Introduction

Starting a business is a fun part. You’ve got the idea; you’ve landed off the first client, or perhaps you’ve just sold your first vintage jacket online. It feels great. Then, “admin’s anxiety” kicks in.

You know you need to tell the taxman about your money, but the gov.uk website can feel like a maze of jargon. You hear terms like “UTR,” “Class 2,” and “Payment on Account,” and suddenly, you’re worried you’ve already missed a deadline you didn’t know existed. At Lanop, we see this every day. We sit down with new business owners who are terrified they’ve done something wrong before they’ve even started.

Here is the good news: registering as a sole trader is one of the more straightforward things you will do in business. It isn’t a test. It’s just a notification process.

This guide isn’t a generic copy-paste of the government’s website. It is a practical walkthrough of how to register as a sole trader, written from our perspective as accountants who guide real people through this process week in, week out. If you want the bigger operational picture (banking, records, tax habits), our complete resource on setting up and running a sole trader business in the UK is a valuable companion.

Let’s get you sorted out.

How to Register as a Sole Trader (HMRC Step-by-Step)

Starting your own business in the UK is an exciting journey and registering as a sole trader is the first step. The process is entirely online, and while it may sound daunting, it’s quite simple when broken down. Here’s a super easy guide, complete with screenshots, to get you registered with HMRC as a sole trader.

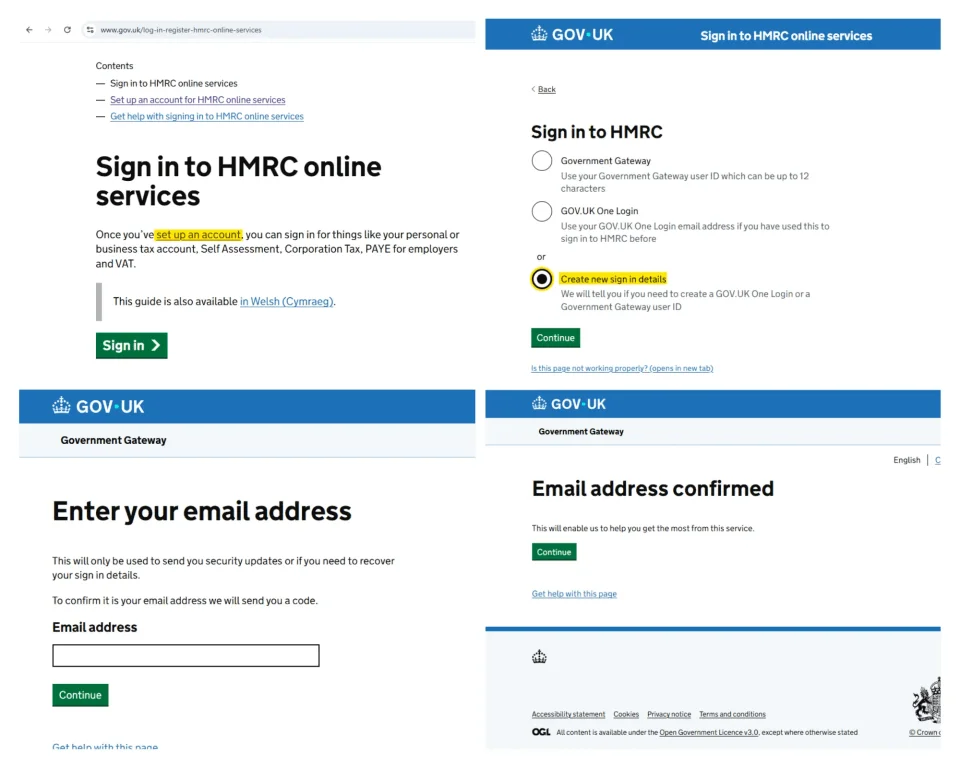

Step 1: Access HMRC Online Services

Visit GOV.UK. You will notice that GOV.UK One Login is now the primary method for new users, though some services still allow Government Gateway. If you don’t have either, follow the prompts to “Create an account.”

- Start at the Link: Click “Log in to your HMRC online account.“

- Choose “Set up an account”: Even if you have a personal account, you must ensure it is linked to business services. To do this correctly, select the “Individual” or “Personal” account type during the initial setup. Most sole traders start here because, legally, you and your business are the same entity. Once this is set up, you can easily add “Self-Assessment” to your dashboard to report on your business income.

- Verify Your Email: HMRC will send a 6-digit confirmation code to your inbox. Enter this code on the registration page to verify your identity. Once confirmed, you will see an “Email address confirmed” screen, allowing you to proceed with setting up your account password and security.

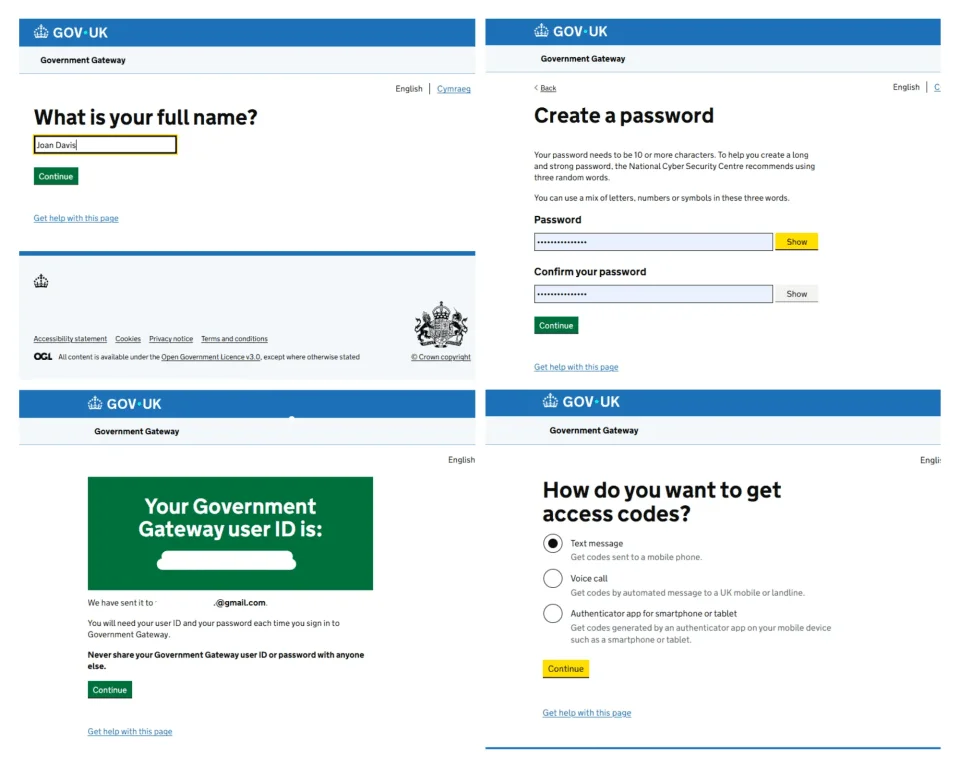

Step 2: Get your Gateway ID and Create Account Password

Since 2024-2025, HMRC has shifted heavily toward GOV.UK One Login.

- Identity Verification (The “High Security” Step): You will likely need the GOV.UK ID Check app. You’ll be asked to:

- Scan your Passport or UK Driving License.

- Take a “liveness” photo of your face to match the ID.

- Provide your National Insurance Number.

- The 12-Digit User ID: Once the account is created, HMRC will display a Government Gateway User ID.

- Set Up 2-Step Verification (2FA): After that you will be asked to add 2FA. Choose to receive a 6-digit access code via an authenticator app or your mobile number for an OTP (One-Time Password). You will need this code every time you sign in.

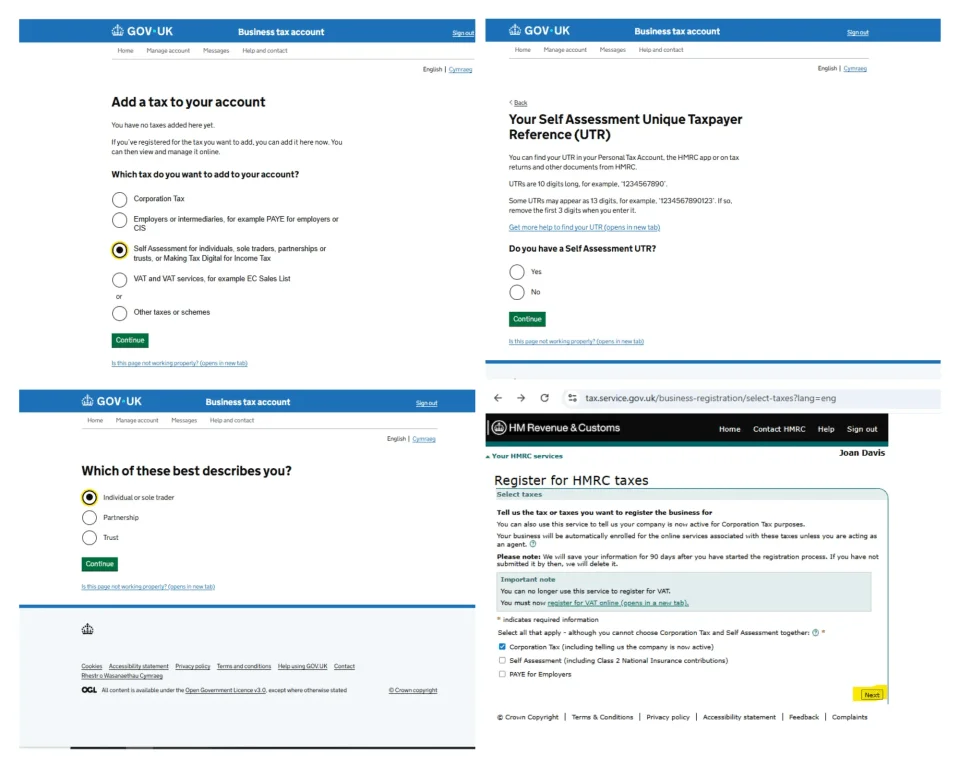

Step 3: Register for Self-Assessment

Once logged in, you must officially notify HMRC that you are a sole trader to receive your tax reference number.

- Select Service: On your account’s home screen, select “Add a tax, duty or scheme” and choose “Self-Assessment”.

- Identify Your Status: When asked why you are registering, select “Working for yourself” (Sole Trader).

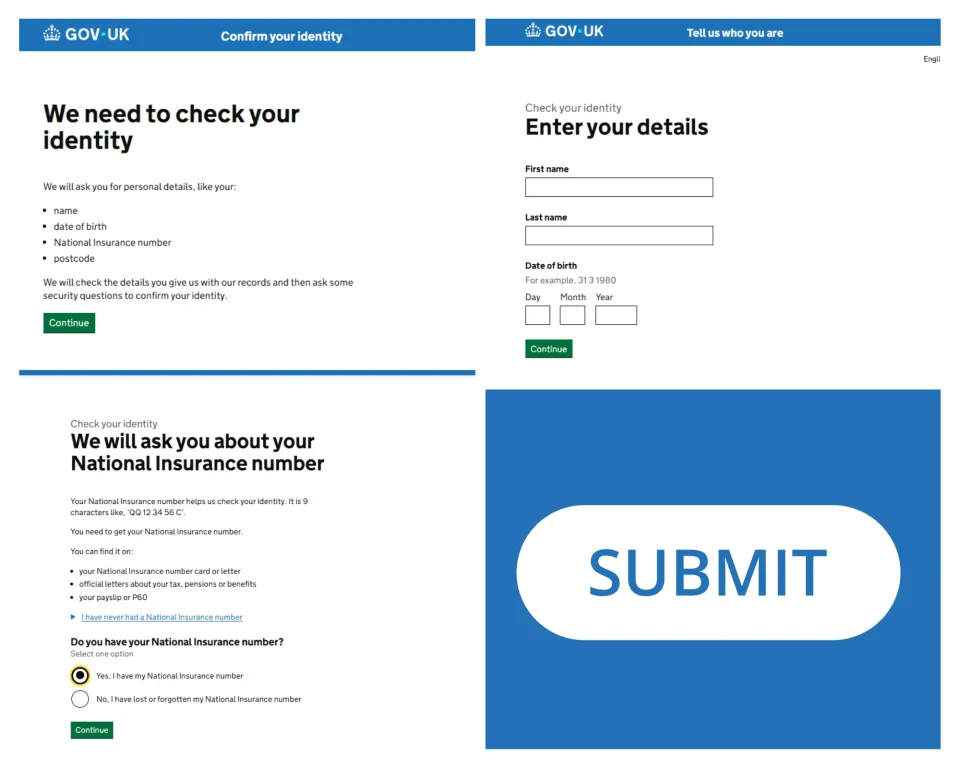

- Enter Personal Details: Provide your full name, date of birth, and home address.

- National Insurance Number: Enter your UK National Insurance number to link the business to your identity.

- Business Details: Enter your business start date, the nature of your trade (e.g., “Painter” or “Consultant”), and your business address.

- Trading Name: Provide the name you use on your invoices (this can simply be your own name).

- Submit: Review your information and click “Submit” to complete the digital application.

What happens next? HMRC will mail your Unique Taxpayer Reference (UTR) number to your home address, usually within 10 to 15 working days.

Ongoing Responsibilities

Set Up Making Tax Digital (MTD) – NEW for 2026

As of April 2026, if your annual business income is over £50,000, you are legally required to follow Making Tax Digital for Income Tax rules. This means using compatible software to keep digital records and send quarterly updates to HMRC instead of just one annual return.

Register for VAT (If turnover > £90,000)

If your “taxable turnover” exceeds £90,000 (the threshold set in the 2024 budget), you must register for VAT. Many sole traders register voluntarily even if they earn less, to reclaim VAT on expenses.

Register as an Employer (PAYE)

If you plan to hire anyone (even just one person), you must register for PAYE through your HMRC account before their first payday.

What Is a Sole Trader?

A sole trader is simply a person who runs a business as an individual.

There is no legal distinction between “you” (the person) and “the business.” If the business makes a profit, that money is yours. If the business owes money, you owe that money personally.

When you investigate sole trader registration in the UK, you aren’t applying for a license to trade (unless your industry requires one, like food or security). You are simply raising your hand to HMRC and saying, “I am now earning income outside of my salary, and I need to pay tax on it via Self-Assessment.” If you’re still unsure who needs to file and why, read who must file a Self Assessment return.

It is the most popular structure in the UK because it is low maintenance. You don’t need to file accounts at Companies House, and you don’t need a company secretary. You just need to keep track of what you earn and what you spend. If you want that appropriately done from day one, Lanop’s sole trader accounting support is designed for precisely this stage.

Do You Need to Register as a Sole Trader?

Not every penny requires paperwork. If you sold a lawnmower on eBay to clear out the shed, HMRC doesn’t care. If you bake cakes for your niece’s birthday and she gives you £20 for ingredients, that’s not a business.

You need to look at the “Badges of Trade.” Are you doing this regularly? Are you doing it to make a profit?

When you must register

The brutal rule is the Trading Allowance. You must register as self-employed if your gross trading income is more than £1,000 in a single tax year (April 6th to April 5th).

Note the word “gross.” This means your total sales before you deduct any expenses.

- Scenario: You start a side hustle fixing computers. You charge £1,200 for your work, but you spent £400 on parts. Your profit is only £800.

- Verdict: You still need to register because your income (£1,200) was over the £1,000 threshold.

You also need to register if you want to pay voluntary Class 2 National Insurance to protect State Pension eligibility (where relevant). This is one of the common “small detail, big impact” areas we review when onboarding clients into Lanop’s sole trader service.

When you may not need to register

If your total income from the side hustle is under the £1,000 trading allowance, do I need to register? No.

You don’t even need to tell HMRC. You can just keep that money. It’s a tax-free allowance designed to stop people from having to file tax returns for tiny amounts of hobby income.

However, keep an eye on it. It’s very easy to accidentally cross that £1,000 line in December and not realise it until the tax year is over.

Common misconceptions to correct

“I made a loss, so I don’t need to register.”

This is the most common mistake we see. If your turnover (sales) was high, say £10,000, but your expenses were £12,000, you made a £2,000 loss. You still need to register. In fact, you want to register because you can often set that trading loss against your other income (like your salary) to get a tax refund.

“I need to register specifically as a ‘Sole Trader’.”

Technically, you register for Self-Assessment. Being a sole trader is the status; the registration gets you a UTR so you can file. If you want a shorter version of the process, Lanop also has a step-by-step guide to setting up as a sole trader.

When to Register (Timing and Deadlines)

There is a sweet spot for registration.

If you register too early (e.g., “I have an idea for a business but haven’t started”), HMRC will send you a tax return request for a year where you did nothing. That’s just annoying, admin.

If you register too late, you risk penalties.

The deadline is the Self-Assessment registration deadline, October 5th, after the tax year you started trading.

Let’s put this in real terms:

- You start your freelance writing business in August 2024.

- This falls in the 2024/25 tax year (which runs April 6th 2024 to April 5th 2025).

- You must register by October 5th 2025.

- You must file and pay your tax by January 31st 2026.

We always advise clients: don’t wait until October 5th. Do it once you are settled and trading. If you leave it to the last minute, and there’s a delay with the post, you’ll be sweating.

If you want a clear reminder of what the January deadline covers (and what penalties look like), see Lanop’s guide on the UK Self Assessment deadline and how to avoid penalties.

What You Need Before You Register

Don’t start the online form until you have these sitting in front of you. The government gateway times out for security reasons, and nothing is more frustrating than having to start over because you couldn’t find your passport.

- Your National Insurance (NI) Number: It’s on your pay slip, P60, or in your digital tax account.

- Your Personal Details: Current address and date of birth.

- Date You Started Trading: This doesn’t have to be the day you had the idea. It’s usually the day you started “holding yourself out for business” (advertised) or made your first sale.

- Business Name: If you don’t have a fancy brand name, just use your own name.

- Business Description: You’ll need to pick a sector. If you are a “Virtual Assistant,” you might select “administrative and support service activities.”

If You Already Have a UTR or Filed a Self-Assessment Before

This is a specific scenario that trips up many of our clients.

Let’s say you tried freelancing five years ago, registered, quit, and went back to a full-time job. You likely told HMRC to close your Self-Assessment record.

Now, you are starting a new side hustle.

Do not register for a new UTR. You have one for life, like your NI number.

If you try to create a new one, you will confuse HMRC’s system, potentially creating duplicate records that take months to fix. Instead, you need to sign in with your old details and “reactivate” your Self-Assessment. If you can’t see the option online, you often have to call HMRC or file form CWF1, specifically stating you are restarting trading.

Special Situations

Business isn’t always neat. Here are the messy real-world situations we handle at Lanop.

PAYE job plus side business

This is the most common “modern” sole trader. You work 9-to-5 in marketing, and you sell illustrations on weekends.

You do not need to tell your employer (unless your contract says so). Your tax code at your primary job usually stays the same.

PAYE and self-employed tax in the UK work together like this:

- You get your salary (tax is taken off automatically).

- You get your business profit (no tax is taken off yet).

- At year-end, you file a tax return. You tell HMRC, “I earned £40k from my job (tax already paid) and £10k from my business (0 tax paid).”

- HMRC calculates the tax just on the £10k and sends you the bill.

Be aware: because your salary likely uses up your tax-free Personal Allowance (£12,570), your business profit will be fully taxable at 20% (or 40% if you are a higher earner) from the first pound of profit.

Online selling and platforms (eBay/Amazon/Etsy/Shopify)

If you are looking up online selling tax in the UK (eBay/Amazon/Etsy), you might be worried about the “side hustle tax” news stories.

Here is the truth: The tax rules haven’t changed. If you are trading, you owe tax. What has changed is visibility. Platforms like Vinted, eBay, and Etsy now send data to HMRC about how much you earn.

If you are just selling your own old clutter, you are fine. If you are buying things to sell at a profit, you are a business. If you hit that £1,000 revenue allowance, register. Do not assume you can fly under the radar because it’s “just an app.”

Freelancers/contractors with multiple clients

If you have multiple clients, you are the definition of a sole trader.

The main thing to watch here is IR35, though that typically impacts Limited Companies more. As a sole trader, ensure you keep autonomy. You set your hours. You use your own equipment. You can send a substitute if you are sick (in theory). This proves you are a business, not a “disguised employee.”

What Happens After You Register

You hit submit. You get your letter. Then… silence.

HMRC doesn’t send you a “Welcome Kit.” You are on your own until the tax return notice lands. Here is what you should be doing in that quiet period.

Taxes you should expect

You need to prepare for sole trader tax and National Insurance mentally.

- Income Tax: The same rates as everyone else (0%, 20%, 40%, 45%).

- Class 4 NI: This is the specific tax for self-employed people. It kicks in around £12,570 profit.

- Class 2 NI: This is now mostly abolished for profits over £12,570, but you might still see it mentioned on older help guides.

Record-keeping requirements

You don’t need to be an accountant, but you do need to be organised. Record keeping for sole traders is not optional. If HMRC investigates you five years from now, you need to prove every number on your tax return.

Keep:

- Invoices you sent.

- Receipts for everything you bought for the business.

- Bank statements.

The best advice we can give: Open a separate bank account. It doesn’t legally have to be a “business” account (though banks prefer that). Just having a separate “Monzo” or “Starling” account where all business income goes in, and all expenses go out, will save you days of work when tax season hits.

If you want practical ways to keep this simple, Lanop’s bookkeeping tips for sole traders are a strong starting point.

Invoicing basics for sole traders

Invoicing as a sole trader in the UK doesn’t require expensive software. A Word document or Canva template is fine.

It must show:

- Your business name and address.

- The client’s name and address.

- A unique invoice number (001, 002, etc.).

- The date.

- What you did and how much it costs.

Do not add VAT. If you are not registered for VAT, it is illegal to charge it.

Your First Self-Assessment Return (What People Get Wrong)

There is a nasty surprise waiting for successful sole traders called “Payments on Account.”

If your tax bill is over £1,000, HMRC assumes you will earn the same next year and asks you to pay half of next year’s bill in advance.

Let’s say your first year goes well. You owe £2,000 in tax. You log in to pay, expecting to transfer £2,000. HMRC demands £3,000. (£2,000 for the year just gone + £1,000 towards next year).

This is why we advise saving 25–30% of every payment you receive in a separate pot. If you want common filing errors to avoid (the ones that cause penalties and enquiries), read our guide on Self Assessment mistakes to avoid.

VAT and Sole Traders (When It Becomes Relevant)

Most new sole traders don’t need to worry about VAT yet.

The VAT threshold for a UK sole trader is £90,000. That’s a lot of turnover. Until your sales hit that figure in a rolling 12-month period, you can ignore VAT.

However, you can choose voluntary VAT registration for a sole trader.

- Good idea if: You sell to other businesses (they can claim the VAT back), and you have high equipment costs (you can claim VAT back).

- Bad idea if: You sell to the general public (consumers). You effectively just make your prices 20% higher for no benefit to them.

Sole Trader vs Limited Company

Is this definitely the right path?

The sole trader vs limited company UK debate usually comes down to tax vs. hassle.

- Sole Trader: Simple. Low admin. Low cost. But there is a high personal risk (if the business gets sued, you get sued).

- Limited Company: Separate legal entity. Better tax planning if you earn over £50k. But, much more paperwork and higher accountancy fees.

Our advice? Start as a sole trader. Prove the business works. You can always “incorporate” into a Limited Company later. It’s much harder to dismantle a Limited Company and go back to being a sole trader.

Troubleshooting and Common Problems

“I stopped trading, but the letters keep coming.”

You must actively stop trading as a sole trader and tell HMRC. They are not psychic. If you don’t tell them you quit, they will fine you for not sending a tax return, even if you earned zero.

“I lost my UTR letter.”

Check your Personal Tax Account online or the HMRC app. It is usually displayed there.

“I have no idea how to fill out the form.”

Don’t guess. If you miscategorise an expense, it can trigger an enquiry. This is where an accountant pays for themselves.

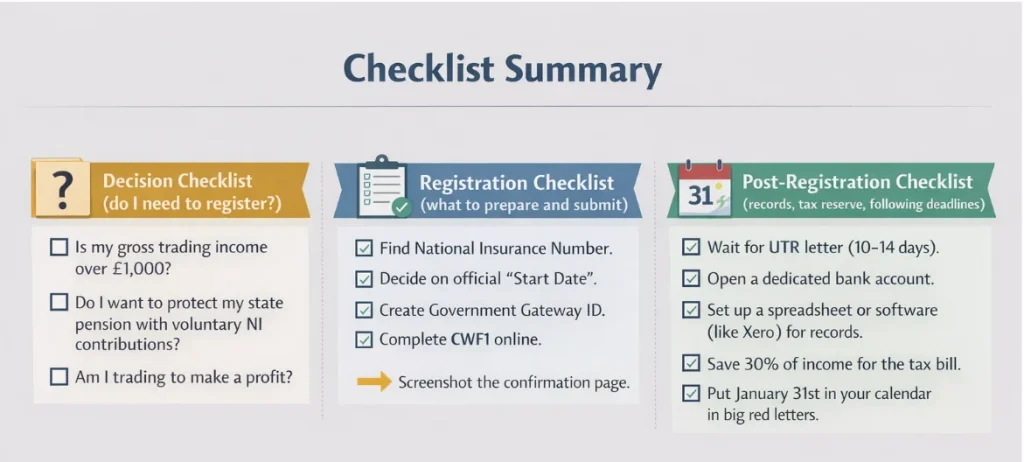

Checklist Summary

Decision checklist (do I need to register?)

- Is my gross trading income over £1,000?

- Do I want to protect my state pension with voluntary NI contributions?

- Am I trading to make a profit?

Registration checklist (what to prepare and submit)

- Find National Insurance Number.

- Decide on official “Start Date.”

- Create Government Gateway ID.

- Complete CWF1 online.

- Screenshot the confirmation page.

Post-registration checklist (records, tax reserve, following deadlines)

- Wait for UTR letter (10-14 days).

- Open a dedicated bank account.

- Set up a spreadsheet or software (like Xero) for records.

- Save 30% of income for the tax bill.

- Put January 31st in your calendar in big red letters.

How Lanop Helps Sole Traders

There is a difference between doing your taxes and doing your taxes well.

Anyone can fill in a form. But we help you sleep at night.

Register correctly and on time

We handle the HMRC registration properly, align dates and activity descriptions, and prevent avoidable issues. This is part of our dedicated sole trader service.

Stay compliant without overpaying

We apply the rules around allowable expenses confidently and defensibly. If you want a clearer view of what you can claim (especially under modern reporting rules), this guide is practical: MTD expenses for sole traders.

File and plan with confidence

We don’t just file; we explain. That includes Payments on Account, deadlines, and cash-flow planning. If you want help specifically with the annual return, see Self Assessment tax return support.

Scale and restructure when it makes sense

When your side hustle tax UK situation becomes a full-time career, we are there to advise on incorporation, VAT, and payroll.

Conclusion

Registering as a sole trader is the moment your project becomes “real.” It’s a box-ticking exercise, yes, but it’s an important one.

The key takeaway? Don’t hide from the admin. The horror stories you hear about HMRC usually come from people who buried their heads in the sand until the brown envelopes start piling up.

Get registered, get a separate bank account, and keep your receipts. If you do those three things, you are already ahead of 90% of new business owners.

And if you want someone to handle the whole process properly, registration, bookkeeping habits, Self-Assessment, and planning, that’s precisely what Lanop’s sole trader accountants do.

FAQs

Do I need to register as a sole trader?

Yes, if your gross trading income is over £1,000 in a tax year (April 6th to April 5th), or if you need to pay Class 2 National Insurance to qualify for benefits.

When should I register as self-employed with HMRC?

You should register as soon as you start trading. The absolute latest you can register is October 5th, after the tax year in which you started.

What is the deadline to register for Self-Assessment in the UK?

The deadline is October 5th. If you miss it, you might not get fined immediately, but you risk not getting your UTR in time to file your return by January 31st, which will result in an automatic £100 penalty.

What happens if I miss the registration deadline?

If you miss it, you might not get fined immediately, but you risk not getting your UTR in time to file your return by January 31st, which will result in an automatic £100 penalty.

Do I need to register if I earn under £1,000?

Usually, no. If your total sales are under £1,000, you don’t need to tell HMRC anything.

Is the £1,000 trading allowance based on revenue or profit?

It is based on revenue (turnover). Even if your expenses mean you made zero profit, if your sales were over £1,000, you must register.

How do I register as a sole trader with HMRC?

Go to gov.uk, create a Government Gateway ID, sign in, and select “Register for Self Assessment.“ You will need to answer questions about when you started and what your business does.

What details do I need to register?

You need your National Insurance number, full name, home address, business start date, business name, and a description of the work you do.

What is a UTR, and why do I need it?

A UTR (Unique Taxpayer Reference) is a 10-digit number that identifies you to HMRC. You cannot file a tax return or pay tax without it.

How long does it take to get a UTR?

It can vary, but typically it takes about 10 to 15 working days to arrive by post.

I already have a UTR, do I need a new one?

Do not register for a new UTR. You should log in to your existing account and re-register for Self-Assessment (Form CWF1) to reactivate your trading status.

I'm on PAYE. How do I report business income?

You register for Self Assessment for the business only. At the end of the year, you fill in a tax return that includes your salary (from your P60) and your business profit. HMRC calculates the extra tax due.

I sell on eBay/Amazon/Etsy. When do I register?

Register if your total sales exceed £1,000. You must keep digital records of all sales, platform fees, postage receipts, and the cost of items you sold.

What records do sole traders need to keep?

You must keep digital records of all sales, platform fees, postage receipts, and the cost of items you sold.

What taxes do sole traders pay?

You pay Income Tax on profits (20%, 40%, or 45%) and Class 4 National Insurance. You may also pay Class 2 National Insurance depending on your profit level.

When do I need to register for VAT?

You must register if your taxable turnover (sales) goes over £90,000 in a rolling 12-month period.

When should I switch to a limited company?

It is worth considering a limited company when your profits hit around £50,000 for tax efficiency, or sooner if you need the legal protection of limited liability.