Introduction:

In the UK, tax does not work on guesswork or flexibility. It works on dates. Once those dates pass, problems tend to follow very quickly. One of the most important of those dates is the self assessment deadline, which affects far more people than many realize. Anyone who earns money outside a standard PAYE job, whether through self-employment, rental income, freelance work, or investments, is expected to take responsibility for reporting it. For income earned during the 2024/25 tax year, which ended on 5 April 2025, that responsibility comes to a head at the self-assessment deadline of 31 January 2026. By then, the return must be submitted online, and any tax owed must be paid to HM Revenue & Customs (HMRC).

What often surprises people is how much of the process rests on the individual. Under PAYE, most of the work happens in the background, and tax is deducted before wages even reach a bank account. Self-Assessment is different. It assumes you will keep track of your income, understand what needs to be declared, and calculate the figures correctly. That can feel manageable at first, but as the self-assessment tax return filing deadline gets closer, especially in the middle of winter, it becomes far more demanding. With tax thresholds frozen and the goalposts around side income still very much in motion, an increasing number of people are starting to tackle Self-Assessment for the first time. Spending time to understand self-assessment deadlines early on can be the difference between a smooth filing and 11th-hour panic.

Case Study: First-Time Self-Assessment Filing Without Last-Minute Stress

Client profile:

Freelance digital consultant, first year outside PAYE

Situation:

The client left full-time employment during the 2024/25 tax year and began freelancing alongside a short PAYE contract. They were unsure whether they needed to file a tax return and only became aware of Self-Assessment requirements in late summer. Like many first-time filers, they assumed HMRC would contact them automatically.

What Lanop did:

Lanop Business and Tax Advisors confirmed the client was required to file, completed the Self-Assessment registration before the October deadline, and ensured the UTR and Government Gateway access were set up early. We reviewed income sources, identified allowable expenses, and explained how payments on the account would work so there would be no surprises in January.

Outcome:

The return was filed well before the self-assessment deadline; the tax bill was planned, and the client avoided penalties entirely.

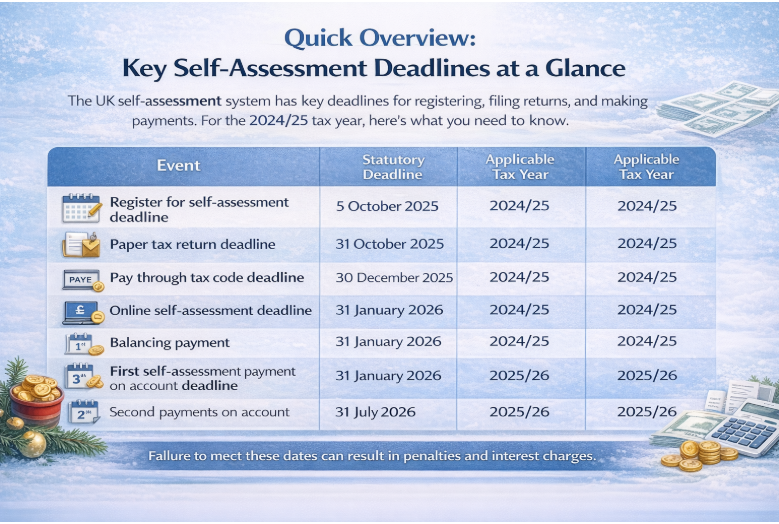

Quick Overview: Key Self-Assessment Deadlines at a Glance

The operation of the UK tax system is based on a series of payment and reporting dates designed to control the flow of data and money. Self-assessment time limits are designed to give taxpayers sufficient time to get their papers in order, but they do not excuse tardiness. It’s important to understand these dates to manage cash flow and stay compliant effectively. The 2024/25 tax year is the key target for this cycle and covers all income and capital gains earned between 6 April 2024 and 5 April 2025.

| Event | Statutory Deadline | Applicable Tax Year |

|---|---|---|

| Register for self-assessment (deadline 5 October 2025) | 5 October 2025 | 2024/25 |

| Paper tax return deadline 31 October 2025 | 31 October 2025 | 2024/25 |

| Pay through tax code deadline 30 December 2025 | 30 December 2025 | 2024/25 |

| Online self-assessment deadline 31 January 2026 | 31 January 2026 | 2024/25 |

| Balancing payment 31 January 2026 | 31 January 2026 | 2024/25 |

| First self-assessment payment on account deadline | 31 January 2026 | 2025/26 |

| Second payments on account 31 July | 31 July 2026 | 2025/26 |

What Is Self-Assessment and Who Needs to File?

Self-Assessment is how HMRC collects Income Tax from people whose tax has not been deducted at source. Unlike PAYE, under which HMRC collects tax and National Insurance contributions before a salary even reaches an employee’s bank account, Self-Assessment relies on individuals reporting to the state how much they have earned. It is a self-certification-based system that requires citizens to declare their eligibility to file and register accordingly. This would include the correct treatment of self-employed profits, rental income, and investment returns, as well as any relevant tax-free allowances and reliefs.

The relevant legislation for the procedure is found mainly in the Taxes Management Act 1970 and subsequent Finance Acts. The reporting restrictions are slightly more complex for tax year 2024/25, following changes to dividend allowances and capital gains relief that have been drastically reduced under recent government policy. As such, a large number of people may have avoided the self-assessment tax return filing deadline before but are now entering the system because their untaxed income exceeds the lowered limits.

Do I Need to Do a Self-Assessment Tax Return?

Determining whether an individual is required to file is the first step to avoid a self-assessment of a late filing penalty. The question of whether I need to do a self-assessment tax returnis typically answered by looking at my sources of income for the period from 6 April 2024 to 5 April 2025.

Individuals are generally required to file if they meet any of the following criteria:

- They were self-employed as sole traders and had a gross income of more than £1,000 before expenses.

- They were in partnership throughout the year.

- They had rental income from property if their gross income was above the £1,000 property allowance, even if they used only that proportion.

- They or their partner received Child Benefit and one of them had an adjusted net income (of more than £60,000), which led to the High-Income Child Benefit Charge being due.

- They had taxable income such as from savings, investments, or dividends above the allowances they were entitled to keep, which were £500 for dividends in 2024/25.

- They had disposed of assets, such as shares, crypto coins, or a second home, resulting in a capital gain of more than £3,000 above the annual exempt threshold.

- They had income for the year in excess of £150,000, whether or not all or part of it was received through PAYE.

- They want to get their hands on certain tax reliefs, such as pension contributions for higher-rate taxpayers or gifts to charity.

Who Does NOT Need to File?

Conversely, many individuals remain outside the scope of Self-Assessment if their tax affairs are simple and handled entirely via PAYE. Individuals typically do not need to file if:

- Their only income is from a single employer who uses PAYE, and they have no other untaxed income sources above the allowances.

- Their self-employed income is below the £1,000 trading allowance, and they do not wish to pay voluntary National Insurance contributions.

- They have already settled any tax due on dividends or interest income via a simple assessment or a dynamic tax code change initiated by HMRC.

- They sold assets for a profit, but the total gains were below the £3,000 Capital Gains Tax (CGT) exemption.

- HMRC has specifically contacted them to confirm they have been removed from the Self-Assessment system after the individual notified them of a change in circumstances.

It is vital to note that even if no tax is owed, if HMRC has issued a notice to file, the individual must submit a return or formally ask HMRC to withdraw the notice. Failing to do so will lead to an automatic fine the moment the self-assessment deadline passes.

Self-Assessment Deadlines for the 2024/25 Tax Year

Self-Assessment Registration Deadline: 5 October 2025

For individuals who have not previously filed or whose circumstances have changed and now owe tax, the self-assessment register deadline (5 October 2025) is the first critical feature on their radar. On this date for the year in question, you need to notify HMRC that you have a tax due based on what has been generated (by the employer and other bodies) for tax in the previous year. By registering the taxpayer at that date, you allow HMRC time to post the UTR. On my Amended Return instructions/interview, there is a statement that says E-file requires the 10-digit code shown in the image below.

And while HMRC may not penalize late registrations (at least, immediately) after this date, you run the growing risk of missing the final self-assessment tax return filing deadline in January. One common breaking point is the Government Gateway activation code – a letter in the post that takes 10 working days to reach the addressee. If a taxpayer tries to sign up on 20 January, “they probably won’t get their credentials in time for sending off the self-assessment by 31 January, and they’ll incur an avoidable £100 penalty as a result.

Paper Tax Return Deadline: 31 October 2025

HMRC has increasingly shifted toward a “digital-by-default” strategy, which is reflected in the significantly earlier paper tax return deadline of 31 October 2025. This date is set to midnight on Halloween, following the end of the tax year. The primary reason for this earlier date is to allow HMRC’s manual data entry teams enough time to process the physical forms and calculate the tax due before the January payment deadline.

Taxpayers who miss this date must shift to the online system. If HMRC receives a paper return after 31 October, it is considered late, and a self-assessment late filing penalty will be issued, regardless of whether the tax is paid by January. The only exceptions are for those with a reasonable excuse or those who cannot file online due to specific technical limitations of the HMRC system (such as in confidence or residency scenarios).

Online Self-Assessment Deadline: 31 January 2026

The vast majority of taxpayers use the online portal, which offers a 3-month extension compared to the paper route. The online self-assessment deadline of 31 January 2026 is the most publicized date in the UK tax calendar. It marks the final moment to submit the 2024/25 digital return and pay any tax owed.

The digital system offers immediate advantages, including an instant calculation of tax liability and an electronic acknowledgment of receipt. This “real-time” feedback is essential for those who need to know their balancing payment on 31 January 2026 to manage their business bank accounts. Despite the convenience, the portal often experiences heavy traffic in the final 48 hours, so it’s advisable to set an earlier internal deadline for self-assessment to avoid system timeouts or technical glitches.

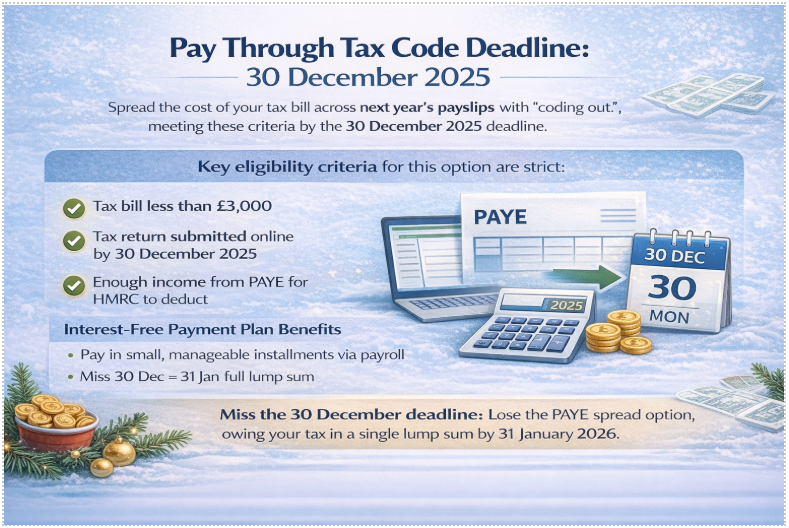

Pay Through Tax Code Deadline: 30 December 2025

A specific provision exists for those who wish to have their tax liability collected in small, manageable installments through their wages or pension throughout the following year. This is known as “coding out” debt. To qualify, the taxpayer must meet the pay through the tax code deadline of 30 December 2025.

The eligibility criteria for this option are strict:

- The tax bill must be less than £3,000.

- The return must be submitted online by 30 December 2025.

- The taxpayer must have enough income through PAYE for HMRC to take the deduction.

This option is highly beneficial for cash flow, as it effectively provides an interest-free payment plan. However, missing this date by even 24 hours removes the option, and the full balancing payment on 31 January 2026 must then be settled in a single lump sum.

What Do You Need to File Your Self-Assessment Tax Return?

Preparation is the cornerstone of a stress-free self-assessment tax deadline. Gathering documentation early prevents the typical “January rush” and reduces the likelihood of errors that could trigger an HMRC inquiry. The quality of the data submitted is just as important as the timeliness of the submission.

Core Information Everyone Needs

Regardless of the source of income, all filers must have their primary identifiers ready. These include:

- HMRC provides the 10-digit Unique Taxpayer Reference (UTR) upon registration.

- Their National Insurance number is used to link employment records and benefits.

- Records of any untaxed income received during the 2024/25 tax year, including cash payments and digital transfers.

- Details of any contributions to charities or private pensions, as these can provide relief that reduces the overall tax bill or extends the introductory rate of the band.

| Document | Source | Purpose |

|---|---|---|

| UTR Number | HMRC Letter | To identify the taxpayer on the portal. |

| P60 | Employer | To show total pay and tax deducted from a job. |

| P11D | Employer | To report benefits in kinds like company cars. |

| Interest Statements | Banks | To report untaxed interest earned on savings. |

| Dividend Certificates | Investment Platforms | To report dividend income over £500. |

What Do You Pay on 31 January 2026?

The financial obligation on the self-assessment tax deadline is often comprised of two or three distinct elements. This combined total can create a significant cash flow burden if not anticipated, particularly for individuals in their first year of self-employment or those whose profits have risen sharply.

Balancing Payment: What It Means

The balancing payment on 31 January 2026 is the primary element of the tax bill. It represents the difference between the total tax and National Insurance owed for the 2024/25 year and any payments on account made in January and July 2025.

If an individual’s total liability for the year is {L} and they have already paid {P} through payments on account, the balancing payment is calculated as:

{Balancing Payment} = {L} – {P}

If {L} is greater than {P}, the difference must be paid by midnight on 31 January 2026. This payment also includes any amounts due for the High-Income Child Benefit Charge and any Capital Gains Tax incurred on the sale of assets during the 2024/25 period.

Payments on Account Explained (31 January & 31 July)

The payments on account system, 31 January and 31 July, is HMRC’s way of collecting tax in advance for the current year. It applies to any taxpayer whose previous year’s bill was more than £1,000, unless more than 80% of their tax was already collected through PAYE.

Each payment on account is precisely 50% of the previous year’s total tax and Class 4 National Insurance bill. This means that on 31 January 2026, a taxpayer is not only settling their debt for the year that has passed (2024/25) but also paying 50% of their estimated debt for the year that is currently in progress (2025/26). This “look-forward” mechanism often comes as a shock to new freelancers, who effectively end up paying 150% of their first year’s tax bill in a single installment.

Can You Reduce Payments on Account?

HMRC understands that business conditions are not static. If the taxpayer is aware that their income for the 2025/26 tax year will be less than in 2024/25, perhaps because of the loss of a large client, having taken a career break, or they have deferred more into a pension, then these amounts can be applied for to reduce their self-assessment payment on account deadlines.

You can request this reduction when you file your return online or by completing form SA303 at a later time. Although HMRC rarely questions these requests at the time of submission, it pays to be accurate. If a taxpayer pays too little and the final tax bill is more than their new estimate, HMRC will levy interest on the shortfall from the date the payment was originally due. This interest rate is currently 4% above the Bank of England’s base rate, so it’s not a cheap mistake.

Case Study: Managing a High January Tax Bill with Time to Pay

Client profile:

Small business owner, retail services

Situation:

The client faced a much higher-than-expected tax bill due to a strong trading year. On top of the balancing payment, they were also hit with payments on account, making the January total unmanageable in one lump sum. The concern was not filing, but cash flow.

What Lanop did:

Lanop ensured the return was filed on time to avoid late filing penalties, then helped the client apply for HMRC Time to Pay immediately after submission. We prepared realistic monthly figures and handled communication with HMRC to secure approval.

Outcome:

The client avoided late payment penalties, spread the tax bill over manageable instalments, and kept the business running smoothly.

What If You Can’t Pay Your Self-Assessment Tax by 31 January?

Facing a tax bill that exceeds available liquid assets is a common source of anxiety as the self-assessment deadline approaches. HMRC has established mechanisms to support those in genuine financial difficulty, provided the taxpayer is proactive in their communication.

HMRC Time to Pay: How It Works

The HMRC time-to-pay self-assessment service is a formal arrangement that allows taxpayers to spread their tax bill into monthly installments, typically over 12 months. In recent years, HMRC has automated this process, allowing individuals to set up a plan online without speaking to an advisor.

To set up an online plan, the following conditions must be met:

- The tax debt must be between £32 and £30,000.

- The taxpayer must have no other active payment plans or tax debts with HMRC.

- The 2024/25 tax return must have been filed before the plan is requested.

- The request must be made within 60 days of the self-assessment deadline.

While a Time to Pay arrangement stops the application of the late payment penalty self-assessment, it does not prevent the accrual of interest. HMRC is legally required to charge interest on all outstanding taxes to ensure fairness to those who paid on time.

What Happens If You File but Don’t Pay?

It is a critical strategic error to delay filing because of an inability to pay the tax. Filing on time is the only way to prevent a late-filing penalty from accruing. If a taxpayer files on time but pays late, they will face a 5% late payment penalty after 30 days, plus interest. However, if they fail to file and pay, they will face a £100 filing fine, daily penalties, and a payment penalty, resulting in a much larger total debt.

Filing the return also provides HMRC with the exact figures needed to negotiate a realistic payment plan. Without a return, HMRC may issue a “determination” with a formal estimate of what they think the taxpayer owes. These estimates are often higher than the actual liability and are legally enforceable until the actual return is submitted.

What Makes HMRC Refuse a Payment Plan?

HMRC is not a bank, and they treat Time to Pay as a last resort for those in genuine hardship. A request for a plan may be refused if:

- The taxpayer has a history of broken payment agreements or multiple years of non-compliance.

- The taxpayer has significant liquid assets (such as savings or investments) that could be used to pay the bill immediately.

- The proposed monthly installments would take significantly longer than 12 months to clear the debt without a compelling reason (such as long-term illness).

- The taxpayer has failed to keep up with other tax obligations, such as VAT or PAYE for their employees.

In such cases, HMRC’s Debt Management team may take more aggressive recovery action, including seizing goods, taking funds directly from bank accounts, or even initiating bankruptcy proceedings.

Self-Assessment Late Filing & Late Payment Penalties

The penalty regime in the UK is designed to be punitive enough to encourage timely submission while scaling with the duration of the non-compliance. These fines are not tax-deductible and represent a pure loss to the individual or business.

Late Filing Penalties Explained

The self-assessment late filing penalty is triggered at midnight on 1 February 2026. This £100 fine is automatic and is issued regardless of whether the individual owes any tax or is due to a refund.

If the delay persists, the costs escalate rapidly:

- Three months later: Daily penalties of £10 are charged for up to 90 days, totaling a maximum of £900.

- Six months later: A further penalty of 5% of the tax due or £300, whichever is higher, is added.

- Twelve months late: Another 5% or £300 is charged.

Late Payment Penalties Explained

The late payment penalty self-assessment follows a tiered structure based on the amount of tax unpaid. These are separate from the filing fines and also separate from the interest charges.

| Duration of Overdue Payment | Penalty Amount |

|---|---|

| Up to 30 days | No penalty (but interest accrues) |

| After 30 days | 5% of the tax unpaid at that date |

| After 6 months | A further 5% of the tax unpaid at that date |

| After 12 months | A further 5% of the tax unpaid at that date |

Under the Finance Act 2021, a new penalty regime is being phased in to align with Making Tax Digital. For those in the new system, a 2% penalty is applied if the tax is unpaid after 15 days, increasing to 4% after 30 days, followed by a daily “second late payment penalty” at an annualized rate. For the 2024/25 year, most taxpayers will remain under the 5% tier system, but staying updated on these shifts is essential as the self-assessment deadlines evolve.

Can You Appeal a Self-Assessment Penalty?

Taxpayers have a legal right to appeal against a self-assessment penalty they believe is incorrect or unfair. An appeal must usually be lodged within 30 days of the penalty of notice. To succeed, the taxpayer must demonstrate a “reasonable excuse” for a serious or unexpected event that prevented them from meeting their obligations despite taking reasonable care to do so.

Accepted reasonable excuses often include:

- The death of a partner or close relative shortly before the deadline.

- An unexpected stay in the hospital or a life-threatening illness.

- HMRC’s own system failures or technical issues that prevent submission.

- Natural disasters such as fires or floods destroyed business records.

- Postal strikes or significant delays that were entirely outside the taxpayer’s control.

Excuses that are almost never accepted include finding the website too difficult, forgetting the deadline, or being let down by an accountant. HMRC expects taxpayers to have contingency plans, such as appointing an alternative person to file if they are busy or ill.

What Happens After You File Your Self-Assessment?

Once you hit the “submit” button, HMRC provides an immediate digital receipt. Within 72 hours, the calculation is processed, and your SA302 “Tax Calculation” becomes available for download. This document is an official summary of your income and tax for the year and is the primary evidence required by mortgage lenders and banks when you apply for credit as a self-employed person.

Filing the return starts the clock on the “enquiry window.” Under normal circumstances, HMRC has 12 months from the date of filing to open an inquiry into your return. During this time, they may ask for evidence of your expenses or clarification on your income sources. If you have kept good records and used an accountant to prepare your return, these inquiries are usually resolved quickly. However, if inaccuracies are found, HMRC can charge penalties for “careless” or “deliberate” errors, ranging from 30% to 100% of the tax understated.

Your return data is also used to update your National Insurance record. Paying your Class 4 and voluntary Class 2 contributions (if applicable) through Self-Assessment is what builds your entitlement to the State Pension and other contributory benefits. Ensuring your self-assessment deadline is met is therefore not just about avoiding fines but about protecting your future financial security.

How to Avoid Penalties

- Start early and don’t leave everything until January: Missing the self-assessment deadline often happens because registration, logins, or documents are delayed at the last minute.

- Always file your return on time, even if you can’t pay: Submitting the self-assessment tax return filing deadline avoids the automatic £100 late filing penalty. Payment issues can be dealt with separately.

- Know the key dates and work backwards from them: Understanding the main self-assessment deadlines makes it easier to plan, especially if payments on account are due.

- Keep simple, organized records during the year: Rushed figures lead to mistakes, and mistakes can trigger penalties or HMRC queries.

- Open and respond to HMRC letters or emails promptly: Ignoring notices can remove your right to appeal and make penalties harder to challenge.

- Tell HMRC if your circumstances change: If you no longer need to file, ask HMRC to withdraw the notice rather than assuming it no longer applies.

- Get advice early if something doesn’t look right: Many penalties can be avoided or reduced if issues are addressed before the self-assessment deadline, 31 January 2026.

Penalty Appeal After Missing the Deadline

Client profile:

Landlord with rental income and PAYE employment

Situation:

The client missed the self-assessment deadline on 31 January 2026 due to a serious illness and received an automatic £100 late filing penalty. They were unsure whether an appeal was even possible and worried the penalties would keep increasing.

What Lanop did:

Lanop reviewed the circumstances, gathered supporting evidence, and submitted a formal appeal to HMRC citing a reasonable excuse. We also ensured the return was filed immediately to prevent further penalties from accruing.

Outcome:

HMRC accepted the appeal and cancelled the penalty. The client avoided additional charges and gained clarity on future filing obligations.

Looking Ahead: What Changes After 31 January 2026?

The 31 January 2026 deadline is likely the final “traditional” deadline for a significant portion of the UK’s small business and landlord community. From 6 April 2026, the government is mandating the first phase of Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA).

Under the new rules:

- April 2026: Self-employed individuals and landlords with a combined gross income of over £50,000 must keep digital records and submit quarterly “updates” to HMRC using compatible software.

- April 2027: The threshold drops to £30,000, bringing nearly a million more people into the quarterly reporting cycle.

- April 2028: Current plans suggest a further reduction to £20,000.

This represents a fundamental change in the UK self-assessment tax return deadline. Instead of one annual “look-back,” taxpayers will be in constant digital contact with HMRC. While this may feel burdensome, the goal is to reduce the “tax gap” caused by manual errors and to provide business owners with a clearer, real-time view of their tax liability.

How Lanop Can Help with Self-Assessment

The transition between the 2024/25 and 2025/26 tax years is particularly complex due to the “mid-year” changes announced in the 2024 Budgets, including the significant shifts in Capital Gains Tax and the High-Income Child Benefit Charge. Attempting to navigate these changes alone often leads to overpaying tax or incurring avoidable fines.

Lanop provides full-service tax advisory that goes beyond mere form-filling:

- Accuracy & Compliance: We ensure every source of income, from dividends to side-hustles, is correctly reported to avoid HMRC inquiries.

- Tax Optimization: We identify all allowable expenses and reliefs, ensuring you pay only the minimum required by law.

- Cash Flow Management: We help you calculate your balancing payments and payments on account months in advance, helping you avoid January financial stress.

- MTD Readiness: We help you select and implement the right digital software today, so the transition to quarterly reporting in 2026 is seamless and stress-free.

“I’ve dealt with Self-Assessment before, but this was the first time it felt properly clear. Everything from the deadlines to the payments was explained in a way that actually made sense. Lanop helped me file on time and plan for the tax bill instead of panicking in January. It took a lot of pressure off.”

— James R., Sole Trader, London

Conclusion

The self-assessment deadline of 31 January 2026 is a key date that anyone within the Self-Assessment system needs to plan for in advance. By this point, your tax return must be submitted, and any tax due for the 2024/25 year must be paid to HMRC. Leaving things until the last minute often leads to rushed decisions, missed details, and avoidable penalties.

Self-Assessment involves more than a single form. Registration deadlines, filing methods, payment rules, and penalties all connect, and misunderstanding any one of them can cause problems later. Knowing what information to prepare, how payments on account work, and what options exist if you cannot pay in full, Whole puts you in a far stronger position.

The most effective approach is simple: act early, keep clear records, and address issues as soon as they arise. With the proper preparation, meeting the self-assessment deadline becomes a straightforward task rather than a source of stress, allowing you to move forward without unresolved tax concerns hanging over the next year.

FAQs

What is the Self-Assessment deadline 31 January 2026 (UK)?

The Self-Assessment deadline of 31 January 2026 is the final date to submit your online tax return for the 2024/25 tax year and pay any tax owed to HMRC. It applies to anyone required to file under Self-Assessment, including the self-employed, landlords, and people with untaxed income. Missing this date usually results in automatic penalties, even if no tax is due.

Do I need to file a Self-Assessment tax return for 2024/25?

You usually need to file if you earned income that was not fully taxed through PAYE. This includes self-employment, rental income, dividends above the allowance, capital gains, or high income linked to Child Benefit. If HMRC has issued you a notice to file, you must submit a return unless HMRC formally withdraws it.

What is the deadline to register for Self-Assessment for 2024/25?

If you are filing for the first time, the deadline is 5 October 2025. This is the date by which you must tell HMRC that you need to submit a return. Registering late increases the risk of missing the January filing deadline because UTR and activation codes are sent by post.

What is the paper Self-Assessment deadline for 2024/25?

The paper Self Assessment deadline is 31 October 2025. Returns received after this date are treated as late, even if tax is paid by January. Most taxpayers now file online, but anyone submitting paper forms must meet this earlier deadline to avoid penalties.

What is the online Self-Assessment deadline for 2024/25?

Only if you report the early date on the FPS. If you report the contractual date, it counts as one payment per month.

What is the safest payroll approach to prevent Universal Credit deductions when paying early?

The online Self-Assessment deadline is 31 January 2026. By midnight on this date, your tax return must be submitted electronically, and any tax owed must be paid. Filing online gives you more time than paper filing and provides an instant tax calculation.

What must be done by 31 January 2026: file, pay, or both?

Both. By 31 January 2026, you must submit your tax return and pay any tax due for the 2024/25 tax year. In many cases, this also includes your first payment on account for the following tax year. Filing without paying still avoids the late filing penalty, but interest and payment of penalties may apply.

What documents do I need for Self-Assessment (P60, P45, dividends, rental income)?

Standard documents include your P60 or P45, bank interest statements, dividend vouchers, rental income records, and details of expenses. Self-employed individuals should also have income records and allowable costs. Having these ready early makes filing far easier and reduces mistakes.

How do I calculate my Self-Assessment tax bill for 31 January 2026?

HMRC’s online system calculates your tax automatically once you enter your income and expenses. The final bill may include a balancing payment for 2024/25 and payments on account for 2025/26. The calculation is shown before submission, so you can see exactly what you owe before filing.

What are payments on account, and are they due on 31 January 2026?

Payments on account are advance payments towards the next tax year’s bill. They usually apply if your previous tax bill was over £1,000. The first payment is due on 31 January 2026, with the second due on 31 July 2026. Each payment is usually 50% of the previous year’s tax.

Can I reduce payments on account, and how do I do it?

Yes, if you expect your income to be lower in the next tax year. You can request a reduction through your online return or HMRC account. It’s essential to be realistic if you reduce payments too much and underpay; HMRC will charge interest on the difference.

What is the late filing penalty for missing 31 January 2026?

If you miss the deadline, HMRC issues an automatic £100 late filing penalty, even if you owe no tax. Further penalties apply after three, six, and twelve months. Filing as soon as possible limits how much the penalties grow.

What is the late payment penalty and interest for paying after 31 January 2026?

Interest starts accruing immediately after the deadline. A late payment penalty of 5% usually applies after 30 days, with additional penalties at 6 months and twelve months. These charges apply even if the return itself was filed on time.

If wages are paid early, does the employer’s PAYE/NIC payment deadline to HMRC change?

No. Your deadline for paying HMRC remains the 22nd (electronic) of the following month (January).

How do I apply for HMRC Time to Pay for Self-Assessment?

If you cannot pay your tax in full, you may be able to apply for HMRC Time to Pay. This allows you to spread payments over monthly instalments. In many cases, the arrangement can be set up online once your return has been filed.

Can I pay Self-Assessment through my tax code, and what is the deadline?

In some cases, HMRC can collect tax through your PAYE tax code as a lump-sum payment. To use this option, your tax return must be filed by 30 December 2025, and the tax owed must usually be under £3,000.

How do I appeal a Self-Assessment penalty to HMRC?

You can appeal if you have a reasonable excuse, such as serious illness or HMRC system issues. Appeals must usually be made within 30 days of the penalty of notice. Supporting evidence improves your chances of success.