Introduction

SDLT rules in England and Northern Ireland changed in 2024. Buyers now pay more tax when buying another property. From 31 October 2024, the SDLT surcharge increased from 3% to 5%. The surcharge applies to second homes and other properties. Buyers must pay a higher rate when the purchase is completed.

Higher SDLT rates have increased costs for many buyers. Some buyers now pay tens of thousands more in tax. Many later recover the extra amount through an SDLT higher rates refund.

The surcharge often affects buyers replacing their main home. Buying a new home before selling the old one triggers the surcharge. You can claim a refund after selling the previous home. Understanding SDLT surcharge refund rules helps buyers recover the extra tax.

How Additional Property Tax Changed from 3% to 5%

The SDLT surcharge increased from 3% to 5% in October 2024. Buyers now pay more tax when buying another property.

The surcharge applies if you already own a property. This includes homes in the UK and overseas. The higher rate must be paid when the purchase completes.

This often affects buyers replacing their main residence. Many people buy a new home before selling the old one. In these cases, the surcharge applies first.

Example of the financial impact:

- A £1 million property surcharge increased from £30,000 to £50,000

- Buyers now pay £20,000 more in SDLT

- Many later claim an SDLT higher rates refund

From April 2025, the SDLT nil-rate band reduced to £125,000. Buyers now pay SDLT on more of the property price. This increases the total SDLT cost.

The 5% surcharge still applies to additional properties. This makes the SDLT surcharge refund more important for many buyers.

Some buyers may still qualify for the old 3% rate. This applies if contracts were exchanged before 31 October 2024 and not changed later.

Core Eligibility: Replacement of Main Residence Rule

The main rule for an SDLT higher rates refund is replacing your main residence. This happens when you sell your old home and buy a new one.

If you sell the old home before or on the same day, no surcharge applies. You only pay the normal SDLT rate.

Many buyers buy first and sell later. In this case, the 5% surcharge applies at purchase. You can claim an SDLT surcharge refund after selling the old home.

When the Higher SDLT Rate Applies

The surcharge usually applies when all these conditions exist:

- The property price is £40,000 or more

- You already own another property

- The other property is worth £40,000 or more

- You have not sold your previous main residence

HMRC checks these conditions on the purchase date.

When You Qualify for an SDLT Refund

You may qualify for a refund if:

- The new home becomes your main residence

- You sell the previous main residence later

- The sale happens within the allowed time

After selling the old home, you can submit an SDLT higher rates refund claim. This allows you to recover the extra SDLT paid.

How HMRC Determines Your Main Residence for an SDLT Refund

To qualify for an SDLT higher rates refund, you must sell your main residence. The property must have been your main home within the last three years.

HMRC does not allow you to choose your main residence. Instead, they review facts and supporting evidence. The decision depends on how you used the property.

HMRC checks several indicators to confirm your main residence, including:

- Your voter registration address

- Your workplace location

- Your children’s school address

- Your official government correspondence address

These records help prove where you genuinely lived.

Owning a property alone is not enough. You must have lived in it as your main home. Investment properties usually do not qualify for an SDLT surcharge refund. For example, you may own several properties but live in a rented home. Selling one of your owned properties may not qualify. This is because it was not your main residence. HMRC focuses on where you lived, not just what you owned. Providing clear evidence improves your chances of a successful refund claim.

Step-by-Step Guide: How to Claim an SDLT Higher Rates Refund

Claiming an SDLT higher rates refund is easier using HMRC’s online system. Most buyers use the online service because it is faster. Manual claims are still possible in some cases.

Step 1: Submit Your SDLT Refund Claim Online

The fastest method is the HMRC online refund service. You or your agent can submit the claim through Government Gateway. Make sure your 11-digit UTRN is ready. You can find it on your SDLT5 certificate.

Step 2: Provide Required Information

HMRC needs correct details to process your SDLT surcharge refund. Missing details can delay your refund.

You must provide:

- Full names of all buyers

- Purchase completion date

- Total SDLT paid and surcharge amount claimed

- Address of the previous main home

- Date the previous home was sold

- Name of the person who bought the old home

Correct details help avoid delays and rejection.

Step 3: HMRC Reviews Your SDLT Refund Claim

HMRC reviews your claim after submission. You can check progress using the HMRC online service.

HMRC usually sends confirmation first. A decision or request for more details may follow. Accurate claims improve your chances of faster SDLT refund approval.

SDLT Refund Evidence Checklist:

| Evidence Category | Specific Documents | Importance |

|---|---|---|

| Transaction Proof | Completion statements for both purchase and sale. | Confirms the dates and the total amounts paid. |

| Disposal Proof | Signed TR1 form or Land Registry transfer document. | Proves the purchaser no longer holds a “major interest.” |

| Residency Proof | Utility bills, Council Tax records, and bank statements for the 3 years prior. | Essential if HMRC disputes that the sold property was the “main residence.” |

| Financial Authority | Signed letter of authority for the agent and accurate SDLT refund bank details. | Ensures the money reaches the correct account and prevents fraud. |

| Exceptional Cases | Medical records, government restriction orders, or legal stay documents. | Only required if claiming outside the 3-year window. |

SDLT Refund Processing Time: What to Expect

Many buyers worry about the SDLT refund processing time after submitting a claim. HMRC aims to process refunds within 15 working days. However, delays are common due to a high number of HMRC claims.

Most buyers receive their SDLT higher rates of refund within 4 to 8 weeks. Online claims usually process faster than claims sent by post. Postal claims may take longer to complete. Processing time often ranges between 8 and 12 weeks. Some claims take longer during busy periods. Complex claims or manual reviews may delay refunds further. In rare cases, processing may take several months. Submitting accurate information helps speed up your SDLT surcharge refund. Clear documents help reduce the risk of delays.

Common Reasons SDLT Refund Claims Get Rejected

Many SDLT higher rates of refund claims fail due to simple mistakes. HMRC checks every claim carefully. Small errors can lead to refund rejection.

1. Property Needed Repairs but Still Counted as a Home

Many buyers think damaged homes do not count. This belief is incorrect.

HMRC treats most homes as residential, even when repairs are needed. Examples include:

- Broken heating

- Electrical problems

- Damp issues

- Renovation work

Only severe structural damage may change the property’s status. Repair needs alone do not qualify for an SDLT surcharge refund.

2. Keeping Any Share in the Old Home

You must fully sell your old main home. Keeping any share can block your refund.

Examples include:

- Keeping a small ownership share

- Staying listed as joint owner

- Owning part of another home

HMRC checks ownership on the purchase date. Any remaining share may stop your SDLT for higher rates of refund.

3. Never Living in the Property

You must live in the home as your main residence. Ownership alone is not enough.

HMRC may reject your refund if:

- You never lived in the home

- The home was used only for investment

- Tenants lived there full time

These homes do not qualify as main residences.

Why Checking Eligibility Early Matters

Many buyers misunderstand SDLT refund rules. This leads to rejection. Check your eligibility before submitting your claim. Correct details improve approval chances. Early checks help avoid delays and refund refusals.

SDLT Refund Rules for Married Couples and Joint Buyers

HMRC checks property ownership for both partners. This applies even if one person buys the home.

For example:

- One partner buys a home in their name

- The other partner owns another property

- The 5% SDLT surcharge still applies

HMRC treats both partners as one buyer.

A refund may still be possible later. This applies after selling the previous main home. You can claim an SDLT surcharge refund if all conditions are met.

SDLT Refund Rules After Divorce or Separation

Different rules apply after permanent separation. HMRC then treats each person as a separate buyer.

This means:

- Your ex-partner’s property does not affect your purchase

- SDLT depends only on your own property ownership

- You may qualify for standard SDLT rates

A court order is not always required. HMRC checks if the separation is real and permanent.

Understanding these rules helps couples claim the correct SDLT for higher rates of refund.

Case Study: SDLT Higher Rates Refund Success

A homeowner bought a new home before selling the old one. Because of this, the 5% SDLT surcharge applied. This increased the total tax paid.

The homeowner expected an SDLT higher rates refund. The steps were not clear. Help was needed to avoid errors.

The Challenge

The homeowner needed clear answers:

- Did the purchase qualify for a refund?

- What proof did HMRC need?

- How could refund rejection be avoided?

Missing proof could delay the refund.

Lanop’s Work

Lanop checked the case carefully. Property records and proof of living were checked.

Lanop then completed the refund claim:

- Gathered all needed proof

- Submitted the claim through HMRC online

- Checked SDLT numbers and bank details

Careful checks helped avoid mistakes.

The Result

HMRC approved the claim quickly. The homeowner received the full SDLT surcharge refund. Correct action helped secure the refund without delay

How Lanop Helps

Lanop helps homeowners recover extra SDLT paid.

Lanop Business and Tax Advisors can help with:

- Checking refund rules

- Reviewing property records

- Completing refund claims

- Meeting HMRC deadlines

Expert helps improve refund success.

I was unsure if I qualified for an SDLT refund. Lanop reviewed my case, submitted the claim, and secured the refund smoothly. Their expertise made everything simple.

— Sarah C., Manchester

Conclusion

Paying the 5% surcharge does not mean you lose the money forever. Many buyers can claim an SDLT higher rates refund after selling their main home. Refund approval depends on ownership, property use, and timing. Even small errors can cause refund rejection.

Higher SDLT costs mean buyers must follow the rules carefully. Early checks help prevent missed deadlines and refund issues. Clear advice improves your chances of recovering the SDLT surcharge refund.

FAQs

You may qualify if you paid the 5% surcharge when buying a home. You must sell your previous main home within the allowed time.

HMRC checks if the new home replaced your main home. Ownership, use, and timing all affect your refund.

Replacing your main home means buying a new home and selling the old one. The new home must become your main place to live.

HMRC requires proof that you lived in the old home. Investment properties usually do not qualify for an SDLT surcharge refund.

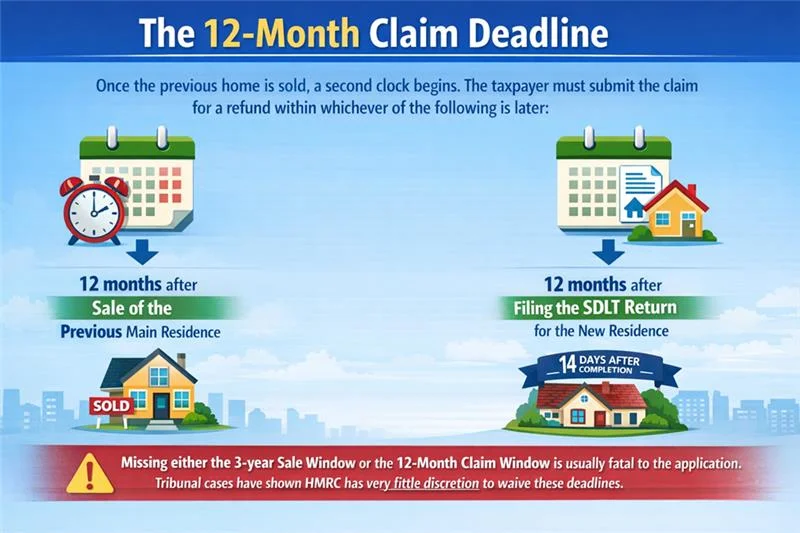

You must claim the refund within 12 months of selling your old home. You can also claim within 12 months of filing your SDLT return. HMRC rejects late claims. Early action protects your SDLT refund.

If you sold your old home before buying another one, the surcharge should not apply. You may not need to claim a refund. If SDLT was charged in error, you can correct the SDLT return.

Yes. Many buyers buy first and sell later. You can claim an SDLT higher rates refund after selling the old home. The sale must happen within the allowed time.

You can submit your claim through HMRC’s online refund service. You need your SDLT reference number and key dates.

Check all details before submitting. Errors can delay your refund.

Most buyers use HMRC’s online refund service. Some older cases require the SDLT16 refund form.

Using the correct method helps avoid delays.

HMRC requires correct transaction details, including:

- Property address

- Purchase date

- Sale date

- SDLT reference number

- Bank details

Wrong details can delay your SDLT surcharge refund.

HMRC may request proof to confirm your refund.

Common documents include:

- Sale completion statement

- Purchase completion statement

- Utility bills or council tax records

These show the property was your main home.

Some refunds arrive within a few weeks. Others take several months.

Missing or wrong details often cause delays.

You can contact HMRC to check your refund status. Provide your SDLT reference number.

This helps HMRC find your claim faster.

HMRC checks property ownership for all buyers. The surcharge may apply if one buyer owns another home.

You may still qualify for a refund after selling your main home.

Yes. Overseas property ownership can trigger the surcharge.

Refund eligibility depends on whether that property was your main home. HMRC applies the same rules worldwide.

Yes. You can amend your SDLT return instead of filing a new claim.

Act quickly to avoid missing the deadline. on whether that property was your main home. HMRC applies the same rules worldwide.

HMRC may reject your claim for these reasons:

- Missing the deadline

- Keeping ownership in another property

- No proof of main residence

- Missing or wrong details

Careful checks improve your refund approval chances. the deadline. on whether that property was your main home. HMRC applies the same rules worldwide.