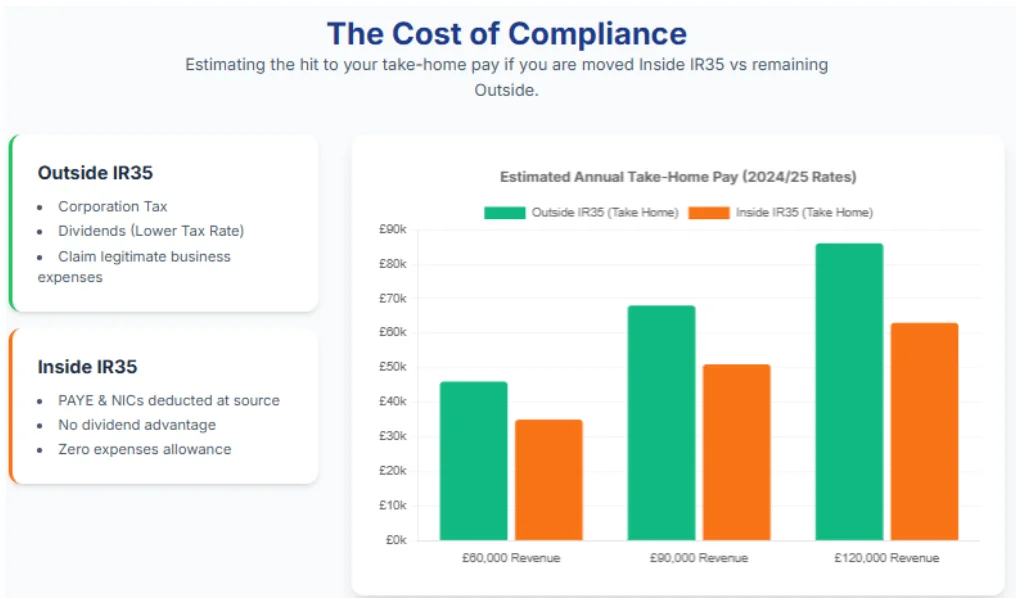

The consensus among tax advisors is that for long, term contractors expecting to secure future outside IR35 work, maintaining the IR35 status for contractor limited company is advisable, even if temporary inside roles are taken.

IR35 for Sole Traders & Self, Employed

IR35 technically doesn’t apply to sole traders, as it targets those working through intermediaries like limited companies. Sole traders work as individuals, not through a PSC.

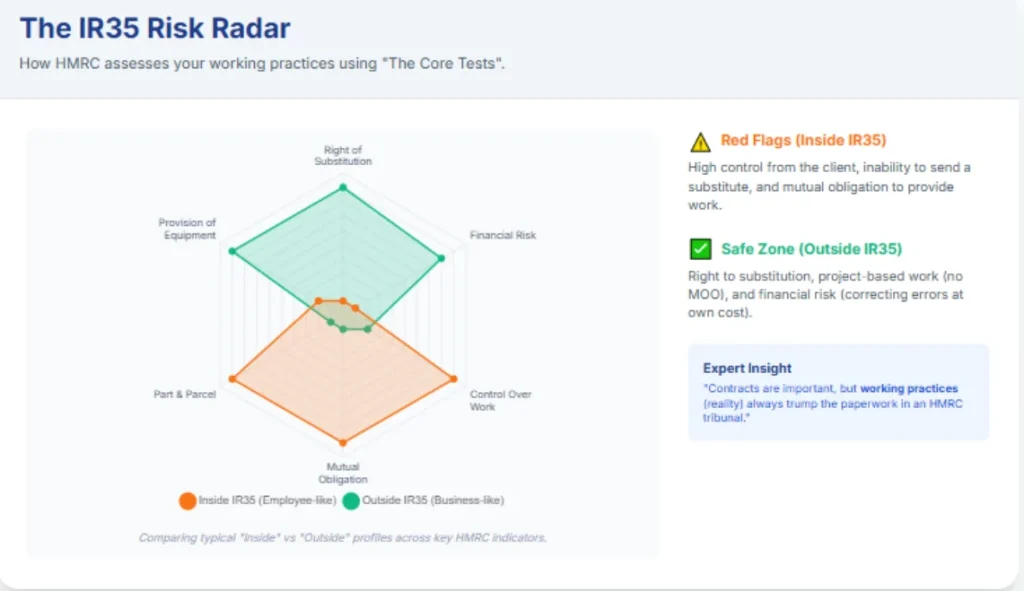

However, they aren’t off the hook. HMRC can still assess their employment status using the same principles as IR35, Control, Substitution, and Mutuality of Obligation. If a sole trader is found to be working like an employee, they could face backdated tax, NICs, penalties, and interest.

So, whether you’re a limited company contractor or a sole trader, the key is the same: work independently, show you’re genuinely in business, and stay on top of your status.

Sector, Specific IR35 Examples

The application of contracting and IR35 explained principles varies significantly across industries due to differing norms regarding control, equipment, and substitution feasibility.

IT: Developers and Project Managers

This sector is a long-standing IR35 hotspot. Developers often manage their own workflows and resist client micromanagement, which helps support an ‘Outside IR35’ status if autonomy is clear. PMs need to show control over delivery, not just follow client orders.

In Lime IT Ltd v Justin (2003), a developer’s unexercised but genuine right to substitution was key to proving self-employment.

Creative Industries

Journalists and creatives working on long-term contracts, especially with broadcasters, must watch for Mutuality of Obligation (MOO). In the Ackroyd case, seven-year continuous engagement led to an ‘Inside IR35’ ruling. To stay compliant, creatives should avoid exclusivity, link work to defined deliverables, and diversify income sources.

Construction (CIS)

Subcontractors under the Construction Industry Scheme (CIS) sometimes fall within IR35. CIS governs payment deductions, but IR35 decides employment status, especially if the subcontractor uses a PSC. For medium and large clients, a Status Determination Statement (SDS) is still required. If deemed ‘Inside’, IR35 rules take priority over CIS deductions in some cases.

Healthcare

Locum doctors and other medical professionals often face strict control, particularly in the NHS, where public sector rules have been applied since 2017. Shift structures, compliance protocols, and limited substitution often lead to ‘Inside IR35’ rulings. Many opt for umbrella companies and instead focus on negotiating higher day rates to offset lower take-home pay.

What To Do If You Are Put Inside IR35

Receiving an ‘Inside IR35’ determination requires immediate and decisive action to protect the IR35 status for contractor limited company and overall financial position.

Immediate Steps

- Stop Work Review: Immediately review the SDS to ensure it is valid, paying attention to the specific reasons cited by the client.

- Document Reality: Begin meticulously documenting the actual working arrangements. This means gathering emails, logging instances of autonomy, and proving how the work differs from the reasons given in the SDS.

- Engage an IR35 Accountant: Contact a specialist ir35 accountant to evaluate the determination and prepare a strategic response.

Challenge

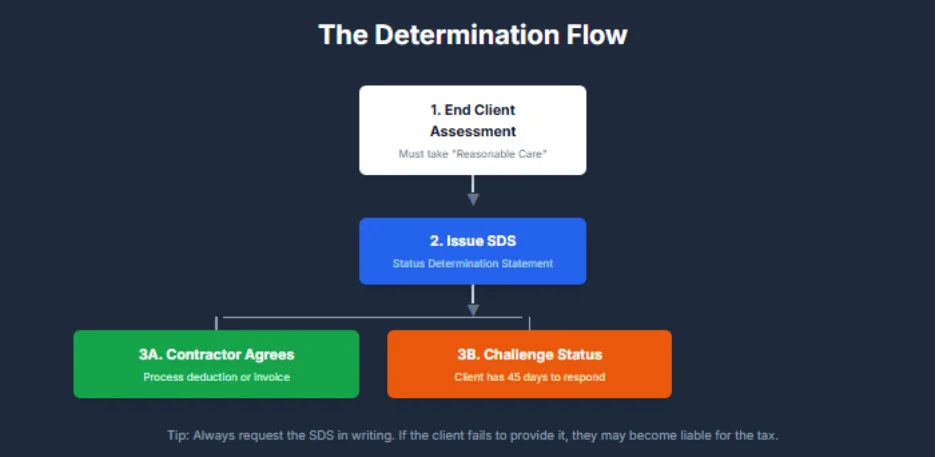

The formal Right to Challenge must be exercised within 45 calendar days of receiving the SDS. The contractor must submit a formal appeal detailing specific reasons for disagreement, citing common law tests and presenting counter evidence. The client then has 45 days to respond, either by upholding the original decision with detailed rationale or issuing a new, revised SDS. This is the primary route for a contractor inside IR35 to do.

Evidence

To succeed in a challenge, the evidence must directly negate the client’s reasoning. Key evidence points for the contractor IR35 checklist 2026 include:

- Contractual terms (ensuring alignment with working practices)

- Confirmation of Arrangements (CoA) agreed with the end client.

- Proof of financial risk (e.g., invoices for fixing errors).

- Documentation proving autonomy and control over methods.

Should You Close Your Limited Company

If the determination is upheld and the contractor concludes that all future work will also be inside IR35, they may question if contractors inside IR35 should shut down their company.

- Dormancy: Many choose to make their PSC dormant if they anticipate future outside IR35 work. This maintains the structure while minimizing administrative costs.

- Members’ Voluntary Liquidation (MVL): If the company holds significant retained profits (e.g., over £25,000) and is solvent, an MVL is the most tax efficient method of winding down. MVL allows the profits to be extracted as capital, potentially qualifying for Business Asset Disposal Relief (BADR), saving substantial personal tax compared to extracting the funds as dividends. This process requires expert insolvency and tax advice.

Case Study (Closing PSC via MVL)

Scenario: Ms. Johnson, a long, term ir35 contractor with over £80,000 retained profits in her PSC, secured a permanent role, meaning all future work would be PAYE. She needed to wind down her limited company tax efficiently.

Lanop’s Intervention: Lanop determined that a straightforward strike off was not suitable due to the profit level. We guided Ms. Johnson through a Members’ Voluntary Liquidation (MVL) process, working with liquidators to ensure the profits were extracted as capital, qualifying for BADR, minimizing her personal tax liability compared to extracting the funds as a dividend.

Outcome: Ms. Johnson closed her limited company efficiently and saved tens of thousands in personal tax liabilities on the retained profits.