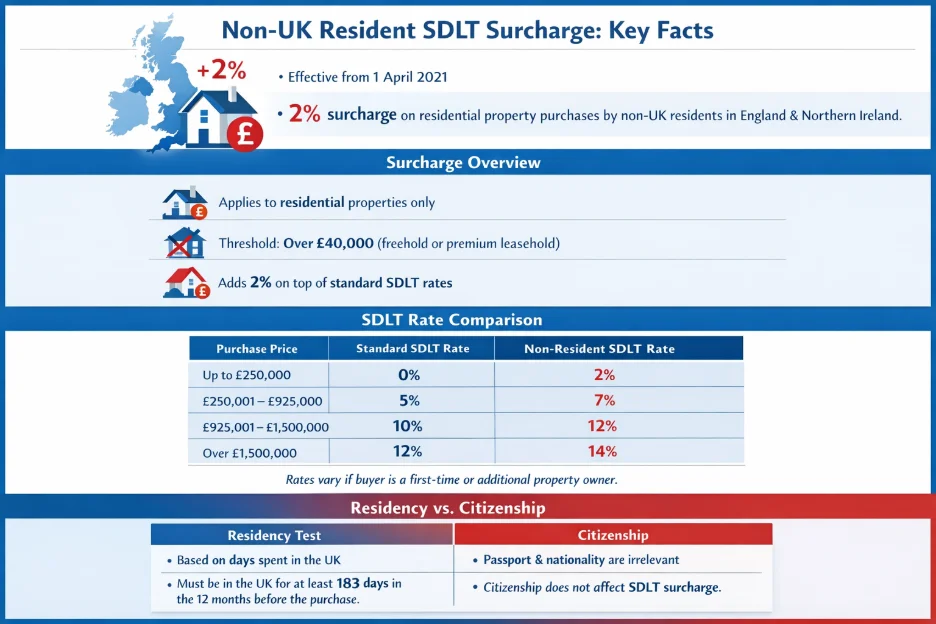

The SDLT residence test and the 183-day rule

“183-day rule” is the main test to establish residence for SDLT. A person is a UK resident for the transaction if they have spent at least 183 days in the UK during any 365 day period (starting from 6 April) that falls in the ‘relevant period’ of either:

The Relevant Period Framework

The relevant period lasts for two years, from 364 days before the date of effectiveness (the closing date) to 365 days after. This results in two pathways to residency:

- The Backward-Looking Test: The buyer satisfies the 183-day rule in the year before acquisition.

- Forward Looking: The forward-looking test ensures that the purchaser did not meet the requirement at completion but met it within 12 months of the purchase date, then a retrospective reclaim will be allowable.

- Days in the UK are calculated based on “midnights.” A person is in the UK on a day if they are physically present there at midnight. Although the tax itself only applies to property in England and Northern Ireland, days spent in Scotland or Wales will still

count towards the 183-day total.

Special Cases and Aggregates

The shares of joint buyers and couples will be protected so that ownership itself does no

get split up to avoid the tax. Under normal joint purchase conditions, the 2% surcharge

would also apply to an entire transaction if any one of the buyers is a non-resident.

But there is a major exception in the “Spouse/Civil Partner Rule”. If the buyers are spouses or civil partners living together at the effective date, and one of them is a UK resident for

SDLT purposes, then the purchase will be regarded as a resident transaction even if the

other spouses are nonresident. This break is based on the couple buying the property together.

Corporate and Trust Residency Tests

Companies are generally non-resident if they are not resident in the UK for Corporation Tax purposes.” However, the legislation has a “Non-UK Control Test” for UK resident close companies. A UK company is non-resident if it is a “close company” and control of the company is held by non-residents.

Residence of trust, depending on the applicable law for that trust:

- Bare Trusts: The test is based on the residency of beneficiaries.

- Discretionary Trusts: residency of trustees taken into account – if any trustee is non-resident, a surcharge is generally imposed.

Case Example: How to Protect Against Surcharges in Relationships and Joint Marital Purchases

A husband and wife, upon settling down has bought their luxury apartment in London. The husband was a British national who had unavoidably spent 190 days during the previous year on business in the UK. The wife had only been in the UK for 30 days and was not a UK national. First advice = you will be liable for the 2% surcharge as the wife is a non-resident.

Lanop Business and Tax Advisors stepped in, pointing out that pursuant to the specific provisions for a married couple living together, the residence status of the husband was sufficient for the whole deal. Due to Lanop’s documentation of their marital status and living arrangements, the settlement was reportable as a UK residential purchase (subject to standard rates rather than the surcharge), sidestepping a £50,000 surcharge.

Application and interaction with other SDLT rates

The 2% surcharge is not a substitute for the other taxes; it’s in addition to them. This interplay is of special importance in the context of HRAD. Where a non-resident individual already owns property elsewhere in the world, they are required to pay the standard SDLT rate plus 5% HRAD surcharge and 2% non-resident surcharge.

Calculation Methodology

The overall SDLT liability on a non-resident buying an additional property may be summarized in mathematical terms as:

For a £1,000,000 acquisition by a non-resident who already has another property:

- Standard SDLT: £37,500 (based on a £125k nil-rate band) or £31,250 (if using the temporary £250k band).

- Non-Resident Surcharge (2%): £20,000.

Some of the more common compliance traps are related to the “Substantial Performance” rule. If a contract was substantially performed (e.g., the buyer took possession or paid all but a nominal part of the price) before official completion, the effective date of the transaction and therefore, the period of residence in question was brought forward.

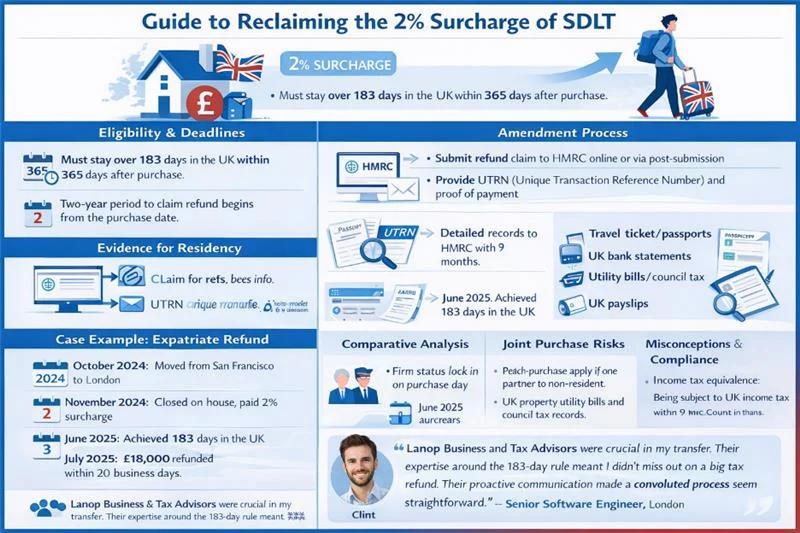

Guide to reclaiming the 2% surcharge of SDLT.

The ‘forward-looking’ residence test enables many purchasers who are non-resident when they purchase to recover the 2% surcharge if they become resident in the UK in the year after their purchase. It’s a standard issue for expatriates who come back to the UK, or outside entrepreneurs immigrating because of work.

Eligibility and Deadlines

If I’m reading this correctly, to be eligible for a refund, the applicant must satisfy the 183-day residency test for any 365 days not more than one year after the effective date. The period in which a claim for refund of SDLT (that had been incorrectly paid) must be made is two years, beginning with the effective date of purchase. It is important to note that this applies for a longer 12 months compared to the usual 12-month amendment period for other SDLT mistakes!

The Amendment Process

The relief is normally claimed by making a post-submission to the original SDLT return using the HMRC website or by writing a letter. The appellant must furnish the Unique Transaction Reference Number (UTRN) and proof of payment of tax.

Evidence for Residency

HMRC works on a “process now, check later” basis, but very often opens enquiries within nine months of paying your refund. To protect against such inquiries, taxpayers must keep detailed records of:

- Documents relating to travel (tickets, passport stamps).

- Bank statements showing UK-based transactions.

- UK property utility bills and council tax records.

- Pay slips or templates showing work that was done in the UK.

Case Example: Relief After Successful Refund Withdrawal for Expatriate Returnee

In October 2024, a software engineer moved from San Francisco to London. In November 2024, they closed a house. They had not been in the UK at all during the last year and paid the 2% surcharge. Lanop Business and Tax Advisors were engaged to administer the claim in the future. In June 2025, the client achieved 183 days of physical presence. Lanop produced a comprehensive day-count spreadsheet and sent off the amendment to HMRC. The £18,000 refund was paid into the customer’s account within 20 business days. Lanop also arranged the evidence file in preparation for the 9-month HMRC review period, meaning our client had peace of mind.