Introduction

Your employment status is now not simply just a matter of ‘set and forget’ administration; it is one of the cornerstones upon which you build your own financial and legal security as a contractor in the UK. IR35 is in place to make sure those who work via an intermediary, such as a Personal Service Company (PSC),pay similar levels of Income Tax and National Insurance compared with their fellow employees when carrying out the same role. If you want contractor-focused support beyond theory, start with contractor accounting services that cover IR35 end-to-end.

Ultimately, the issue comes down to one simple question: Does your relationship with your “client” resemble a business-to-business transaction, or is it just a glorified form of employment? Even though there is a contract in place, your day-to-day working practices will speak louder than that. At the end of this guide, you will be able to conduct a self-assessment inside or outside IR35, which includes knowledge of how the HMRC IR35 checker works and defends your position as an independent business based on commercial facts. For a deeper background, you can also read alongside this guide, see What is IR35 in 2025?.

IR35 Rules Explained

What are the IR35 Rules and who do they apply to?

IR35 (Intermediaries legislation) rules were implemented in order to tackle “disguised” employment. This is where a worker provides services to a client via an intermediary (usually a personal service company, or PSC) that person would be regarded as an employee for tax purposes if the intermediary did not exist. For a full breakdown of the legislation and how HMRC applies it, see IR35 legislation explained (contractor status and tax guide).

These rules apply to three main parties:

- The Contractor: Operating via a PSC or partnership.

- The Client: The organization receiving the services.

- The Agency: The entity that pays the PSC.

In the private sector, as of April 2021, it is generally the end-client’s responsibility to decide on whether IR35 applies or not inside or outside (unless they are regarded as a “small” business). The key way of deciding how you are taxed is whether you fall inside or outside IR35. If you want hands-on help with the practical steps contractors take, you can use Lanop’s contractor services for IR35, tax and limited company compliance.

What does inside IR35 mean?

This means for tax purposes (as defined by HMRC) you are treated as an employee who is working on that engagement. If you are ‘caught’ by IR35, your fee-payer will be required to deduct Income Tax and employees’ National Insurance contributions from what they pay to your business – before it arrives in your company bank account.

A common misconception is that being inside IR35 grants you full employment rights, such as holiday pay, sick pay, or redundancy. In reality, you may be taxed as an employee without receiving the statutory benefits of one. This “zero-rights employment” is a significant risk of inside IR35 contract engagements that contractors must factor into their rate negotiations.

If you need understanding about the filing and compliance impact, especially where PAYE interacts with your wider tax position, our Self Assessment tax return support can help.

What does outside IR35 mean?

It signifies that you are operating as a genuine, independent business entity. You are responsible for your own taxes, but you have the flexibility to pay yourself a combination of salary and dividends, which is often more tax-efficient.

An outside IR35 contract reflects a commercial relationship where the contractor provides a specific service or deliverable rather than simply providing “personal labour.” However, simply having a “compliant” contract is not enough; if your daily actions mirror those of a staff member, HMRC can look past the paperwork.

Lanop Case Study:

We recently assisted a Project Manager whose client issued an “inside” determination based on a generic internal policy. By reviewing their actual deliverables and level of autonomy, Lanop helped the contractor present a factual case to the client, resulting in a corrected outside IR35 status.

Contractors in similar roles can also review tax tips for contractors (compliance and take-home).

"Lanop’s deep understanding of the legislation gave me the confidence to challenge an unfair determination successfully."

— Mark D., IT Consultant.

Inside vs outside IR35

The difference between inside and outside IR35 boils down to the nature of the relationship. HMRC focuses on “badges of trade.” Are you controlled by a manager? Do you have to do the work yourself? Does the client have to give you work, and do you have to accept it?

| Feature | Inside IR35 | Outside IR35 |

|---|---|---|

| Tax Treatment | Taxed via PAYE; deductions at source. | Paid gross; contractor manages Corporation Tax / Self-Assessment. |

| Control | Client decides how, when, and where work is done. | Contractor has high autonomy over delivery methods. |

| Substitution | You must perform the work personally. | You can provide a qualified substitute to do the work. |

| Equipment | Often uses client-provided laptops/tools. | Generally provides own specialist equipment and software. |

Ultimately, inside vs outside IR35 explained is about the “hypothetical contract.” If the intermediary were removed, would the remaining relationship look like a job or a service contract?

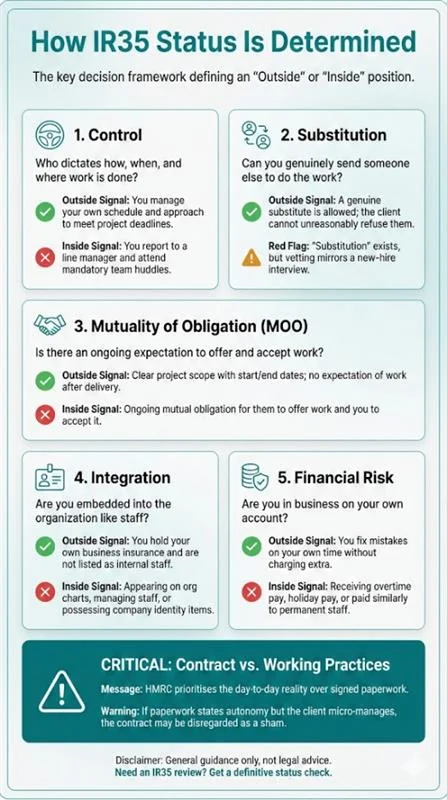

How IR35 status is determined (the decision framework)

Control (who decides how/when/where?)

If a client directs what you should be doing day by day, walks you from project to project or specifies your hours of work, then again,probably inside. Contractors that sit outside of IR35 are simply engaged to deliver a particular outcome, and with many being brought in because they know best, not everyone agrees on ‘how.

- Outside Signal: You manage your own schedule to meet a deadline.

- Inside Signal: You attend “team huddles” and report to a line manager for task allocation.

Substitution (can you genuinely send someone else?)

A true business-to-business relationship doesn’t depend on a specific individual. If your contract allows you to send a substitute, and the client has no right to unreasonably refuse them, this is a strong outside IR35 indicator.

- Red Flag: The contract says you can substitute, but the client requires “vetting” that mirrors a new hire interview.

Mutuality of obligation (is there an ongoing obligation?)

Mutuality of Obligation (MOO) is the “expectation” of work. In employment, the employer must provide work, and the employee must do it. An outside IR35 contract should have a clear start and end date based on a project, with no expectation of further work once the task is complete.

Integration (are you embedded as staff?)

Are you on the office floor plan? Do you have a company business card? Do you manage internal staff? If you are integrated into the corporate hierarchy, you look like an employee.

- Outside Signal: You have your own business insurance and do not appear on the client’s internal “staff” directory.

Financial risk + being “in business on your own account.”

Genuine businesses take risks. If you make a mistake and have to fix it on your own time without extra pay, you are showing a “badge of trade.”

- Inside Signal: You are paid for overtime or “on-call” hours just like a permanent staff member.

Contract vs working practices

This is the single most important point. HMRC and courts will prioritise what happens on the ground over what is written in the outside IR35 contract. If the contract says you have “autonomy” but your manager micro-manages you, the contract is considered a “sham.” You can get a detailed status determination reference alongside your own checklist by reading Lanop’s IR35 contractor status and tax guide.

Lanop Case Study:

A graphic design firm was worried about its contractors’ statuses. Lanop conducted a “Working Practices Audit,” identifying that while the contracts were perfect, the contractors were attending internal Christmas parties and staff training. We helped them decouple these social elements to protect their outside IR35 status.

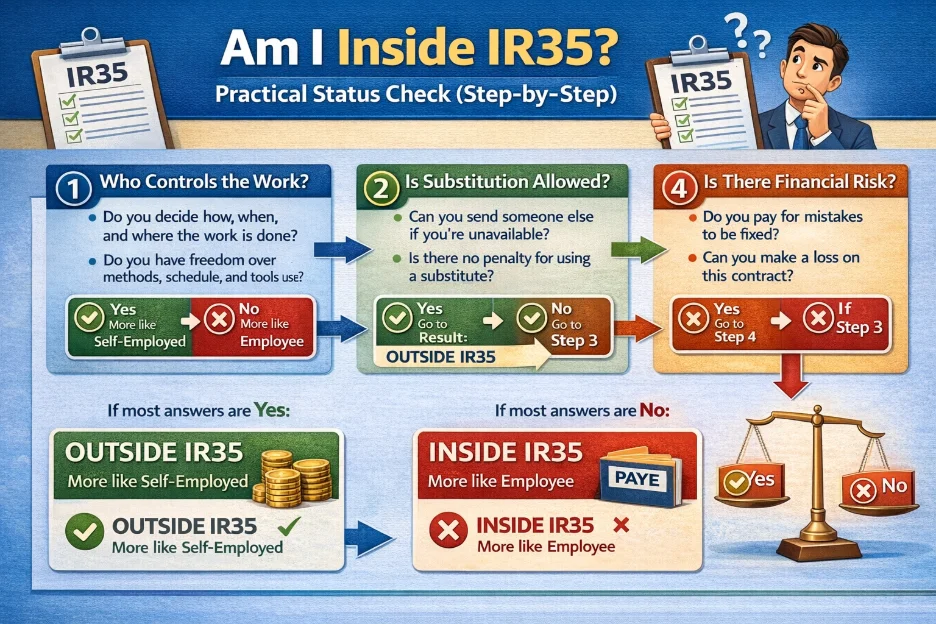

“Am I inside IR35?” practical status check (step-by-step)

To answer the question inside IR35, follow this 10-step checklist to evaluate your current engagement.

- Right of Substitution: Is there a clause allowing a substitute, and is it a “fettered” or “unfettered” right?

- Control over ‘What’: Does the client have the right to move you to a different task than the one agreed upon (Right of Direction)?

- Control over ‘How’: Do you use your own methodology, or are you following the client’s internal SOPs?

- Control over ‘Where’ and ‘When’: Is the location and timing dictated by the client for no valid operational reason?

- Equipment: Do you provide your own high-end hardware/software?

- Financial Risk: Do you have Professional Indemnity insurance and a requirement to rectify errors at your own cost?

- Exclusivity: Are you prohibited from working for other clients during the contract term?

- Employee Benefits: Do you receive any perks like gym memberships, subsidized canteens, or “staff” parking?

- Notice Period: Does the contract have a long notice period (like 1 to 3 months) that mirrors employment?

- Termination: Can the contract be terminated immediately upon completion of the specific deliverable?

Running an IR35 status check inside vs outside using these steps helps you gather the evidence needed for a formal IR35 status determination inside or outside. If you are still asking, am I inside or outside IR35, it is time to document your daily routine for a professional review.

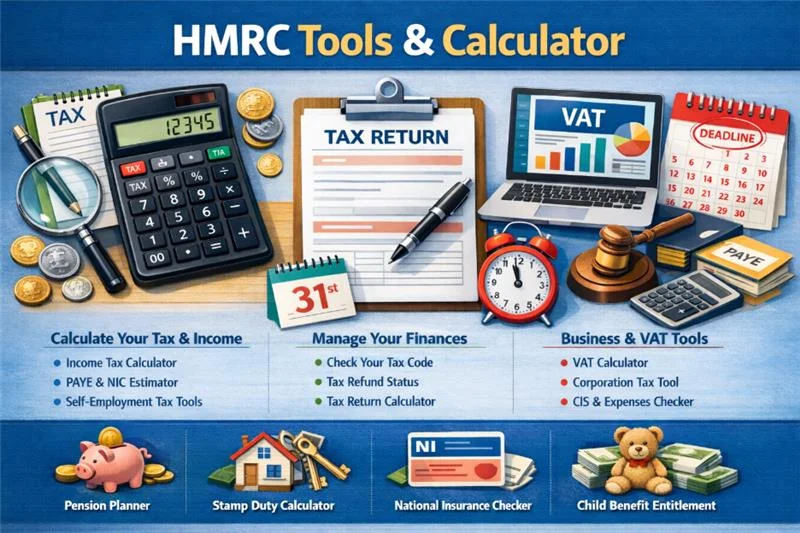

HMRC tools + calculator

HMRC IR35 checker (CEST): how to use it safely

CEST (Check Employment Status for Tax) is the official HMRC IR35 checker and can be found here. Although HMRC says it will accept the outcome (if you’re telling them the truth), the tool has come under fire for its approach to MOO (Mutuality of Obligation).

- Best Practice: Use it as a starting point, but do not rely on it as the final word.

Failure Mode: If the tool returns “Unable to determine,” it usually means your working practices are “grey.” In this case, you must seek professional advice to avoid the risk of inside IR35 contract pitfalls.

Inside vs outside IR35 calculator: what it should (and shouldn’t) tell you

When using an inside vs outside IR35 calculator, you are looking for a financial projection.

A good outside IR35 calculator will factor in:

- Your gross day rate.

- Corporation Tax (currently 19% to 25%).

- Dividend tax rates.

- Business expenses (travel, equipment).

Conversely, an IR35 calculator inside must account for:

- PAYE Income Tax.

- Employee National Insurance.

- Apprenticeship Levy (often passed down).

- Umbrella company margin/fees.

Inside or outside the IR35 calculator, HMRC tools don’t usually provide the take-home math; they provide the status. Use a dedicated IR35 calculator inside vs outside to compare your net income across both scenarios before signing a contract. To get modelled properly with your actual numbers, consider contractor accountants who optimize take-home legally.

Outside IR35 contract: what counts vs what is risky

What counts as an outside IR35 contract?

An outside IR35 contract is a “Contract for Services” rather than a “Contract of Service.” It should focus on what (the outcome) rather than the who (the person).

Evidence of being “in business” includes:

- Multiple Clients: Showing you aren’t dependent on one source of income.

- Business Infrastructure: Having a website, business email, and office space.

- Financial Investment: Spending your own money on training and marketing.

Outside IR35 contract checklist (quick scan)

- Clear definition of a specific project or “Statement of Work” (SOW).

- No “Substitution” clause that unreasonably requires the client to interview the substitute.

- No requirement for the contractor to be “managed” or “appraised.”

- Requirement for the contractor to provide their own equipment.

- A “non-exclusivity” clause.

Lanop Case Study:

A software developer was offered what looked like an outside IR35 contract. Lanop’s review found a “Mutuality” clause hidden in the fine print that required the developer to accept any task the client assigned. We renegotiated the SOW to be specific, securing the outside status. For techies, our guide accountants for software developers (IR35-aware) can be helpful.

Risk, disputes, and real-world problems

Risk of inside IR35 contract (and risk of getting outside wrong)

The risk of inside IR35 contract work is primarily financial (lower take-home) and professional (less autonomy). However, the risk of a “false” outside determination is much higher. If HMRC investigates and finds you should have been inside IR35, they can claim back taxes, interest, and penalties spanning several years.

If your client says “inside IR35” and you disagree

If you receive a Status Determination Statement (SDS) stating you are inside IR35, you have a legal right to disagree via the “Client-Led Disagreement Process.”

- Gather Evidence: Use your 10-step checklist and logs of your working practices.

- Formal Response: Write to the client detailing why the SDS is factually incorrect regarding control or substitution.

- Third-Party Review: Present an independent report (like one from Lanop) to add weight to your challenge.

IR35 inside or outside 2026: what changes contractors should know

Heading into IR35 inside or outside in 2026, HMRC is increasingly focusing on the “SOW” (Statement of Work) model. Simply changing the name of your contract to “SOW” won’t work if the IR35 Rules are still being breached in practice. From April 2023, the turnover threshold for “small companies” is set at £10.2 million, meaning more contractors will become responsible for their own determinations.

Common scenarios: Are you inside or outside IR35?

| Scenario | Likely Status | Why? |

|---|---|---|

| Fixed hours + client laptop + reports to manager | Inside | High control and integration. |

| Project-based + own PC + sends substitute occasionally | Outside | Demonstrates independence and substitution. |

| Working via an Umbrella Company | Inside | Umbrellas are designed for inside IR35 roles. |

| Long-term (3+ years) + no end date + uses staff canteen | Inside | Looks like “part and parcel” of the organisation. |

How do I know if I’m inside or outside IR35?

If you answer “Yes” to “Can I be moved to any task?” or “Does the client supervise my work?”, you are likely inside IR35. What counts as outside IR35 is the ability to say “No” to work outside your original scope and the freedom to deliver that work your own way.

How Lanop Business & Tax Advisors can help

Managing IR35 Rules effectively requires a mix of legal precision and accounting expertise. At Lanop, we provide a structured approach to protect your status and your income.

Full IR35 Review for Contractors: We assess both your contract and working practices, providing a comprehensive report that can be shown to HMRC as evidence of having taken “reasonable care.”

- SDS Challenge Support: If your client has issued an “Inside” determination you disagree with, we help you build a factual rebuttal pack based on case law.

- Proactive Tax Planning: If you are inside IR35, we help you structure your business to remain efficient, managing the “deemed payment” calculations correctly.

- HMRC Enquiry Defense: Should you face an investigation, our specialist team manages the correspondence, builds your defense file, and represents your interests to minimize potential liabilities.

What to prepare before speaking to us:

- A copy of your current or proposed contract.

- Any Status Determination Statement (SDS) provided by the client.

- Notes on your daily routine (e.g., who allocates tasks, whose equipment you use).

Lanop Case Study:

An engineering firm was unsure how to transition their 20+ contractors for 2025. Lanop Business & Tax Advisors implemented a compliance framework, performed individual audits, and issued clear SDSs. This allowed the firm to keep their talent while eliminating the risk of future HMRC penalties.

"Lanop simplified a massive compliance headache and kept our best contractors happy."

— Director, Lead Engineering Ltd.

Conclusion

Understanding IR35 Rules is the difference between a thriving independent business and a costly tax dispute. Your status is not defined by a single word in a contract, but by the cumulative evidence of your professional relationship with your client.

As we move into IR35 inside or outside in 2026, staying compliant requires constant vigilance and a clear audit trail that proves your independence.

Would you like us to perform a professional review of your current contract to ensure you are operating safely outside IR35?

FAQs

What are the IR35 Rules?

They are tax laws designed to identify “disguised employees” working through limited companies. IR35 Rules ensure people who work like employees pay similar tax to what they would as a direct hire.

What does inside IR35 mean?

It means HMRC views your contract as a job for tax purposes. You will have PAYE and National Insurance deducted from your pay by the fee-payer before you receive it.

What does outside IR35 mean?

It means you are a genuine business. You receive your contract fee gross and manage your own company taxes, allowing for better tax efficiency through dividends and expenses.

Inside vs outside IR35 explained (Definition)?

The main difference is the “hypothetical relationship.” Inside looks like employment (client control, personal service); outside looks like a specialist service provided by one company to another (autonomy, substitution).

Am I inside IR35?

You are likely inside IR35 if the client controls your daily work, you cannot provide a substitute, and there is a mutual obligation to provide and accept work beyond the current project.

How do I do an IR35 status check inside vs outside?

Start with the 10-step checklist provided above. Document your answers and back them up with evidence like emails, insurance certificates, or project plans.

How does the HMRC IR35 checker work?

The HMRC IR35 checker (CEST) asks a series of questions about your role. It provides a result based on HMRC’s interpretation of tax law. While they stand by it, it is often seen as being overly cautious.

What if the HMRC IR35 checker can’t determine status?

This is common for nuanced roles. In this situation, you should seek a professional IR35 status check inside vs outside from a specialist like Lanop to avoid incorrect classification.

Who decides my IR35 status, me or my client?

If the client is a medium or large company, they decide to issue an SDS. If they are a small company (turnover under £15m from April 2025), the contractor (you) remains responsible for the determination.

What is an IR35 Status Determination Statement (SDS)?

It is a formal document issued by the client stating your IR35 status and the reasons why they reached that conclusion. It must be provided to you and the agency.

How can I check my IR35 status using the HMRC tool?

Visit the GOV.UK website and search for “CEST.” You will need your contract details and a clear understanding of your daily tasks to complete the questionnaire.

How to tell if you’re outside IR35

You can tell you are outside if you have the right to provide a substitute; you work without direct supervision on how to finish tasks, and you do not receive employee benefits.

Inside vs outside IR35 calculator: what should I enter?

Enter your daily or hourly rate, your expected business expenses, and any pension contributions you plan to make to see a comparison of net take-home pay.

Inside or outside IR35 calculator HMRC: is it reliable?

It is “reliable” in that HMRC will honor the result if the data is accurate, but it is often criticized for ignoring Mutuality of Obligation, a key factor in many court cases.

Outside IR35 calculator vs inside calculator: why results differ

Results differ because an outside IR35 calculator assumes you pay Corporation Tax and dividends, while an inside one applies higher PAYE tax rates and National Insurance.

What counts as outside an IR35 contract?

A contract that specifically defines a project with a clear end-date, includes a right of substitution, and does not provide employee perks like holiday pay.

Risk of inside IR35 contract: what should I watch for?

Watch for “blanket determinations” where clients put everyone inside IR35 without looking at individual roles. This can drastically reduce your take-home pay by up to 30%.

What happens if HMRC decides my contract is inside IR35?

You (or your fee-payer) will be liable for unpaid tax and National Insurance, plus potential interest and penalties. Since April 2024, HMRC has offset taxes already paid through your PSC to avoid “double taxation.

How much tax will I pay if I’m inside IR35?

Typically, your tax burden will mirror that of a permanent employee. This usually means paying 20% to 45% Income Tax and the employee’s National Insurance (currently 8%), while the employer’s NI (13.8%) is typically deducted from the assignment rate. Depending on your earnings.

Can I still use my limited company if I’m inside IR35?

Yes, but the company will receive “deemed payments” which have already been taxed at source. This is often administratively complex, leading many to use Umbrella companies instead.

How can I legally stay outside IR35 as a contractor in 2025?

Ensuring your outside IR35 contract is robust and, more importantly, that your daily working practices consistently demonstrate independence, financial risk, and a lack of integration.

What are the risks if I wrongly claim to be outside IR35?

The biggest risk is an HMRC investigation leading to a significant back-tax bill. Penalties range from 15% for “careless” errors to 100% for “deliberate and concealed” avoidance.