Introduction

The Lasting Power of Attorney (LPA) system in England and Wales has gone through its biggest update in years. The Ministry of Justice runs the policy. The Office of the Public Guardian (OPG) handles the day-to-day work. The shift from paper forms to digital services is now well underway.

Demand drove the change. Registrations went from 691,746 in 2020/21 to over 1.36 million in 2024/25. To deal with this, the government raised fees and updated the law through the Powers of Attorney Act 2023.

This guide covers the LPA fee increase for 2026, who qualifies for a reduction, how the new Universal Credit rules work, and what the process looks like now. If you are also considering your wider estate plan, our estate planning service covers LPAs as part of a full wealth protection strategy.

Why Did LPA Fees Change?

The OPG works under a rule called full cost recovery, set by His Majesty’s Treasury. It means users pay for the service, not taxpayers.

Between April 2013 and March 2017, the OPG charged too much. Fees exceeded the actual cost of processing. This led to a refund scheme, and millions of donors received refunds. By April 2017, the fee settled at £82 per document.

But demand kept rising. An older population and greater public awareness put more pressure on the system. The OPG raised fees in November 2025 to cover the real cost of running a modern, digital service.

What Are the Current LPA Fees in 2026?

The standard registration fee is now £92 per document. This has been in effect since 17 November 2025. It applies to both LPAs and Enduring Powers of Attorney (EPAs). The fee is set by the date the OPG receives your document.

Most donors make two LPAs. One covers Property and Financial Affairs. One covers Health and Welfare. So the cost doubles. For couples, four documents mean a larger total spend.

| Application Category | Fee Now in Effect (From 17 November 2025) |

| Single LPA Registration | £92.00 |

| Dual LPA Registration (Single Person) | £184.00 |

| Couple Registration (4 LPAs Total) | £368.00 |

| Repeat Application Fee (within 6 months) | £46.00 |

| Enduring Power of Attorney (EPA) | £92.00 |

| Certified/Office Copy of LPA | £35.00 |

The repeat application fee is now £46. This is what you pay when you resubmit a rejected document. The OPG’s message is clear: get it right first time. The extra income from the rise is put at £11 million a year. It funds the move to digital.

How Long Does LPA Processing Take in 2026?

Current processing times run at 12 to 16 weeks. The OPG has cleared its backlog, and things have improved the 20-plus-week delays seen in earlier years.

Every application also has a built-in 28-day wait. The Mental Capacity Act 2005 requires this. During this time, the OPG contacts anyone named as a person to be notified. They can raise concerns or formally object. After this period ends, the OPG aims to finish within 40 days. Digital applications move faster. Paper ones and those with errors take longer. The long-term goal is to achieve two weeks of fully digital applications.

Who Qualifies for LPA Fee Reductions in 2026?

The OPG offers two types of support. You can get a full exemption (100% off) or a remission (50% off). Both depend on the donor’s income, not the attorney’s or the person who fills out the form.

Full Fee Exemption

A donor qualifies if they receive certain means-tested benefits when the OPG gets the application. You need official proof, award letters dated within the current tax year work. Bank statements do not.

| Qualifying Benefit | Evidence Needed |

| Income Support | Official entitlement letter with dates and amounts |

| Income-based Jobseeker’s Allowance | Letter from the DWP |

| Income-related Employment and Support Allowance | Full breakdown showing the income-related element |

| Guarantee Credit (element of Pension Credit) | Breakdown showing the Guarantee Credit portion |

| Housing Benefit | Entitlement letter (bank statements not accepted) |

| Council Tax Reduction or Support | Letter from the local authority, not a single person discount letter |

| Local Housing Allowance | Official entitlement notice |

| Working Tax Credit (with qualifying elements) | Proof of Child Tax Credit or disability elements |

Personal Injury Exception: If a donor received a personal injury award over £16,000, they cannot claim a fee of exemption. This applies even if they receive one of the benefits above.

Remission for Low-Income Donors

Some donors do not receive those benefits but still have low incomes. A 50% remission is available, bringing the fee to £46 per document. The cut-off is a gross annual income under £12,000, before tax.

The income total must include state, workplace, and private pensions; wages or self-employment income; non-means-tested benefits such as Attendance Allowance, PIP, or DLA; and interest from savings, investments, or rental income.

Donors must send Form LPA120 with their application to claim the reduction. The OPG no longer accepts late claims. If LPA120 is missing when you apply, you pay the full £92 fee regardless of your income.

What Changed with Universal Credit and LPA Fees in February 2026?

This is the most important recent change for many donors. From 2 February 2026, Universal Credit no longer automatically gives you a fee reduction.

In the past, getting Universal Credit was enough to qualify for support. Most claimants got a reduction with little extra review needed. That has now ended. The OPG now looks at your total gross annual income. You only get the 50% remission if that income is under £12,000.

This means more work for donors and their advisors. You need 12 months of Universal Credit statements or a P60 to support your claim. If you are applying now and you receive Universal Credit, do not assume you will get a discount. Gather your income evidence first.

How Does the Powers of Attorney Act 2023 Affect LPA Registration?

The LPA fee increase in 2026 links directly to the Powers of Attorney Act 2023. This law got Royal Assent in September 2023. It gives the OPG the legal base to go digital. The old system had real problems. Wet signature rules, postal delays and high error rates made it slow and costly.

Donor-Centric Registration

Only the donor can now register an LPA. This is a key protection. It makes sure the donor knows about the application and agrees before anything begins.

Identity Verification

The new system verifies the identities of donors, attorneys, and certificate providers. This tackles growing LPA fraud. Checks may use government digital tools or standard document verification.

Error Reduction Through Digital Checks

The digital system checks for errors as you go. It stops you from submitting a form with the wrong signing order or missing fields. This should bring the current 15% error rate down fast.

The Hybrid Model

Not everyone is comfortable online. The Act keeps a paper route open. But the OPG has improved its handling of paper forms. Data from physical documents is now digitised more quickly. One area stays complex even in the digital version: the Preferences and Instructions sections. A computer can check if a box is ticked. It cannot determine whether an instruction is legally sound or will cause conflict between attorneys. This is where a professional advisor still adds clear value.

What Are the Most Common LPA Rejection Reasons?

In 2024, the OPG sent back over 133,000 applications. With the LPA registration cost now at £92, errors are more expensive. And with the repeat fee at £46, there is a real financial case for getting it right the first time.

| Cause of Rejection | How Common | How to Avoid It |

| Incorrect Signing Order | Around 15% of all errors | The donor signs first, then the certificate provider, then the attorneys. No exceptions. |

| Clerical Errors | Around 10% of rejections | Illegible writing or correction fluid on any page gets it rejected. |

| Unlawful Instructions | High in DIY cases | Avoid terms that cannot be enforced, such as medical instructions that clash with a clinician’s duties. |

| Inconsistent Information | Common in paper forms | Names and dates of birth must match in every section of the form. |

| Witness Eligibility | Common technicality | Attorneys cannot witness the donor’s signature. All witnesses must be over 18. |

The risk goes beyond the OPG fee. Think about this scenario. A donor loses mental capacity while fixing a rejected form. They can no longer sign a new one. The only route forward is a Deputyship application through the Court of Protection. That process can cost an estate thousands in legal and court fees. Getting it right the first time is not just about saving £46. It can save far more.

Good estate planning support makes sure your LPA is correctly structured and signed from the start, so rejection is never a risk.

Case Study: How LANOP Integrates LPAs Into Tax Planning

In UK tax and estate planning, an LPA is often an afterthought. People deal with inheritance tax first. LANOP Business and Tax Advisors took a different approach. Mental capacity planning is a core part of how LANOP protects client wealth, not an optional extra.

LANOP’s work covers landlord accounting, VAT returns, HMRC tax investigations and inheritance tax planning. In every one of those areas, an LPA can make or break the outcome.

Business Continuity and Business Relief

LANOP helps business owners use Business Relief to cut their IHT bill. Without a registered LPA, a director who loses capacity could leave a business unable to renew its VAT registration or manage payroll. A Business LPA lets a trusted person step in quickly and act until a long-term plan is in place. For more on how this fits into wider planning, see our guide on tax pitfalls to avoid for UK businesses.

Property Investors and the Let Property Campaign

For landlords, losing capacity at the wrong time can be costly. This is especially true for those using the HMRC Let Property Campaign to sort out their tax position. If a landlord loses capacity mid-investigation, their attorney needs legal authority to deal with HMRC, file returns and keep the process moving. The LPA grants this. Without it, everything stops. Our landlord accounting team always recommends establishing an LPA before initiating any voluntary disclosure.

Gifting and the 7-Year Rule

Good IHT planning often relies on lifetime gifts. But if a donor loses capacity, attorneys cannot make large gifts without clear instructions in the LPA or a Court of Protection order. LANOP makes sure the LPA includes the right clauses to keep a gifting plan on track. For more on IHT gifting rules, read our blog on strategies to avoid inheritance tax on a house. For wider asset planning, our succession planning service covers how an LPA fits into a long-term ownership transition.

Testimonial:

“We came to LANOP for landlord accounting and to cut our IHT bill. Our advisor said we had to do our LPAs first. We were a bit surprised. Then my husband had a minor stroke. Because the LPA was already in place, our advisor kept our gifting plan going without interruption. Without that £164 spent, our IHT bill would have been close to £50,000 higher.” — LANOP Client, Property Investor

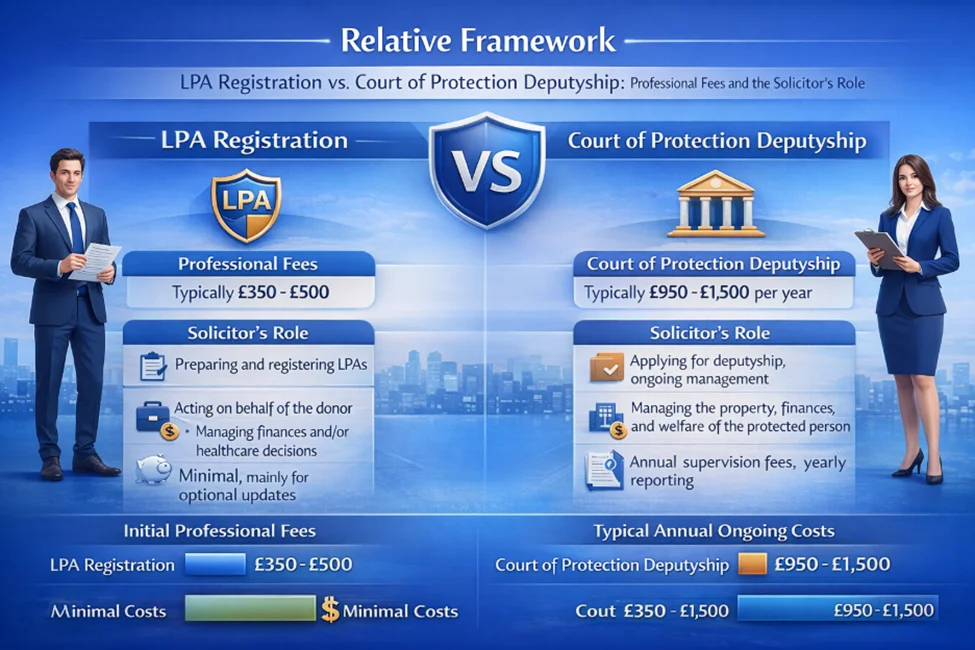

How Does LPA Registration Compare to Court of Protection Deputyship?

If someone loses capacity without a registered LPA, a Deputyship Order is the only option. It is slower, more expensive and far more intrusive.

| Metric | Lasting Power of Attorney | Deputyship Order |

| Upfront Cost (2026) | £92 (Single) / £184 (Dual) | £421 (Court Application Fee) |

| Annual Fees | £0 (unless disputed) | £320 supervision plus £200 to £400 bond |

| Time to Set Up | 12 to 16 weeks | 6 to 12 months |

| Donor Control | Maximum, you choose the person | At a minimum, the court chooses |

| Medical Assessment | Certificate Provider (solicitor or friend) | Formal medical capacity assessment |

| Reporting | None (unless disputed) | Mandatory annual financial accounts |

Deputyship happens when planning fails. A court order can take 12 months to get. In that time, families often cannot access accounts, pay for care or cover bills. Debt and real stress follow. The cost gap between an LPA and a Deputyship is why LANOP’s estate planning team treats LPA registration as urgent rather than optional.

How Much Do Solicitors Charge for LPA Services?

LPA solicitor costs in the UK vary. Most firms charge £300-£500 plus VAT per LPA document. Many offer both the Financial and Health LPAs together for £600-£1,000 for a couple. Some firms charge around £50 to act as a certificate provider. This means verifying the donor’s mental capacity and confirming no pressure is being applied.

A good advisor does far more than fill in a form. They add tailored instructions. These might prevent attorneys from selling certain family assets or require them to consult a named advisor before making major investments. LANOP’s estate planning service includes this level of detail as standard. It also aligns your LPA with your wider financial planning and IHT strategy, so everything works together.

How Can LANOP Help with LPA Planning?

LANOP Business and Tax Advisors provides joined-up support across estate planning, tax, and business continuity. Here is what that looks like in practice.

Integrated Tax Efficiency. LANOP ensures your LPA aligns with your IHT plan. A change in authority should not create tax costs or break your existing strategy. See how this connects with our inheritance tax planning service.

Business Continuity for Business Owners. LANOP drafts Business LPAs that keep your company running during incapacity. This covers payroll, contracts, VAT and HMRC duties. It links with our succession planning service for long-term business transitions.

First-Time-Right Applications. The industry rejection rate is 15%. LANOP’s advisors check everything before it goes in. This saves you the repeat fee, the delay and the far higher cost of a Deputyship application.

Full Wealth Protection. From trust setup to HMRC investigation support, LANOP treats the LPA as a core part of your financial plan, not an add-on.

Conclusion

The 2025/26 LPA fee changes are now in effect. The fee is £92 per document. The Universal Credit automatic pass ended on 2 February 2026. And the OPG no longer accepts late remission claims. If you have not yet registered your LPA, you are already operating under the new rules.

The LANOP case shows what an LPA can do when it is treated as a tax and business planning tool. It protects estates, keeps businesses going and stops a well-designed IHT plan from falling apart when the donor loses capacity.

If you have not yet registered, do not wait. The longer you leave it, the greater the risk. Make sure the signing order is correct, the witness is eligible, and every step follows the legal sequence. As the OPG moves fully digital, the advisor’s role will shift from filling out forms to protecting donors, ensuring the authority for an LPA grant is used wisely and in line with donors’ long-term wishes.

To talk through how an LPA fits your estate plan, speak to the team at LANOP’s estate planning service.

Frequently Asked Questions

The fee is £92 per document. This has been in effect since 17 November 2025. It applies to both LPAs and EPAs. The extra income from the rise, around £11 million a year, funds the OPG’s digital upgrade.

You need benefit award letters dated within the current tax year, a P60 or three months of payslips. Bank statements alone are not enough. Your LPA120 form must go in with your application. Late claims are no longer accepted.

If the donor receives a qualifying benefit, such as Income Support or Housing Benefit, they may be entitled to a 100% exemption. Donors with a gross annual income under £12,000 who do not receive those benefits may be eligible for a 50% remission, bringing the fee to £46 per document.

No. Each firm sets solicitor fees. The £92 is a fixed government charge. Professional fees are on top and vary by firm.

No. This changed on 2 February 2026. Universal Credit recipients must now prove their total gross income is under £12,000 to get the 50% remission. The automatic pass no longer applies.

Budget £184 for the OPG fee (two documents at £92 each). If you use a professional, add £500-£800. Couples registering four documents pay £368 in OPG fees.

Budget £184 for the OPG fee. Then add roughly £500 to £800. This is if you need professional legal support. This ensures that the documents are valid.

The process usually stops, and fees are not refunded. If the fee was paid between 2013 and 2017, when the OPG was overcharging, relatives may still be able to claim a refund under the old programme.

A Business LPA is a Financial LPA that gives a named person the legal right to run your business if you lose capacity. It covers payroll, contracts and VAT. Without one, your business could come to a halt, with no legal way for anyone to act until a court order is obtained.

No. A Deputyship is a court order that only becomes available after someone has lost capacity. It takes 6 to 12 months, costs far more, requires annual reporting and gives the donor no say in who is picked. An LPA set up in advance avoids all of that.