step 3 – Submit Your Appeal Online or by Post

Once your explanation and documents are ready, you have two options to file your appeal.

Online Submission:

This is the fastest and simplest route. If you have a Government Gateway login, you can go straight into your HMRC account, find the penalty notice, and click through to submit your appeal. The system lets you write your explanation and upload any supporting files. You will get confirmation instantly.

Postal Submission:

Prefer paper? That works too. Download the SA370 form from HMRC’s website (or SA371 for partnership appeals). Fill it in by hand, attach printed copies of your documents, and send it to the address on your penalty notice. This form is reviewed by trained HMRC case officers who assess whether your excuse aligns with their Reasonable Excuse criteria clearly defined in Gov.UK.

Either way, keep a copy of everything. It’s not unusual for appeals to be reviewed weeks later, and you might need to reference what you sent. Submitting a well-prepared self-assessment penalty fine appeal puts you in a much stronger position than rushing at the last minute.

Step 4 – Wait for HMRC’s Response

After you’ve submitted the appeal, the waiting begins. HMRC won’t give you an exact response time, but in most cases, people hear back within a few weeks. If your appeal is clear and well-supported, the decision may come more quickly.

They’ll respond in writing, and they will do one of three things:

- Cancel or reduce the penalty

- Request more details or evidence

- Reject your appeal altogether

If they reject it and you still feel the decision is unfair, you can take the next step and ask for an independent review or even head to a tax tribunal. But most appeals do not get that far. What matters most is submitting an appeal that is honest, detailed, and backed by proof. That is often enough to turn the situation around and take the pressure off.

What Happens After the Appeal?

Once you have sent in your appeal, things do not move instantly and that is completely normal. HMRC doesn’t fire off a reply to the next day. Instead, your case enters a review queue, and from there, it’s about waiting. That wait can be a little stressful, but it’s part of the process. You will not be left guessing forever, though. Eventually, a letter will arrive either by post or in your HMRC account. That letter will spell out where things stand. It will either be good news that the fine is gone or not-so-good news that the penalty still stays. Either way, you will have a clear answer, and from there, you can decide what to do next.

If Your Appeal Is Accepted

If HMRC reviews your case and agrees with your explanation, they’ll either cancel the penalty in full or reduce it. This is the best-case scenario and means your appeal against a self-assessment penalty has worked.

Here’s what can happen next:

- The fine is removed from your account

- Any related interest charges may be cancelled as well

- Your record is updated to reflect the cleared penalty

You do not have to take further action at this stage. It is always a good idea to save the acceptance notice in your records, just in case you need it in the future especially if you are applying for a mortgage or business loan where financial history matters.

An approved self-assessment penalty fine appeal can bring significant relief not just financially, but emotionally as well. It gives you breathing space and helps you move forward without the stress of lingering penalties.

If Your Appeal Is Rejected

Now, what if the answer isn’t what you hoped for?

HMRC might decide that your excuse does not fit their rules, perhaps your reason wasn’t strong enough, or the supporting evidence was insufficient. If that happens, they will explain why your HMRC appeal against a self-assessment penalty did not go through.

But that does not mean the story ends there.

You can ask for a review. It is free and handled by someone different within HMRC, someone who has not seen your case yet. It gives you a second chance, and sometimes that’s all it takes. Still not satisfied after that? You can then escalate the matter by appealing to the tax tribunal. That is more formal, and it may take time, but it exists for situations like this when you believe the system got it wrong. Even if your HMRC penalty appeal isn’t successful the first time, don’t assume you’ve failed. There is more than one route to ensure your case is fairly considered.

How Lanop Can Help You Appeal HMRC Tax Penalties

If you are staring at a fine from HMRC and wondering what to do next, you are not alone and you don’t have to figure it out by yourself. As an ACCA-accredited firm, we are bound by professional ethics and have a proven track record across over 1,000 self-assessment submissions and reviews. We take the stress off your shoulders by helping you respond with clarity and confidence. Whether you are challenging a self-assessment penalty fine appeal or unsure how to explain your circumstances, we work with you to build a proper case. We help you to gather the right documents, shape your explanation, and make sure your appeal is sent on time. And if HMRC says no? That is not the end. We can help you to request a second review or go further if it comes to that. You do not need to understand every rule in the book. With Lanop, the HMRC penalty appeal process becomes easier to manage. Your appeal against the self-assessment penalty deserves to be heard properly, and we are here to make sure that happens.

Conclusion: Don’t Let Penalties Weigh You Down

With Lanop’s trusted advisors on your side, you don’t need to face penalties alone. Our knowledge, ethics, and client-first approach give you the clarity and confidence to move forward. If you believe you’ve been unfairly charged, it’s worth taking the time to appeal against self-assessment penalty decisions and you don’t have to do it alone.

With the right help and a clear explanation, you stand a real chance of turning things around.

FAQs – How to Appeal HMRC Self-Assessment Penalties

How to appeal HMRC tax penalties

If you have been fined by HMRC and believe it’s unfair, you can appeal. The first step is to check the penalty notice for the charge’s reason. Then, explain your situation clearly what happened, when, and why. If you were seriously ill, experienced a death in the family, or ran into unexpected issues, it may qualify as a HMRC reasonable excuse for penalties. You can submit your appeal online through your HMRC account or send it by post. With the right documents and a calm explanation, your appeal against the self-assessment penalty might be approved.

How to challenge self-assessment penalties

If you have been fined and something about it does not sit right, you are not stuck. HMRC does allow people to explain their side, and many get their penalties reduced or cancelled. The key is to be honest. You do not need fancy language. Just describe what really happened: maybe you were sick, out of the country, or facing something personal. Include any documents that help support your explanation. A self-assessment penalty fine appeal is not a formality. It’s your chance to clear things up and the HMRC penalty appeal process exists for exactly that reason to listen.

How to avoid self-assessment penalties

To avoid self-assessment penalties, start early and stay organized. Keep your income records, expenses, and deadlines in one place a notebook, a spreadsheet, whatever works for you. Waiting until the last minute often leads to rushed mistakes or missed filings. That is when HMRC steps in with fines. If something unexpected happens like illness or technical trouble, don’t ignore it. Take action and explain the situation. Sometimes, you can still appeal against self-assessment penalty charges if it is clear, you made an honest effort. Staying prepared now saves you a big headache later.

How to appeal against self-assessment penalty

If you have been hit with a penalty and feel it’s unfair, you can absolutely challenge it. First, take a careful look at the notice from HMRC, it tells you why you were fined. Then explain your situation clearly and honestly. Maybe you were unwell, going through a crisis, or facing technical problems. These could count as valid reasons. Gather anything that supports your story. Submit the appeal online or by post and keep copies for yourself. The HMRC self-assessment penalty appeal process is your opportunity to explain your situation — not just defend yourself.