Preface Decoding Capital Allowances on buses for UK Businesses

Understanding what capital allowance on cars is essential for any UK business planning to invest in vehicles. This form of duty relief allows companies to neutralize the cost of long-term means similar to ministry, outfit, or vehicles against taxable gains, either immediately or over several years. In simple terms, capital allowances on cars help reduce the overall duty bill by accounting for the depreciation in an auto’s value over time.

The Core Principle of Capital Allowances

The idea behind capital allowance on cars is straightforward: vehicles, like other business assets, lose value as they are used. This decline is honoured through duty relief rather than being treated as a regular business expenditure. While day-to-day costs like energy and insurance are subtracted incrementally, larger investments such as buses are claimed gradually under the capital allowances on the company car frame. Businesses can claim capital allowances on car purchases when they are classified as “factory and ministry. ” Still, buses are treated differently from other means, such as vans or outfits, meaning they follow their own set of rules under HMRC guidelines for capital allowances on cars self-employed or incorporated businesses.

The Unique Status of Business Buses

Unlike marketable vehicles such as vans or lorries, business buses do not qualify for the Annual Investment Allowance(AIA) or Full Expensing. This means you cannot abate the full cost incontinently, regardless of the auto’s price or your business structure. Rather, buses are assessed based on CO ₂ emissions. This is where capital allowances on cars, CO2, and capital allowance rates on vehicles come into play. The government intends to promote cleaner transport. Relief rates are directly tied to capital allowances on cars, CO2 emissions, and encouraging businesses to invest in environmentally friendly vehicles.

For illustration, capital allowances on electric cars or capital allowances on hybrid cars can offer advanced reliefs through the 100% First Year Allowance (FYA). At the same time, high-emission or luxury vehicles are confined under capital allowances on expensive cars with private use rules. Businesses seeking the most effective duty relief should explore capital allowances on zero-emission cars or capital allowances on low-emission vehicles, as they align with the UK’s sustainability pretensions.

On the other hand, if a business opts for petrol or diesel models, relief is limited through lower capital allowance rates on cars. Whether you are running a limited company or handling your sole trader capital allowances on cars, it is vital to plan. Your claim could differ depending on the auto’s CO₂ emissions, purchase system (cash, parcel, or finance), and private use position, especially in cases involving capital allowances on electric cars with private use or capital allowances on finance lease cars. In short, claiming capital allowances on cars is not a one- size- fits process. It demands attention to environmental conditions, power type, and how the auto is used within the business.

The Foundational Framework Writing Down Allowances (WDA) and CO₂ Thresholds.

When a business auto does not qualify for the 100 First Year Allowance generally reserved for new, zero-emission vehicles, relief is claimed through Writing Down Allowances (WDA). This system allows businesses to abate the chance of the auto’s remaining value each time from taxable gains, gradually reducing the auto’s written-down value. The specific capital allowance rates on cars depend on the car’s CO₂ emissions. For illustration, capital allowances on hybrid cars, capital allowances on used electric cars, or indeed capital allowances on second-hand electric cars may fall under different WDA pools grounded on immigration situations.

Lower- emigration or electric models qualify for advanced reliefs, while advanced CO ₂ models admit reduced allowances. Understanding this CO₂-grounded system is essential for maximising duty savings. Whether you are calculating capital allowances on leased cars, capital allowances on pcp cars, or capital allowances on hire purchase cars, every gram of CO₂ emitted affects how much you can claim. For companies and self-employed individuals, planning around capital allowances on cars, for example, computations can make a measurable difference in long-term tax effectiveness. With strategic investment, especially in capital allowances on second-hand cars or capital allowances on taxi car businesses, one can achieve both financial and environmental advantages.

Determining the Correct Allowance Pool

For buses bought on or after 1 April 2021(for Corporation Tax) or 6 April 2021(for Income Tax), HMRC applies three specific orders that determine the rate of duty relief. CIS Accountants frequently guide businesses through these distinctions to ensure every purchase falls into the most profitable pool. Zero Emission (0g/ km) New and unused completely electric vehicles qualify for the 100 First Year Allowance (FYA), allowing the business to abate the full cost immediately.

Low-emission (1g/ km to 50g/ km) buses in this band frequently include Plug-in Hybrid Electric Vehicles (PHEVs), and certain capital allowance on second-hand electric cars falls under the Main Rate Pool, attracting an 18% Writing Down Allowance (WDA) on a reducing balance basis. High Emission (Over 50g/ km) Vehicles exceeding 50g/ km CO ₂ emissions, including most petrol, diesel, and some mongrels, are placed in the Special Rate Pool, limited to a 6 WDA. This clear split between the 18 and 6 rates shows how pivotal capital allowances on cars CO2 emissions data directly determines how quickly a business can recover costs through duty relief.

Understanding the WDA Medium

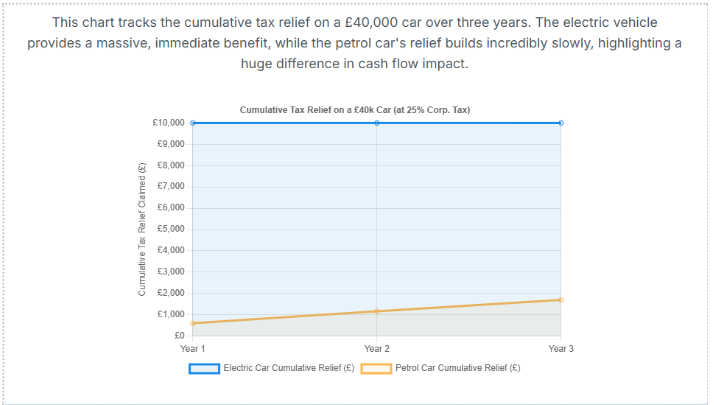

Writing Down Allowances are applied to the remaining pool balance each time rather than the auto’s original cost. For example, if a low-emigration auto going £ 30,000 qualifies for the 18 Main Pool, the Year 1 deduction is£ 5,400(18 of£ 30,000), leaving£ 24,600. In Time 2, the deduction becomes£ 4,428(18 of£ 24,600), with£ 20,172 remaining. Still, 000 falls under the 6 Special Rate Pool, the Year 1 deduction is only£ 1, if a high emigration auto goes £ 30. This comparison highlights how capital allowances on cars CO2 thresholds produce major differences in cash inflow benefits.

The steep drop from 18 to 6 past the 50g/ km mark serves as an erected counterincentive for choosing advanced-emigration vehicles. Businesses that elect effective models like those qualifying for the 18 WDA or capital allowance on hybrid cars gain relief and remain more competitive as environmental regulations strain. Forward- allowing companies guided by CIS Accountants can thus align smart duty planning with sustainability pretensions, guarding against unborn policy shifts that may correct advanced-emigration means.

Table 1: UK Capital Allowance Rates for Business Cars (Post-April 2021)

| Vehicle Criteria (New/Used & CO2) | Allowance Type | Rate | Pool Allocation |

|---|---|---|---|

| New & Unused, Zero Emission (0g/km) | First Year Allowance (FYA) | 100% | Single Asset Pool |

| New or Used, Low Emission (1 g/km to 50 g/km) | Writing Down Allowance (WDA) | 18% | Main Rate Pool |

| Used Electric Cars (capital allowance on used electric cars) | Writing Down Allowance (WDA) | 18% | Main Rate Pool |

| New or Used, High Emission (Over 50 g/km) | Writing Down Allowance (WDA) | 6% | Special Rate Pool |

Strategic Advantage Zero and Low Emission Vehicles

The most important duty impulses are centred around capital allowances on electric cars, making them the foundation of a smart, sustainable line strategy for UK businesses. Partnering with experts like Let Property Campaign ensures that these openings are maximised while staying biddable with HMRC regulations.

The 100 First Year Allowance (FYA) on Zero Emission Cars

Businesses that buy a new and unused zero-emission vehicle, completely electric or 0g/km CO₂, can claim the full purchase cost against taxable gains in the time of accession. This accelerated deduction, known as the 100 First Year Allowance (FYA), answers the question many ask: “Can I claim 100 capital allowances on an electric car?” Yes, the vehicle is both new and unused. This immediate relief delivers far less cash inflow benefits than spreading deductions through the slower WDA system.

Also, companies can claim 100 FYA on the outfit used for installing electric vehicle charging points, promoting structure growth alongside line electrification. Still, this generous scheme is time-sensitive; the 100 FYA applies only until 31 March 2026, after which zero-emission buses are anticipated to return to the 18 WDA Main Rate Pool. This brewing deadline means acting now can yield a far better Net Present Value (NPV) on duty savings than postponing investment and accepting slower unborn relief.

Capital Allowances on Used and Second-Hand Electric Cars

While duty impulses for new EVs are largely favourable, the treatment of capital allowances on used electric cars or capital allowances on second-hand electric cars is especially different. Used EVs do not qualify for the 100 FYA. Rather, they enter the Main Rate Pool, attracting an 18 Writing Down Allowance (WDA) each time. For example, a business coping with a £20,000 used EV can claim £3,600 (18%) in the first year. This difference creates a clear request imbalance; the duty cost of a new EV, formerly 100% relief is applied, can be mainly lower than that of a used model, indeed if the outspoken prices are analogous. The government deliberately designed this policy to stimulate new EV adoption and drive the growth of the clean vehicle demand.

Capital Allowances on Hybrid Cars

When it comes to capital allowances on hybrid cars, the CO₂ threshold becomes the defining factor. To qualify for the 18 Main Rate WDA, a mongrel vehicle must emit between 1g/km and 50g/km, a standard generally met only by ultramodern Plug-in Hybrid Electric Vehicles (PHEVs) with longer electric ranges. However, the auto drops to the Special Rate Pool at 6%, significantly decelerating duty relief if emissions exceed 50g/km. This stark difference underscores why businesses must confirm the functionary capital allowances on cars CO2 data before coping. Strategic pre-purchase planning, especially when guided by experts like Let Property Campaign, can help avoid expensive mistakes and ensure each vehicle purchase aligns with long-term duty and environmental pretensions.

Navigating Business Structure and Private Use Constraints

The computation and claim of capital allowances on auto purchases vary extensively depending on your business structure and how important the vehicle is for a particular trip.

Limited Companies Claiming Full Cost (The Corporate Pool)

When a limited company buys a vehicle, it can generally claim capital allowances on company buses based on the full purchase price. The cost is added to the applicable pool, Main, Special, or 100 First Year Allowance (FYA), and subtracted from taxable gains according to the appropriate rate (100, 18, or 6). Still, that use is handled independently through the Benefit-in-Kind (BIK) system, if a company car is used tête-à-tête by a director or hand. The BIK value depends on the car’s list price and its CO2 emissions. The current low BIK rates for completely electric vehicles (0g/km) make this approach particularly duty-effective. A company can claim the full 100 FYA on a new EV while the hand enjoys a veritably low particular duty charge. This palm-palm script aligns with sustainable line programs frequently seen in a Family Business setting.

Sole Dealers and Hookups – The Private Use Restriction

For tone-employed professionals, similar to sole dealer capital allowances on buses, the rules shift. However, the capital allowance claim must be reduced to reflect the proportion of private use if the vehicle is used for both business and private purposes.

Obligatory Private Use Adjustment

For illustration, if a sole dealer uses their auto 80% for business and 20% personally, they can only claim 80% of the capital allowance. Indeed, if it is a new electric auto that qualifies for the 100 FYA, the same restriction applies to capital allowances on electric buses with private use. This means that a £50,000 EV used half the time for business would only yield a £25,000 deduction in the first year. Accurate avail logs are critical to support the claim and avoid HMRC scrutiny.

The Single Asset Pool

Vehicles used incompletely for business and incompletely for particular purposes are placed in a single asset pool, separate from the Main or Special Rate pools. The Writing Down Allowance (WDA) is either 18 or 6 per cent applied on a reducing balance, and the performing allowance is also reduced by the private use chance. When the auto is ultimately vended, only the business portion of the proceeds affects the computation, ensuring that relief matches true business operation.

The BIK vs. Private Use Trade-Off

For high-value or high-emission vehicles similar to those falling under capital allowances on precious buses with private use, sole dealers face slow and limited relief through the 6 WDA, further reduced by their particular operating chance. In discrepancy, companies profit from faster deductions and more effective structures through BIK and FYA claims, especially when dealing with low-emission or electric vehicles.

Indispensable Simplified Avail Rate

Sole dealers and hookups can choose to skip the capital allowances system entirely by using HMRC’s Simplified Mileage Rate, which presently stands at 45p per mile for the first 10,000 long hauls and 25p thereafter. This covers all running costs, including depreciation following the capital allowance on auto and is frequently the easiest option for lower operations or low-avail druggies.

Table 2: Capital Allowances: Limited Company vs. Sole Trader/Partnership

| Aspect | Limited Company (Director/Employee Car) | Sole Trader / Partnership (Partner’s Car) |

|---|---|---|

| CA Claim Basis | Claims 100% of asset cost against corporate profit. | Claim is restricted by the documented business use percentage. |

| Private Use Adjustment | None on the CA claim; private use results in BIK charge for the recipient. | Mandatory reduction of the claim (e.g., 70% business use allows only 70% of CA). |

| Car Pool Type | Main/Special Rate Pool (or single asset pool for 100% FYA EV). | Single Asset Pool (mandatory if any private use exists). |

| Alternative Claim | Not applicable (must use CAs). | Can opt for HMRC Simplified Mileage Rate. |

Complex scripts, Backing styles, and Specialized Vehicles

The capability to claim a capital allowance on auto expenditure depends primarily on whether the business is recognised as the asset’s owner for tax purposes. Understanding how different backing structures affect power and thus eligibility is crucial to maximising duty effectiveness.

Acquisition Styles and Ownership Criteria

Outright Purchase and Hire Purchase (HP)

When a business acquires a vehicle outright or through capital allowances on a hire purchase bus, HMRC generally treats the business as the profitable proprietor from the date the agreement is launched. This power allows the company to claim capital allowances continuously on the full cost, indeed, if part of the payment is financed. Any interest paid on the HP contract is claimed independently as a deductible profit expenditure, creating a clean separation between capital and finance costs.

Leasing and Finance Lease

In standard operating plates or contract hire agreements, power stays with the finance company. Because the business is not the legal proprietor, it cannot claim capital allowances on leased buses. Rather, parcel settlements are subtracted as a business expenditure. Still, when it comes to capital allowances on finance parcel buses, the same rule applies to the letter, not the border, claims the CA. There is a notable catch if the leased vehicle’s CO2 emissions exceed 50g/ km; 15 of the parcel payments are disallowed for duty relief. This “Lease Disallowance Trap” effectively doubles the penalty, as the business loses both capital allowance eligibility and part of its expenditure deduction. For high-emigration lines, this can heavily impact profitability.

PCP Agreements

Under capital allowances on pcp buses, power generally transfers only when the final balloon payment is made. Also, the vehicle is treated as leased, meaning no CAs can be claimed. The business can only abate rental payments as an expenditure, and if emissions exceed 50g/ km, the same 15% disallowance applies.

Special Category Vehicles

Pool buses

The capital allowances on pool buses bracket applies when vehicles are kept at a business demesne, used by multiple workers, and are not available for private use. These vehicles qualify for full Handbasket recovery, a rare advantage, and CAs (100, 18, or 6) grounded on their CO2 emissions. Businesses frequently use pool buses to maintain flexibility while staying biddable and maximising permissible duty deductions.

Hack and Private Hire Vehicles

Vehicles used as hacks or capital allowances on private hire buses generally follow standard immigration-grounded rules. Still, certain traditional Hackney Carriages (like London black taxicabs) qualify as technical trade means. These frequently fall under the 100 Annual Investment Allowance (AIA), allowing the entire cost to be written off immediately. This provides a major fiscal edge to companies or sole dealers managing lines in transport-heavy sectors such as logistics, tourism, or Real Estate operations.

Optimal Backing Strategy

The stylish backing route depends on the auto’s emissions profile. For zero-emission vehicles (0g/ km), Hire Purchase is frequently the superior strategy because it allows full power and immediate 100 FYA claims. Leasing forfeits that advantage, spreading deductions over time. For high-emission buses (over 50g/ km), leasing becomes less appealing due to the 15% reimbursement disallowance. In similar cases, outright purchase under the slower 6 WDA can offer cleaner duty treatment and lower long-term costs.

| Aspect | Low-Emission Car (Hybrid, 40g/km) | High-Emission Car (Diesel, 120g/km) |

|---|---|---|

| Applicable WDA Rate | 18% (Main Rate Pool) | 6% (Special Rate Pool) |

| Initial Cost | £40,000 | £40,000 |

| Year 1 CA Claim | £7,200 (18% of £40,000) | £2,400 (6% of £40,000) |

| Year 1 CT Saving (25% rate) | £1,800 | £600 |

| Tax Written Down Value (TWDV) Carried Forward | £32,800 | £37,600 |

| Year 2 CA Claim | £5,904 (18% of £32,800) | £2,256 (6% of £37,600) |

| Total CA Claimed Over 2 Years | £13,104 | £4,656 |

The capability to pierce the 18 Main Rate allows a business to claim duty relief nearly three times as briskly in the first two times compared to the slower 6 Special Rate. This brisk recovery significantly boosts cash inflow, making it a vital advantage when planning capital investment.

Client Case Study: Strategic Fleet Transition and Immediate Tax Savings

Eco Outsourcing recently supported one of our motorists, a fast-growing tech consultancy operating as a limited company, which was facing high Corporation Tax arrears due to rapid profit growth. The company demanded to expand its indigenous deals line and wanted to balance immediate duty relief with manageable Benefit-in-Kind (BIK) exposure for workers.

The script

The customer planned to invest£ 180,000 in four new vehicles. Preliminarily, they had reckoned on diesel buses that only qualified for the 6 WDA, leading to slow duty relief and weak cash inflow benefits.

The Eco Outsourcing Solution

- Zero-Emission Strategy We advised investing in four new zero-emission electric vehicles (£45,000 each, total £ 180,000). Because they were bought before the 2026 deadline, the customer is eligible for the 100 First Year Allowance (FYA), allowing full deduction in the first year.

- Financing Structure: The vehicles were acquired through capital allowances on hire purchase buses, which fairly established company power and assured immediate eligibility for capital allowances.

- Maximized Commercial Relief The company claimed a£ 180,000 deduction against commercial gains in Year 1.

- Minimized BIK workers and directors served from the current ultra-low BIK rates applied to 0g/ km vehicles, combining company duty effectiveness with particular savings.

Result

With a 25% Corporation Tax rate, the customer saved£ 45,000 on duty in the first year alone. This forward- allowing strategy centered on using the 100 FYA window freed up substantial capital for reinv

Future Outlook and Policy Changes

Duty planning around vehicles is not stationary; it requires foresight. Unborn policy adaptations could reshape the fiscal benefits of certain vehicle choices, making visionary strategy essential.

The Impending End of the 100 FYA (Post-March 2026)

The current extension of the 100 FYA for zero-emission buses until 31 March 2026 is a limited occasion. After that, new zero-emission vehicles are anticipated to shift into the Main Rate Pool, where they will attract only 18 WDA on a reduced balance base. To illustrate the impact, a£ 70,000 EV bought before the deadline secures an immediate£ 70,000 deductions. Bought after, the Year 1 deduction drops to just£ 12,600, a sharp decline that directly affects cash inflow and investment return. This planned policy shift indicates that the government believes EV relinquishment has reached a stage where extraordinary duty impulses are no longer necessary.

VED Changes and Other Operating Costs

Indeed, as capital allowances on zero-emission buses deliver outspoken savings, ongoing costs are evolving too.

- Vehicle Excise Duty (VED) From 1 April 2025, new zero-emission buses will no longer be exempt and will pay a standard rate after a low first-time figure.

- Despite this change, EVs remain seductive due to the combined benefits of 100 FYA (until 2026), low BIK rates, and reduced energy and conservation costs.

Looking ahead, as capital allowance rates homogenize and impulses reduce, businesses must acclimatize their Total Cost of Ownership (TCO) models. Fleet directors should start factoring in these adaptations to stay ahead of the request and maintain cost effectiveness in their long-term vehicle strategies.

How Eco Outsourcing Helps UK Businesses Master Capital Allowances on Cars

The intricate and ever-changing world of HMRC capital allowances on cars, particularly when it comes to zero-emission vehicles, CO2 thresholds, and private use rules, requires more than general account knowledge. It demands expert, forward- allowing guidance. That is where Eco Outsourcing comes in. We give acclimatized duty advisory services that help UK businesses not only claim every eligible allowance but also structure their investments for maximum effectiveness and long-term compliance.

Client Quote:

“Eco Outsourcing helped us understand the tax rules around company cars and showed us how to claim properly. They found reliefs we didn’t know existed and helped us structure things properly. We saved money and finally felt confident about our decisions.”

Strategic Pre-Acquisition Planning

At Eco Outsourcing, the stylish duty strategy starts before the purchase is made.

Optimal Structuring and Finance

Our platoon helps guests determine the ideal power setup, whether a limited company or sole trader, and elect the stylish backing route, such as Hire Purchase (HP) or leasing. We clarify when the business, rather than the lender, can rightfully claim the capital allowance on a car. We also guide guests through the counteraccusations of capital allowances on leased cars, helping them avoid the 15% parcel disallowance that applies to high-CO2 vehicles.

Deadline operation

With the 31 March 2026 cut-off approaching for the 100 First Year Allowance on zero-emission buses, Eco Outsourcing helps guests plan purchases strategically to secure the most generous reliefs before the window closes.

Emigrations Verification

Our experts corroborate CO2 emission situations, especially for cold-blooded vehicles, to confirm they stay within the 50g/km limit and qualify for the 18 Main Rate WDA, avoiding gratuitous deportation to the slower 6 Special Rate Pool.

Compliance and Maximization

After accession, Eco Outsourcing ensures claims are both accurate and optimised. We bring structure and perfection to a process that frequently trips up, indeed, enduring finance brigades.

Accurate Bracket

We rightly identify and classify means by distinguishing between standard buses (eligible for WDA or FYA), vans and lorries (AIA or FE eligible), and special vehicles like hacks to ensure no occasion for duty relief is missed.

Private Use conscientiousness

For sole dealers, hookups, and capital allowances on cars in self-employed cases, we apply detailed record-keeping systems, including avail logs, to prove business use probabilities. This industriousness directly supports accurate and advanced permissible claims.

Pool Management and Disposal

Eco Outsourcing manages the allocation of vehicles into the correct pools, Main, Special Rate, or Single Asset, and handles balancing adaptations on disposal. This ensures every stage of the vehicle’s duty life is rightly reckoned for and biddable. By partnering with Eco Outsourcing, businesses turn complex capital allowances on company cars and tonne-employed claims into a structured, biddable, and profitable duty strategy. We combine deep duty moxie with real-world business sapience to deliver clarity and confidence, especially for guests navigating, where delicacy and compliance are paramount.

FAQs

Can I claim 100 capital allowances on an electric auto?

Yes, businesses can claim 100 capital allowances on a new and unused electric auto with zero CO2 emissions (0g/km). This 100 First Year Allowance (FYA) lets you abate the full cost from taxable gains at the time of purchase. Still, this relief ends on 31 March 2026. Habituated electric buses do not qualify for the FYA but can claim 18 Writing Down Allowance (WDA). For sole dealers or hookups with private use, the claim must be based on the business-use chance.

Can I claim capital allowance on my auto?

Yes, you can claim capital allowance on my auto if it is used for business purposes and possessed by a sole dealer, corporation, or limited company. Workers cannot claim capital allowances but may be eligible for allowable expenditure claims. The rate depends on CO2 emissions: 100 FYA for new zero-emission buses, 18 WDA for low-emission buses (over 50g/km), and 6 WDA for advanced-emission vehicles.

Can you claim capital allowances on buses?

Yes, you can claim capital allowances on buses used for business purposes, but buses are treated differently from standard factory and ministry vehicles. They do not qualify for the Annual Investment Allowance (AIA) or Full Expensing. Instead, you claim duty relief through the CO2-grounded Writing Down Allowance (WDA) system 18 for low-emission vehicles and 6 for high-emission buses or the 100 FYA for new, zero-emission buses.

Can you claim capital allowances on electric buses?

Yes, you can claim capital allowances on electric buses, and they presently offer the most generous duty relief available. New and unused electric vehicles qualify for a 100% FYA until 31 March 2026, allowing businesses to write off the full purchase cost immediately. After this date, or for used electric buses, claims shift to the 18 Main Rate WDA.

What capital allowances can I claim on an auto?

The capital allowances you can claim depend on the car’s CO2 emissions. For new zero-emission vehicles (0g/km), businesses can claim a 100% First Year Allowance (FYA). For low-emission buses (1–50g/km), the 18 Writing Down Allowance (WDA) applies under the Main Pool. Buses with emissions above 50g/km qualify for only 6 WDA under the Special Rate Pool.

Conclusion: Drive Tax Efficiency with Expert Support

Capital allowances on buses play a vital part in helping UK businesses reduce duty arrears on vehicle investments. With the 31 March 2026 deadline for the 100 First Year Allowance approaching, now is the time to invest in capital allowances on electric buses and capital allowances on cold-blooded buses to maximise relief. Accurate CO2 shadowing, correct backing choices like HP over leasing, and clear attestation for capital allowances on buses in use are essential for compliance and savings. Lanop Business and Tax Advisors help businesses navigate HMRC capital allowances on buses, ensuring every claim is optimised and biddable for long-term duty effectiveness.