Introduction

If you’re a UK business owner, overseeing VAT doesn’t stop at filing your return every quarter. It is a process that requires paying attention to the evidence for every penny reclaimed. At the heart of this is the concept of the (simplified) vat receipt threshold, which aims to reduce admin for small transactions while ensuring that HMRC has a clear audit trail.

Qualifying as a VAT Receipt. If you are a sole trader, finance admin, or director of a limited company, then learning what is considered a VAT receipt in the UK could mean the difference between making a successful reclaim and being subjected to a costly audit. This guide simplifies the documentation that you need as a retailer or an e-tailer and shows us how to be proactive so we can work with clients to keep them out of trouble.

Quick Answer: The Simplified VAT Receipt Threshold + What You Need to Reclaim VAT

In the UK, the simplified vat receipt threshold is currently set at £250 (including VAT). If a purchase is for £250 or less, HMRC allows businesses to use a simplified invoice or receipt to reclaim input tax, provided it contains specific essential details.

To reclaim VAT effectively, your evidence must meet these criteria:

- The £250 Limit: The total transaction value must not exceed this amount to qualify for simplified rules.

- Validity: The document must show the supplier’s VAT registration number; a card machine slip is almost never sufficient on its own.

- Itemisation: The receipt must clearly show the date of supply and a description of what was purchased.

- Retention: You must keep these records for at least six years to satisfy VAT record-keeping requirements in the UK.

For practical systems that prevent missing/cropped receipts and improve retrieval speed during an HMRC check, see why businesses are moving to cloud accounting for HMRC-ready record keeping.

VAT Thresholds vs VAT Receipt Threshold UK (Avoid the Most Common Confusion)

It is a common pitfall for new business owners to confuse the various vat thresholds set by HMRC. While they all relate to VAT, they serve entirely different legal purposes.

What the HMRC VAT registration threshold is (and why it’s different)

The HMRC VAT threshold for registration is the level of taxable turnover at which a business must register for VAT. As of 1 April 2024, this business VAT threshold is £90,000. This is a “macro” threshold; it determines if your business is part of the VAT system.

In contrast, the VAT receipt threshold in the UK is a “micro” or transaction-level threshold. It dictates the level of detail required on a single piece of evidence (an invoice or receipt) to allow you to reclaim VAT on that specific purchase.

What the VAT receipt/invoice threshold is (transaction-based)

The VAT receipt threshold in the UK focuses on the administrative requirements of the seller. When you buy goods or services, the seller’s obligation to provide a “Full VAT Invoice” only triggers if the sale exceeds £250. Below this, they can issue a simplified version.

Common misconceptions (clear “myth vs fact” bullets)

- Myth: “You can use a credit card slip to request back VAT if it’s under £250.”

- Fact: The card slip does not usually display the supplier’s VAT number or any indication of the rate of VAT that was applied, so it is NOT a valid receipt.

- Myth: “Thanks to the simplified vat receipt threshold, I don’t need a receipt at all for anything less than £250”

- Fact: You almost always need evidence. The threshold only simplifies what needs to be on that evidence.

- Myth: “The registration threshold and the receipt threshold are the same number.”

- Fact: They are entirely different (£90,000 vs £250).

If you miss deadlines or file with weak evidence, the risk becomes financial, not just administrative. Use LANOP’s UK VAT penalties guide (how fines and points work) to understand the real cost of non-compliance.

Case Study:

The Threshold Mix-up A startup founder believed that because their turnover was below the £90,000 HMRC vat threshold, they didn’t need to keep formal VAT receipts for their equipment purchases. When they later registered and tried to back-claim VAT on initial costs, HMRC challenged the lack of documentation.

How LANOP Helped:

LANOP stepped in to perform a forensic review of the founder’s bank statements and successfully contacted major suppliers to re-issue compliant documents. We then implemented a “Threshold Alert” system in their accounting software to ensure they never confused registration limits with receipt requirements again.

Client Testimonial:

“I was lost in the jargon of thresholds. LANOP didn’t just explain the rules; they cleaned up my past mistakes and gave me a system that works.”

David L., Tech Founder.

What Counts as a VAT Receipt in the UK (Buyer Evidence)

To protect your business from an audit, you must understand what counts as a vat receipt. Not every piece of paper printed at a till is created equal in the eyes of HMRC.

VAT receipt vs card slip vs order confirmation

A standard card slip (the one that says, “Customer Copy” and shows only the last four digits of your card) is evidence of payment, not evidence of a taxable supply. An order confirmation from a website is often just a summary of what you intend to buy; it may not contain the tax point (date) or the final VAT breakdown. A valid VAT receipt requirements check must be performed on every document before it enters your accounting software.

When a till receipt is not enough

A till receipt is insufficient if it is “vague.” For instance, a receipt saying “Miscellaneous” or “Goods” without a VAT registration number doesn’t pass. In addition, if you are buying items with different VAT rates (for example, a standard-rated notebook and a zero-rated sandwich), these should be clearly separated on the receipt.

“Valid VAT receipt requirements” checklist

To ensure you are compliant, check every receipt against this list:

- Is the supplier’s name and address visible?

- Is there a unique invoice/receipt number?

- Does it show the supplier’s 9-digit UK VAT number?

- Is the date of supply (tax point) clear?

- Is there a description of the goods or services?

- Is the total amount (including VAT) clearly stated?

Comparison: Full Invoice vs. Simplified Receipt

| Feature | Full VAT Invoice | Simplified VAT Receipt |

|---|---|---|

| Transaction Value | Over £250 (inc. VAT) | £250 or less (inc. VAT) |

| Supplier Name/Address | Mandatory | Mandatory |

| Supplier VAT Number | Mandatory | Mandatory |

| Customer Name/Address | Mandatory | Not Required |

| VAT Rate per Item | Mandatory | Total VAT must be identifiable |

| Unique Invoice No. | Mandatory | Recommended/Mandatory |

Full VAT invoice (when it’s required)

If you spend £250.01 or more, you must have a full VAT invoice. This document must include your business name and address. If you purchase a laptop for £1,000 and the receipt is made out to “Cash Guest,” HMRC may challenge your right to reclaim that VAT.

Simplified VAT invoice/receipt (when it’s allowed)

The simplified vat invoice rules apply only to retail sales and transactions under the £250 mark. It allows the seller to omit your details (the customer) and provide a less granular breakdown of the tax, provided the total VAT is still clear.

Modified VAT invoice (where it appears and why it matters)

A modified invoice is a hybrid used for retail sales over £250. It lists the total inclusive of VAT and then shows the VAT amount separately at the end. While rare in B2B service sectors, you will often see these in large “big box” retail stores.

Case Study:

The £251 Problem: A marketing agency bought a suite of software licenses for £255. They only kept a simplified receipt. During a check, HMRC identified that because the total was over the simplified vat receipt threshold, the lack of the agency’s name and address on the document made the claim invalid.

How LANOP Helped:

LANOP’s compliance team caught this during a monthly review. We immediately reached out to the software provider to secure a full VAT invoice addressed to the agency. We then updated the agency’s internal “Purchasing Policy” to mandate full invoices for any spend over £250, providing a safety buffer. (Note: While £240 works as a buffer, the legal threshold is £250).

Simplified VAT Invoice Rules and the Simplified VAT Receipt Threshold

As we move into 2025, HMRC remains strict on the simplified VAT invoice rules. Even with the VAT receipt threshold 2025 likely to stay at £250, the quality of digital records is being scrutinised more than ever.

If you’re self-employed or running a small team, read Making Tax Digital for sole traders (2025 compliance guide) so your receipts capture and quarterly submissions match MTD expectations.

The simplified VAT receipt threshold (what it covers and what it doesn’t)

The simplified VAT receipt threshold covers most day-to-day business expenses: travel, small office supplies, and subsistence. However, it does not cover “distance selling” or certain types of high-value services where a full contract is involved.

Minimum details on a VAT receipt

When you are looking for the minimum details on a VAT receipt to ensure they meet the valid VAT receipt requirements, look for:

- Supplier identity: Trading name and address.

- VAT Number: Always starts with “GB” for UK-registered businesses (unless it’s an EU/International transaction with different rules).

- The Tax Point: The date the VAT becomes due.

- Description: What was bought (e.g., “Printer Ink”, not “Sale”).

- Rate of VAT: If the items are mixed, the receipt must show which are 20%, 5%, or 0%.

Mixed VAT rates and itemisation

A common failure point is a receipt from a supermarket. If you buy ground coffee or roasted beans (0%) and cleaning supplies (20%), the receipt must subtotal these. You cannot simply apply 20% to the bottom-line total.

When you must request a full VAT invoice

You must request a full invoice if:

- The total is over £250.

- You are a sole trader needing to prove the purchase was for the business and not personal use.

- The item is a capital asset (like a vehicle or expensive machinery).

VAT Receipt for Small Purchases and Day-to-Day Expenses

For a vat receipt for a small purchase, consistency is key. Whether it’s a £5 notebook or a £45 train ticket, the same rules apply.

Sole trader vs limited company: does anything change?

For VAT receipts for sole traders, the burden of proof is often higher because HMRC looks for “private use” overlap. Ensure your receipts are kept separate from personal shopping. Limited companies have a clearer legal separation, but the documentation requirements remain identical.

Petty cash VAT receipts: how to run them audit-safe

Handling petty cash VAT receipts is a frequent source of errors.

Action Plan for Petty Cash:

- Voucher System: Every withdrawal must have a signed voucher.

- Evidence Attachment: Staple the VAT receipt threshold for expenses compliant receipt to the voucher.

- Approval: A manager must sign off on the monthly petty cash reconciliation.

- Digital Scan: Even petty cash receipts should be scanned for Making Tax Digital (MTD) compliance.

Case Study:

Petty Cash Chaos. A retail shop was using petty cash for numerous small repairs and supplies, but rarely kept the petty cash vat receipts, assuming the amounts were too small for HMRC to care.

How LANOP Helped:

LANOP redesigned its petty cash process, introducing a digital “Capture-First” policy. We integrated a mobile app that allowed staff to photograph receipts before the cash was even reimbursed. This turned a messy box of paper into a searchable, compliant digital archive.

Client Testimonial:

“LANOP turned our shoebox of receipts into a digital system that actually makes sense. No more lost VAT.”

James K., Shop Owner.

Digital VAT Receipts, HMRC Rules, and Best Storage Practices

HMRC’s “Making Tax Digital” (MTD) initiative has changed the landscape for digital VAT receipts under HMRC rules.

Are digital receipts acceptable?

Yes. PDF invoices, e-receipts sent by email, and pictures of paper receipts are all accepted. HMRC’s priority is that the record is legible and reflects the original transaction.

Scanning paper receipts: process + quality standard

When scanning, ensure you capture the entire document, including the edges. A “cut off” VAT number makes the document invalid.

A storage system that survives an HMRC inspection

The best way to store vat receipts is in a cloud-based folder structure or accounting software.

- Organise by tax year and then by month.

- Use a naming convention: YYYY-MM-DD_Supplier_Amount.pdf.

- Maintain a clear audit trail from the bank statement to the receipt.

If you are choosing tools, software to manage vat receipts should support bank matching, receipt capture, and compliant record storage. If you are running expenses through Xero Expenses, ensure receipt capture rules are enforced at the point of spend.

VAT Record Keeping Requirements UK (What Records You Must Keep and for How Long)

Compliance is not just about having the receipt; it’s about keeping it. Vat record-keeping requirements in the UK are statutory and strictly enforced.

What records must you keep

You must keep:

- A VAT account (summary of totals).

- All purchase and sales invoices.

- Supporting docs (delivery notes, contracts).

- Import/Export documentation (C79 certificates).

How long must you keep VAT records

You need to follow the “How long do you keep VAT receipts” rule: 6 years. You have digital records; make sure they are backed up. If your business shuts down, you still have to maintain these records until the remainder of the 6 years have passed.

VAT Receipts for Fuel UK (Common Errors and Controls)

Reclaiming VAT on fuel is one of the most complex areas of VAT compliance. Vat receipts for fuel in the UK require more than just the receipt itself.

What a fuel VAT receipt must show

To reclaim any VAT on fuel, you must have a valid VAT receipt from the petrol station. A card slip is never enough. The receipt must cover the amount of VAT you are reclaiming.

Evidence and logs that reduce risk

HMRC requires you to prove that the fuel was used for business. You must keep a mileage log showing:

- Date of trip.

- Start and end points.

- Purpose of the journey.

- Total miles.

Frequent mistakes

The biggest mistake is claiming 100% of the VAT on a fuel receipt when the car is used for both business and private trips. You must either use the “VAT Fuel Scale Charge” or only reclaim the VAT on the business portion of the mileage using HMRC’s Advisory Fuel Rates (AFR).

Claiming VAT Without Receipt (Lost Receipt, Missing VAT Number, Supplier Refusal)

Can you reclaim VAT without a receipt? Technically, HMRC has the discretion to allow a reclaim without a valid invoice under Statement of Practice 1/2007, but this is strictly for exceptional circumstances and should not be a standard business practice.

Lost VAT receipt: step-by-step recovery process

- Contact the supplier: Most modern systems can re-issue a PDF receipt.

- Bank Evidence: Use your bank statement to find the exact date/time to help the supplier find the transaction.

- Alternative Evidence: If the supplier is gone, keep delivery notes or emails discussing the order.

Supplier refusal

If a supplier refuses to provide a valid VAT receipt or a requirements-compliant document, they are technically in breach of HMRC rules. You should document your attempts to contact them.

What to document internally (exception log)

If you must claim without a receipt, create an internal “Exception Memo.” State why the receipt is missing, what you did to find it, and provide secondary evidence of the purchase. This shows HMRC that you are acting in good faith.

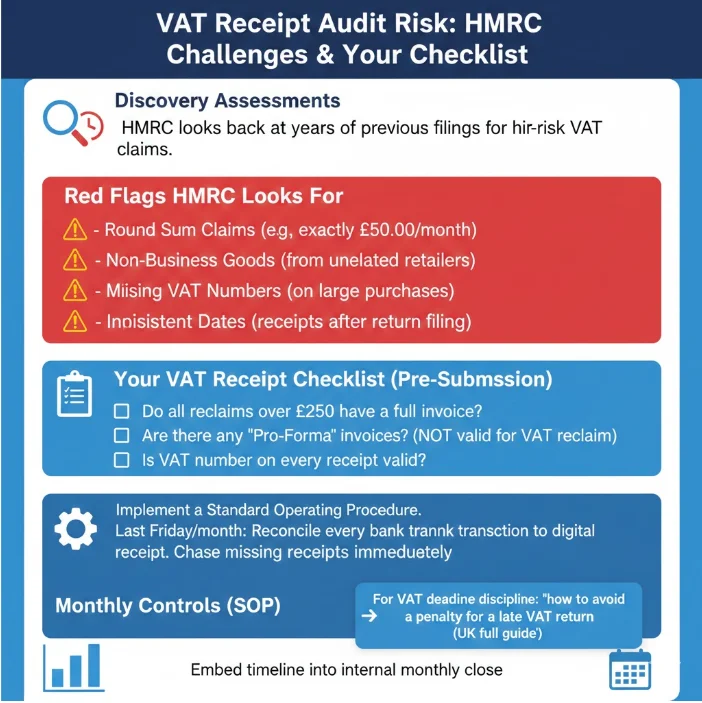

VAT Receipt Audit Risk: How HMRC Challenges Claims

A high vat receipt of audit risk can lead to “Discovery Assessments” where HMRC looks back at years of previous filings. Red flags HMRC looks for

- Round sum claims (e.g., claiming exactly £50.00 every month).

- Receipts from retailers that don’t sell business-related goods.

- Missing VAT numbers on large purchases.

- Inconsistent dates (receipts dated after the VAT return was filed).

Your VAT receipt checklist (pre-submission)

Before you hit ‘submit’ on your return, use this VAT receipt checklist:

- Do all reclaim over £250 have a full invoice?

- Are there any “Pro-Forma” invoices? (Pro-forma invoices are not valid documents for reclaiming VAT as they are not tax points; you must wait for the actual VAT invoice.

- Is the VAT number on every receipt valid?

Monthly controls (SOP)

Implement a Standard Operating Procedure (SOP). On the last Friday of every month, reconcile every bank transaction to a digital receipt. If a receipt is missing, chase it immediately while the transaction is fresh.

For a VAT-deadline discipline framework (and what to do when things slip), follow how to avoid a penalty for a late VAT return (UK full guide) and embed the same timeline into your internal monthly close.

Software to Manage VAT Receipts (What to Look For)

In the modern era, using software to manage vat receipts is no longer optional for most people.

Features that matter

- OCR (Optical Character Recognition): The software should automatically read the VAT number and amount.

- Direct Bank Feed: To match receipts to payments in real-time.

- Cloud Archive: Ensuring you meet the 6-year retention rule.

Implementation plan

- Week 1: Choose software (e.g., Dext, Hubdoc, or Xero Expenses).

- Week 2: Connect your bank and train staff to take photos of receipts immediately at the point of purchase.

How LANOP Can Help

Navigating the simplified VAT receipt threshold and broader HMRC compliance can be overwhelming. At LANOP, we specialise in taking the “tax anxiety” out of your business operations.

- VAT Compliance Setup: We configure your software to flag invalid receipts before they become an issue.

- Audit-Ready Processes: We design record-keeping workflows tailored to your industry.

- Risk Reviews: Our team performs “health checks” on your previous filings to

- And correct potential red flags.

- HMRC Support: If you are facing an inquiry, we provide expert representation to defend your legitimate claims.

Conclusion

Understanding the simplified VAT receipt threshold is a fundamental pillar of UK business finance. By keeping your documentation sharp, you protect both your cash flow and your standing with HMRC. Remember the £250 limit for simplified evidence and always ensure a valid 9-digit VAT number is present to stay compliant.

For any transaction over £250, you must request a full VAT invoice addressed to your business. To ensure long-term security, keep all records for six years and use automation to prevent any lost receipts or miscalculations.

For tailored VAT support and an audit-ready record-keeping setup, LANOP Business & Tax Advisors are happy to help.

Frequently Asked Questions

Does the simplified VAT receipt threshold include VAT, and will it change in 2026?

Yes, it is £250 inclusive of VAT. Well, as per the current 2025 guidance, it is £250…but always check the Autumn Statement for sudden bursts of inflation!

What is a “modified invoice,” and when is it used?

Retailers use a supplementary invoice for sales over £250. It shows the VAT inclusive amount, then states what the VAT is separately, compared to a complete invoice, which will display net + vat = gross.

Can I still claim back the VAT even if no supplier’s VAT number is shown on the receipt?

No. A VAT number is a legal necessity to undertake any reclaim of VAT. If you didn’t have it, you wouldn’t be able to prove the supplier was registered to collect the tax.

How can you fight if the supplier refuses to give a VAT invoice / valid VAT receipt?

You should also tell them if they are VAT registered; by law, they must provide one. If they continue, then do not recover VAT and instead look for other suppliers.

Can I get VAT back if the receipt/invoice is under a person’s name (and not a business)?

In general, yes, travel and subsistence expenses would be deductible if the employee was acting in the interests of the business and the business reimbursed them.

What do I do with receipts, where standard/reduced/zero VAT is on one purchase?

The items that are subject to the respective rate must be separately listed on the receipt. You need to work out your reclaim for the VAT you were charged on each item, individually.

Can I recover VAT on online market/portal invoices from companies similar to Amazon/eBay, and what must appear on the document?

Yes, make sure you download the VAT Invoice and not the Order Summary. Marketplace VAT can be a challenge post-Brexit; LANOP’s UK Post-Brexit VAT Guide explains why the “invoice” you download must match the actual supplier and VAT registration status. The VAT number of the seller in the UK must be on the invoice (as many marketplace sellers are based abroad, check beforehand).

What are the first reasons that HMRC would reject/review VAT receipts?

Incorrect VAT numbers, invoices made out to the wrong person, use of “pro-forma” invoices and failure to show proof of business use.

How can I avoid double claiming VAT where there are multiple hard and/or soft copy receipts?

Use software that has “duplicate detection” capabilities and enforce a rule with your team or staff that once a receipt is scanned, the paper original either gets stamped with a “Scanned” stamp or filed away immediately.

What's the most effective way to check VAT receipts monthly before submitting a VAT return?

Try matching your bank statement, one line at a time, to your digital receipts. Flag any transaction posted without a receipt for follow-up.

Audit trail, approvals, exports - what software functionality is important for VAT compliance (beyond receipt capture)?

You should ensure they have an indelible audit trail (the who, what and when of everything that has been changed), the facility to keep images for 6 years and that they seamlessly integrate with HMRC-recognised MTD software.