Navigating Property Capital Gains Tax (CGT) UK in 2025/26

If you’re a landlord, property investor, or someone planning to sell a second home, the rules around Property Capital Gains Tax (CGT) in the UK have never been more critical to understand. The government’s 2025 updates mean more people will pay tax on property sales than before. The capital gains tax allowance on property has been reduced, pulling even ordinary transactions into the CGT net.

In simple terms, CGT is charged on the profit you make when a property increases in value, and you decide to sell or transfer it. The calculation looks straightforward: your sale price is the purchase price minus the purchase price, but the details matter. Many sellers overlook allowable capital gains tax deductions for property in the UK, including renovation costs, professional fees, and stamp duty. Taking these into account can make a meaningful difference in how much tax you owe.

What often slips under the radar are the opportunities within capital allowances on property, HMRC. These allowances can cover parts of a building, fixtures, or systems that qualify for tax relief. Knowing how and when to claim them is a powerful way to reduce the amount of gain you report. In 2025, understanding allowable capital expenditure on property and how to make a valid claim could be the difference between a heavy tax bill and well-managed, compliant savings.

At Lanop, our advisors regularly help clients navigate the finer details of capital allowances on commercial property, capital allowances on residential property letting, and other related reliefs. This guide unpacks the latest changes for 2025, explains the revised capital gains tax allowance on property in the UK, and shares smart, ethical ways to minimise your exposure. Whether you own a buy-to-let, a mixed-use site, or a small portfolio, this article will help you understand your obligations and how to make the most of them.

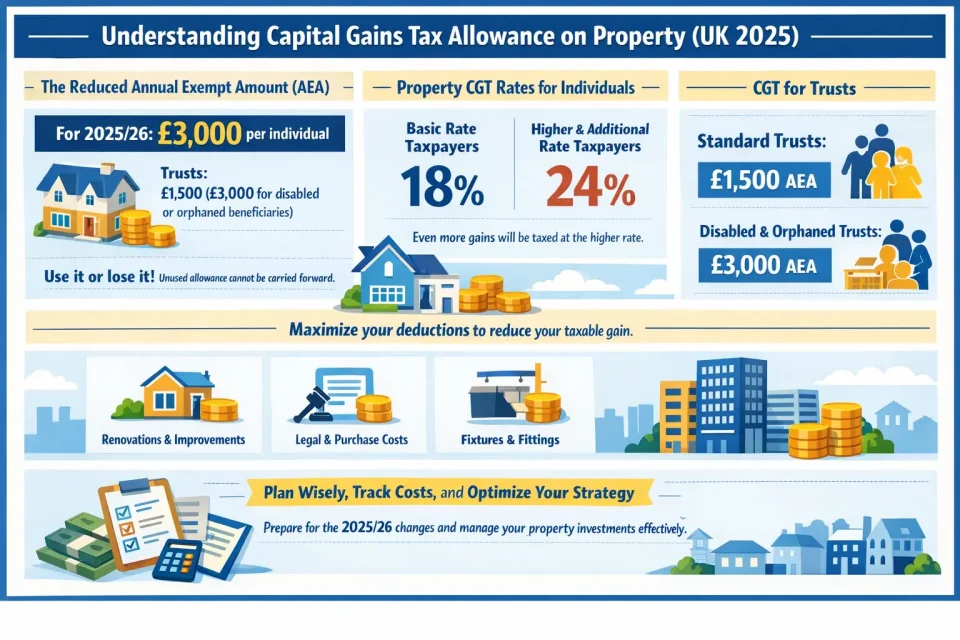

Understanding Capital Gains Tax Allowance on Property (UK 2025)

Good tax planning starts with knowing the numbers that matter most. For property owners in the UK, the capital gains tax allowance on property has changed sharply for the 2025/26 tax year. HMRC has scaled back to the Annual Exempt Amount (AEA), and this reduction affects almost everyone selling or transferring a property.

The Reduced Annual Exempt Amount (AEA)

The AEA is the slice of your gain that can be realised tax-free each year. For 2025/26, that figure falls to £3,000 per individual. Once the tax year ends, any unused allowance disappears; it cannot be carried forward. The smaller limit means even moderate appreciation on a flat or rental unit could now create a reportable gain.

This lower threshold has profound implications. In previous years, a larger AEA protected smaller profits from paperwork and taxes. Now, sellers must record every cost carefully for purchase price, legal fees, and improvement of work to calculate the actual gain. Miss one detail, and you risk paying more than necessary.

Trusts, which are often used to hold family assets, get an even tighter margin: £1,500, or £3,000 where the trust benefits a disabled person or an orphaned child.

Property CGT Rates for Individuals

When you sell a residential property that isn’t your main home, the gain falls under CGT. The rate depends on your income bracket:

- Basic Rate Taxpayers: 18 %

- Higher and Additional Rate Taxpayers: 24 %

With the AEA so low, many owners will find themselves paying the higher 24% rate. That makes it vital to use every available allowable deduction for capital gains tax on property in the UK and to understand how capital allowances on property, HMRC can legally reduce what you owe. Correctly claiming relief on fixtures, refurbishments, and eligible building systems can trim thousands off liability.

Corporate Structures and CGT Treatment

Limited companies don’t pay CGT in the same way individuals do. When a company sells a property, the profit counts as trading income and is taxed under Corporation Tax. Because of this, many professional investors structure their holdings through companies, allowing them to claim capital allowances on commercial property and to offset costs more efficiently.

The takeaway for 2025? Every landlord and investor should reassess how they hold and report property assets. Keeping detailed records of allowable capital expenditure on property and understanding when claiming capital allowances on property applies are no longer optional; they’re essential parts of an innovative, compliant strategy.

Table 1: UK Property Capital Gains Tax Rates and Allowances (2025/2026)

| Taxpayer Type | Annual Exempt Amount (AEA) | Residential Property CGT Rate | Notes |

|---|---|---|---|

| Individuals (Basic Rate Band) | £3,000 | 18% | Applies within the basic income tax band. |

| Individuals (Higher/Additional Rate Band) | £3,000 | 24% | Applies above the basic threshold. |

| Trusts (Standard) | £1,500 | 24% | Full 24% rate on chargeable gains above AEA. |

| Companies | N/A | Corporation Tax Rate | Gains taxed as corporate profits. |

The extreme reduction in allowance heightens the value of offset capital losses. For example, a £3,000 loss can completely offset a £3,000 gain, effectively eliminating exposure to the 24% rate.

Case Study: Reducing CGT Through Early Planning

A London-based landlord approached Lanop after learning that the capital gains tax allowance for UK propertyhad fallen to £3,000. He was preparing to sell two buy-to-let flats and feared a large tax bill. Lanop’s tax team reviewed his transaction schedule and advised splitting contract exchanges over two tax years. By reorganising completion dates and documenting every allowable deduction for capital gains tax on UK property, he legitimately used two allowances and reduced his CGT by almost £5,800.

“I thought the new CGT allowance meant a huge loss on my sale. Lanop not only spotted the timing opportunity but handled all the HMRC paperwork. I saved thousands and learned the value of real planning.”

— Property Investor, London

Allowable Deductions for Capital Gains Tax on Property (UK)

When you sell a property, HMRC isn’t interested in the total amount you receive; it’s the profit that matters. To work out that figure correctly, every seller needs to know which expenses can legally be deducted. These recognised costs, known as allowable deductions for capital gains tax on property in the UK, can reduce what you owe and, in many cases, make a significant financial difference.

In practice, these deductions fall into three straightforward groups:

- Expenses tied to buying the property.

- Costs connected with the purchase or sale process.

- Money spent on genuine improvements to the building.

Incidental Costs of Buying and Selling

Whenever you buy or sell, you pay several one-off costs that are directly linked to the transaction. HMRC allows you to offset these against your gain. Typical examples include:

- The original purchase price plus Stamp Duty Land Tax (SDLT).

- Legal or conveyancing fees.

- Surveyor or valuation charges.

- Land registry and title confirmation costs.

When you dispose of the property, similar rules apply. You can usually claim for:

- Estate agent or auctioneer commission.

- Advertising and marketing expenses.

- Professional advice for CGT reporting.

- Legal fees for completing the sale.

Every one of these fits within allowable costs for capital gains tax on property, provided the spending was wholly and exclusively for that purpose. Keeping receipts and contracts is vital because HMRC may ask for proof later.

Enhancement Expenditure

Improving a property is different from maintaining it. HMRC classes of improvement work as allowable capital expenditure on property only when it both increases the property’s value and remains part of the structure when you sell. Think of things like:

- A new extension or loft conversion.

- Replacing an outdated kitchen with a modern installation.

- Complete rewiring, plumbing, or energy-efficiency upgrades.

- Structural changes, such as adding a basement or open-plan layout.

If the work meets these criteria, it can form part of your claim. In some circumstances, these improvements also fall under capital allowances on property renovations, particularly when fixtures or integral features qualify for relief. Always keep clear evidence of invoices, contracts, and before-and-after photos to show that the work genuinely enhanced the asset.

Capital vs Revenue: Knowing the Difference

A common pitfall for landlords and investors is confusing day-to-day maintenance with long-term improvement. Repainting a wall or fixing a leaking tap doesn’t raise the property value; it simply keeps it usable. Those are revenue expenses and belong to your rental accounts, not in your CGT calculation. The golden rule: once a cost has been claimed for income-tax purposes, it cannot be used again to reduce your gain.

Getting this distinction right matters even more if you deal with capital allowances on rental property, capital allowances on residential property, or capital allowances on investment property in the UK. Each category has separate HMRC guidance and mixing them up could cost you money or delay your return.

For anyone who bought property decades ago, especially before 31 March 1982, it’s sensible to obtain a professional valuation. Different base-cost rules apply to older assets, and expert input ensures your capital allowance claim on commercial property or older residential holdings is calculated correctly.

Case Study: Reclaiming Missed Costs on a Renovated Flat

A client who had renovated a Victorian flat had never claimed allowable capital expenditure on property because she assumed routine renovations didn’t count. During Lanop’s review, advisers separated actual improvements, such as new wiring, plumbing, and a loft conversion, from simple repairs. They updated her CGT computation with legitimate allowable costs for capital gains tax on property and secured an additional £22,000 reduction in taxable gain.

“I didn’t realise how strict HMRC is about what counts as ‘improvement’. Lanop went through every invoice, highlighted eligible work, and completely changed my tax outcome. They were meticulous and easy to work with.”

— Residential Landlord, Brighton

Understanding Capital Allowances on Property: The Strategic Advantage

When you own property, reducing tax during ownership can be just as powerful as cutting it on sale. That’s where capital allowances on property come in. Unlike CGT deductions, which apply only when you dispose of an asset, these allowances help lower your taxable profits year after year. Done correctly, they free up cash flow, improve returns, and create long-term financial efficiency.

Capital Allowances on Commercial Property

If you own or invest in business premises, you have the most to gain. Commercial properties usually qualify because they contain assets used directly in trade. The capital allowances on commercial property systems let owners claim tax relief on qualifying Plant and Machinery (P&M), everything from office furniture to air-conditioning and electrical systems.

Plant and Machinery and Integral Features

Plant and Machinery typically cover movable business items such as desks, fittings, and computer systems. Integral Features refer to more permanent elements, such as lifts, heating systems, lighting, and plumbing, which can qualify for capital allowances on commercial property assets in the UK. These hidden allowances can be substantial but are often overlooked during purchase negotiations.

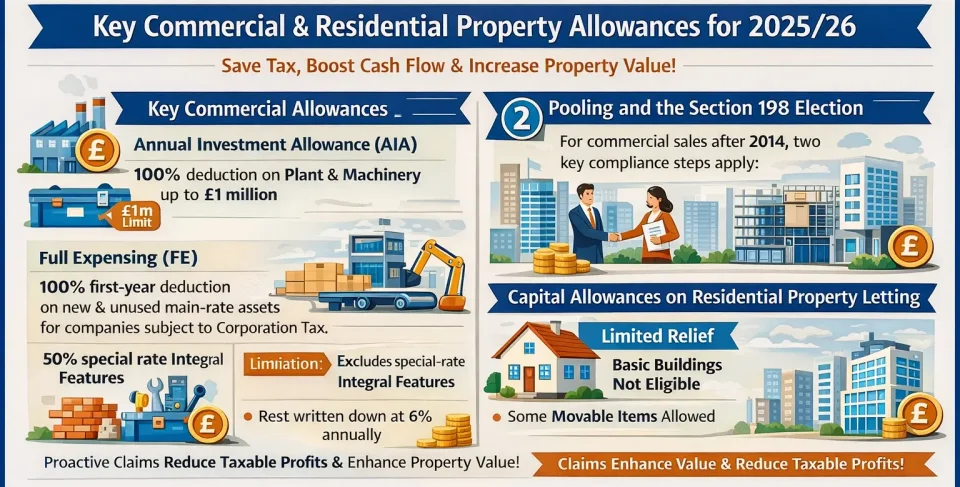

Key Commercial Allowances for 2025/26

- Annual Investment Allowance (AIA): A full 100% deduction on qualifying Plant and Machinery spending, up to £1 million.

- Full Expensing (FE): A 100% first-year deduction on new and unused main-rate assets for companies subject to Corporation Tax.

- Limitation: It excludes special-rate items such as Integral Features.

- 50% Special Rate First-Year Allowance: Provides an initial 50% relief on special-rate assets, with the rest written down at 6% per year.

- Structures and Buildings Allowance (SBA): A steady 3% annual deduction spread over 33⅓ years for new commercial builds or significant renovations.

By proactively managing your capital allowance claim on commercial property, you reduce taxable profits and boost cash flow throughout ownership. It also enhances property value when it’s time to sell. Working with specialists who understand capital allowances on commercial property, HMRC, and capital allowances on freehold property ensures nothing is missed, and every legitimate relief is claimed.

Capital Allowances on Residential Property Letting

Residential landlords have a different set of rules. For most standard buy-to-let homes, relief is limited because the structure itself doesn’t qualify. You can’t usually claim walls, roofs, or plumbing systems. However, certain movable items, such as appliances or furniture, may be deductible under the cash basis of accounting.

The Exception: Furnished Holiday Lettings (FHLs)

This is where things get interesting. Up until April 2025, Furnished Holiday Lettings is treated as a trade for tax purposes. That means owners can claim capital allowances on residential property, including fixtures, fittings, and even Integral Features. But with the FHL regime expected to change in 2025, landlords should act quickly. Maximising claims before 6 April 2025 helps protect against future losses caused by policy reform or balancing adjustments.

For those operating multiple rentals, understanding capital allowances and capital gains allowances on rental property is essential. Every properly documented improvement could mean significant savings when done under the proper framework.

Capital Allowances on Improvements, Leasehold, and Investment Properties

Many investors overlook that improvements made during ownership can also qualify. If you’ve upgraded heating, lighting, or structural systems, you might be entitled to capital allowances on property improvements or even capital allowances on property renovations.

Leaseholders in commercial spaces also benefit. When tenants pay for fit-out or refurbishment work and retain rights to those assets, they can often claim capital allowances on leasehold property improvements. Similarly, identifying eligible items for capital allowances on investment property in the UK can generate meaningful tax relief over time.

The Mandatory Pooling Trap

One crucial rule applies to anyone buying or selling commercial property with fixtures. Since 2014, the seller must first record (or “pool”) their qualifying expenditure in their capital allowance records before the buyer can claim. If this step is skipped, the buyer’s fixture value becomes zero, meaning all entitlement to relief is lost. Both sides must also agree on the fixture of value in writing, using a Section 198 election under the Capital Allowances Act 2001. This rule highlights why capital allowances on property should never be an afterthought in contract negotiations. A simple oversight could cost thousands. Professional tax support ensures compliance, accurate pooling, and fair allocation of value when buying or selling.

Because claiming capital allowances on property and claiming capital allowances on rental property require technical understanding, working with experienced accountants is essential. The proper guidance helps you safeguard eligibility, avoid errors, and secure every allowance that’s legally available.

Case Study: Unlocking Hidden Relief in a Commercial Building

A logistics company owned a warehouse purchased years earlier but had never reviewed its fixtures. Lanop’s specialists carried out a detailed audit using the Capital Allowances Act 2001, identifying substantial capital allowances on commercial property assets in the UK, including lighting, air-conditioning, and electrical systems. The claim produced over £180,000 in qualifying expenditure, saving more than £34,000 in Corporation Tax.

“Lanop’s engineers and accountants worked together to uncover allowances we didn’t even know existed. Their report was HMRC-ready, and the tax refund hit our account within weeks.”

— Operations Director, Mid-sized Logistics Firm

Table 2: Comparison of Major Capital Allowance Types (Plant and Machinery Focus)

| Allowance Type | Rate | Applicable Entity | Applicable Assets | Key Limitation |

|---|---|---|---|---|

| Annual Investment Allowance (AIA) | 100% (up to £1 million) | All business structures | Most plant & machinery including Integral Features | Subject to £1 million limit |

| Full Expensing (FE) | 100% | Companies (under Corporation Tax) | New unused main rate plant & machinery | Excludes Integral Features and cars |

| 50% First-Year Allowance | 50% (initial) | Companies (under Corporation Tax) | Special Rate Assets (Integral Features) | Remaining 50% claimed at 6% WDA |

| Structures & Buildings Allowance (SBA) | 3% p.a. | All business structures | New non-residential construction or renovation | Claimed over 33⅓ years |

Innovative Strategies to Save on Capital Gains Tax (CGT)

With the capital gains tax allowance on property in the UK now sharply reduced, every pound counts. Careful timing and structured planning can still protect much of your gain. By combining timing, transfers, and targeted reliefs, property owners can meaningfully lower their final bill while staying within HMRC rules.

Make the Most of Annual Exempt Amounts and Timing

The new £3,000 allowance for 2025/26 leaves little room for error. One simple, lawful tactic is to manage when a sale legally takes place. Because HMRC taxes gain at the date of contract exchange, not completion, you can sometimes split a disposal over two tax years by scheduling exchange just before 5 April and completing shortly after. Doing so allows two separate £3,000 Annual Exempt Amounts (AEAs) to effectively double your tax-free threshold to £6,000 for a single transaction.

Good record-keeping is essential. Your solicitor’s exchange date will confirm which tax year applies, ensuring you receive the full benefit of your capital gains allowance on property.

Use Spousal or Civil-Partner Transfers Wisely

Transfers between spouses or civil partners are treated as “no gain, no loss” for CGT, creating two clear advantages:

- Double the Allowance: Each partner can claim their own £3,000 AEA, giving the couple a combined £6,000 tax-free limit.

- Rate Optimisation: If one partner pays CGT at 18 per cent and the other at 24 per cent, moving ownership to the lower-rate partner can reduce the overall liability.

The receiving partner steps into the original owner’s shoes, inheriting their base cost and purchase history, so accurate records remain critical.

Offset Capital Losses to Neutralise Gains

Losses from other assets, such as shares, bonds, or cryptocurrency, can offset profits from property sales. If you have more losses than gains, the excess can roll forward indefinitely for future use. Another helpful option is a Negligible Value Claim (NVC) declaring a nearly worthless asset as disposed of for CGT purposes, so the loss is recognised now rather than later.

Pairing these techniques with allowable deductions for capital gains tax on property in the UK often brings down your effective tax rate dramatically.

Apply Strategic Property Reliefs

Principal Private Residence (PRR) Relief

If the property being sold was once your main home, you may qualify for PRR, which removes CGT for the period you lived there plus the final nine months of ownership. Many homeowners overlook this rule when selling a house, only to later rent it out.

Lettings Relief: the Narrow Window

Lettings Relief used to cover most landlords, but HMRC has restricted it. Today, you qualify only if you lived with your tenant during the let period. Because of this limitation, claiming other reliefs, such as capital allowances on investment properties, or identifying additional allowable costs for capital gains tax on property, has become far more critical for long-term investors.

Combine Reliefs with Professional Planning

The most innovative approach is rarely a single tactic. Coordinating PRR, spousal transfers, and well-timed disposals can multiply savings. At the same time, a professional review of your capital allowances on property HMRC records ensures no missed opportunities or compliance errors.

Case Study: Combining Spousal Transfers and Loss Offsets

A couple selling a jointly owned investment property wanted to minimise their CGT exposure. Lanop advised a pre-sale ownership adjustment so both partners could use their capital gains allowance on property and apply separate tax bands. They also offset share-portfolio losses against property gains. The strategy reduced their effective CGT rate from 24% to 11%.

“We’d never thought about ownership transfers before. Lanop handled the process smoothly and explained every step in plain English. When the final numbers came back, we were astonished at how much we saved.”

— Married Investors, Surrey

How to Claim Capital Allowances on Property (Step-by-Step Guide)

Claiming capital allowances on property can significantly reduce your taxable income, but it’s a process that requires care, evidence, and timing. HMRC has strict rules, and skipping even one step can mean losing valuable relief forever. Here’s how to approach it the right way.

Step 1: Identify and Value the Qualifying Assets

The first move is to find out exactly what qualifies. A detailed review of the property’s spending history often uncovers hidden opportunities. Specialists use the Capital Allowances Act 2001 as a guide to separate the cost of land, buildings, and fixtures.

Inside every property are two broad categories of assets:

- Plant and Machinery (P&M): items like furniture, heating units, and computers.

- Integral Features (IFs): fixtures that form part of the structure, such as lifts, air-conditioning, lighting, and plumbing systems.

A professional valuation helps you determine how much of your total purchase price can be allocated to these qualifying elements. Many investors discover that retrospective assessments reveal thousands of missed claims, especially in older buildings.

Step 2: Pooling and the Section 198 Election

For commercial transactions completed after 2014, two key compliance steps apply.

- Mandatory Pooling: The seller must show that all fixtures and fittings have been entered (or “pooled”) into their capital-allowance records.

- Section 198 Election: The buyer and seller must agree on the value of those fixtures and submit the election to HMRC within two years.

If either side fails to act, the buyer permanently loses the right to claim. This rule is why professional handling of capital allowances on commercial property and capital allowances on commercial property with HMRC is essential during every sale.

Step 3: Calculate and File the Claim

Once all assets are identified, they must be placed into the correct tax pool. Generally:

- Main Rate Pool: 18 percent writing-down allowance.

- Special Rate Pool: 6 per cent for long-life or integral features.

You can then apply the relevant reliefs:

- Annual Investment Allowance (AIA): Immediate 100 per cent deduction on qualifying assets up to £1 million.

- Full Expensing (FE): 100 per cent deduction for new, unused main-rate assets.

- Structures and Buildings Allowance (SBA): 3 per cent annual deduction for construction or major refurbishment.

Filing your claim:

- Sole traders or partnerships: Declare via Self-Assessment (SA100) using HMRC Help sheet HS252.

- Limited companies: Include it in the CT600 Corporation Tax return with detailed calculations attached.

Timing matters. AIA and Full Expensing must be claimed in the year the purchase occurs, while Writing-Down Allowance (WDA) can continue for as long as you own the asset.

By approaching the process carefully and ideally with expert input, you can ensure full compliance and maximum savings from capital allowances on rental property, capital allowances on investment property UK, and capital allowances on commercial property assets in the UK.

Case Study:

Securing Missed Allowances After a Sale

A property developer had recently sold an office block but failed to complete the Section 198 election and risked losing all fixture-related reliefs. Lanop intervened within the two-year window, negotiated with the buyer’s accountant, pooled the fixtures, and filed the correct election under HMRC guidelines. The developer recovered over £70,000 through capital allowances on commercial property HMRC compliance.

“I’d almost written off the claim. Lanop’s team stepped in, liaised with the buyer, and fixed everything before the HMRC deadline. Their attention to detail and speed saved us a fortune.”

— Property Developer, Manchester

How Lanop Helps You Navigate Capital Gains Tax and Property Allowances

Managing capital gains tax on property and understanding capital allowances on property are complex tasks that require more than just accounting knowledge. They demand a strategic partner who understands how these rules work together. That’s where Lanop Business and Tax Advisors make a real difference.

Tailored Advice for Every Property Owner

No two clients face the same circumstances. Whether you’re selling a buy-to-let, improving a commercial warehouse, or managing a mixed-use portfolio, Lanop provides tailored tax planning built around your goals. Their specialists evaluate allowable deductions for capital gains tax on property in the UK, optimise timing to maximise the capital gains allowance on property, and identify missed opportunities in capital allowances on investment property in the UK and capital allowances on residential property.

Deep Technical Expertise and HMRC Compliance

Lanop’s tax team brings hands-on experience with UK legislation, including the Capital Allowances Act 2001 and HMRC’s most recent updates for the 2025/26 tax year. They handle all aspects of documentation, from Section 198 elections to accurate pooling of fixtures, ensuring that claims for capital allowances on commercial property HMRC withstand complete compliance checks. This precision protects clients from penalties while unlocking legitimate reliefs often missed by general accountants.

End-to-End Support from Calculation to Claim

Lanop’s process covers every step from analysing property transactions to preparing HMRC-ready reports and submitting capital allowance claims on property within the correct time frame. Their specialists ensure that every qualifying cost is supported by evidence, whether it relates to capital allowances on property improvements, leasehold fit-outs, or allowable capital expenditure on property.

Proactive Planning to Reduce Tax Burden

Beyond compliance, Lanop helps clients plan for the future. They model scenarios to optimise spousal transfers, time disposals strategically, and integrate capital allowances on property HMRC reliefs into long-term business plans. This approach doesn’t just minimise today’s liability; it also builds sustainable efficiency across future investments.

Trusted by Property Owners Across the UK

From first-time investors to established developers, Lanop’s clients consistently highlight transparency, accuracy, and real savings. Every case, whether reclaiming missed allowances or restructuring ownership for better CGT outcomes, demonstrates Lanop’s ability to turn complex tax challenges into measurable results.

Why Choose Lanop

- Proven Expertise: Decades of experience in UK property tax, compliance, and accounting.

- Strategic Insight: Practical, data-driven solutions for both individuals and corporate investors.

- End-to-End Service: From asset identification to final submission, Lanop manages it all.

- Ethical and Transparent: Every strategy is fully compliant with HMRC regulations.

“Lanop took the stress out of property tax planning. Their advice not only reduced my CGT but also helped me recover allowances I didn’t know I could claim. They deliver exactly what they promise: clarity, savings, and complete confidence.”

— Investor, Greater London

Conclusion: Turning Property Tax Complexity into Opportunity

With the capital gains tax allowance on property in the UK now lower and HMRC’s scrutiny higher than ever, expert advice is no longer optional. Partnering with Lanop ensures that every deduction, every allowance, and every strategic opportunity is used to your advantage.

If you’re planning to sell, renovate, or invest in property this year, contact Lanop Business and Tax Advisors today. Their specialists will help you stay compliant, optimise your returns, and secure the reliefs you’re entitled to under current UK law.

FAQs

Can you claim capital allowances on investment property?

Yes, property investors can often claim capital allowances on investment property when parts of the building qualify as plant or integral features. Items such as lighting, heating, air conditioning, and other business fixtures may be eligible. The claim must be based on accurate valuation and ownership documentation. Working with tax specialists ensures every qualifying asset is identified and correctly pooled under HMRC’s Capital Allowances Act 2001.

Can you claim capital allowances on property improvements?

You can claim capital allowances on property improvements when the spending adds lasting value rather than simply maintaining the asset. Qualifying upgrades may include new electrical systems, energy-efficient lighting, or permanent air-conditioning. Routine repairs don’t qualify. Each improvement must be documented appropriately and remain part of the property at sale. A professional review helps verify which improvement costs meet HMRC’s definition of plant and machinery for allowable relief.

Can you claim capital allowances on rental property?

Yes, landlords may claim capital allowances on rental property in limited situations. While the structure itself isn’t eligible, certain fixtures and fittings like appliances, heating, and lighting can qualify when used for business or furnished lettings. Commercial landlords benefit most, but even residential investors can gain relief on eligible equipment. Keeping clear records and consulting experts ensures compliance and maximises the allowable deduction under current HMRC guidelines.

How to avoid capital gains tax allowance on property?

You cannot avoid taxes illegally, but you can reduce them through legitimate planning. Timing sales strategically, offsetting losses, and using spousal transfers can all lower liability within the capital gains tax allowance on property rules. Maximising deductions and applying reliefs such as Principal Private Residence or Lettings Relief also helps. Professional advisors like Lanop ensure your approach remains fully compliant while minimising your overall CGT exposure.

What are capital allowances on property?

Capital allowances on property are tax reliefs that let owners deduct qualifying expenditure on plant, machinery, or integral building features from taxable profits. They apply mainly to commercial and furnished properties where assets are used in business. Examples include lighting, heating, lifts, and air conditioning. Relief reduces income or corporate tax and encourages reinvestment in property improvements. Accurate assessment and documentation are essential for a valid HMRC claim.

What capital allowances can I claim on a rental property?

The capital allowances on a rental property depend on how it’s used. Residential landlords can claim on fixtures and furniture in furnished lets, while commercial landlords can include integral features such as lighting, heating, or security systems. Expenses for improvements that enhance value rather than simple maintenance may also qualify. Each claim requires detailed records and valuation to ensure HMRC acceptance and maximise the overall tax benefit for property owners.

What is the capital gains tax allowance on property?

The capital gains tax allowance on property is the amount of gain you can make before paying CGT. For the 2025/26 tax year, HMRC sets this Annual Exempt Amount at £3,000 per person. If a property sale profit exceeds this threshold, the excess is taxed at 18% or 24%, depending on your income band. Using allowable deductions and reliefs helps reduce the final taxable gain within legal limits.

Can I claim capital allowances on commercial property?

Yes. Owners can claim capital allowances on commercial property for qualifying plant, machinery, and integral features used in business operations. This includes air-conditioning, lighting, lifts, and electrical systems. Claims can cover new builds, refurbishments, or acquisitions if values are correctly pooled and agreed under Section 198 elections. Professional valuation and documentation are crucial to ensure the claim meets HMRC standards and maximises potential tax savings.

Can you claim capital allowances on residential properties?

You can only claim capital allowances on residential properties when they are used commercially, such as furnished holiday lets or serviced apartments. Standard buy-to-let homes generally don’t qualify, except for movable items like furniture and appliances. Commercial parts of mixed-use buildings may also be eligible. Consulting an accountant familiar with HMRC’s property rules ensures that qualifying assets are correctly identified, and relief is claimed where permissible.

What is a capital allowance on a rental property?

A capital allowance on rental property lets landlords deduct certain costs of equipment and fixtures from their rental profits before tax. Items such as lighting, heating systems, and built-in appliances can qualify if used for business or furnished letting purposes. The structure itself doesn’t qualify, but interior fixtures often do. Keeping invoices and maintaining accurate records ensures compliance and helps landlords claim all legitimate relief available under HMRC guidance.