Introduction

If you’re a professional contractor in the UK, the phrase IR35 legislation likely conjures up a mixture of stress, confusion, and tax anxiety. You’ve earned a great rate, say, £500 a day for specialist IT consulting, but how much of that are you keeping? And, more importantly, are you operating safely and in compliance?

This isn’t just abstract tax law; IR35 legislation is fundamental to your entire contracting life, determining your operational status, your exposure to HMRC enquiries, and crucially, your net take-home pay.

The legislation’s goal, put, is to ensure that “disguised employees”, those who work like an employee but bill through an IR35 limited company for tax advantages, pay the appropriate Income Tax and National Insurance Contributions (NICs).

This comprehensive guide, written by a Lanop specialist who handles these rules every day, cuts through complexity. We’ll cover the core status tests, the significant 2021 reforms, the forecast IR35 changes 2025, and provide practical, numbers-focused insight into how IR35 affects your tax.

We know the central question: “Am I inside or outside IR35, and how does it really affect my tax and take-home pay?“ Let’s get you the expert clarity you need.

What is IR35 Legislation Explained in Simple Terms?

IR35 legislation is the UK’s anti-avoidance tax law. Formally known as the Intermediaries Legislation (Chapter 8, ITEPA 2003), it applies when a worker provides services to a client through an intermediary, typically their Personal Service Company (PSC). The rule asks a key question: if the PSC weren’t there, would the worker be considered an employee of the client? If the answer is yes, then IR35 applies.

The sole purpose here is tax parity. HMRC introduced it to stop “disguised employment,” where professionals benefit from the tax efficiency of a limited company (lower dividend taxes, more allowable expenses) while enjoying the security and working practices of employment.

The Difference Between IR35 Legislation and IR35 Off-Payroll Working Rules

This is where confusion often lies. The original IR35 legislation (Chapter 8) placed the responsibility for determining status and paying the correct tax squarely on the contractor’s PSC.

However, the IR35 off-payroll working rules (Chapter 10) are the 2017 (Public Sector) and 2021 (Private Sector) reforms. These reforms shifted the compliance burden. Now, for medium and large clients, the client determines the status, and the fee-payer (often an agency) deducts PAYE/NICs if the role is ‘Inside IR35’.

When we talk about HMRC IR35 compliance today, we are usually referring to the modern Chapter 10 IR35 off-payroll working rules.

Who Does IR35 Apply To

IR35’s legislation doesn’t apply to every self-employed person; it specifically targets services delivered through an intermediary.

IR35 – Who the Rules Affect in the Supply Chain

| Role | Application of Rules | Key Factor |

|---|---|---|

| Contractors operating through Personal Service Companies (PSCs) | The primary target. The rules assess the relationship between the worker (via their PSC) and the client. | Intermediary in the supply chain. |

| Freelancers and self-employed workers | Generally, not directly applicable if they contract directly as a sole trader. IR35 law is focused on the intermediary. | No intermediary (PSC) is involved. |

| Umbrella company workers | They are employees of an umbrella company. They operate under PAYE, so IR35 legislation is effectively “priced in” or irrelevant, although the gross rate is determined by the client’s assessment. | Already employed for tax purposes. |

| End-clients (medium/large) | Responsible for status determination (SDS) and taking reasonable care. | Compliance and liability risk. |

| Agencies and fee-payers | Responsible for deducting PAYE/NICs if the client determines the role is Inside IR35. | Payroll and collection risk. |

The IR35 Small Company Exemption

This is a critical lifeline for many contractors. If the end client is classified as ‘small’ under the Companies Act 2006, they are exempt from Chapter 10 IR35 off payroll working rules.

The responsibility for determining status and handling tax then reverts to the contractor’s PSC under the original Chapter 8 rules. A company is ‘small’ if it meets two or more criteria for two consecutive financial years:

| Criteria | 2024/25 Threshold | 2025/26 Threshold (From 6 April 2025) |

|---|---|---|

| Annual Turnover | Not more than £10.2 million | Not more than £15 million |

| Balance Sheet Total | Not more than £5.1 million | Not more than £7.5 million |

| Number of Employees | Not more than 50 | Not more than 50 |

Case Study: The Small Company Advantage

Sarah, an HR consultant, had two contracts: one with a FTSE 100 firm (large) and one with a rapidly growing tech startup. The startup, with 35 staff and £8m turnover, met the ir35 small company exemption criteria. We advised Sarah that she needed to conduct her own ir35 assessment for the startup contract, giving her full control over the determination and PSC tax management.

Inside IR35 vs Outside IR35

This is the central dilemma. The distinction is not merely administrative; it defines your tax reality and working freedom.

- Inside IR35: The contract is deemed one of ‘disguised employment.’ For tax purposes, you are treated as an employee. This means the contract income must be subject to PAYE Income Tax and NICs at source.

- Outside IR35: The contract is genuinely a business-to-business relationship. You are treated as a truly self-employed enterprise. You pay Corporation Tax, and you can take a tax-efficient mixture of low salary and dividends.

How IR35 Affects Your Tax

IR35 status and tax for contractors change dramatically based on this line.

The immediate issue here is: “Will I earn less inside IR35?” Yes, almost certainly. When you are Inside IR35, you lose the primary benefit of operating an ir35 limited company: the ability to extract profits via lower-taxed dividends and claim a wide range of business expenses.

Furthermore, the client or fee-payer must deduct Employer’s NICs (currently 15% for 2025/26). While legally an employer cost, this is almost always factored out of the gross contract rate offered to the contractor, meaning the contractor effectively absorbs this significant 15% cost, leading to higher effective taxation and a substantial drop in net income.

Case Study: Negotiating the Rate

Mark, a software developer, was offered an Inside IR35 role with a day rate of £450. We advised him to maintain a similar net income to his £400 Outside IR35 rate, he needed to account for the 15% Employer NIC burden plus employee tax/NICs. We helped him negotiate an uplifted rate to £520, which the client accepted, understanding the new employment cost reality.

IR35 Status Determination (How HMRC Decides)

HMRC, tax tribunals, and clients use a set of employment status tests developed through decades of common law, stemming from cases like Ready Mixed Concrete. We must look past the paperwork and assess the reality of the working relationship.

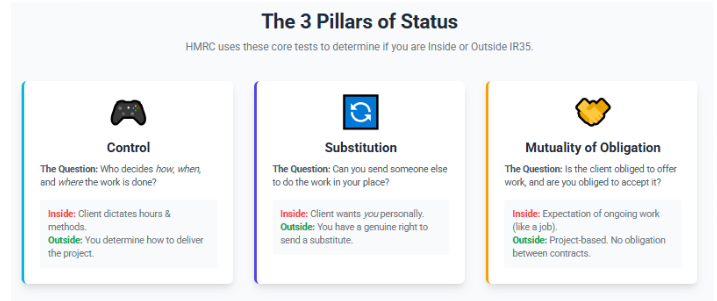

The Three Cornerstone Tests

a) Control: The Decisive Factor

Control is often the most important factor in an ir35 status determination. It asks: who decides how, when, and where the work is done?

- Inside IR35 Pointer: The client dictates specific daily hours, requires approval for time off, dictates the specific methods or sequence of tasks, or can move the contractor between unrelated projects.

- Outside IR35 Indicator: You are engaged for a specific deliverable, and you have the autonomy to determine your own methodology, schedule, and sometimes location to achieve that result.

b) Substitution / Personal Service

The right of substitution is a powerful indicator of self-employment. A genuine contractor is contracting a service from their PSC (their business), not their personal service.

- Outside IR35 Indicator: Your contract must include an unrestricted right to send a substitute, provided the substitute is suitably qualified. Crucially, this substitution must be at your own cost, and the client’s only right is to check the substitute suitability (not veto them based on personal preference).

- The Trap: HMRC frequently disregards substitution clauses that are purely contractual “shams” and have no practical reality (e.g., in high-security roles or if the client would never allow it).

c) Mutuality of Obligation (MOO)

MOO is often misunderstood. It refers to the reciprocal obligation: the client must be obligated to provide work, and the worker must be obligated to accept it.

- The Modern View: MOO is often present during a contract (you agree to work; they agree to pay). The decisive factor in IR35 is usually the lack of an ongoing obligation. Outside IR35 engagements should be project-specific, with no expectation or obligation for the client to offer future work, and no obligation for the contractor to accept it.

Case Study: Challenging Control

Amelia, an engineering project manager on a £750 day rate, was deemed Inside IR35 by her client’s automated ir35 status determination tool because she had to attend 9 a.m. meetings. Lanop helped her challenge this, demonstrating with evidence that while the meeting was fixed, she controlled the rest of her day, set her own methodology, and worked for others. We argued that the meetings were co-ordination, not control.

Clinet Testimonial: “The advice was surgical. We proved the client only controlled the ‘what’ (the outcome), not the ‘how’ (the method), which was key to overturning their initial IR35 assessment.” – Amelia

Secondary Status Tests: Being “In Business on Your Own Account”

Beyond the core three, tribunals assess the commercial reality of your PSC, asking if you are genuinely running a business. These secondary factors provide crucial context.

- Financial Risk: You must be exposed to risk. This means correcting faulty work in your own time at your own cost, facing bad debts, and incurring business expenses.

- Provision of Own Equipment: An independent business usually invests in its own significant tools, software, and premises. If the client provides everything, it points towards employment.

- Integration: Avoid acting like a staff member. Don’t use client email addresses, attend company social events, or benefit from employee perks like paid sick leave.

Contract vs. Working Practices

Let’s bust the biggest myth: “A strong contract alone keeps you outside IR35.”

The written ir35 contract is important, but actual working practices can, and often do, override it. HMRC and the tribunals look at reality.

The famous Kaye Adams (Atholl House Publishing) case proves this. The ultimate ruling that she was outside IR35 wasn’t based solely on her contract but on the overall commercial picture, proving that secondary factors and the reality of the work matter deeply. You need to ensure your contract and your day-to-day reality align perfectly.

Status Determination Statement (SDS)

For medium and large clients, the IR35 off payroll working rules mandate a formal ir35 status determination statement (SDS).

What is a Valid SDS?

The SDS is a document issued by the client that states their conclusion (Inside or Outside IR35) and, critically, provides the specific reasons for that determination. It must be passed to the contractor and the next party in the chain (the agency/fee-payer).

The client must exercise reasonable care in reaching this conclusion. Without reasonable care, the SDS is invalid, and the tax liability transfers from the fee-payer back to the client, a massive risk for them.

The Problem of “Blanket Determinations”

A blanket determination, where a client assesses an entire role or department as ‘Inside IR35’ without assessing the unique working practices of each individual contractor, is explicitly considered a failure to take reasonable care by HMRC. This practice is unlawful and highly risky for the client, as it automatically transfers the financial liability back to them.

Contractor Rights to Challenge

If you receive an SDS you disagree with, you have a statutory right to challenge the decision.

- Submit the Challenge: You must submit your challenge in writing within 45 days, providing specific reasons and evidence (emails, SOWs, working practice details) to support your claim of being Outside IR35.

- Client Review: The client must review your challenge and respond within 45 days. They must either issue a new SDS upholding your appeal or reaffirm the original determination with a detailed explanation.

This process is vital. It’s your chance to provide factual, documented evidence that the client’s initial automated or role-based decision failed to capture genuine self-employment in your specific engagement.

Case Study: The Successful SDS Challenge

Chantelle, a finance consultant on a £300 day rate, was issued an Inside IR35 SDS. The stated reason was “Standard Contractor Role.” Lanop helped her draft a formal, evidence-backed appeal, including project plans and emails showing she refused to attend a staff training day and had negotiated her own working hours. The client reviewed the evidence, agreed the role was genuinely project-based, and reversed the ir35 status determination statement.

Practical Tax Impact: How IR35 Affects Your Take-Home Pay

The primary effect of IR35 legislation is on your bottom line. Let’s look at IR35 contractor tax implications directly.

Inside IR35: PAYE, NICs, and Employer Costs

If you are Inside IR35, your contract income is taxed like employment:

- Income Tax & Employee NICs: Deducted via PAYE at source (20% basic, 40% higher).

- Employer NICs (15%): The fee-payer (agency/client) must pay 15% Employer NICs on earnings above the Secondary Threshold (£5,000 annually, 2025/26). This cost is almost always deducted from the gross rate paid to your limited company or umbrella. This is the single biggest factor reducing your take-home pay.

- Restricted Expenses: Your IR35 status tax deduction rules severely limit what you can claim. If using your limited company, you get a 5% flat-rate allowance for admin costs, plus limited items like professional indemnity insurance. Daily travel, home office costs, and subsistence are disallowed.

Outside IR35: Tax-Efficient Profit Extraction

When Outside IR35, you have flexibility:

- Corporation Tax: Your PSC pays Corporation Tax (CT) on profits (19% for 2025/26).

- Income Extraction: You take a small salary (taxed under PAYE) and the remainder as dividends. Dividends are taxed at lower rates (8.75% basic, 33.75% higher in 2025/26).

- Full Expenses: You can claim all legitimate and wholly necessary business expenses against CT, reducing your tax liability.

Simple Worked Examples (Approximate)

The precise impact depends on individual circumstances (e.g., pension contributions, tax codes), but the following approximations show the steep difference:

| Day Rate (Based on 220 days/year) | Outside IR35 (PSC) Net Annual Income (Approx.) | Inside IR35 (PAYE via Umbrella/PSC) Net Annual Income (Approx.) | Percentage Loss of Income |

|---|---|---|---|

| £300/day (£66,000 p.a.) | £56,000 - £58,000 | £43,000 - £45,000 | ~20–25% |

| £500/day (£110,000 p.a.) | £88,000 - £92,000 | £60,000 - £65,000 | ~30–35% |

| £750/day (£165,000 p.a.) | £125,000 - £130,000 | £85,000 - £90,000 | ~30–35% |

The loss of income for a higher-rate contractor (£500–£750 day rate) is significant, often 30% to 35% compared to Outside IR35. This difference illustrates why a robust IR35 assessment is critical. You must use a professional ir35 tax calculator or speak to an accountant for a personalized, precise projection.

Case Study: The Tax Hit

Elena, a technical architect for £600/day, received an Inside IR35 determination. We ran a precise financial comparison. The results showed her annual tax and NIC bill would increase by approximately £25,000 compared to her previous Outside IR35 arrangement, primarily due to the 15% Employer NIC burden and loss of dividend tax efficiency. This immediately justified demanding a 15–20% rate increase from the client.

“The numbers from the ir35 tax calculator were frightening, but Lanop gave me the leverage to negotiate a commercial rate that properly compensated me for the contractor tax IR35 inside burden.”

- Elena

IR35 for Limited Companies

IR35 for Limited Company Tax Planning

For many contractors, the PSC is the heart of their business. IR35 legislation profoundly affects how you run your ir35 limited company.

If you are consistently Outside IR35, your PSC is an effective vehicle for:

- Profit Extraction: Maximizing dividends and Corporation Tax efficiency.

- Tax Planning: Utilizing pension contributions, Research & Development (R&D) claims, and other legitimate business reliefs.

- Reserves: Retaining earnings within the company for future investment or a planned tax-efficient closure.

If your role is determined to be Inside IR35, you face two choices:

- Operate Inside IR35 via your PSC (Deemed Payment): The fee-payer runs the contract income through PAYE, and the money is paid to your limited company. You only benefit from the 5% flat-rate allowance and limited allowable expenses.

- Move to an Umbrella Company: This is often simpler. If the contract is deemed Inside IR35, moving to an umbrella removes the hassle of the ‘deemed payment’ payroll calculation, simplifies compliance, and offers continuity of employment for things like mortgage applications. However, you lose all of your ir35 limited company’s tax efficiency and control.

For many contractors’ tax IR35 inside scenarios, especially short-term ones, the simplicity of the umbrella outweighs the administrative hassle of running a ‘deemed payment’ calculation through a PSC with severely restricted expenses. This trade-off must be managed by your accountant.

IR35 & Contracts (Critical Contractor Consideration)

You must treat your ir35 contract review with the utmost seriousness. The contract and working practices must align to demonstrate genuine self-employment.

Contract Clauses HMRC Focus On

HMRC and tribunals scrutinize these clauses:

- Substitution: Is the right to substitute genuine, unrestricted, and exercised at your cost?

- Control: Does the contract clearly state you are engaged for a result or delivery, not for a fixed time? Does it give you autonomy over methods and working hours?

- Mutuality of Obligation: Does the contract state a clear end date (or end trigger), with no ongoing obligation to offer or accept work beyond the current Statement of Work (SOW)?

- Equipment and Financial Risk: Does the contract state you provide your own essential equipment and that you are liable for correcting any faulty work without pay?

Avoiding Employee-Like Behavior Traps

Avoid ’employee-like behavior’ at all costs. This is where the contract fails in reality.

- Open-Ended, Rolling Contracts: These look much more like permanent employment than fixed-term, project-based contracts.

- Fixed Hours: If your client insists you work 9 to 5, you look like an employee.

- Line Management/Supervision: A client should manage what you deliver, not how you deliver it. Supervision of method is a major red flag

Case Study: Contract Remediation

Raj, a management consultant, brought us a draft ir35 contract which stated, “Contractor must attend all team meetings and report to the Programmed Director daily.” We immediately flagged this as an IR35 compliance risk. We helped him successfully negotiate rewording the clause to “The Contractor will attend essential project co-ordination meetings as required to meet the Statement of Work deliverables,” and removed the direct reporting line.

IR35 Compliance: How to Stay Safe

Managing IR35 compliance isn’t a one-off task; it’s continuous risk management.

Practical Steps to Reduce IR35 Compliance Tax Risk

- Check Working Practices Regularly: Does the reality on the ground still match your Outside IR35 status? A shift in client behavior (e.g., adding supervision) can quietly fail your status.

- Keep Documentation: Maintain records for a minimum of six years. Document everything: signed SOWs, emails demonstrating autonomous decision-making, and evidence of seeking new clients or business investment.

- Annual IR35 Assessment and Contract Reviews: Proactively review your contract and working practices before and during an engagement.

- Use IR35 Insurance Sensibly: Comprehensive insurance covers two things: a) Legal Defense Costs (typically £50k–£100k per claim) and b) Tax Liability Coverage (protecting against back taxes, interest, and penalties).

When in doubt, always seek professional IR35 reviews, like those offered by Lanop, to get an independent opinion that HMRC can respect.

Case Study: Audit Trail Defence

Maria received a full HMRC enquiry notice regarding two years of her tax affairs. She was initially terrified. Because she had meticulously documented her contracts, substitution discussions (even if not exercised), and business expenses based on our advice, we were able to present a clean, clear audit trail that demonstrated ‘reasonable care.’ This led to HMRC concluding the investigation with no further action.

IR35 Assessment Tools

HMRC’s CEST Tool

HMRC’s online tool, Check Employment Status for Tax (CEST), is designed to help determine status. HMRC guarantees to stand by the determination if the information entered is accurate and remains in line with their guidance.

However, CEST has clear limitations:

- Inconclusive Results: It frequently results in an ‘unable to determine’ outcome in nuanced or borderline cases, shifting the burden back to the client.

- Accuracy is Key: The result is only as good as the input. Misunderstandings of working practices can lead to unreliable outcomes.

Third-Party IR35 Assessment Providers

To fully discharge the ‘reasonable care’ requirement, clients and contractors often turn to independent third-party experts, such as those that partner with Lanop. These services typically offer a comprehensive review of both the written contract and the actual working practices, providing a holistic and robust opinion that often goes beyond the scope of the HMRC ir35 tool.

IR35 Off-Payroll Rules for Clients

The 2021 reforms fundamentally changed the relationship between client and contractor.

Client and Fee-Payer Responsibilities

For medium and large clients:

- Client (End Hirer): Responsible for the ir35 status determination and issuing the SDS. You must take reasonable care.

- Fee-Payer (Agency): If the determination is Inside IR35, the fee-payer must operate PAYE and NICs.

Penalties and Risks

Getting a determination wrong exposes the client to significant penalties: up to 100% of the unpaid tax, interest, and potential extension of the enquiry window to six years if HMRC deems the failure ‘careless’.

Clients can structure compliant processes by:

- Conducting individual, not blankets, assessments.

- Training staff (HR/hiring managers) on the nuances of the legislation.

- Maintaining a clean audit trail (SOWs, SDSs, challenge responses).

- Ensuring clear information sharing through the supply chain.

IR35 & Umbrella Companies

If you take an Inside IR35 role, an umbrella company becomes a popular choice.

How Umbrella Companies Work

An umbrella company acts as your employer, receiving the gross fee from the agency/client. They run this income through their payroll, deducting Income Tax, Employee NICs, and Employer NICs (the 15% cost). They also typically deduct an admin fee.

The key benefits are simplicity and compliance; you are paid via PAYE, so the IR35 umbrella company tax effect is straightforward.

Compliance Risks

You must watch out for non-compliant umbrellas that try to use contrived tax avoidance schemes (e.g., claiming payments are non-taxable to avoid the 15% Employer NIC cost). HMRC has issued warnings (Spotlight 60) emphasizing that you as the worker are personally responsible for any resulting tax debt, interest, and penalties, even if the scheme was marketed as compliant. Always choose a reputable, fully transparent umbrella company.

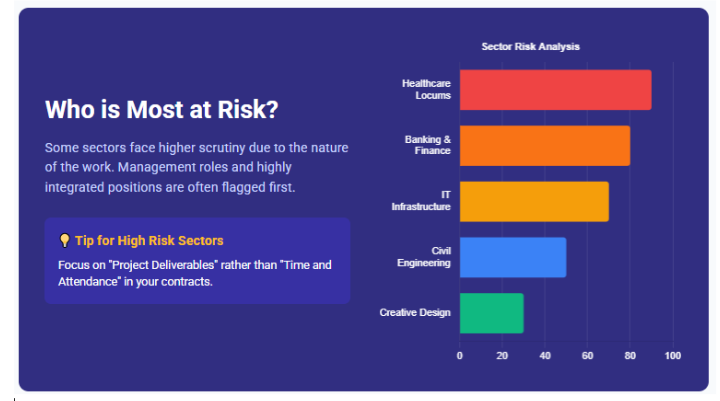

Sector-Specific Guidance

While IR35 legislation is industry-neutral, HMRC ir35 scrutiny and typical working patterns vary significantly by sector.

| Sector | Typical Risk Level | Common Working-Practice Traps |

|---|---|---|

| IT & Tech Contractors | High (Highest Scrutiny) | Working full-time, on-site for months; using client’s IT equipment/email; being part of Agile “scrums” and receiving direct supervision. |

| Construction | Medium | High site presence is normal, but control over method and being treated like a PAYE worker without substitution is a trap. |

| Healthcare Locums | High (High Volume) | Working fixed rotas; low financial risk; high level of client control over how work is performed. |

| Management/Finance/HR Consultants | Medium/High | Integrated into client’s management structure; using client job titles; rolling contract extensions. |

| Engineering Contractors | Medium/High | Like IT; long-term, sole client relationships; lack of evidence of working for others. |

How Lanop Helps: Your Specialist IR35 Defense

At Lanop Business & Tax Advisors, we are seasoned UK contractor accountants and tax specialists. We don’t just process your accounts; we act as your expert defense and strategic tax partner for all IR35 and contractor status tax issues.

Take Control of Your Status and Tax Today:

- IR35 Contract and Working-Practice Reviews: Our specialists provide robust, documented reviews of your contract and day-to-day practices, complete with suggested amendments to secure Outside IR35 status.

- SDS and Status Challenges: If you receive an unfair determination, we manage the formal challenge process, leveraging case law and expert evidence to overturn incorrect Inside IR35 decisions.

- Contractor Accounting & Tax Optimization: We handle all your PSC compliance, ensuring you are extracting profits tax-efficiently when Outside IR35, and managing your financial transition smoothly if you take an Inside IR35 role.

- Tax Planning around IR35 and Contractor Status Tax: We provide personalized rate and pay calculations, enabling you to negotiate commercially viable rates that compensate for the full tax burden of Inside IR35 roles.

Getting specialist help early can save you from years of tax, stress, and risk. Don’t leave your livelihood by chance.

Book A Free Consultation with Lanop now to secure your status and take-home pay

Conclusion:

IR35 legislation is here to stay, and the IR35 off payroll working rules have fundamentally shifted risk and responsibility. The difference between Outside IR35 and Inside IR35 isn’t just a label; it’s the difference between keeping 75% of your income and keeping 60%.

The path to safely operating Outside IR35 requires professional vigilance: meticulous contract negotiation, continuous alignment of working practices, detailed record-keeping, and the proactive use of expert ir35 assessment. For those moving Inside IR35, demanding the correct rate uplift to offset the IR35 reforms tax impact is non-negotiable.

LANOP Business & Tax Advisors are here to help you get it right, every time.

FAQs

What is IR35 legislation explained in simple terms?

It’s an anti-tax avoidance ir35 law that ensures contractors who work like employees pay tax like employees.

How do I know if I’m inside or outside IR35?

You are inside if the client has high control over how you work, there is no genuine right of substitution, and there’s an expectation of ongoing work. You are outside if you demonstrate genuine autonomy and business risk.

What does IR35 mean for contractors in 2025?

Expect stricter umbrella regulation and slight increases in the ir35 small company exemption thresholds. The focus on robust IR35 compliance for clients will remain high.

Does ir35 law apply to self-employed workers?

It applies if you provide your services through an intermediary, like a PSC. If you are a direct self-employed trader, the normal self-employment rules apply.

How do I calculate my ir35 tax if I’m inside IR35?

You will be subject to PAYE Income Tax and Employee NICs, plus the fee-payer will deduct the cost of Employer NICs (15% for 2025/26) from your gross rate.

Does IR35 apply if I work for just one client?

Yes. Working for a sole client is a factor but not a determinant. Status depends on control, substitution, and MOO.

Can I dispute an inside IR35 decision or ir35 status determination?

Yes, you have a statutory right to challenge the SDS in writing within 45 days, and the client must respond within 45 days.

Do small companies have to follow ir35 regulations?

Clients that meet the ir35 small company exemption criteria are exempt from the Off-Payroll rules. The ir35 limited company contractor is then responsible for determining their own status under the original rules.

What happens if my IR35 status changes to mid-contract?

The client must issue a new SDS with reasons. The tax treatment (PAYE deductions) will change from the effective date of the new determination.

Do umbrella workers need to worry about IR35?

Not directly. Since they are employees of the umbrella, they are paid via PAYE. They primarily need to worry about the cost of the Employer NICs being deducted from their rate and avoiding non-compliant tax schemes.

What are the IR35 contractor tax implications of going inside IR35?

The biggest implications are the loss of dividend tax efficiency, the loss of most business expense deductions, and the absorption of the 15% Employer NIC cost.