Introduction

The landscape for UK business owners has shifted significantly. As of January 2026, the rules governing how we move from a sole trader or partnership structure into a limited company, a process known as incorporation, have faced their most rigorous updates in decades.

Whether you are a portfolio landlord managing residential units or a serial entrepreneur scaling a service-based trade, understanding Section 162 Incorporation Relief is no longer just “good practice”; it is a financial necessity to avoid immediate, crippling tax bills.

In this guide, we provide an authoritative deep dive into the mechanics of s162, the critical HMRC changes effective from April 6, 2026, and the strategies you need to protect your wealth during a transition.

Why s162 Incorporation Relief is Critical

Instead of paying CGT at 18% or 24% (the current rates for residential property as of April 2024) at the point of tIncorporation is the process by which an enterprise’s assets and business are transferred into a limited company. For the majority, this is caused by a desire for limited liability, easier access to finance, or more efficient profit extraction via dividends. However, the act of “selling” your business to your own company is, in the eyes of HMRC, a disposal at Market Value.

Without relief, this “paper sale” triggers Capital Gains Tax (CGT) on the difference between what you originally paid for your assets (like property or Goodwill) and what they are worth today. For a business with significant growth, this could result in a tax bill in hundreds of thousands of pounds, all before the company has even started trading.

A Quick Summary of the HMRC and CGT Changes from April 2026

Between April 6, 2026, relief on incorporation is not an “automatic” right - if the conditions are satisfied. Section 162 relief applies automatically if all conditions are met. However, taxpayers may formally elect to disapply the relief under Section 162A if they wish to pay CGT upfront (for example, to utilize BADR or create a Director’s Loan Account). Business could be assessed tax on the value of its shares once they are traded on the market.

What Is Incorporation Relief?

The Incorporation Relief governed by Section 162 of The Taxation of Chargeable Gains Act (TCGA) 1992 is a relief that gives you the ability to ‘roll over’ any capital gain made on the transfer of business into the base cost of shares you are given in exchange.

The Purpose: Continuity Over Crystallisation

The dominant objective of s162 is to prevent there being a tax impediment to adopting a new legal form (from unincorporated to incorporated). It understands that if you own 100% of a business as an individual and then own 100% of the shares in the company that owns the industry, you have not really “cashed out.”

How Incorporation Relief Defers CGT

Instead of paying CGT today, the gain is “attached” to your new shares.

- Regular Disposal: You sell an asset for £500k (Cost £100k). You pay CGT £400k.

- s162 Relief: The £400k gain is subtracted from the market value of your new shares. If your shares are worth £500k, their “tax cost” becomes £100k. You only pay tax when you eventually sell those shares.

The mathematical formula for the adjusted base cost is:

Base Cost of Shares = Market Value of Shares – Deferred Capital Gain

Incorporation Relief vs. Entrepreneurs’ Relief (Business Asset Disposal Relief)

It is vital to distinguish s162 from Business Asset Disposal Relief (BADR).

- s162: A deferral relief. You pay 0% today, but you have a lower base cost for your shares.

- BADR: A rate relief. You pay tax today, but at a reduced rate (as of April 6, 2026, the BADR rate is 18% (having risen from 14% in the 2025/26 tax year, and 10% previously).

Choosing between them is a strategic decision. If you want to create a Director’s Loan Account (DLA), allowing you to draw money out of the company tax-free later, you might choose to “elect out” of s162, pay the 18% tax now, and “sell” the assets to the company for a debt.

Understanding the Real Relief: Incorporation Relief vs. Other Schemes

As HMRC tightens its grip, several “aggressive” schemes have been marketed to business owners, particularly landlords. It is essential to understand what is statutory and what is a “Spotlight” risk.

CGT Incorporation Relief (TCGA 1992 s162)

This is the gold standard. It is written into legislation and, provided you meet the specific conditions (Going Concern, All Assets, Share Consideration), it is a safe and accepted path.

SDLT Partnership Rules (Finance Act 2003 Schedule 15)

While s162 deals with CGT, Stamp Duty Land Tax (SDLT) is the other half of the puzzle for property businesses. Under Schedule 15, the transfer of land from a partnership to a company may result in a 0% SDLT charge if the partners and the company’s shareholders are the same. However, this is heavily scrutinised.

Aggressive LLP Schemes & HMRC Warnings

HMRC has issued warnings about schemes that tell individuals to move properties into an LLP (Limited Liability Partnership) for a short period before incorporation.

Warning: HMRC views “overnight partnerships” created solely to avoid SDLT as tax avoidance. If the partnership lacks “commercial substance” or a genuine “view to profit” as a collective entity, HMRC will likely apply the General Anti-Abuse Rule (GAAR).

The Conditions for CGT Incorporation Relief (The Real Checklist)

To qualify for s162, you must satisfy four strict conditions simultaneously. If you miss one, the entire relief collapses.

1. Eligibility for Sole Traders & Partnerships

Relief is only available to individuals or partnerships. It cannot be used by a company transferring its business to another company (that would fall under different group relief rules).

2. The “Going Concern” Rule

The business must be transferred as a going concern. This means the company must be able to continue the business without interruption. You cannot stop trading, wait six months, and then incorporate.

3. The “All Assets” Rule and Exclusions

You must transfer all the business’s assets to the company.

- The Cash Exception: Under s162, you are legally allowed to keep Cash out of the transfer without disqualifying the relief.

- The Risk: Many owners try to keep the business premises (land) in their personal name, while moving only the “trade.” This disqualifies s162 relief because you haven’t transferred all assets.

4. Non-Share Consideration Risks (ESC D32)

The transfer must be wholly or partly in exchange for shares.

- If you receive only a Director’s Loan Account (debt), s162 does not apply.

- If you receive both shares and Cash, the relief is prorated.

- Liability Assumption: If the company takes over your mortgages, this is technically “non-share consideration.” However, Extra-Statutory Concession D32 (ESC D32) allows HMRC to ignore business liabilities taken over by the company, provided they were genuine business debts.

Case Study: The Portfolio Transition (2026)

The Client: Mark and Sarah, a married couple with a portfolio of 12 residential properties in Manchester.

The Situation: The properties are worth £4.5M, with an original purchase cost of £2.5M. They have a “pregnant gain” of £2M.

The Goal: Incorporate to mitigate the 2026 changes to personal tax rates.

The Strategy:

- Activity Audit: Lanop reviewed their logs. They spent 25 hours a week managing the portfolio, meeting the Ramsay business test.

- Transfer: All 12 properties were transferred to “M&S Properties Ltd.”

- Consideration: They received 1,000 Ordinary Shares. No cash or DLA was taken initially to maximise s162 deferral.

- The Result: The £2M gain was rolled into the shares. They paid £0 CGT on the day of incorporation. Their share base cost was adjusted to £2.5M (Market Value £4.5M – Deferred Gain £2M).

“We were terrified of the 2026 CGT changes. Lanop didn’t just give us a spreadsheet; they helped us document our ‘business activity’ over the previous 3 years, so we were ready for an HMRC enquiry. The incorporation was seamless.” — Mark S., Property Developer.

Why Single-Property Owners Usually Miss It

For landlords, the biggest hurdle is proving they have a “Business” rather than an “Investment.”

The “Ramsay” Test

In the landmark case of HMRC v Elizabeth Moyne Ramsay [2013] UKUT 226 (TCC), the Upper Tribunal ruled that for property letting to be a business, there must be a “sufficient degree of activity.“ In that case, the owner spent approximately 20 hours per week managing a block of 10 flats.

Common Mistakes and Overlooked Conditions

- The Passive Landlord: If you have one house and a letting agent does everything, you are an investor, not a business owner. You will likely fail the S162 test.

- Scale: While there is no “magic number” of properties, it is challenging to argue that a single buy-to-let constitutes a business requiring the level of activity seen in the Ramsay case.

The Other Myth: “Partnership for 3 Years and You Avoid SDLT”

A dangerous myth persists: “If you form a partnership and wait three years, you can incorporate without paying SDLT.”

Dispelling the Myth

While it is true that transfers from a partnership to a connected company are calculated using the Sum of the Lower Proportions (SLP) formula, which can result in 0% SDLT, the 3-year rule is not a statutory “get out of jail free” card.

HMRC looks at Anti-Avoidance provisions in Section 75A of the Finance Act 2003. If they believe the partnership was formed specifically to avoid SDLT, they can ignore the partnership and charge SDLT on the full market value.

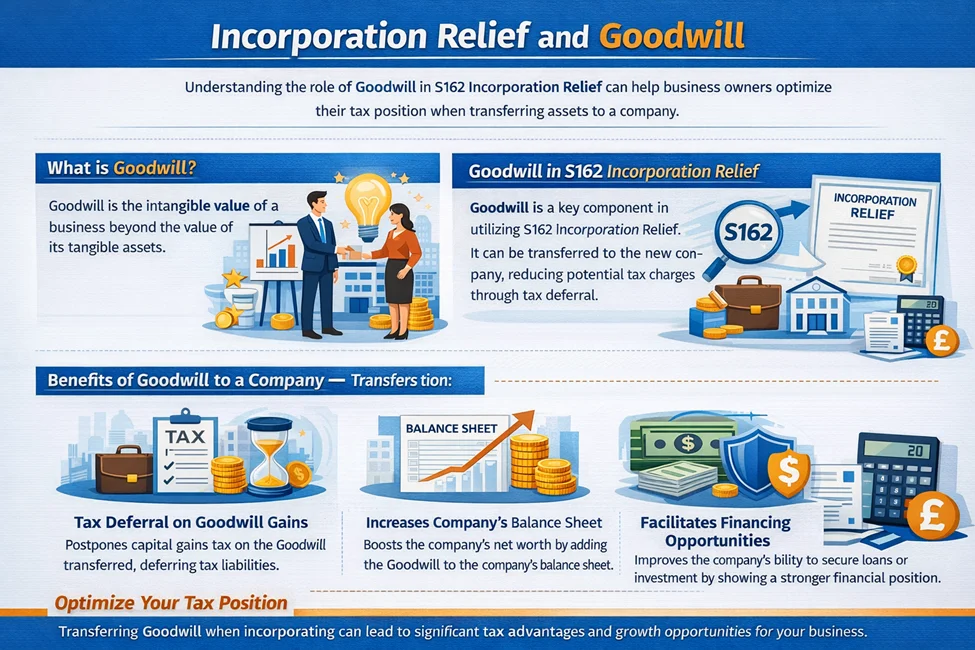

Incorporation Relief and Goodwill

In non-property businesses, the most valuable asset being transferred is often Goodwill.

Defining Goodwill

Goodwill is the “intangible” value above the physical assets. When you incorporate, you are “selling” that Goodwill to the company.

Share Base Cost After Relief

If you use s162, the gain on that Goodwill is deferred into your shares. However, if you choose to “elect out” (s162A), you could pay CGT at the prevailing BADR rate (which increases to 14% in April 2025 and 18% from 6 April 2026). and create a Director’s Loan Account equivalent to the value of the Goodwill. This allows you to withdraw money from the company tax-free later.

Capital Gains Tax Changes from April 6, 2026

Before 2026, s162 relief was often described as “automatic.” You simply didn’t report a gain if you met the conditions.

The New Claim Requirement

Starting April 6, 2026, HMRC has introduced a mandatory claim mechanism as detailed here.

- Reporting: You must disclose the incorporation on your Self-Assessment tax return.

- The Claim: You must specifically provide a computation showing the s162 relief claim.

- Supporting Data: HMRC now expects a breakdown of the assets transferred, the market value, and the calculation of the “rolled-over” gain.

SDLT and Other Tax Impacts

Incorporation relief only covers Capital Gains. It does not automatically cover Stamp Duty Land Tax (SDLT).

- Property Businesses: You will likely owe SDLT based on the market value of the properties moved into the company unless you qualify for Partnership Relief.

- Interaction: Incorporating a property business is a “double-tax” event (CGT + SDLT). s162 handles the CGT; Schedule 15 handles the SDLT. You must satisfy both separately.

Electing Out of s162 Relief (s162A)

Section 162 relief is “automatic” (before 2026) or the default (after 2026) unless you tell HMRC you don’t want it. This is done via a Section 162A Election.

When to Elect Out?

- Utilising BADR: If you have unused Business Asset Disposal Relief, you can pay 18% tax now to rebase your assets to market value.

- Creating a DLA: Paying tax now allows you to “sell” the business to the company for a debt (the DLA), which you can draw tax-free.

- Using Losses: If you have personal capital losses, you can use them to offset the gain on incorporation.

Practical Step-by-Step Incorporation Relief Checklist

- Preparation (6 Months Before):

Conduct a Ramsay Test Audit (document 20+ hours of work/week). Get a professional RICS valuation for all property assets.

Obtain a specialist in Goodwill valuation. - The Transfer:

Draft a formal Purchase & Sale Agreement. Ensure all assets (except Cash) are listed for transfer.

Secure “Letter of Consent” from mortgage lenders for the transfer of debt. - Post-Incorporation (The Filing):Identify the Tax Year:

Ensure the claim is made in the year the transfer completes.

Submit the SA108: Tick the boxes for the new April 2026 mandatory claim.

Costs: Expect advisor costs ranging from £5,000 to £15,000 for a complex property incorporation.

Strategies & Common Mistakes

Avoiding Non-Share Consideration Issues

If your company takes over a personal loan that wasn’t strictly for the business, ESC D32 will not apply. You will be taxed on that loan amount as if it were a cash payment. Ensure your “business liabilities” are strictly documented.

When Professional Advice is Essential

Incorporation is a “one-shot” deal. If you get the structure wrong, you cannot undo it without paying massive taxes. Expert advice is essential to model whether Rollover Relief (s162) or BADR (s162A) results in more long-term wealth.

2025 to 2026 Update: HMRC Is Tightening the Claims Process

Why is HMRC making these changes? For years, incorporations happened “under the radar.” Now, HMRC’s “Connect” AI system links Land Registry transfers directly to Self-Assessment records.

Tips for Preparation:

- Don’t wait until January 2028 to think about your 2026 incorporation.

- Ensure your “Going Concern” status is backed by bank statements showing active trading right up to the transfer date.

- Maintain a “Business Activity Diary” to survive the inevitable HMRC enquiry.

How Lanop Can Help

Navigating s162 in the 2026 tax environment requires a tax strategist, not just an accountant.

At Lanop, we specialise in:

- The Ramsay Audit: We help landlords document their activity to bridge the gap between “investor” and “business owner.”

- HMRC-Proof Valuations: Our team ensures your Goodwill and Property Valuations withstand scrutiny.

- April 2026 Compliance: We manage the new formal claim process, ensuring your deferral is legally sound and fully disclosed.

Conclusion

Incorporation Relief remains the most potent tool for UK business owners to scale without an immediate tax penalty. However, the shift in 2026 from “automatic” to “claim-based” relief means the margin for error has disappeared.

Whether you are seeking to defer millions in capital gains or simply want to structure your family business for the next generation, the time to act is now.

Ready to protect your business?

Contact Lanop today for a bespoke Incorporation Feasibility Study.

FAQ

It is a Capital Gains Tax relief that allows individuals to defer the tax due when they transfer their entire business (as a going concern) to a limited company in exchange for shares.

You must be a sole trader or a partnership. 2. You must transfer the whole business as a going concern. 3. You must transfer all assets (excluding Cash). 4. The transfer must be wholly or partly for shares.

Yes. The business must be active and operational at the time of transfer. If you have already ceased trading, you cannot use s162.

Yes. If you decide to keep the business premises in your personal name but move the rest of the business, the entire s162 relief will fail. The only exception allowed by law is Cash.

It does not fail, but it is restricted. You will have to pay immediate CGT on the portion of the gain that relates to the Cash or Director’s Loan you receive.

Yes, but only through Extra-Statutory Concession D32 (ESC D32). Without this concession, the debt the company takes over is treated as “cash” paid to you, triggering an immediate tax bill.

The base cost is the market value of the shares received, minus the deferred capital gain. This “tax cost” is what you use when you eventually sell the shares.

From April 6, 2026, you must make a formal claim on your SA108 (Capital Gains) page, providing a computation of the relief and a description of the business transferred.

Yes, under s162A. It is helpful if you want to pay a lower rate of tax now (BADR at 18%) to create a Director’s Loan Account, which lets you take money out of the company tax-free later.

Yes, but it is highly scrutinised. You must prove the property portfolio is a “business” (usually 20+ hours of management per week) rather than a passive investment.

HMRC looks for “business activity” logs, tenant management records, maintenance diaries, and proof that the owners personally spend significant time managing the portfolio.

Goodwill gain can be rolled into the shares (s162) or taxed at a low rate (BADR), creating a debt for the owner to draw down. Lanop can help you model which is more tax-efficient.

Disputing the “Business” status of property owners. 2. Challenging the valuation of Goodwill. 3. Denying relief because an asset (like land) was kept out of the company.

They are separate. s162 handles the Capital Gains Tax. SDLT relief (under Schedule 15) handles the Stamp Duty. You must meet the criteria to achieve a “tax-free” incorporation

The most significant change is the mandatory claim requirement on the Self-Assessment return. Additionally, the increase in the BADR rate to 18% changes the math for those considering “electing.”