CGT on incorporation

Capital Gains Tax (CGT) is the second pillar of the “frictional” cost of transferring property to a company. When an individual disposes of a property, HMRC calculates the gain based on the difference between the original purchase price (plus capital improvements and buying/selling costs) and the current market value.

Why CGT can arise + market value CGT

As of the October 2024 Budget, Capital Gains Tax rates for residential property were aligned with other assets. The rates are now 18% for basic-rate taxpayers and 24% for higher-rate taxpayers (this part is correct); however, the text implies these are “special” residential rates. In 2025/2026, these are simply the standard CGT rates.

If a landlord purchased a property for £200,000 and it is now worth £350,000, they have a taxable gain of £150,000. Without relief, the market value of the CGT bill for a higher-rate taxpayer would be approximately £36,000 (ignoring any annual exempt amounts). The deadline for reporting and paying CGT on UK residential property disposals is 60 days, creating a significant cash-flow challenge if the property was transferred without a cash exchange.

Incorporation Relief CGT is explained carefully.

Section 162 of the Taxation of Chargeable Gains Act 1992 provides the primary mechanism to defer this liability. Known as incorporation relief of CGT, this provision allows the gain to be “rolled over” into the base cost of the shares issued by the company. Effectively, the individual pays no CGT at the time of transfer; instead, the gain is only realized when they eventually sell the shares in the company.

However, the conditions for Section 162 are stringent:

- The Business Test: The property activity must be a “business” rather than a passive investment. Case law, most notably Ramsay v HMRC (2013), suggests that the owner must spend approximately 20 hours or more per week actively managing the properties to qualify.

- Whole Business: You must transfer the entire business and all its assets (excluding cash) to the company.

- Share Consideration: The transfer must be made wholly or partly in exchange for shares. If cash is taken, the relief is restricted proportionally.

Crucial Update (2025/2026 Budget): From 6 April 2026, incorporation relief CGT will no longer be an automatic “rollover.” Landlords will be required to actively claim the relief on their tax returns and provide supporting evidence that their portfolio meets the “business” test. This shift increases the compliance risk and the need for robust record-keeping regarding management hours and business activities.

Case Study: Portfolio Incorporation with Mortgage Refinance (SDLT + CGT Planning)

Client profile: A higher-rate taxpayer landlord with a small portfolio of 3 buy-to-let properties, each mortgaged, held personally. The client wanted to reduce the impact of Section 24 and build a long-term structure for reinvestment.

The problem:

The client assumed they could “move” the existing mortgages into a company. They also underestimated the immediate SDLT cost and were unsure whether the Section 162 incorporation relief could defer to CGT. Timing was sensitive because their fixed-rate deals had early repayment charges (ERCs).

How Lanop helped:

- Built a full incorporation model covering SDLT at market value, CGT exposure, expected refinancing costs, and 5–10 year breakeven.

- Coordinated with a specialist broker and solicitor so the refinance and legal transfer happened in the correct order (avoiding delays that can break mortgage offers).

- Planned around ERC windows, sequencing completions to reduce early repayment penalties where possible.

- Strengthened the Section 162 position by reviewing portfolio operations and helping the client document practical evidence of active management activity for relief support.

- Structured funding via a director’s loan account (where appropriate) to keep the transaction practical and flexible.

Outcome:

The client moved forward with incorporation using a clear timeline, understood the real upfront friction costs, secured a suitable limited company mortgage, and established a structure that supported reinvestment and long-term tax efficiency rather than guesswork.

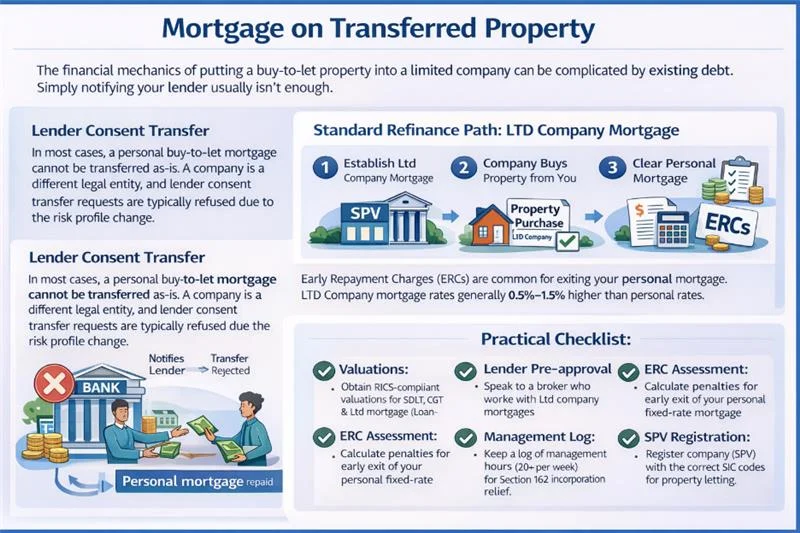

Mortgage on Transferred property

The financial mechanics of putting property into a company are often complicated by existing debt. Many landlords believe they can simply notify their current lender of the change, but the reality is more involved.

Lender Consent Transfer

In the vast majority of cases, a personal buy-to-let mortgage cannot be moved to a company. A company is a different legal entity with a different risk profile. Consequently, seeking lender consent transfer for an existing loan usually results in a refusal, as the bank wants the loan underwritten against the company’s financial standing, not just the individual’s credit history.

Common refinance path: refinance to Limited Company + LTD Company mortgage

The standard procedure for incorporating a mortgaged property is to refinance limited company ownership. This involves:

- Establishing a new LTDcompany mortgage facility within the SPV.

- The company is using these funds to “purchase” the property from the individual.

- The individual is using the proceeds to redeem their existing personal mortgage.

This can result in payment of Early Repayment Charges (ERCs) on the personal mortgage, which can be anywhere between 1% and 5% of any balance remaining. Further, LTD company mortgage rates are generally greater (by 0.5% to 1.5%) for those personal, since the lending is considered commercial in nature.