Preface: The foundation of UK SME Resilience

For the small and medium-sized enterprise (SME) sector in the United Kingdom, navigating the complications of commercial and particular taxation is not just a compliance task but a vital strategic function. Effective application of Tax reliefs UK provides a pivotal medium through which gains can be defended, cash inflow optimized, and capital freed up for reinvestment and growth. These reliefs are designed as government impulses to promote specific profitable actions, such as investing in new physical means, funding invention, or attracting early-stage capital. A common and frequently expensive misconception among entrepreneurs is that duty planning begins and ends with the periodic form of the Self-Assessment or CT600 return. In reality, maximizing tax relief for small business owners requires time-round visionary engagement in tax-efficient business planning.

Given the constant changes in the UK duty geography, similar to adaptations to allowances, oscillations in Corporation Tax rates, and the preface of new investment impulses, a reactive approach nearly always results in missed opportunities and increased arrears. This companion aims to offer a comprehensive UK small business tax guide, furnishing essential UK business tax tips that take businesses from introductory compliance to strategic fiscal advantage. The current profitable geography, paired with the endless rise in the Corporation Tax rate to 25 for high-profit companies, underscores the growing fiscal benefits of effective duty mitigation. When a company takes full advantage of deductions like the Annual Investment Allowance UK small business or Full Expensing, the cash savings are now significantly larger than when the rate was 19. This growing value of deductions makes duty planning more essential than ever, impacting everything from hiring opinions (payroll tax relief for small businesses) to long-term capital investment plans. These sophisticated tax-saving strategies for small business owners in the UK bear perfection, scrupulous record-keeping, and a solid understanding of the differences between duty administrations for Limited Companies and Sole Proprietors.

Foundational Duty Saving Strategies, Maximizing Allowable Business Charges

The first step in reducing a duty bill is to identify and claim Allowable business expenses precisely. Whether operating as a Limited Company (to reduce Corporation tax reliefs for small businesses in the UK) or a Sole Trader (to reduce Income tax), the abecedarian demand set by HMRC is that an expenditure must be incurred “wholly and simply” for business purposes. However, claiming the full quantum is generally disallowed, although a specific business proportion may occasionally be allowed, if an expenditure serves both particular and business functions.

Detailed functional expenditure Deductions

A wide variety of costs are considered HMRC allowable expenses for small businesses. Office and executive Costs. This includes everyday consumables like stationery, printing costs, and important technological charges. Deductions can be claimed for software subscriptions, serviceability (if the demesne is used simply for business), and general conservation. For businesses using a digital structure, website development costs, marketing, and advertising are all completely deductible against gains. Financial, Legal, and Professional Services: Freight paid for professional services is essential and permissible.

This includes accountancy services, legal fees related to business operations (e.g., contract review), business bank account charges, credit card sales, freight, overdraft interest, and interest on business loans. Staff and Hand Costs, stipend, and subcontractor costs are crucial to deductions. Fresh deductions can be made for hand-related benefits, such as eye tests and spectacles needed for VDU work. A largely effective, yet frequently overlooked, medium is the trivial benefit of impunity. Employers can give non-cash benefits up to £50 per hand per occasion without driving duty or National Insurance arrears, as long as the benefit is not contractual or performance based. Directors of ‘closed’ companies (those with five or fewer shareholders) are subject to a £300 periodic limit on these trivial benefits.

Strategic Deductions for Working from Home

As remote and cold-blooded work becomes more common, it is important to rightly regard costs related to the “use of home as office.” Limited Company Directors are generally limited to claiming the flat-rate HMRC allowance, which is £6 per week (£312 annually for the 2024/25 and 2025/26 duty times). This simplified approach avoids the complexity and possible Benefit in Kind duty charge when calculating factual commensurable costs. Self-Employed individuals (Sole Traders) Sole traders have further inflexibility

They can use the flat-rate simplified charges (ranging from £10 to £26 per month, depending on hours worked) or claim a commensurable share of factual costs, including rent, mortgage interest, serviceability, and council tax. Claiming factual expenses may lead to larger deductions but requires careful computation and evidence, as certain capital costs may be subject to UK business expense deductions, which are not available to limited company directors. Still, make sure to include these charges to maximize your savings if you are filing your Self-Assessment Tax Return.

Maximizing Business Travel and Mileage Relief

For the smallest businesses, trip costs can be a significant ongoing expenditure. One of the most effective ways to manage these costs is by claiming business mileage tax relief through Approved Mileage Allowance Payments (AMAPs). This system applies when a manager or director uses their own vehicle for work-affiliated trips. The rates, which have remained stable, determine the duty-free allowance a company can repay or that an existing company can claim duty relief on. Trips between temporary workplaces and the home or main office are permissible, but ordinary commuting is not covered.

HMRC Approved Mileage Allowance Payments (AMAPs)

| Vehicle Type | First 10,000 Business Miles | Each Mile Over 10,000 |

|---|---|---|

| Cars and Vans | 45p | 25p |

| Motorcycles | 24p | 24p |

| Bicycles | 20p | 20p |

It is possible to claim relief retrospectively, as duty to rebate claims can stretch back over four times, emphasizing the necessity of active record-keeping of avail logs.

The Nuance of Training and Professional Development

The duty of deductibility of training courses is frequently examined by HMRC, especially for sole traders. Training costs are permissible if they are incurred wholly and simply acquire knowledge for the trade or to stay up to date with industry technology or changes. These are considered profit expenditures. Still, training costs that help an individual start a new business or enter a fully different business area are generally considered capital expenditure, meaning they are non-deductible for tax purposes. The crucial factor is whether the training maintains current earning capacity (profit) or creates a new one (capital).

Strategic Investment Reliefs, Capital Allowances, and Asset Growth

Beyond routine charges, small business tax relief in the UK heavily depends on the strategic operation of Capital Allowances, designed to encourage capital investment. These reliefs allow businesses to abate the cost of coping means from their taxable gains either immediately or over time.

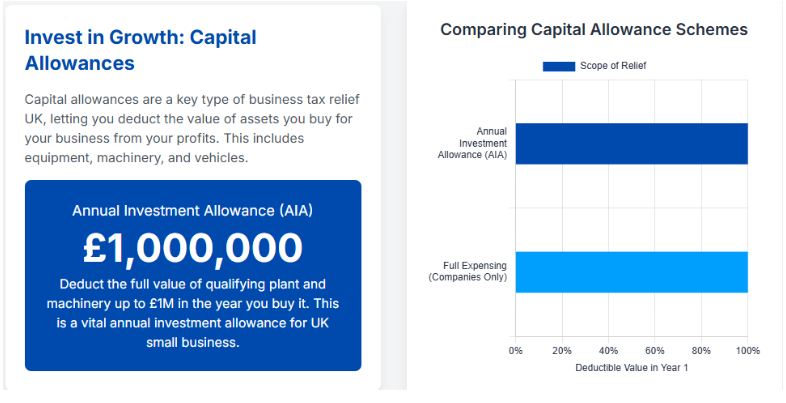

The Annual Investment Allowance for UK small businesses: The Foundation Relief

The AIA is arguably the most significant relief for the smallest and medium-sized enterprises. It allows a 100% deduction for qualifying expenditure on the utmost factory and ministry, letting the business write off the entire cost of the asset against taxable gains at the time of purchase. This immediate deduction significantly boosts cash inflow. The AIA limit has been permanently set at £1 million per time, ensuring most capital investments made by small businesses are completely covered. This relief applies widely to Sole Dealers, hookups, and Limited Companies.

Full Expensing (FE) for Limited Companies

The preface of Full Expensing (FE), made endless in the 2023 Autumn Statement, represents one of the most generous forms of Corporation tax reliefs for small businesses in the UK. FE offers an uncapped, 100 first-time allowances for qualifying expenditure on ‘main pool’ factory and ministry, similar to manufacturing outfit, IT systems, and other loose factory and ministry. This relief is available simply to companies subject to UK Corporation Tax, meaning sole dealers and hookups cannot claim it. For means not qualifying for the main pool, like integral structure features (e.g., wiring, air exertion), a 50% first-time allowance is available under the FE governance.

The Strategic Comparison: AIA vs. Full Expensing

While FE provides an uncapped 100 deduction, the AIA, with its £1 million limit, remains largely applicable and frequently the favored option within UK small business tax relief schemes. The main difference lies in their compass and duty of treatment upon disposal. Compass of Qualifying means the AIA covers both the main pool and special rate means (up to the £1 million limit). FE offers 100 relief only for the main pool means, and 50 relief for the special rate means

For an SME spending under £1 million, claiming all expenditure under the AIA simplifies administration and maximizes relief. Balancing Charges (regain) A crucial consideration for the Tax reliefs available for UK limited companies is the eventuality of regain of relief. However, the disposal proceeds are treated as taxable income, leading to a balancing charge if an asset claimed under FE is ended later. Means claimed under the AIA still generally enter the general pool after the first time and do not face this immediate regain threat, making AIA safer for means likely to be vended quickly

The endless £1 million AIA limit and uncapped FE, combined with the 25% commercial duty rate, produce a strong fiscal incentive for companies to accelerate capital spending. Every pound spent on qualifying means a reduction in taxable profit, and with the advanced duty rate, the benefit from the deduction is significantly enhanced, making strategic capital planning essential for successful application of HMRC tax reliefs for small businesses.

Case Study 01 – Manufacturing SME saves £95,000 in corporate tax. This client base is just to the south of Preston and employs 27 staff.

A precision-engineering business that had invested in new machinery and process improvements was simply claiming its standard allowable expenses. Having been through their spending, they were able to enhance £400,000 of equipment spend with the Annual Investment Allowance and get enhanced relief on £150,000 of qualifying R&D expenditure, £95k reduced their Corporation Tax bill in year one, and cash was freed up for more staff training.

"Lanop enabled us to find reliefs we didn’t even know were available. The tax savings have given us a real amount of breathing space for growth.”

Fuelling Innovation R&D Tax Relief for Small Businesses UK

Exploration and Development (R&D tax relief for small businesses UK) is designed to encourage UK companies to invest in invention by reducing their duty bill or providing a cash payment. This relief is frequently overlooked because numerous businesses fail to recognize that their routine conditioning, similar to developing new internal software, refining manufacturing processes, or overcoming technological hurdles, qualifies as R&D. R&D is unnaturally defined by the successful resolution of scientific or technological queries.

The elaboration of the R&D Scheme

Historically, R&D tax relief for small businesses in the UK was administered through the devoted SME scheme for companies established before 1 April 2024. This scheme allowed companies to abate an additional 86% of their qualifying costs from trading profit, in addition to the standard 100% deduction, resulting in a total 186% deduction. For loss-making companies, this enhanced deduction could be surrendered for an outstanding duty credit. Since 1 April 2024, the geography has significantly shifted with the introduction of the Research and Development intermingled scheme, moving numerous SMEs into a new unified frame.

The Intensity Condition and Payable Credits

Under the new system, companies that are largely R&D-intensive may still qualify for an enhanced outstanding duty credit (worth up to 14.5% of the surrender able loss), furnishing pivotal cash inflow for innovative enterprises. To be eligible for this advanced rate, the company must meet the intensity condition. A company satisfies this condition if its applicable R&D expenditure is at least 30% of its total expenditure (including that of any connected companies) for the accounting period.

This measure tightens the criteria for entering the most generous cash payouts, icing the benefit is primarily directed at companies where R&D is a central and substantial part of the business operation. The complexity in defining qualifying expenditure, calculating the claimable quantum, and navigating the transitions between old and new schemes requires technical SME tax planning advice. Incorrect claims constitute a significant detector for HMRC scrutiny; thus, exercising experts to directly model and defend claims is critical to securing the full benefit without undue threat.

People, Payroll, and Training Tax Reliefs

Effective duty strategy extends beyond fixed means and invention into the realm of mortal capital. Managing payroll efficiently is vital for cash inflow, and several government schemes give direct payroll tax relief for small businesses.

Case02: Director Optimizes Pay Structure & Payroll Relief Situation. Our client is a director who wanted to improve his pay structure while achieving payroll relief.

On the job front, a service-sector private-limited company was handicapped by escalating expenses on salaries. By reviewing the director’s shareholders’ remuneration package using a mix of salary and dividends, the business also claimed Employment Allowance to reduce Employer NICs, resulting in higher(net) take-home pay being paid, which reduced the overall payroll tax burden. The financial difference is enhanced further by the forthcoming rise in the Employment Allowance to £10,500.

“A couple of clever changes to the way I pay myself have made a huge difference, less tax and better cash flow without reducing salaries.”

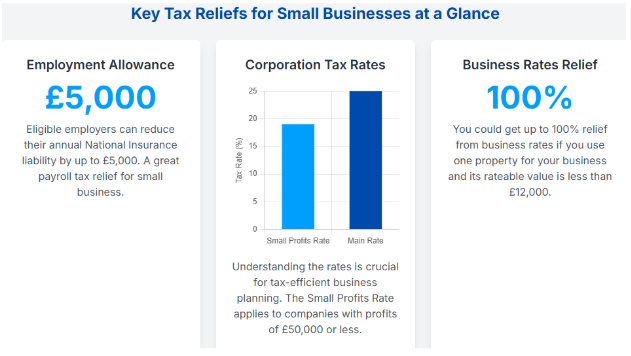

The Employment Allowance (EA): A Strategic Shift

The Employment Allowance (EA) is a critical relief that allows eligible employers to reduce their periodic liability for Employer’s Class 1 National Insurance contributions (NICs). This relief acts as a direct subvention for employing staff and is claimed each time payroll is run until the periodic limit is reached. For duty ages starting from 6 April 2025, the value and Eligibility of the EA will undergo substantial changes, greatly serving growing businesses. Increased Value: The EA is set to increase from £5,000 to £10,500, furnishing a direct neutralization against rising employer NIC costs, offering pivotal Tax benefits for small businesses in the UK.

Expanded Eligibility The restriction that limited the allowance to employers whose total secondary Class 1 NIC liability was under £100,000 in the former duty time will be removed starting in 2025/26. This change removes a hedge that preliminarily discouraged moderate pool expansion and ensures more businesses can pierce the relief. The junking of the £100,000 liability limit is a vital development. Preliminarily, a growing SME could lose the EA entirely as soon as its NIC liability exceeded the threshold, creating a counterincentive for hiring. By barring this precipice edge, the government is extending this significant cash-inflow relief to further enterprises, simplifying pool planning and payment budgeting.

Duty-Effective Remuneration Pension benefactions

Employer contributions made to a director’s or hand’s pension scheme are largely duty effective. These benefactions are generally treated as a permissible business expenditure, reducing the company’s Corporation Tax liability. Likewise, neither the hand nor the employer incurs NICs on these payments (subject to periodic and continuance allowance limits), making it one of the cleanest ways to prize value from a company while erecting particular wealth.

Attracting Growth Capital Start-up Duty Reliefs UK (SEIS/ EIS)

For incipient and growing enterprises seeking external backing, specific government schemes transfigure the duty profile of the business, making it largely appealing to private investors. The Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) are core factors of launch-up duty reliefs in the UK, furnishing investors with generous incentives that significantly alleviate the threat associated with investing in high-threat, early-stage companies.

Seed Enterprise Investment Scheme (SEIS)

SEIS is targeted at the lowest and youngest enterprises. To qualify, the company must generally have been trading for no longer than three years, have gross means not exceeding£ 350,000, and employ fewer than 25 people. Income Duty Relief Investors can claim up to 50% Income duty relief on their investment, up to a periodic investment limit of£ 200,000. Capital Earnings duty (CGT), gains from the trade of shares are exempt from CGT, provided the shares have been held for a minimum of three years, and the Income duty relief was claimed and not withdrawn. Reinvestment Relief SEIS offers investors the unique benefit of exempting the lower of 50% of the gain or 50% of the SEIS subscription quantum from CGT, furnishing an immediate duty advantage on previous disposals.

Enterprise Investment Scheme (EIS)

EIS is designed for slightly larger, growing SMEs. It allows companies to raise further capital than SEIS, though the investor impulses are less generous. Income Duty Relief Investors can claim up to 30% Income Duty relief (on investments up to£ 1 million annually). Capital Earnings Deferral EIS permits investors to postpone a capital gain made on the trade of another asset over the life of the investment. Duty on the original gain is only outstanding when the EIS shares are vended. Loss Relief Both SEIS and EIS give loss relief.

However, the investor can neutralize that loss (net of the original Income duty relief) against their income duty, further reducing the overall fiscal threat, if the shares end up at a loss. The isolation between SEIS Reinvestment Relief and EIS Deferral Relief is a crucial strategic consideration for investors. SEIS offers an outright exemption on a portion of a current capital gain, furnishing an advanced immediate benefit for individuals who have lately sold assets at a profit. EIS, in discrepancy, only defers duty payments. Businesses seeking capital must completely optimize the SEIS window, limited by company age and asset limits, to maximize their appeal to angel investors and take advantage of these significant duty benefits for small businesses in the UK.

Key Tax Incentives for SEIS and EIS Investors

| Relief Type | SEIS (Seed Enterprise Investment Scheme) | EIS (Enterprise Investment Scheme) |

|---|---|---|

| Income Tax Relief Percentage | Up to 50% | Up to 30% |

| Investment Limit (Investor) | £200,000 per year | £1,000,000 per year (generally) |

| Capital Gains Tax (CGT) Exemption | Yes (If held 3+ years) | Yes (If held 3+ years) |

| CGT Reinvestment Relief | Yes (50% of reinvested gain exempted) | No |

| CGT Deferral | No | Yes |

| Loss Relief | Yes | Yes |

Duty-Effective Business Planning for proprietor-directors

For proprietor-directors of limited companies, strategic profit birth is the core of duty-effective business planning. The thing is to maximize disposable particular income while minimizing the combined liability of commercial duty and particular income duty/ NICs.

The Salary vs. Tips Strategy

The most effective strategy for the utmost proprietor-managed limited companies is a mongrel approach, combining a small payment with tip payments.

Payment element the proprietor-director generally pays themselves a payment set at or near the Personal Allowance (£12,570 for 2025/26). This payment is deductible against Corporation Tax, increasing eligibility for state pension and other benefits, while minimizing National Insurance contributions (NICs). Tip element gains are outgunned by using tips, paid from the company’s retained, post-Corporation duty gains. Tips are not subject to NICs, furnishing a substantial duty saving compared to an advanced payment.

Navigating the Tip Tax Landscape

While tips offer NIC savings, they are decreasingly subject to Income duty due to the gradual reduction of the tip duty allowance. For the 2025/26 duty time, the periodic tip allowance is set at just £500. Tip income above this threshold is subject to particular taxation based on the existent income band.

UK Dividend Tax Rates (2025/26 Tax Year)

| Tax Band | Taxable Income Range | Income Tax Rate | Dividend Tax Rate |

|---|---|---|---|

| Personal Allowance | Up to £12,570 | 0% | 0% |

| Basic Rate | £12,571 to £50,270 | 20% | 8.75% |

| Higher Rate | £50,271 to £125,140 | 40% | 33.75% |

| Additional Rate | Above £125,140 | 45% | 39.35% |

The ongoing reduction of the tip allowance forces proprietors-directors to continually adapt their fiscal business strategies. As further tip income becomes taxable, the relative appeal of maximizing duty-deductible employer pension benefits (which admit Corporation duty reliefs for small businesses in the UK and avoid particular duty until pullout) and non-cash benefits (similar to the £300 trivial benefits allowance for directors) grows. This shift changes the focus of SME duty planning advice, making these options more central to effective duty-effective business planning.

Case Study: The Transformative Impact of Strategic Tax Reliefs

The complexity and interconnected nature of UK duty relief for small businesses mean that incremental relinquishment often does not yield optimal results. A unified, strategic approach can significantly alter a company’s fiscal line.

Script Integrating R&D and Capital Allowances for a Manufacturing SME

We worked with a limited company in the manufacturing sector, specializing in high-precision factors. While profitable five times, they were paying the complete 25% Corporation Tax rate, counting substantially on claiming introductory permissible business charges. They were not apprehensive that areas such as process improvements and recent capital expenditures qualified for significant duty relief for small businesses.

The Challenge and Intervention

The customer had lately invested £400,000 in advanced ministry and spent time refining product processes to reduce waste, which qualified as R&D.

Maximizing Capital Allowances. The £400,000 investment is eligible for the Annual Investment Allowance for UK small businesses, allowing a 100% write-off against taxable profit in the correct accounting period, significantly reducing their post-duty reliefs for UK small business liability. Securing R&D Relief We linked £150,000 in qualifying R&D expenditure, allowing them to claim an enhanced 186% deduction, resulting in a substantial retroactive reduction in taxable profit.

The Result

Combining the AIA claim, the enhanced R&D deduction, and strategic remuneration advice led to a £95,000 reduction in the first time’s Corporation Tax bill. This allowed the customer to reinvest in staff training, showing how visionary use of tax-saving strategies for small business owners in the UK supports business growth.

- Partnership in Prosperity: How Lanop Delivers Maximum Duty Relief

The current duty geography, the junction of R&D schemes, the permanence of Full Expensing, and the expansion of the Employment Allowance offer significant opportunities and substantial pitfalls for UK SMEs. The complexity of these rules requires specialist knowledge to ensure compliance and optimization. Lanop Business & Tax counsels, as chartered accountants and tax strategists, deliver comprehensive solutions to help businesses thrive by simplifying complex tax processes. We help companies transition from introductory reporting to strategic financial management.

Case Study 03: Startup Raises Investment Via SEIS. An entrepreneur is seeking an investor to help fund the development of a new product, with 100% Seed Enterprise Investment Scheme (SEIS) relief available.

An embryonic tech startup preparing to scale required external funding. As part of the SEIS regime, they worked through the trading age and asset requirements, which entitled them to bring in other investors who could benefit from 50% IT relief and potentially exempt gains from CGT. SEIS approval massively boosted their pitch, and the funding round moved quickly from there.

“SEIS revolutionized everything once you told potential investors about the tax incentives. They used to say, ‘Where do I sign?

How Lanop Supports You on This Matter

Visionary Tax Planning and Modelling. We offer bespoke SME duty planning advice, ensuring that businesses strategically time capital investments to maximize benefits from the AIA and Full Expensing. We also optimize remuneration packages for proprietor-directors, balancing payment, tips, and pension benefits to minimize NICs and overall duty exposure. R&D duty Credits moxie We navigate the specialized aspects of defining qualifying expenditure and calculating claims under the merged R&D scheme

Our expert guidance ensures guests meet the new intensity condition where applicable, securing the maximum possible duty credit or enhanced deduction while minimizing the threat of HMRC scrutiny. Compliance and Record- Keeping Accurate record-keeping is pivotal for defensible duty claims. Our Small business account tips UK and counting services ensure that guests rightly classify and validate all HMRC permissible charges for small businesses. We also ensure compliance with major forms, including Corporation Tax, Handbasket, and Self-Assessment Tax Return.

Payroll and Workforce Planning We manage payroll services and ensure businesses directly claim precious reliefs, such as the increased payroll duty relief for small businesses handed by the Employment Allowance. By partnering with Lanop, businesses gain access to a devoted platoon concentrated on turning compliance into a competitive advantage, icing peace of mind and fiscal clarity.

FAQs

How to reduce the duty bill as a small business proprietor in the UK?

The most effective styles to reduce your duty bill include 1) managing and maximizing Allowable business expenses (icing they meet the “wholly and simply” rule); 2) strategically using Capital Allowances, especially the £1 million Annual investment allowance UK small business or uncapped Full Expensing for Limited Companies; and 3) exercising specific UK small business tax relief schemes like R&D tax relief for small businesses UK and the Employment Allowance for payroll cost reductions.

How to claim duty relief as a small business proprietor in the UK?

The medium for claiming duty relief depends on the business structure. For Sole Dealers hookups, duty relief is claimed through the periodic Self-Assessment Tax Return, while Limited Companies use the CT600 Corporation Tax return. Capital Allowances are claimed through these forms. Specific schemes like R&D tax relief for small businesses in the UK bear fresh attestation, and payroll tax relief for small businesses is claimed via payroll software. Accurate attestation is essential, similar to available logs for claiming business mileage tax relief via AMAPs.

What are the duty reliefs for small business owners in the UK?

Some of the most precious Tax reliefs in the UK include the Annual Investment Allowance for UK small businesses, Full Expensing (for capital expenditure), R&D tax relief for small companies UK (for invention), the Employment Allowance (for reducing employer NICs), and the Trivial Benefits immunity. New gambles can profit from Startup tax reliefs UK through SEIS and EIS, which are pivotal for attracting capital.

How can I claim duty relief as a small business proprietor?

To claim duty relief, maintain detailed and empirical fiscal records. These records should easily show that charges were incurred solely for business purposes. For charges like working from home, you can choose between the simplified flat rate or calculating factual commensurable costs. For the trip, Approved Mileage Allowance Payments (AMAPs) are claimed via the applicable duty return. Seeking professional guidance is the safest way to ensure full and accurate claims.

Can small businesses claim duty relief for business charges?

Yes. Businesses can claim Business tax relief UK for costs that meet the “wholly and simply” test, including mileage costs, professional fees, marketing and advertising expenditure, staff hires, subcontractor costs, and fiscal freights like bank charges and business loan interest.

Are there any duty reliefs available for new startups in the UK?

Yes, new startups can profit from the Seed Enterprise Investment Scheme (SEIS), offering investors 50% Income tax relief. As the business grows, it can use the Enterprise Investment Scheme (EIS), which provides 30% Income tax relief and allows for the postponement of previous capital gains. These are core Startup tax reliefs in the UK.

What happens if I do not claim the duty reliefs I am eligible for?

Failing to claim eligible reliefs means overpaying duty, reducing the company’s retained profit and cash inflow. Missing the Employment Allowance could mean losing up to £10,500 of payroll tax relief for small businesses, while neglecting Capital Allowances means paying duty on gains that should have been neutralized by asset purchases. There is frequently a time limit to claim lost reliefs (generally four times), but this requires significant executive work and can delay investment opinions.

Conclusion: Achieving Tax Excellence Through Proactive Strategy

The geography of tax relief for small businesses in the UK is constantly evolving, offering significant opportunities for cost savings and capital optimization when approached strategically. From exercising the uncapped eventuality of Full Expensing to capital investment, using the adding value of the Employment Allowance for pool operation, and laboriously pursuing R&D tax relief for small businesses in the UK, the eventuality to reduce liability is considerable. The crucial takeaway for any entrepreneur is that staying until time’s end is fiscally careless. Effective SME tax planning advice requires ongoing monitoring of expenditure, asset timing, and legislative changes to maximize available deductions. Partnering with expert duty counsels is not an expenditure but a vital investment that turns nonsupervisory complexity into a competitive advantage.