Introduction

Since the phased introduction of Section 24, higher-rate taxpayers have faced a “tilt” in the tax system where mortgage interest is no longer fully deductible. This has pushed many into effective tax rates exceeding 100% of their actual cash flow, making incorporation relief property planning the most sought-after strategy for portfolio survival. For professional investors, incorporation relief for landlords provides a vital mechanism to transition a personally held business into a limited company without triggering a debilitating, immediate Capital Gains Tax (CGT) bill. 12

As a practitioner, I must clarify that incorporation relief on transfer of property deals almost exclusively with CGT deferral under Section 162 TCGA 1992; it is not a “silver bullet” for Stamp Duty Land Tax (SDLT). This guide details the technical nuances of incorporation relief buy to let strategies, specifically how to navigate the rigour of HMRC enquiries while managing the “all assets” requirement for both single high-value units and extensive portfolios.

What Is Incorporation Relief for Property? (Section 162 Explained)

At its core, section 162 of the incorporation relief property is a “roll-over” relief. It is found in Section 162 TCGA 1992. It allows an individual or partnership transferring a business as a “going concern” to a company to defer the capital gains that would otherwise arise on that transfer.

In legal terms, “incorporation” involves the transfer of a business and all its assets (except perhaps cash) to a company in exchange for the issue of shares. When we discuss property incorporation relief, we are moving from a regime of personal Income Tax and CGT to a regime of Corporation Tax.

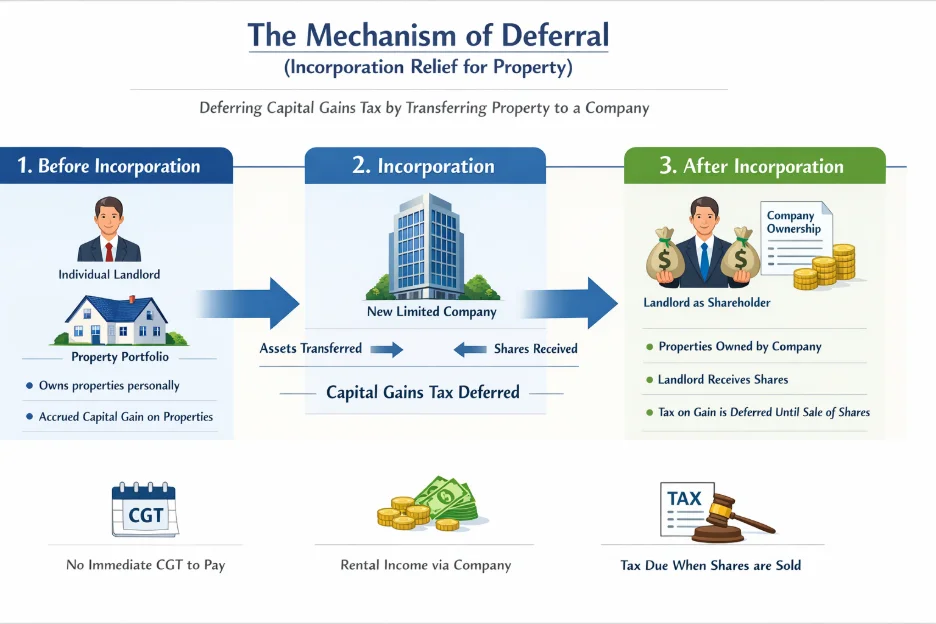

The Mechanism of Deferral

Instead of paying CGT at 18% or 24% (the current rates for residential property as of April 2024) at the point of transfer, the gain is “rolled” into the base cost of the new shares. The tax is effectively paid only when the company’s shares are eventually sold or the company is liquidated.

Where many landlords trip up is failing to distinguish between selling a property to their company and transferring a business. To qualify for s162 incorporation relief property, you are not just selling an asset; you are moving into a functional, operational entity.

Does Letting Property Count as a Business?

The pivot point of any property business incorporation relief claim is whether the activity constitutes a “business” rather than a mere “investment.” This is the most contested area in HMRC enquiries.

HMRC’s Position vs Reality

HMRC’s internal manuals (specifically, CG65715) historically took a restrictive view, suggesting that typical buy-to-let activity is simply the management of an investment. However, the landmark case of Elizabeth Moyne Ramsay v HMRC [2013] shifted the dial. The Upper Tribunal ruled that “business” in the context of S162 is a word of “wide import” and depends on the degree of activity.

Tribunal Principles: Activity and Time

To satisfy the “business” test for incorporation relief property business, the activities must be:

- Significant: Usually involving 20+ hours of work per week (though this is a rule of thumb, not law).

- Continuous: Ongoing management, not just sporadic repairs.

- Commercial: Run with a view to profit, with professional records and systems.

Practical Evidence Checklist

When we prepare an S162 conditions checklist for clients, we demand evidence of the following:

- Management Logs: Diaries showing time spent on tenant vetting, maintenance coordination, and rent collection.

- All Assets Transfer Rule: You must transfer every asset of the business. You cannot “cherry-pick” three properties to incorporate and keep two personally if they are part of the same business.

- Business Bank Accounts: Evidence that the finances were handled through a dedicated business vehicle, even if a sole trader.

- Red Flags: Use of a third-party “fully managed” letting agent can be a double-edged sword. If the agent does everything, the landlord may be viewed as a mere investor, failing the does letting count as business test.

Section 162 Conditions: The Non-Negotiables

To successfully claim Section 162 incorporation relief, four statutory conditions must be met simultaneously. Failure in any one of these results in the relief being denied in full.

- The Transfer of a Business: As discussed, it must be a business, not just assets.

- The Going Concern Requirement: The business must be operational at the moment of transfer and continue to be so immediately after.

- The All Assets Transfer Rule: Every business asset (excluding cash) must be transferred to the company.

- The Consideration Rule: The transfer must be “wholly or partly” in exchange for shares issued by the company to the transferor.

In practice, all assets transfer rule is where “accidental” non-compliance occurs. If a landlord forgets a small piece of land or a specific leasehold associated with the portfolio, the entire S162 claim is technically invalid.

CGT on Incorporation: What Is Deferred (and What Isn’t)

When you incorporate a rental property business, the properties are transferred at Market Value. This creates a “deemed” gain.

How Gains Roll into Shares

The gain is deducted from the value of the shares issued. For example, if a portfolio worth £1m with a £400k gain is transferred for £1m worth of shares, the “base cost” of those shares for future CGT purposes becomes £600k.

Cash Consideration Restricts Relief

A common trap involves the Director’s Loan Account (DLA). If the company “pays” the landlord by creating a credit on a DLA (cash consideration), this cash consideration restricts relief.

The formula for the deferred gain is:

Deferred Gain = Total Gain × (Value of Shares ÷ Total Consideration)

If you take 50% in shares and 50% as a loan account balance, you will immediately trigger 50% of the CGTon the incorporation property. To achieve full CGT deferral into shares, the consideration should be 100% shares.

Practitioner Note: Many “tax schemes” suggest you can create a huge DLA to draw tax-free cash later. While true in a basic sale, doing so kills your S162 relief. You must choose to defer the tax now (S162) or create a DLA and pay the CGT now.

Case Study: The Portfolio Rebuild

Client: A husband-and-wife partnership holding a 12-property portfolio in Manchester, predominantly high-yield HMOs.

Problem: Under Section 24, they were being taxed on “phantom profits.” Despite a net cash flow of £40k, their tax bill was based on a “profit” of £120k because mortgage interest was not fully deductible.

Solution: We documented their 25+ hours a week of active management to qualify for property business incorporation relief. We transferred the entire portfolio to a new company using section 162 incorporation relief.

Outcome: We achieved a full CGT deferral into shares, rolling £340,000 of gains into the company structure. This restored their cash flow and allowed them to reinvest profits at Corporation Tax rates.

“LANOP saved our portfolio. By navigating the complexities of S162, they helped us defer £340k in CGT and restored our cash flow. Truly expert advice.” — D. & S. Richardson, Manchester Portfolio Owners

Mortgages, Liabilities & ESC D32

A significant anxiety for landlords is that mortgages break incorporation relief. Technically, if a company takes over a landlord’s mortgage, that is “consideration” other than shares, which should trigger CGT.

ESC D32 Mortgage Treatment

Fortunately, HMRC applies the esc d32 mortgage treatment (Extra-Statutory Concession D32). This concession allows HMRC to ignore the transfer of business liabilities (like mortgages) when calculating the relief, provided the liabilities were incurred for the business.

Refinance During Incorporation

Timing is everything. If you refinance during incorporation, you must ensure the new debt is clearly linked to the business. Changing lenders at the exact moment of transfer can complicate the S162 claim if not documented correctly. We always advise that the company should ideally take out new “incorporation mortgages” that simultaneously redeem the personal ones.

SDLT on Incorporation: The Most Misunderstood Area

While S162 covers CGT, SDLT incorporation relief is a different beast entirely. Under Section 150 of the Finance Act 2003, a transfer of property to a “connected” company is deemed to take place at market value for SDLT purposes.

The 3% Surcharge

When you transfer property to an LTD, the company must pay the prevailing SDLT rates, plus the SDLT 5% surcharge (Higher Rates for Additional Dwellings – HRAD). This can be a massive upfront cost.

| Property Value | Standard SDLT (Corp) | With 3% Surcharge |

|---|---|---|

| £250,000 | £2,500 | £10,000 |

| £500,000 | £12,500 | £27,500 |

For many, the SDLT on incorporation property makes the exercise non-viable unless they qualify for partnership relief.

SDLT Partnership Incorporation Relief (Schedule 15)

This is the “holy grail” of incorporating portfolio tax planning. If a “genuine” partnership (as defined by the Partnership Act 1890) is incorporated, SDLT can often be reduced to zero under Schedule 15 of the Finance Act 2003.

Genuine Partnership Tests

HMRC is currently aggressively challenging “paper partnerships.” If you and your spouse simply declare you are a partnership on a tax return a month before incorporating, you will likely fail. Property partnership SDLT rules require:

- Joint bank accounts.

- Partnership tax returns (SA800) filed for a period (ideally 2+ years).

- A partnership agreement.

- Shared risks and rewards.

If these exist, SDLT partnership incorporation relief can eliminate the SDLT bill, making the move to a company vastly more attractive.

Buy-to-Let Incorporation: One Property vs Portfolio

Does buy-to-let incorporation relief apply to a single property? Theoretically, yes. Practically, it is much harder to prove.

A single property rarely requires the “business” level of activity seen in Ramsay. However, if that one property is a 10-bedroom HMO (House in Multiple Occupation) with high tenant turnover and intensive management, the argument for property business incorporation relief is much stronger than for a single flat let to a long-term professional couple.

Step-by-Step: How to Transfer Property to a Limited Company

The process of incorporating portfolio tax planning follows a strict sequence:

- Technical Feasibility: Conduct a “Business Test” audit and CGT/SDLT calculation.

- Valuation: Obtain formal RICS valuations. Using “Zillow” or “Rightmove” estimates is an invitation for an incorporation relief of enquiry risk.

- Company Formation: Set up the SPV (Special Purpose Vehicle) with the correct SIC codes (usually 68209 or 68320).

- Mortgage Offer: Secure “in principle” offers for the company to take over the debt.

- Legal Conveyancing: The actual transfer of property to an LTD requires a formal deed of transfer (TR1).

- The S162 Claim: This is made via your Self-Assessment tax return.

How to Claim Incorporation Relief

Unlike some reliefs,the section 162 incorporation relief is “automatic” if the conditions are met. However, you must still report the disposal on your incorporation relief claim on your return.

Incorporation Relief Claim on Return

You report the disposal at market value but then claim the relief to reduce the gain to nil (or the deferred amount). I always recommend including a detailed “white space” disclosure note.

This transparency significantly reduces the risk of an incorporation relief enquiry because it shows HMRC that you have applied the law correctly rather than trying to hide a disposal.

When Incorporation Relief Is NOT a Good Idea

As an adviser, I often tell clients not to incorporate. The cost of incorporating relief adviser services, combined with legal and valuation fees, can be substantial. It is usually not a good idea if:

- You plan to sell the properties in the next 2-3 years (subject to potential double taxation on extraction).

- Your total portfolio capital gains are minor (you might be better off paying the 24% CGT and starting fresh).

- You are a basic-rate taxpayer, so Section 24 doesn’t affect you.

Incorporation vs Alternatives

Sometimes, rather than using incorporation relief property strategies, landlords should consider:

- Intelligent Yield Splitting: Using a “Declaration of Trust” to shift income to a lower-earning spouse (for partnerships).

- Family Investment Companies (FICs): For inheritance tax planning.

- Hybrid Structures: Often marketed but highly risky and frequently targeted by HMRC’s “Spotlight” anti-avoidance publications.

Common Myths & Misconceptions

“Incorporation avoids SDLT”:

False. It triggers SDLT unless Schedule 15 partnership rules apply.

“Any landlord qualifies”:

False. You must pass the “business” test.

“Mortgages always block relief”:

False. See esc d32 mortgage treatment.

“HMRC always accepts claims“:

False. S162 is a high-scrutiny area.

How LANOP Can Help

At LANOP, we are not just accountants; we are tax strategists. We specialise in the high-stakes world of incorporating portfolio tax planning. Our role is to provide a “bulletproof” technical file that justifies your claim for s162 incorporation relief property.

We provide:

- Complete S162 eligibility audits.

- SDLT Schedule 15 partnership analysis.

- Assistance with mortgage lender “Letters of Comfort.”

- Robust defence in the event of an HMRC enquiry.

Conclusion

Incorporation is a powerful tool, but it is a “one-way street.” Once those properties are in the company, taking them back out personally is prohibitively expensive. Therefore, getting the incorporation relief property claim right the first time is non-negotiable.

The difference between a successful incorporation and a tax disaster lies in the details, the evidence of business activity, the exactness of all assets transfer rule, and the navigation of SDL Tincorporation relief.

Are you ready to protect your portfolio from Section 24?

Contact LANOP today for a professional incorporation review. Let us ensure your property business is structured for growth, not just survival.

FAQ

It is a CGT relief that allows you to transfer a property business to a company and defer the capital gains tax by rolling it into the value of the new company shares.

Yes, provided their activity levels are high enough to be classified as a “business” rather than a passive investment.

Only if there is significant, continuous, and commercial activity, case law like Ramsay suggests this usually requires substantial time commitment and management.

1. Transfer a business as a going concern. 2. Transfer all assets (except cash). 3. The transfer must be wholly or partly for shares.

Yes, if they are part of the same business. You cannot “cherry-pick” assets under the all assets transfer rule.

Yes, but the relief is restricted. Only the portion paid in shares is deferred; the portion paid in cash or credit (DLA) is taxed immediately.

Generally, no, provided you follow esc d32 mortgage treatment, which allows business liabilities to be transferred without triggering a CGT charge.

It is deferred (not exempt). The gain is subtracted from the base cost of your shares in the new company.

The gain is calculated at market value and then “rolled over” into the shares. The company’s base cost in the properties becomes the market value at the time of transfer.

By disclosing the disposal and the claim for relief in the Capital Gains section of your SA100 and SA108 forms.

Low activity levels (letting agents doing all the work), small portfolios, or a lack of documentation proving a “business” exists.

Yes, usually at market value plus the 3% surcharge, unless you qualify for partnership relief under Schedule 15.

Yes, through Schedule 15, but the partnership must be “genuine.” HMRC heavily scrutinizes partnerships formed shortly before incorporation.

Yes, companies almost always pay higher SDLT rates on residential property acquisitions.

Management logs, partnership agreements, business bank statements, RICS valuations, and a detailed S162 technical report.